概述

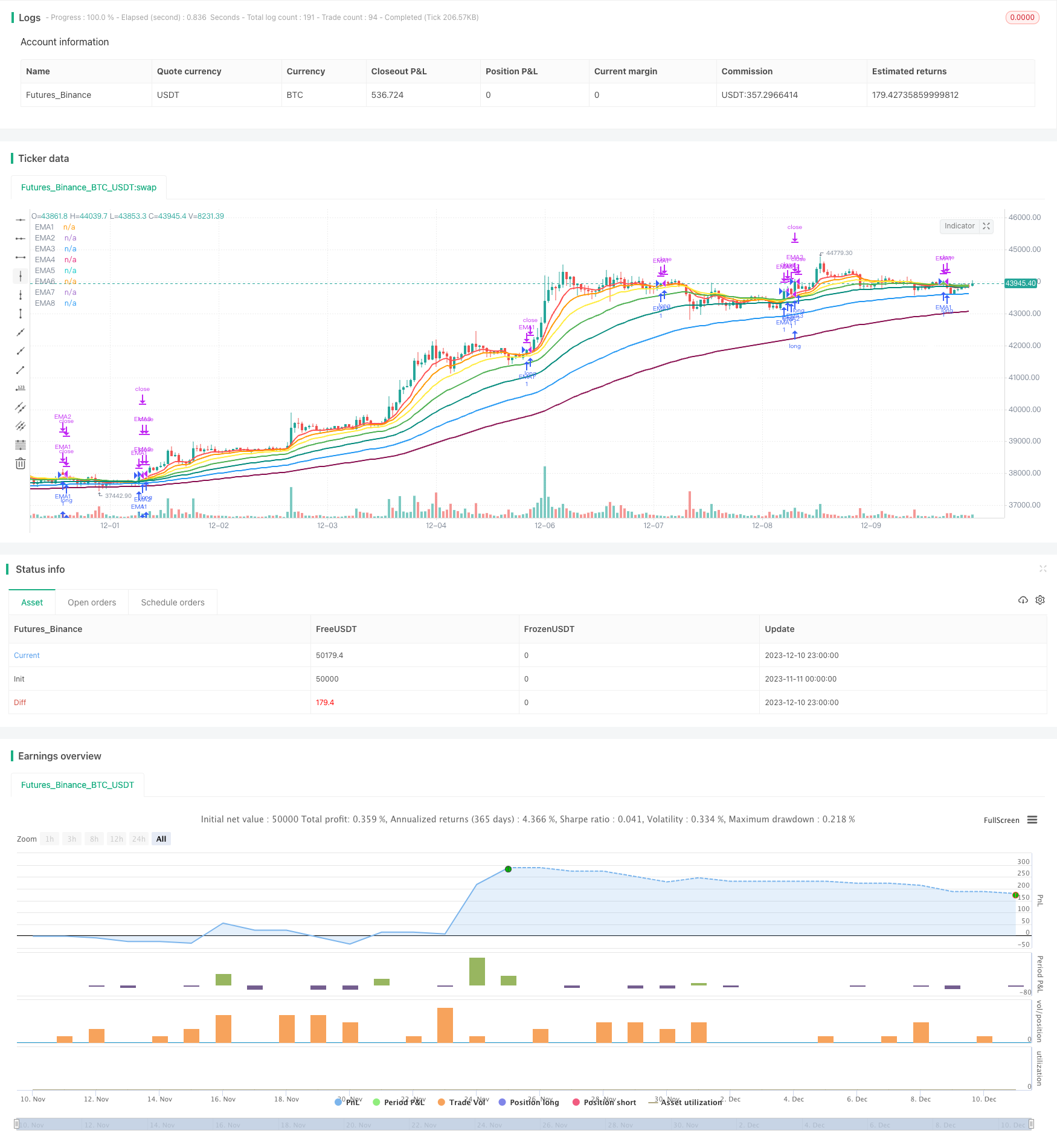

这个策略的核心思想是基于多个指数移动平均线(EMA)的交叉来产生交易信号。当短期EMA上穿较长期的EMA时,做多;当短期EMA下穿较长期的EMA时,平仓。这个策略允许配置多个EMA周期,每个EMA都可以独立启用,策略会在所有启用的EMA上进行交叉交易。

策略原理

该策略设置了8个EMA周期,分别是8日线、13日线、21日线、34日线、55日线、89日线、144日线和233日线。这些EMA被配置为可以独立启用或禁用。

当较短期的EMA从下方上穿较长期的EMA时,产生买入信号;当较短期的EMA从上方下穿较长期的EMA时,产生卖出信号。如果两个EMA都被启用, shorterEMA > longerEMA 为做多信号,shorterEMA < longerEMA 为平仓信号。

举例来说,如果启用55日EMA和89日EMA,当55日EMA上穿89日EMA时,做多;当55日EMA下穿89日EMA时,平仓。这允许这个策略动态调整使用的EMA组合,从更长的周期转换到更短的周期,或者反过来。

持仓数量设置为账户权益除以close再除以启用的EMA组数。这确保了每个EMA上的头寸大小是相同的。

优势分析

- 可以通过配置不同的EMA来调整策略的周期灵活度

- 每个EMA可以独立配置,允许高度自定义

- 持仓按比例分配在每个EMA上,有利于风险管理

- 使用了多个EMA,可以在不同市场阶段切换更适合的EMA

- 策略简单清晰,容易理解和调试

风险分析

- EMA作为单一指标无法确定市场结构,可能发出错误信号

- 大幅震荡市场中EMA容易互相交叉,增加交易频率和滑点成本

- 需要优化EMA参数以适应不同市场

- 可能需要结合其他指标来确认交易信号

可以考虑与其他指标组合使用EMA,例如通道指标或震荡指标来过滤信号,或结合趋势和反转指标。 此外,优化EMA参数非常重要,需要针对不同市场调整。

优化方向

该策略可以从以下几个方面进行优化:

EMA参数优化。可以通过参数扫描和Walk Forward Analysis方法找到最佳EMA参数组合。

增加过滤条件。可以在EMA交叉时增加额外过滤条件来避免错误信号,例如交易量过滤,波动率过滤等。

结合其他指标。可以将EMA与MACD,KDJ,布林带等其他指标组合,利用它们的互补性获利。

动态调整仓位。可以根据市场波动率或趋势力度动态调整每个EMA上的仓位。

损益比优化。优化止损止盈水平,找到最佳风险回报比。

总结

该策略整体来说非常简单直接,通过EMA交叉来捕捉短期和中长期趋势。它的优势在于高度可配置性和灵活性,允许交易者选择最适合自己的EMA组合。但是作为单一指标的EMA容易产生错误信号,这是该策略最大的风险。通过与其他指标组合以及参数优化,可以获得更好的交易表现。

/*backtest

start: 2023-11-11 00:00:00

end: 2023-12-11 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("EMA Fan", shorttitle = "EMA Fan", overlay=true)

// Revision: 1

// Author: @ToS_MavericK

buyprice = 0.0

buyprice := buyprice[1]

// === INPUT SMA ===

EMA1 = input(8)

EMA2 = input(13)

EMA3 = input(21)

EMA4 = input(34)

EMA5 = input(55)

EMA6 = input(89)

EMA7 = input(144)

EMA8 = input(233)

EnableEMA1 = input(true)

EnableEMA2 = input(true)

EnableEMA3 = input(true)

EnableEMA4 = input(true)

EnableEMA5 = input(true)

EnableEMA6 = input(true)

EnableEMA7 = input(true)

EnableEMA8 = input(true)

//Profit = input(defval = 5, type = integer, title = "Profit", minval = 1, step = 1)

//StopLoss = input(defval = 15, type = integer, title = "StopLoss", minval = 1, step = 1)

// === INPUT BACKTEST RANGE ===

FromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2018, title = "From Year", minval = 2012)

ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 2020, title = "To Year", minval = 2012)

// === FUNCTION EXAMPLE ===

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => true // create function "within window of time"

// === SERIES SETUP ===

vEMA1 = ema(close, EMA1)

vEMA2 = ema(close, EMA2)

vEMA3 = ema(close, EMA3)

vEMA4 = ema(close, EMA4)

vEMA5 = ema(close, EMA5)

vEMA6 = ema(close, EMA6)

vEMA7 = ema(close, EMA7)

vEMA8 = ema(close, EMA8)

count = -1

if (EnableEMA1 == true)

count := count + 1

if (EnableEMA2 == true)

count := count + 1

if (EnableEMA3 == true)

count := count + 1

if (EnableEMA4 == true)

count := count + 1

if (EnableEMA5 == true)

count := count + 1

if (EnableEMA6 == true)

count := count + 1

if (EnableEMA7 == true)

count := count + 1

if (EnableEMA8 == true)

count := count + 1

// set position size

Amount = 1 / (close * count)

// === EXECUTION ===

strategy.entry("EMA1", strategy.long, qty = Amount, when = window() and crossover(vEMA1,vEMA2) and EnableEMA1 and EnableEMA2)

strategy.close("EMA1", time > finish or crossunder(vEMA1,vEMA2))

strategy.entry("EMA2", strategy.long, qty = Amount, when = window() and crossover(vEMA2,vEMA3) and EnableEMA2 and EnableEMA3)

strategy.close("EMA2", time > finish or crossunder(vEMA2,vEMA3))

strategy.entry("EMA3", strategy.long, qty = Amount, when = window() and crossover(vEMA3,vEMA4) and EnableEMA3 and EnableEMA4)

strategy.close("EMA3", time > finish or crossunder(vEMA3,vEMA4))

strategy.entry("EMA4", strategy.long, qty = Amount, when = window() and crossover(vEMA4,vEMA5) and EnableEMA4 and EnableEMA5)

strategy.close("EMA4", time > finish or crossunder(vEMA4,vEMA5))

strategy.entry("EMA5", strategy.long, qty = Amount, when = window() and crossover(vEMA5,vEMA6) and EnableEMA5 and EnableEMA6)

strategy.close("EMA5", time > finish or crossunder(vEMA5,vEMA6))

strategy.entry("EMA6", strategy.long, qty = Amount, when = window() and crossover(vEMA6,vEMA7) and EnableEMA6 and EnableEMA7)

strategy.close("EMA6", time > finish or crossunder(vEMA6,vEMA7))

strategy.entry("EMA7", strategy.long, qty = Amount, when = window() and crossover(vEMA7,vEMA8) and EnableEMA7 and EnableEMA8)

strategy.close("EMA7", time > finish or crossunder(vEMA7,vEMA8))

plot(vEMA1, title = 'EMA1', color = red, linewidth = 2, style = line) // plot FastMA

plot(vEMA2, title = 'EMA2', color = orange, linewidth = 2, style = line) // plot SlowMA

plot(vEMA3, title = 'EMA3', color = yellow, linewidth = 2, style = line) // plot SlowMA

plot(vEMA4, title = 'EMA4', color = green, linewidth = 2, style = line) // plot SlowMA

plot(vEMA5, title = 'EMA5', color = teal, linewidth = 2, style = line) // plot SlowMA

plot(vEMA6, title = 'EMA6', color = blue, linewidth = 2, style = line) // plot SlowMA

plot(vEMA7, title = 'EMA7', color = maroon, linewidth = 2, style = line) // plot SlowMA

plot(vEMA8, title = 'EMA8', color = white, linewidth = 2, style = line) // plot SlowMA

//plot(long_stop, title = 'High-ATR', color = red, linewidth = 2, style = line) // plot SlowMA

//plot(short_stop, title = 'Low+ATR', color = green, linewidth = 2, style = line) // plot SlowMA