一、策略概述

本策略名称为“基于SMA、EMA的量化交易策略”,其主要思想是结合不同参数的SMA均线和EMA均线来构建交易信号。

二、策略原理

计算close价格的SMA9、SMA50、SMA180均线和EMA20均线。

根据收盘价close与支撑位sup和阻力位res的关系,确定买入信号和卖出信号。当close突破sup时产生买入信号BuySignal,当close跌破res时产生卖出信号SellSignal。

在买入信号触发时,执行多头开仓策略;在卖出信号触发时,平掉多头仓位。

在卖出信号触发时,执行空头开仓策略;在买入信号触发时,平掉空头仓位。

三、策略优势分析

结合了多种均线来形成交易信号,提高信号的准确性和稳定性。

计算了动态的支撑阻力位,使交易信号更有依据。

采用了高中低波动均线,既注重长期趋势判断又兼顾短期突破,提高策略机会获利率。

支持做多做空双向交易,可以在趋势行情和震荡行情下都能获得收益。

四、策略风险分析

SMA均线存在滞后性,可能导致买入卖出信号被延迟,从而影响策略效果。

没有设定止损机制,持仓亏损可能会扩大。

回测数据不足,实盘中参数需要根据市场调整。

依赖技术指标形成交易信号,无法应对重大黑天鹅事件的冲击。

对应风险的解决方法:

1. 适当调整SMA均线周期;

2. 设定合理的止损位;

3. 加大回测样本量,调整参数;

4. 风控机制需要进一步完善。

五、策略优化方向

增加基于波动率的止损机制,控制单笔损失。

增加机器学习模型判断行情趋势,辅助形成交易信号。

增加关键价格位分析模块,提高支撑阻力判断的准确性。

测试不同均线指标参数的组合,寻找更优参数。

六、策略总结

本策略综合运用了SMA均线和EMA均线的技术指标来构建交易信号,同时计算了动态的支撑阻力位,形成了较为完整的买卖策略逻辑。策略具有指标参数灵活、双向交易、适应多种行情的优点,但也面临均线滞后、止损不完善等问题。未来可从止损机制、趋势判断、关键价格位判断等方面进行策略优化,使策略具有更好的稳定性和盈利空间。

]

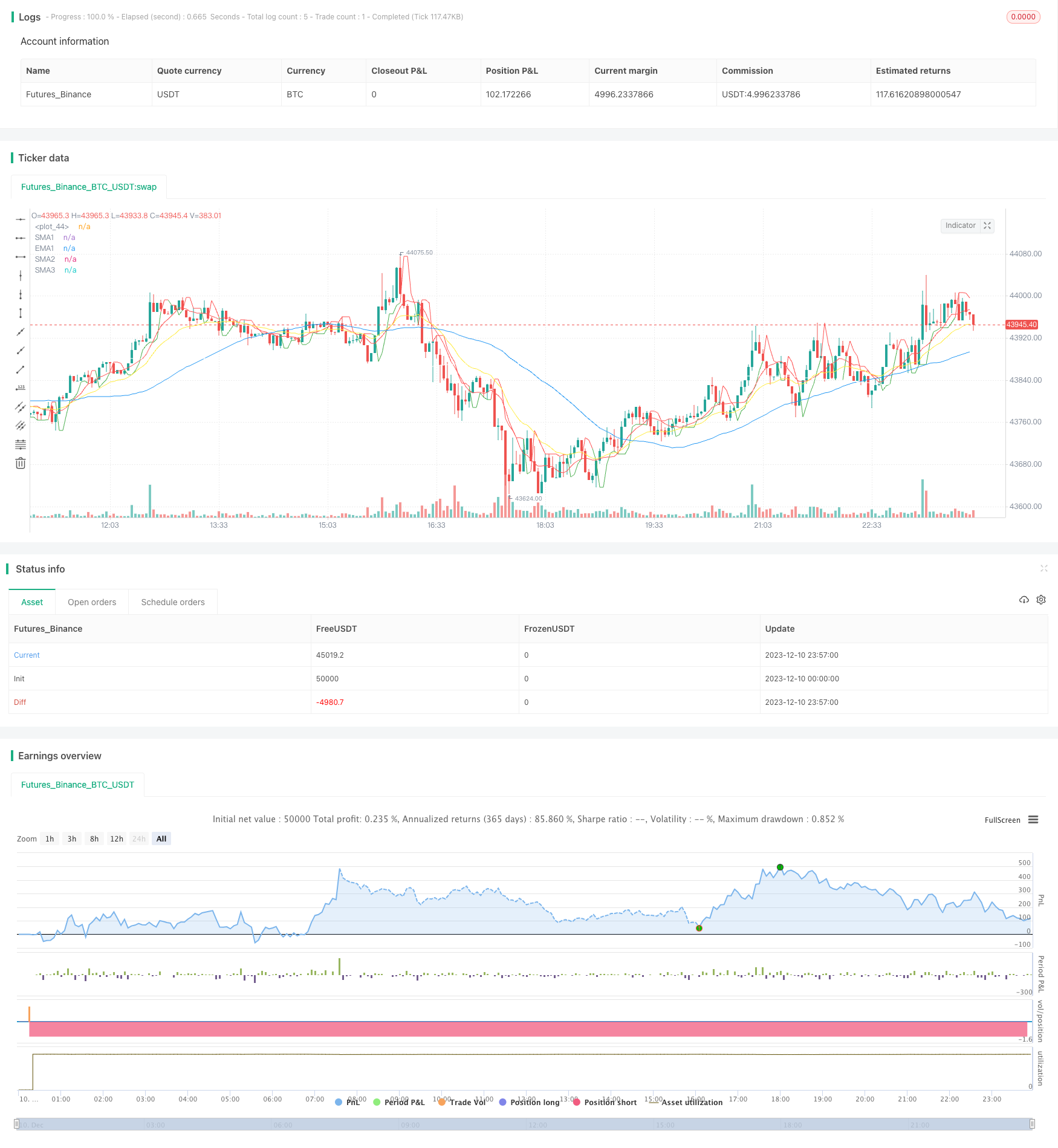

/*backtest

start: 2023-12-10 00:00:00

end: 2023-12-11 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="StrategySMA 9/50/180 | EMA 20 | BUY/SELL", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

//SMA and EMA code

smaInput1 = input(9, title="SMA1")

smaInput2 = input(50, title="SMA2")

smaInput3 = input(180, title="SMA3")

emaInput1 = input(20, title="EMA1")

sma1 = sma(close, smaInput1)

sma2 = sma(close, smaInput2)

sma3 = sma(close, smaInput3)

EMA1 = ema(close, emaInput1)

plot(sma1, color= color.red , title="SMA1")

plot(sma2, color = color.blue, title="SMA2")

plot(sma3, color= color.white, title="SMA3")

plot(EMA1, color = color.yellow, title="EMA1")

no=input(3,title="BUY/SELL Swing")

Barcolor=input(false,title="BUY/SELL Bar Color")

Bgcolor=input(false,title="BUY/SELL Background Color")

res=highest(high,no)

sup=lowest(low,no)

avd=iff(close>res[1],1,iff(close<sup[1],-1,0))

avn=valuewhen(avd!=0,avd,0)

tsl=iff(avn==1,sup,res)

// Buy/sell signals

BuySignal = crossover(close, tsl)

SellSignal = crossunder(close, tsl)

// Enter long position

strategy.entry("Buy", strategy.long, when=BuySignal)

// Exit long position

strategy.exit("Sell", "Buy", when=SellSignal)

// Enter short position

strategy.entry("Sell", strategy.short, when=SellSignal)

// Exit short position

strategy.exit("Buy", "Sell", when=BuySignal)

colr = close>=tsl ? color.green : close<=tsl ? color.red : na

plot(tsl, color=colr)