概述

该策略是一个仅做多的策略,它利用价格突破ATR通道下限来确定入场时机,并以ATR通道均线或ATR通道上限作为止盈退出。同时,它还会利用ATR来计算止损价格。该策略适合做快速短线交易。

策略原理

当价格跌破ATR通道下限时,表明价格出现了异常的下跌。此时策略会在下一根K线开盘的时候做多入场。止损价格为入场价减去ATR止损系数乘以ATR。止盈价格为ATR通道均线或ATR通道上限,如果当前K线收盘价低于前一根K线的最低价,则以前一根K线最低价作为止盈价格。

具体来说,该策略主要包含以下逻辑:

- 计算ATR和ATR通道均线

- 确定时间过滤条件

- 当价格低于ATR通道下限时,标记可以做多入场

- 在下一根K线开盘时做多入场

- 记录入场价

- 计算止损价格

- 当价格高于ATR通道均线或ATR通道上限时,平仓止盈

- 当价格低于止损价时,止损退出

优势分析

该策略具有以下优势:

- 利用ATR通道来确定入场和止盈,可靠性较高

- 做多仅在异常下跌后才入场,避免追高

- 止损规则严格,有效控制风险

- 适合快速短线交易,无须长时间持仓

- 简单易懂的规则,容易实现和优化

风险分析

该策略也存在一些风险:

- 频繁交易带来的交易费用和滑点风险

- 可能出现止损连续被触发的情况

- 参数优化不当可能影响策略效果

- 标的价格波动较大时,止损可能过大

可以通过调整ATR周期,缩小止损系数等方法来降低上述风险。同时选择交易费用较低的券商也很重要。

优化方向

该策略还可以从以下方面进行优化:

- 增加其他指标过滤,避免错失最佳入场时机

- 优化ATR周期参数

- 考虑加入再入场机制

- 动态调整止损幅度

- 加入趋势判断规则,避免逆势入场

总结

该策略整体而言是一个简单实用的短线突破均线反转策略。它有着清晰的入场规则、严格的止损机制以及完善的止盈方式。同时也提供了一些参数调整的优化空间。如果交易者能够选择合适的标的并配合止损来控制风险,该策略应该能够获得不错的效果。

策略源码

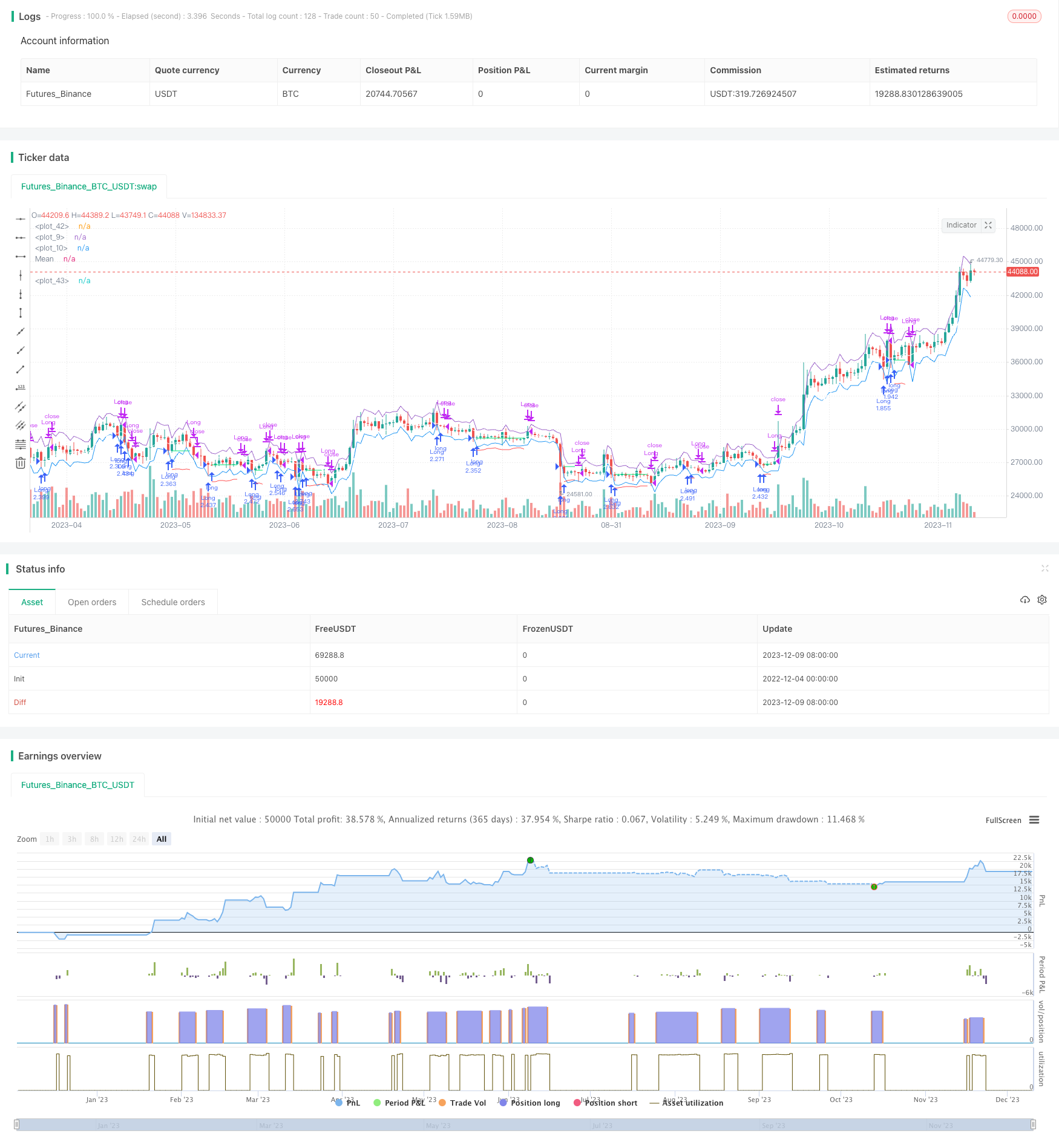

/*backtest

start: 2022-12-04 00:00:00

end: 2023-12-10 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Bcullen175

//@version=5

strategy("ATR Mean Reversion", overlay=true, initial_capital=100000,default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=6E-5) // Brokers rate (ICmarkets = 6E-5)

SLx = input(1.5, "SL Multiplier", tooltip = "Multiplies ATR to widen stop on volatile assests, Higher values reduce risk:reward but increase winrate, Values below 1.2 are not reccomended")

src = input(close, title="Source")

period = input.int(10, "ATR & MA PERIOD")

plot(open+ta.atr(period))

plot(open-ta.atr(period))

plot((ta.ema(src, period)), title = "Mean", color=color.white)

i_startTime = input(title="Start Filter", defval=timestamp("01 Jan 1995 13:30 +0000"), group="Time Filter", tooltip="Start date & time to begin searching for setups")

i_endTime = input(title="End Filter", defval=timestamp("1 Jan 2099 19:30 +0000"), group="Time Filter", tooltip="End date & time to stop searching for setups")

// Check filter(s)

f_dateFilter = true

atr = ta.atr(period)

// Check buy/sell conditions

var float buyPrice = 0

buyCondition = low < (open-ta.atr(period)) and strategy.position_size == 0 and f_dateFilter

sellCondition = (high > (ta.ema(close, period)) and strategy.position_size > 0 and close < low[1]) or high > (open+ta.atr(period))

stopDistance = strategy.position_size > 0 ? ((buyPrice - atr)/buyPrice) : na

stopPrice = strategy.position_size > 0 ? (buyPrice - SLx*atr): na

stopCondition = strategy.position_size > 0 and low < stopPrice

// Enter positions

if buyCondition

strategy.entry(id="Long", direction=strategy.long)

if buyCondition[1]

buyPrice := open

// Exit positions

if sellCondition or stopCondition

strategy.close(id="Long", comment="Exit" + (stopCondition ? "SL=true" : ""))

buyPrice := na

// Draw pretty colors

plot(buyPrice, color=color.lime, style=plot.style_linebr)

plot(stopPrice, color=color.red, style=plot.style_linebr, offset=-1)