概述

该策略结合了移动平均线指标和布林带指标,实现了在均线之间进行双边交易的策略。当价格上破下轨时做多,当价格下破上轨时做空,利用价格在均线之间的振荡获利。

策略原理

- 计算快速移动平均线ma_short和慢速移动平均线ma_long

- 当ma_short上穿ma_long时,做多;当ma_short下穿ma_long时,做空

- 计算布林带的上轨、下轨和中间轨

- 当价格上穿下轨时,确认做多信号;当价格下穿上轨时,确认做空信号

- 结合移动平均线指标和布林带指标的信号,在它们发出同向信号时开仓,不同向时平仓

优势分析

- 结合双重指标,比较稳定,可以滤除一定假信号

- 在均线和布林带之间进行振荡交易,避免追高杀跌

- 允许双边交易,可以充分利用价格的上下波动获利

风险分析

- 布林带参数设置会影响交易频率和获利情况

- 大幅度趋势市场中容易产生较大亏损

- 均线系统本身容易产生较多平仓亏损

风险解决方法:

- 优化布林带参数,调整到适合的交易频率

- 设置止损策略,控制单笔亏损

- 结合趋势判断,在趋势不明显时使用该策略

优化方向

- 测试不同均线系统的参数组合

- 评估是否加入成交量指标过滤信号

- 测试是否结合RSI等指标确定超买超卖区域

以上优化可以进一步提高获利率,减少不必要的交易,降低交易频率和亏损风险。

总结

该策略结合均线系统和布林带指标,实现了在价格均线之间振荡交易的策略。双重指标结合可以提高信号质量,允许双边交易可以获得更多机会。通过进一步优化参数以及加入其他辅助指标判断,可以减少不必要交易和提高获利率,值得实盘检验和优化。

]

策略源码

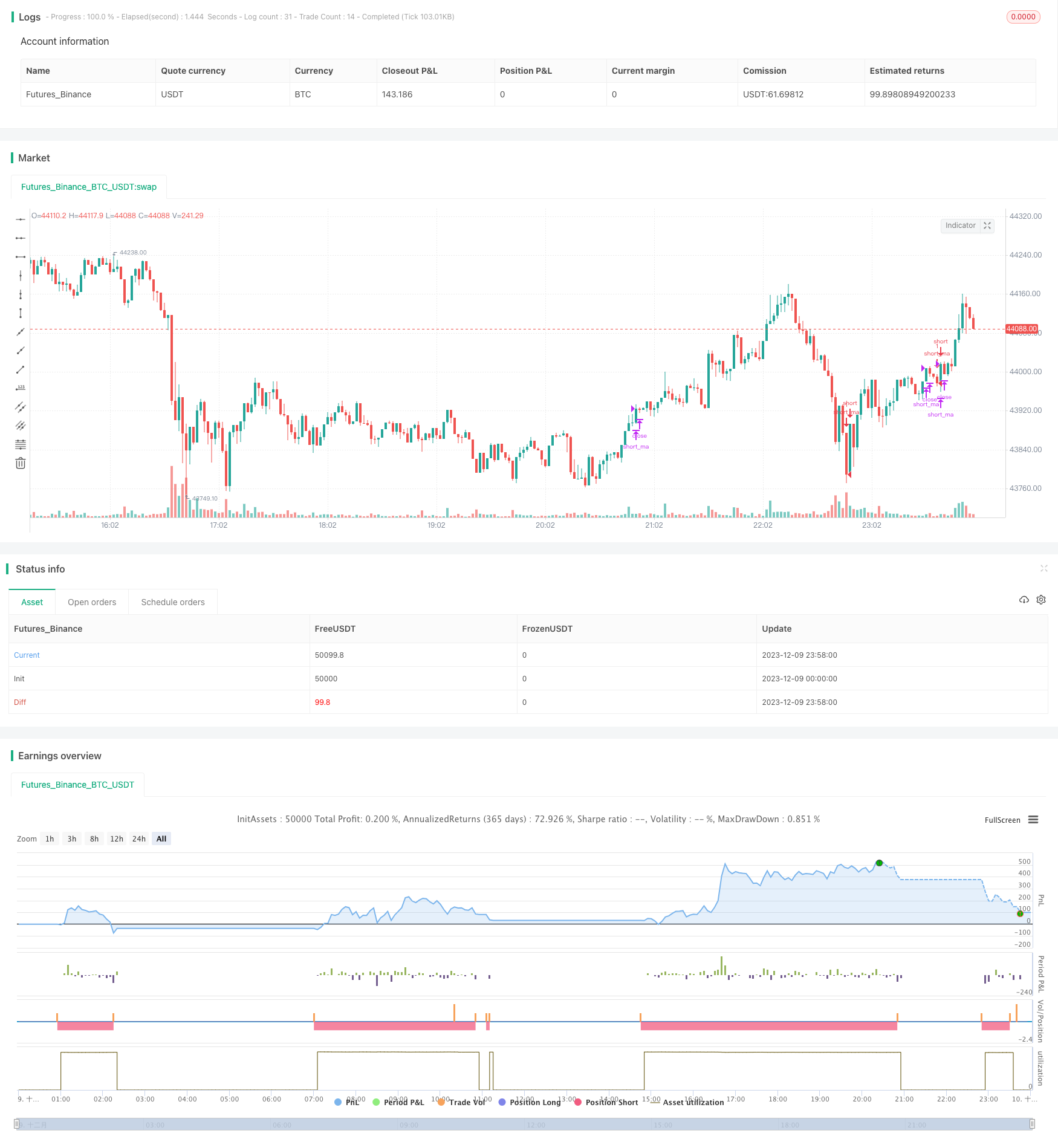

/*backtest

start: 2023-12-09 00:00:00

end: 2023-12-10 00:00:00

period: 2m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("MA-Zorrillo",overlay=true)

ma_short= sma(close,8)

ma_long= sma(close,89)

entry_ma = crossover (ma_short,ma_long)

exit_ma = crossunder (ma_short,ma_long)

BBlength = input(24, minval=1,title="Bollinger Period Length")

BBmult = 2 // input(2.0, minval=0.001, maxval=50,title="Bollinger Bands Standard Deviation")

BBbasis = sma(close, BBlength)

BBdev = BBmult * stdev(close, BBlength)

BBupper = BBbasis + BBdev

BBlower = BBbasis - BBdev

source = close

entry_bb = crossover(source, BBlower)

exit_bb = crossunder(source, BBupper)

vs_entry = false

vs_exit = false

for i = 0 to 63

if (entry_bb[i])

vs_entry := true

if (exit_bb[i])

vs_exit := true

entry = entry_ma and vs_entry

exit = exit_ma and vs_exit

strategy.entry(id="long_ma",long=true,when=entry)

strategy.close(id="long_ma", when=exit)

strategy.entry(id="short_ma",long=false,when=exit)

strategy.close(id="short_ma",when=entry)