概述

该策略运用8条不同周期的指数移动平均线与Ichimoku云图作为主要交易信号,可以在1小时、4小时或日线时间框架下有效运行。

策略原理

该策略的核心原理基于以下两大部分:

- 8条指数移动平均线(Octa-EMA)

该策略使用了8条不同周期的EMA,分别为5日线、11日线、15日线、18日线、21日线、24日线、28日线和34日线。这8条EMA被称为“Octa-EMA”。当较短周期的EMA在较长周期EMA之上时表示多头趋势,反之则表示空头趋势。

- Ichimoku云图指标

Ichimoku云图包含转换线、基准线、延迟线和先导线A/B。云图主要判断趋势方向和提供支持阻力。当价格在云图上方时为多头趋势,在云图下方为空头趋势。

该策略的交易信号来自以上两大组成部分。当8条EMA全部处于多头排列(短EMA在长EMA之上),且价格高于Ichimoku的云图时产生买入信号。当EMA排列转为空头(短EMA下穿长EMA)时产生卖出信号。

策略优势分析

该策略主要有以下优势:

- 使用双重指标过滤,可以减少假信号

- Ichimoku云图可判断趋势方向,避免逆势交易

- 8条EMA交叉组合判断趋势,提高准确性

- 可在多种时间周期下运行

- 参数优化空间大,可针对不同品种定制

策略风险分析

该策略也存在一定的风险:

- 在震荡行情中可能产生较多空头信号

- 买入条件较严格,可能错过部分买点

- 当短期与中长期趋势不一致时可能失效

- EMA参数设置不当可能导致信号滞后

针对以上风险,可以通过调整EMA参数或优化入场条件来降低风险,也可以结合其他指标作为辅助。

策略优化方向

该策略可从以下几个方面进行优化:

- 调整EMA参数,优化对应的周期

- 增加均线多空判断指标,确保趋势判断准确性

- 结合MACD、KDJ等其他指标,优化入场时机

- 增加止损止盈策略,控制单次盈亏

- 测试不同品种参数效果,寻找最佳参数组合

- 利用机器学习算法自动寻优参数

总结

Octa-EMA与Ichimoku云图量化交易策略整体而言是一种较为稳定和可靠的趋势跟踪策略。它同时运用EMA组合判断趋势及Ichimoku过滤信号,在参数优化后可以获得较低的误判率。该策略可广泛应用于股指、外汇、贵金属等品种,也可在多个时间周期下运行。如果能够结合止损止盈及辅助指标,将可以进一步提高策略的胜率和盈利率。

策略源码

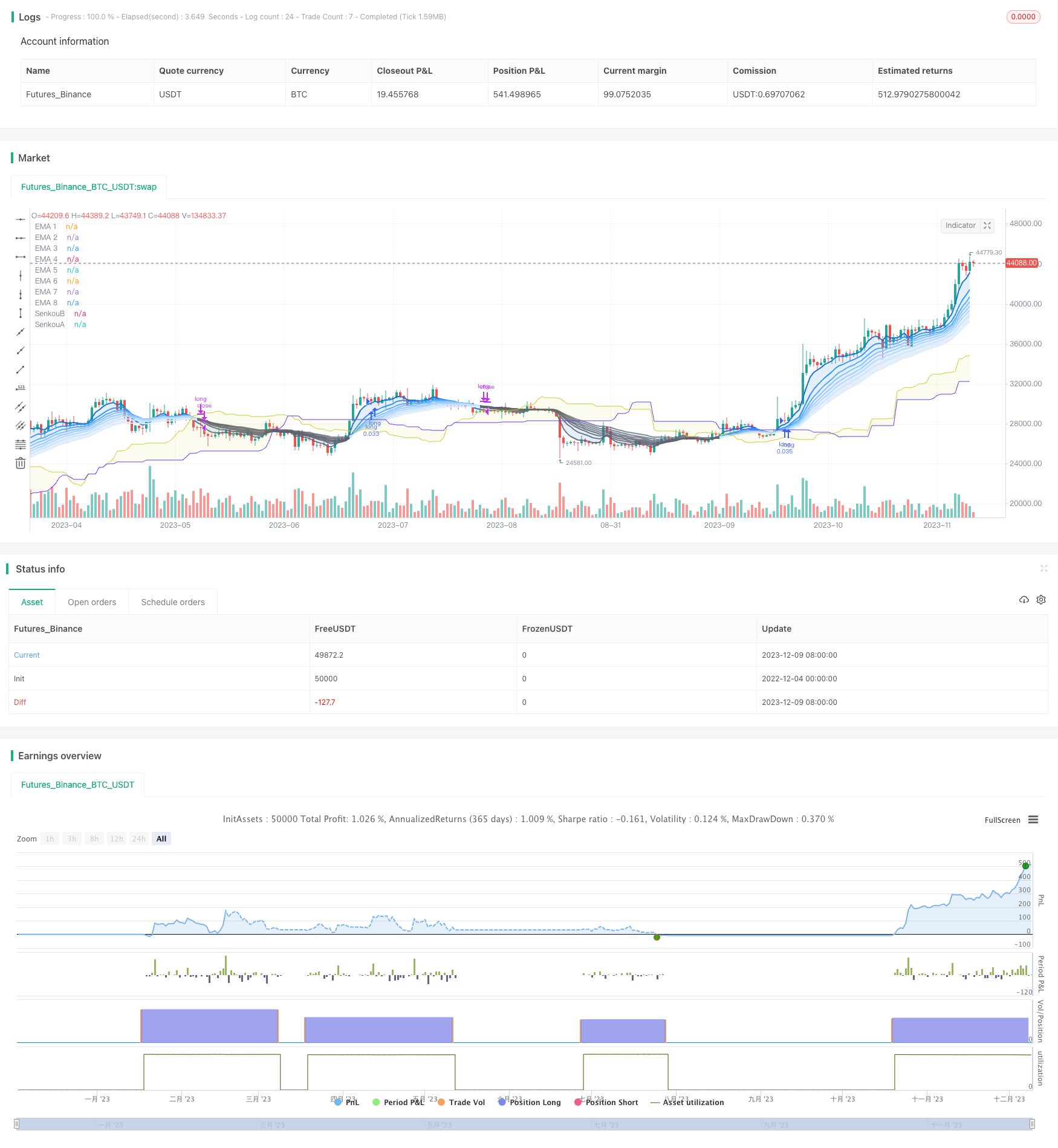

/*backtest

start: 2022-12-04 00:00:00

end: 2023-12-10 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//Fukuiz

strategy(title='Fukuiz Octa-EMA + Ichimoku', shorttitle='Fuku octa strategy', overlay=true, process_orders_on_close=true,

default_qty_type= strategy.cash , default_qty_value=1000, currency=currency.USD, initial_capital=10000 ,commission_type = strategy.commission.percent,commission_value=0.25)

//OCTA EMA ##################################################

// Functions

f_emaRibbon(_src, _e1, _e2, _e3, _e4, _e5, _e6, _e7, _e8) =>

_ema1 = ta.ema(_src, _e1)

_ema2 = ta.ema(_src, _e2)

_ema3 = ta.ema(_src, _e3)

_ema4 = ta.ema(_src, _e4)

_ema5 = ta.ema(_src, _e5)

_ema6 = ta.ema(_src, _e6)

_ema7 = ta.ema(_src, _e7)

_ema8 = ta.ema(_src, _e8)

[_ema1, _ema2, _ema3, _ema4, _ema5, _ema6, _ema7, _ema8]

showRibbon = input(true, 'Show Ribbon (EMA)')

ema1Len = input(5, title='EMA 1 Length')

ema2Len = input(11, title='EMA 2 Length')

ema3Len = input(15, title='EMA 3 Length')

ema4Len = input(18, title='EMA 4 Length')

ema5Len = input(21, title='EMA 5 Length')

ema6Len = input(24, title='EMA 6 Length')

ema7Len = input(28, title='EMA 7 Length')

ema8Len = input(34, title='EMA 8 Length')

[ema1, ema2, ema3, ema4, ema5, ema6, ema7, ema8] = f_emaRibbon(close, ema1Len, ema2Len, ema3Len, ema4Len, ema5Len, ema6Len, ema7Len, ema8Len)

//Plot

ribbonDir = ema8 < ema2

p1 = plot(ema1, color=showRibbon ? ribbonDir ? #1573d4 : color.new(#5d606b, 15) : na, linewidth=2, title='EMA 1')

p2 = plot(ema2, color=showRibbon ? ribbonDir ? #3096ff : color.new(#5d606b, 15) : na, linewidth=2, title='EMA 2')

plot(ema3, color=showRibbon ? ribbonDir ? #57abff : color.new(#5d606b, 15) : na, linewidth=2, title='EMA 3')

plot(ema4, color=showRibbon ? ribbonDir ? #85c2ff : color.new(#5d606b, 15) : na, linewidth=2, title='EMA 4')

plot(ema5, color=showRibbon ? ribbonDir ? #9bcdff : color.new(#5d606b, 30) : na, linewidth=2, title='EMA 5')

plot(ema6, color=showRibbon ? ribbonDir ? #b3d9ff : color.new(#5d606b, 30) : na, linewidth=2, title='EMA 6')

plot(ema7, color=showRibbon ? ribbonDir ? #c9e5ff : color.new(#5d606b, 30) : na, linewidth=2, title='EMA 7')

p8 = plot(ema8, color=showRibbon ? ribbonDir ? #dfecfb : color.new(#5d606b, 30) : na, linewidth=2, title='EMA 8')

fill(p1, p2, color.new(#1573d4, 85))

fill(p2, p8, color.new(#1573d4, 85))

//ichimoku##################################################

//color

colorblue = #3300CC

colorred = #993300

colorwhite = #FFFFFF

colorgreen = #CCCC33

colorpink = #CC6699

colorpurple = #6633FF

//switch

switch1 = input(false, title='Chikou')

switch2 = input(false, title='Tenkan')

switch3 = input(false, title='Kijun')

middleDonchian(Length) =>

lower = ta.lowest(Length)

upper = ta.highest(Length)

math.avg(upper, lower)

//Functions

conversionPeriods = input.int(9, minval=1)

basePeriods = input.int(26, minval=1)

laggingSpan2Periods = input.int(52, minval=1)

displacement = input.int(26, minval=1)

Tenkan = middleDonchian(conversionPeriods)

Kijun = middleDonchian(basePeriods)

xChikou = close

SenkouA = middleDonchian(laggingSpan2Periods)

SenkouB = (Tenkan[basePeriods] + Kijun[basePeriods]) / 2

//Plot

A = plot(SenkouA[displacement], color=color.new(colorpurple, 0), title='SenkouA')

B = plot(SenkouB, color=color.new(colorgreen, 0), title='SenkouB')

plot(switch1 ? xChikou : na, color=color.new(colorpink, 0), title='Chikou', offset=-displacement)

plot(switch2 ? Tenkan : na, color=color.new(colorred, 0), title='Tenkan')

plot(switch3 ? Kijun : na, color=color.new(colorblue, 0), title='Kijun')

fill(A, B, color=color.new(colorgreen, 90), title='Ichimoku Cloud')

//Buy and Sell signals

fukuiz = math.avg(ema2, ema8)

white = ema2 > ema8

gray = ema2 < ema8

buycond = white and white[1] == 0

sellcond = gray and gray[1] == 0

bullish = ta.barssince(buycond) < ta.barssince(sellcond)

bearish = ta.barssince(sellcond) < ta.barssince(buycond)

buy = bearish[1] and buycond and fukuiz > SenkouA[displacement] and fukuiz > SenkouB

sell = bullish[1] and sellcond and fukuiz > SenkouA[displacement] and fukuiz > SenkouB

sell2=ema2 < ema8

buy2 = white and fukuiz > SenkouA[displacement] and fukuiz > SenkouB

//$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

//Back test

startYear = input.int(defval=2017, title='Start Year', minval=2000, maxval=3000)

startMonth = input.int(defval=1, title='Start Month', minval=1, maxval=12)

startDay = input.int(defval=1, title='Start Day', minval=1, maxval=31)

endYear = input.int(defval=2023, title='End Year', minval=2000 ,maxval=3000)

endMonth = input.int(defval=12, title='End Month', minval=1, maxval=12)

endDay = input.int(defval=31, title='End Day', minval=1, maxval=31)

start = timestamp(startYear, startMonth, startDay, 00, 00)

end = timestamp(endYear, endMonth, endDay, 23, 59)

period() => time >= start and time <= end ? true : false

if buy2

strategy.entry(id='long', direction=strategy.long, when=period(), comment='BUY')

if sell2

strategy.close(id='long', when=period(), comment='SELL')