概述

本策略结合了SuperTrend指标和DEMA指标,实现了一个趋势跟踪交易策略。当价格超过上轨时产生买入信号,当价格跌破下轨时产生卖出信号,结合DEMA指标过滤虚假信号。该策略适用于趋势性行情,能够有效跟踪趋势,过滤震荡。

策略原理

该策略主要基于SuperTrend指标判断价格趋势方向。SuperTrend指标结合ATR指标,能够有效判断价格趋势。当价格上涨时会形成上轨,当价格下跌时会形成下轨。当价格从下轨突破时为趋势转折,产生买入信号;当价格从上轨突破时为趋势转折,产生卖出信号。

为了过滤误报信号,该策略还结合了DEMA指标。只有当价格超过上轨且高于DEMA线时才产生买入信号;只有当价格跌破下轨且低于DEMA线时才产生卖出信号。这可以有效过滤震荡市场中的虚假信号。

具体来说,该策略的交易信号逻辑如下:

- 当价格从下轨突破时为趋势转折,产生买入信号

- 当价格从上轨突破时为趋势转折,产生卖出信号

- 只有当买入信号出现且价格高于DEMA线时,才实际产生买入信号

- 只有当卖出信号出现且价格低于DEMA线时,才实际产生卖出信号

通过这样的逻辑设计,能够在趋势성行情中顺势而为,避免在震荡市场中频繁开仓。

策略优势

- 结合SuperTrend指标和DEMA指标,实现趋势跟踪和信号过滤双重效果

- SuperTrend指标参数优化容易,可以根据不同品种和周期进行调整

- DEMA指标参数优化简单,无需重复测试

- 策略适用于趋势性行情,能够顺势而为,跟踪趋势

- 通过DEMA指标有效过滤震荡市场的假信号

- 策略实现简单,容易理解和修改

策略风险

- 策略无法很好应对价格剧烈波动的场景

- 在趋势反转时,可能出现亏损

- DEMA指标参数设置不当,可能错过买入/卖出的最佳时机

- SuperTrend指标参数如ATR周期设置不当,可能产生误报信号

风险解决方法:

- 优化DEMA参数和SuperTrend参数

- 结合止损策略,控制单次停损

- 在关键点增加确认机制,避免误报信号

策略优化方向

该策略可以从以下几个方面进行优化:

SuperTrend指标参数优化。可以测试不同的ATR周期参数,找到最佳参数组合。

DEMA指标参数优化。可以测试不同的参数,确定最佳的参数设置。

增加止损机制。可以根据ATR值设置止损位,避免止损过大。

增加信号过滤规则。可以在关键点增加其他指标的确认,避免误报信号。例如在趋势转折点增加量能指标的确认等。

优化仓位管理。可以根据市场波动性和风险状况动态调整仓位。

总结

本策略整合SuperTrend指标和DEMA指标的优点,实现了基于趋势跟踪和信号过滤的量化交易策略。策略优化空间较大,通过参数优化、止损机制和信号过滤等措施可以进一步改进策略的稳定性和盈利能力。该策略思路简单清晰易于实现,整体风险可控,适合量化交易实盘。

策略源码

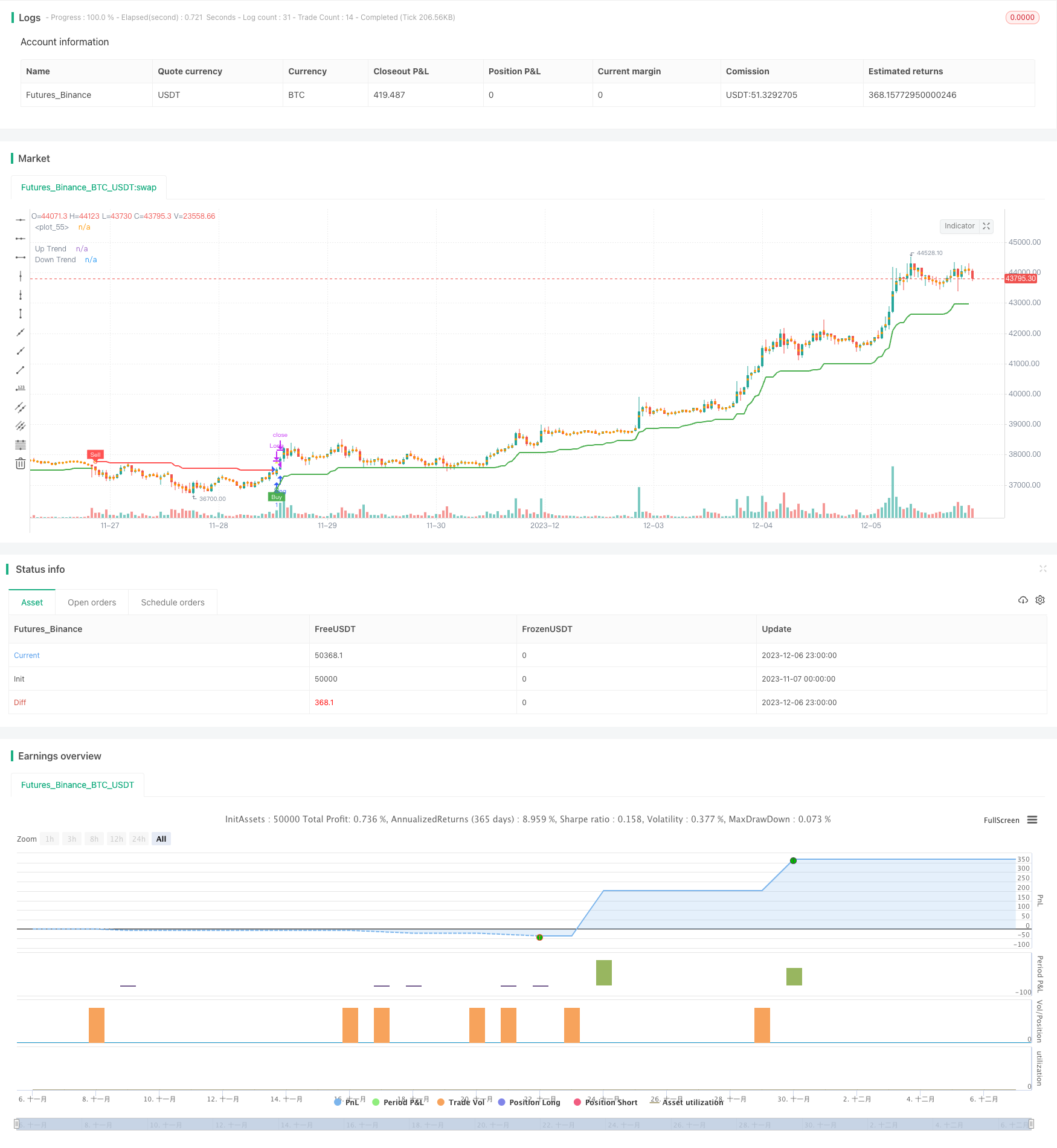

/*backtest

start: 2023-11-07 00:00:00

end: 2023-12-07 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy('Krish\'s Supertrend Strategy', overlay=true)

// Supertrend Settings

Periods = input(title='ATR Period', defval=10)

src = input(hl2, title='Source')

Multiplier = input.float(title='ATR Multiplier', step=0.1, defval=3.0)

changeATR = input(title='Change ATR Calculation Method ?', defval=true)

showsignals = input(title='Show Buy/Sell Signals ?', defval=true)

highlighting = input(title='Highlighter On/Off ?', defval=true)

atr2 = ta.sma(ta.tr, Periods)

atr = changeATR ? ta.atr(Periods) : atr2

up = src - Multiplier * atr

up1 = nz(up[1], up)

up := close[1] > up1 ? math.max(up, up1) : up

dn = src + Multiplier * atr

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? math.min(dn, dn1) : dn

trend = 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dn1 ? 1 : trend == 1 and close < up1 ? -1 : trend

upPlot = plot(trend == 1 ? up : na, title='Up Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.green, 0))

buySignal = trend == 1 and trend[1] == -1

plotshape(buySignal ? up : na, title='UpTrend Begins', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.green, 0))

plotshape(buySignal and showsignals ? up : na, title='Buy', text='Buy', location=location.absolute, style=shape.labelup, size=size.tiny, color=color.new(color.green, 0), textcolor=color.new(color.white, 0))

dnPlot = plot(trend == 1 ? na : dn, title='Down Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.red, 0))

sellSignal = trend == -1 and trend[1] == 1

plotshape(sellSignal ? dn : na, title='DownTrend Begins', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.red, 0))

plotshape(sellSignal and showsignals ? dn : na, title='Sell', text='Sell', location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.new(color.red, 0), textcolor=color.new(color.white, 0))

// DEMA Settings

dema_length = 200

dema = ta.ema(close, dema_length)

// Long and Short Conditions

longCondition = buySignal and close > dema

shortCondition = sellSignal and close < dema

// Strategy Entry and Exit

strategy.entry('Long', strategy.long, when=longCondition)

strategy.entry('Short', strategy.short, when=shortCondition)

strategy.close('Long', when=ta.change(trend) or close < dema)

strategy.close('Short', when=ta.change(trend) or close > dema)

// Plotting

mPlot = plot(ohlc4, title='', style=plot.style_circles, linewidth=0)

longFillColor = highlighting ? trend == 1 ? color.green : color.white : color.white

shortFillColor = highlighting ? trend == -1 ? color.red : color.white : color.white

fill(mPlot, upPlot, title='UpTrend Highlighter', color=longFillColor, transp=90)

fill(mPlot, dnPlot, title='DownTrend Highlighter', color=shortFillColor, transp=90)

// Alerts (using plotshape for alerts in strategies)

plotshape(buySignal, title='SuperTrend Buy', color=color.new(color.green, 0), style=shape.triangleup, size=size.small)

plotshape(sellSignal, title='SuperTrend Sell', color=color.new(color.red, 0), style=shape.triangledown, size=size.small)

changeCond = trend != trend[1]

plotshape(changeCond, title='SuperTrend Direction Change', color=color.new(color.yellow, 0), style=shape.triangleup, size=size.small)