概述

本策略名为“RSI-MA 趋势跟踪策略”,其思路是同时利用 RSI 指标和 MA 均线来判断价格趋势和发出交易信号。当 RSI 指标超过设定的上下阈值时产生交易信号,而 MA 均线用来过滤假信号,在价格持续上涨或者下跌时才会发出信号。这可以在保持一定的盈利空间的同时有效过滤震荡行情。

策略原理

该策略主要使用 RSI 指标和 MA 均线。RSI 用来判断超买超卖,MA 用来判定趋势方向。 具体逻辑是:

计算 RSI 指标值,并设定上阈值 90 和下阈值 10。当 RSI 超过 90 时为超买信号,小于 10 时为超卖信号。

计算一定周期(如 4 日)的 MA 均线。当价格持续上涨时,MA 线上翘;当价格持续下跌时,MA 线下翘。

当 RSI 超过 90 同时 MA 线上翘时,做空;当 RSI 小于 10 同时 MA 线下翘时,做多。

止损设定为每手固定点数,止盈为每手固定百分比。

策略优势分析

该策略结合 RSI 指标和 MA 均线双重过滤,可以有效过滤震荡行情下的假信号。同时通过 RSI 的设置避免信号来得太晚,保证了一定的盈利空间。利用 MA 判定趋势方向,避免逆势交易。此外,策略参数较简单,容易理解和优化。

风险分析

该策略主要风险有:

突发事件造成暴跌或暴涨,RSI 和 MA 都没来得及反应,可能造成较大亏损。

震荡行情中,RSI 和 MA 可能频繁发出信号,造成过于频繁交易而增加交易费用和滑点成本。

参数设定不当也会影响策略表现,如 RSI 上下阈值设置过宽则信号延迟,设置过窄则信号太频繁。

优化方向

该策略可进一步优化的方向包括:

根据不同品种和周期参数进行测试和优化,设定最佳参数组合。

增加其他指标结合,如加入 KDJ、BOLL 等,设置更加严格的过滤条件,减少误交易概率。

设置自适应止损止盈机制,比如根据波动率和ATR 来动态调整止损价位。

增加机器学习算法,根据市场状况自动调整策略参数,实现参数的动态优化。

总结

该 RSI-MA 策略整体来说较为简单实用,同时结合了趋势跟踪和超买超卖判断,在良好的市场环境下能获得较好收益。但也存在一定概率的误交易风险,需要进一步优化以降低风险和提高稳定性。

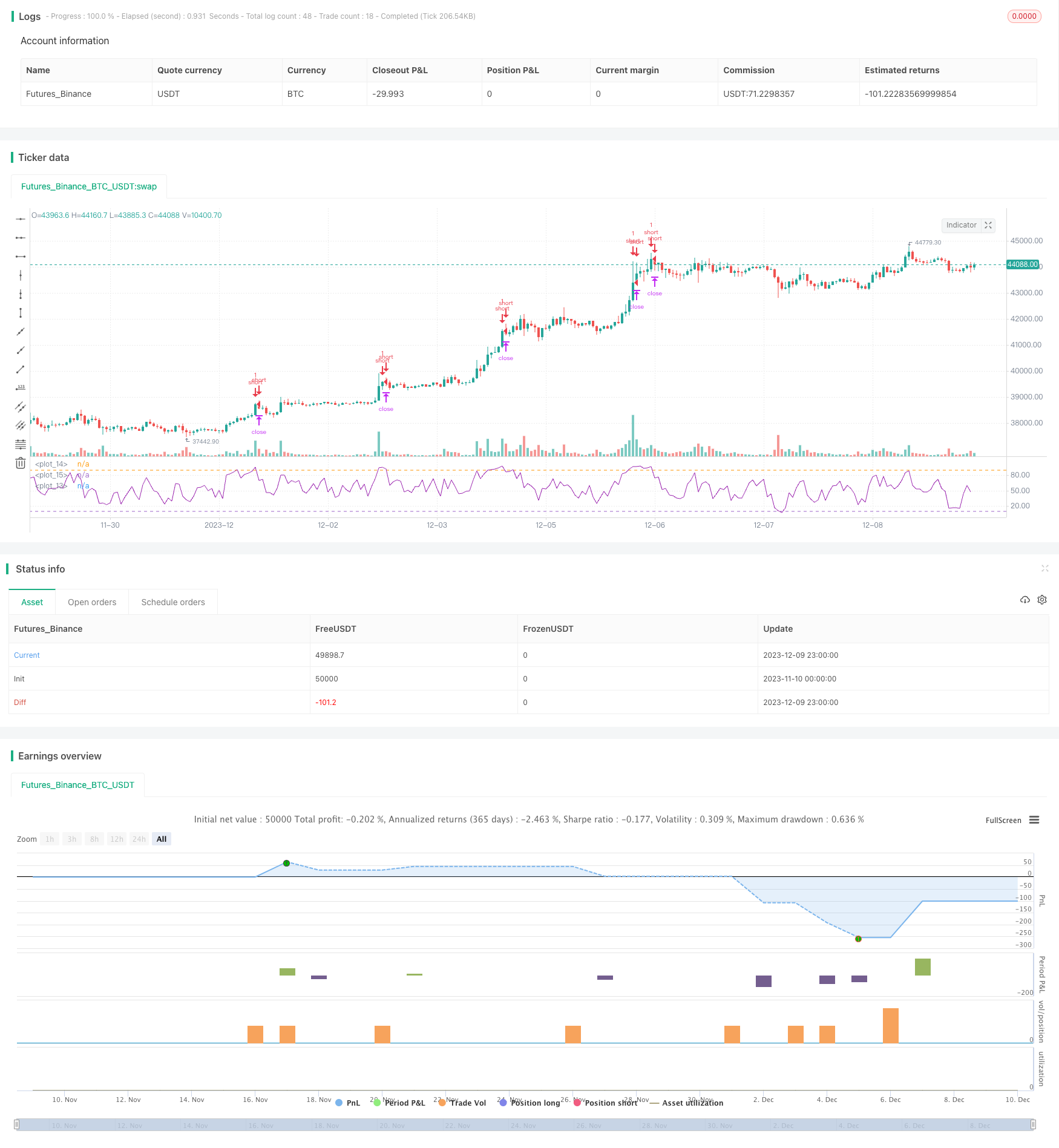

/*backtest

start: 2023-11-10 00:00:00

end: 2023-12-10 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

//This strategy is best used with the Chrome Extension AutoView for automating TradingView alerts.

//You can get the AutoView extension for FREE using the following link

//https://chrome.google.com/webstore/detail/autoview/okdhadoplaoehmeldlpakhpekjcpljmb?utm_source=chrome-app-launcher-info-dialog

strategy("4All", shorttitle="Strategy", overlay=false)

src = close

len = input(4, minval=1, title="Length")

up = rma(max(change(src), 0), len)

down = rma(-min(change(src), 0), len)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

plot(rsi, color=purple)

band1 = hline(90)

band0 = hline(10)

fill(band1, band0, color=purple, transp=90)

rsin = input(5)

sn = 100 - rsin

ln = 0 + rsin

short = crossover(rsi, sn)

long = crossunder(rsi, ln)

strategy.entry("long", strategy.long, when=long)

strategy.entry("short", strategy.short, when=short)

TP = input(15) * 10

SL = input(23) * 10

TS = input(0) * 10

CQ = 100

TPP = (TP > 0) ? TP : na

SLP = (SL > 0) ? SL : na

TSP = (TS > 0) ? TS : na

strategy.exit("Close Long", "long", qty_percent=CQ, profit=TPP, loss=SLP, trail_points=TSP)

strategy.exit("Close Short", "short", qty_percent=CQ, profit=TPP, loss=SLP, trail_points=TSP)