概述

该策略是基于布林带和赫尔指标的交叉来生成交易信号的。当赫尔指标上穿布林带下轨时做多,当赫尔指标下穿布林带上轨时做空。该策略结合了布林带的突破策略和赫尔指标的趋势跟踪策略,从而利用两者的优点。

策略原理

该策略主要基于布林带和赫尔指标的交叉来产生交易信号。

首先,布林带包含三条线:中轨线、上轨线和下轨线。中轨线是n日移动平均线,上下轨线分别是中轨线上下各加一个标准差。如果价格突破上轨,代表有突破的机会;如果价格跌破下轨,代表有回调的机会。

其次,赫尔指标是一种趋势跟踪指标。它利用两个不同周期的加权移动平均线之间的差值,来判断目前的走势。如果短期平均线高于长期平均线就属于多头向上,反之就属于空头向下。

该策略就是结合这两个指标的优点。当赫尔指标上穿布林带下轨时,认为股价可能进入趋势向上阶段,这时做多;当赫尔指标下穿布林带上轨时,认为股价可能进入回调向下阶段,这时做空。

策略优势

结合布林带和赫尔指标两个指标的优点,使交易信号更加可靠。

利用赫尔指标判断趋势方向,以及布林带判断支撑阻力位置,形成交叉信号,可以提高盈利概率。

通过调整布林带和赫尔指标的参数,可以针对不同周期的股票进行优化,适用面更广。

风险及解决方法

当股价处于横盘整理时,该策略可能会产生更多假信号,带来亏损。可以通过优化参数或增加过滤条件来减少假信号。

股价剧烈波动时,布林带和赫尔指标可能同时发出交易信号,需要确保信号顺序性,避免交叉信号判断错误。可以考虑加入止损来控制亏损。

代码中直接设置了开仓数量为100%。实际部署时,需要调整仓位管理,不能全仓开仓,可能导致亏损扩大。

优化方向

可以测试优化布林带和赫尔指标的参数,适应更多周期的股票。

增加交易量或波动率的过滤器,避免在盘整时出现错误信号。

优化止损策略,设置移动止损或挂单止损。

调整仓位管理规则,加入重新进入场内的条件,避免亏损扩大。

总结

本策略综合利用布林带的突破策略和赫尔指标的趋势跟踪策略,通过二者的交叉形成交易信号,实现趋势跟踪和突破的双重效果。该策略在基本面不发生重大变化的前提下,对中短线股票具有较强的适应性。但实际部署时,仍需要针对个股特点进行参数优化,并适当调整仓位管理、止损策略等,从而使策略更加稳健。

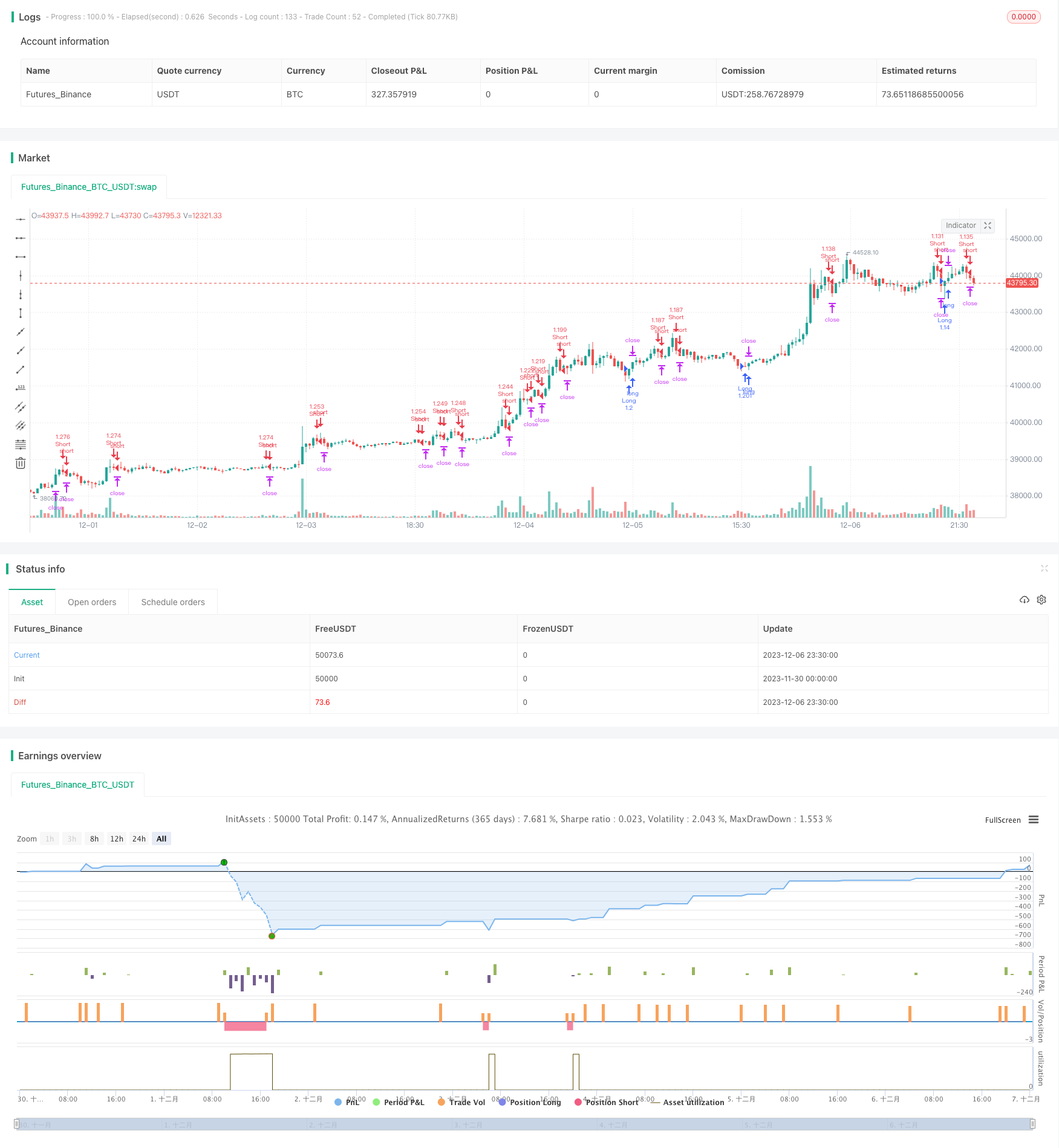

/*backtest

start: 2023-11-30 00:00:00

end: 2023-12-07 00:00:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(title="Strategy Hull Bollinger", shorttitle="Hull bollinger",overlay=true, calc_on_order_fills=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100, overlay=false)

n=input(title="period",defval=3)

n2ma=2*wma(close,round(n/2))

nma=wma(close,n)

diff=n2ma-nma

sqn=round(sqrt(n))

n2ma1=2*wma(close[1],round(n/2))

nma1=wma(close[1],n)

diff1=n2ma1-nma1

sqn1=round(sqrt(n))

n1=wma(diff,sqn)

n2=wma(diff1,sqn)

c=n1>n2?green:red

i = input(1)

PP = close[i]

length1 = input(20, minval=1)

src = input(close, title="Source")

mult = input(2.0, minval=0.001, maxval=10, step=0.2)

basis = sma(src, length1)

dev = mult * stdev(src, length1)

upper = basis + dev

lower = basis - dev

TP = input(500) * 10

SL = input(500) * 10

TS = input(20) * 10

TO = input(10) * 10

CQ = 100

TPP = (TP > 0) ? TP : na

SLP = (SL > 0) ? SL : na

TSP = (TS > 0) ? TS : na

TOP = (TO > 0) ? TO : na

longCondition = crossover(n1,lower)

if (longCondition)

strategy.entry("Long", strategy.long)

shortCondition = crossunder(n1,upper)

if (shortCondition)

strategy.entry("Short", strategy.short)

strategy.exit("Close Short", "Short", qty_percent=CQ, profit=TPP, loss=SLP, trail_points=TSP, trail_offset=TOP)

strategy.exit("Close Long", "Long", qty_percent=CQ, profit=TPP, loss=SLP, trail_points=TSP, trail_offset=TOP)