概述

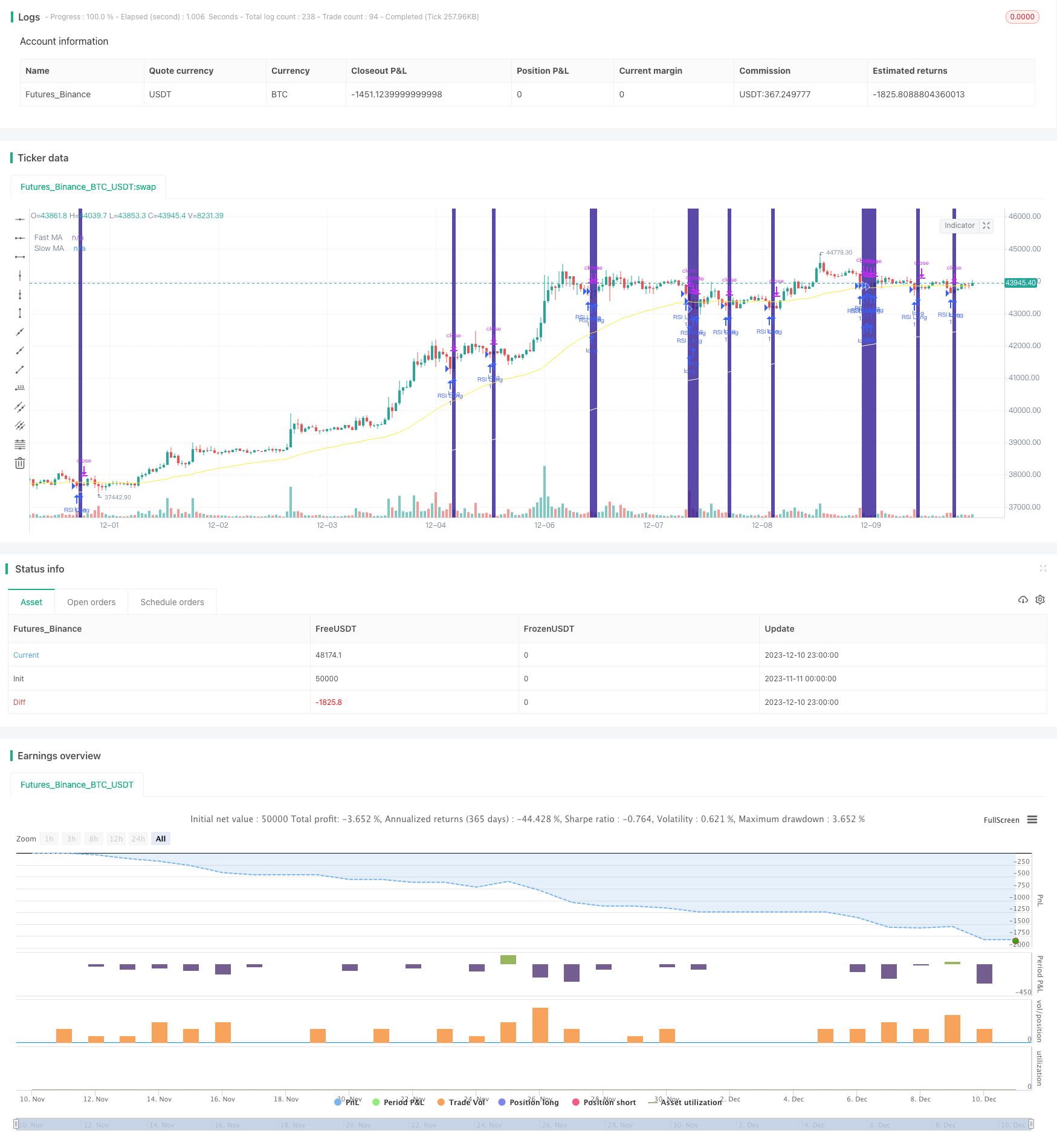

本策略名称为“基于RSI指标的趋势跟踪止损策略”。该策略利用RSI指标判断超买超卖情况,结合快慢MA指标判断趋势方向,设定入场条件。同时使用百分比跟踪止损机制,实现止损退出。

策略原理

该策略主要通过RSI指标和MA指标判断入场时机。RSI指标参数设置为2周期,判断超买超卖情况。快慢MA分别设置为50周期和200周期,判断趋势方向。具体入场逻辑为:

多头入场:快MA上穿慢MA,且价格高于慢MA,同时RSI低于超卖区域(默认10%)时做多;

空头入场:快MA下穿慢MA,且价格低于慢MA,同时RSI高于超买区域(默认90%)时做空。

此外,策略还设定了一个可选的波动率过滤器。该过滤器计算快慢MA的斜率差值,当差值超过设定阈值时才会开仓。其目的是避免价格震荡期无明确方向时开仓。

exit上,策略采用百分比跟踪止损方式。根据输入的止损百分比,结合每跳价差计算出止损价位,实现动态调整止损。

优势分析

该策略主要具有以下优势:

- RSI指标参数设置为2周期,能快速捕捉超买超卖情况,判断反转机会。

- 快慢MA能有效识别趋势方向和转折点。

- 结合RSI和MA双重指标判断,可避免假突破。

- 设置波动率过滤器,可过滤震荡市无明确方向时期。

- 采用百分比跟踪止损方式,可根据市场波动性调整止损幅度,有效控制风险。

风险分析

该策略也存在一定风险,主要体现在:

- RSI和MA指标存在一定滞后性,可能错过部分反转机会。

- 百分比止损在缩量下跌中容易被触发。

- 无法有效处理夜盘和盘前波动较大的品种。

针对上述风险,可从以下方面进行优化:

- 调整RSI参数,设置为1周期,可减少滞后性。

- 根据不同品种特点调整MA周期参数。

- 调整百分比止损水平,兼顾止损与震荡容忍度。

策略优化方向

该策略可从以下方面进行优化:

- 增加其他指标判断,如增加成交量指标,避免虚假突破。

- 增加机器学习模型判断,利用模型预测结果辅助决策。

- 优化复利次数和仓位管理,进一步提升策略收益率。

- 设定夜盘和盘前波动过滤机制。根据波动幅度设定是否参与下个交易日决策。

总结

本策略整体来说是一款较为稳定的趋势跟踪策略。它结合RSI和MA双重指标判断,在保证一定稳定性的同时,也能捕捉比较明确的趋势反转机会。同时设置波动率过滤器可避免部分风险,百分比止损方式也能有效控制单笔损失。该策略可作为多品种通用策略使用,也可针对特定品种进行参数调整和模型优化,从而获得更好的策略效果。

策略源码

/*backtest

start: 2023-11-11 00:00:00

end: 2023-12-11 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// Scalping strategy

// © Lukescream and Ninorigo

// (original version by Lukescream - lastest versions by Ninorigo) - v1.3

//

//@version=4

strategy(title="Scalping using RSI 2 indicator", shorttitle="RSI 2 Strategy", overlay=true, pyramiding=0, process_orders_on_close=false)

var bool ConditionEntryL = false

var bool ConditionEntryS = false

//***********

// Costants

//***********

def_start_date = timestamp("01 Jan 2021 07:30 +0000")

def_end_date = timestamp("01 Dec 2024 07:30 +0000")

def_rsi_length = 2

def_overbought_value = 90

def_oversold_value = 10

def_slow_ma_length = 200

def_fast_ma_length = 50

def_ma_choice = "EMA"

def_tick = 0.5

def_filter = true

def_trailing_stop = 1

//***********

// Change the optional parameters

//***********

start_time = input(title="Start date", defval=def_start_date, type=input.time)

end_time = input(title="End date", defval=def_end_date, type=input.time)

// RSI

src = input(title="Source", defval=close, type=input.source)

rsi_length = input(title="RSI Length", defval=def_rsi_length, minval=1, type=input.integer)

overbought_threshold = input(title="Overbought threshold", defval=def_overbought_value, type=input.float)

oversold_threshold = input(title="Oversold threshold", defval=def_oversold_value, type=input.float)

// Moving average

slow_ma_length = input(title="Slow MA length", defval=def_slow_ma_length, type=input.integer)

fast_ma_length = input(title="Fast MA length", defval=def_fast_ma_length, type=input.integer)

ma_choice = input(title="MA choice", defval="EMA", options=["SMA", "EMA"])

// Input ticker

tick = input(title="Ticker size", defval=def_tick, type=input.float)

filter = input(title="Trend Filter", defval=def_filter, type=input.bool)

// Trailing stop (%)

ts_rate = input(title="Trailing Stop %", defval=def_trailing_stop, type=input.float)

//***********

// RSI

//***********

// Calculate RSI

up = rma(max(change(src), 0), rsi_length)

down = rma(-min(change(src), 0), rsi_length)

rsi = (down == 0 ? 100 : (up == 0 ? 0 : 100-100/(1+up/down)))

//***********

// Moving averages

//***********

slow_ma = (ma_choice == "SMA" ? sma(close, slow_ma_length) : ema(close, slow_ma_length))

fast_ma = (ma_choice == "SMA" ? sma(close, fast_ma_length) : ema(close, fast_ma_length))

// Show the moving averages

plot(slow_ma, color=color.white, title="Slow MA")

plot(fast_ma, color=color.yellow, title="Fast MA")

//***********

// Strategy

//***********

if true

// Determine the entry conditions (only market entry and market exit conditions)

// Long position

ConditionEntryL := (filter == true ? (fast_ma > slow_ma and close > slow_ma and rsi < oversold_threshold) : (fast_ma > slow_ma and rsi < oversold_threshold))

// Short position

ConditionEntryS := (filter == true ? (fast_ma < slow_ma and close < slow_ma and rsi > overbought_threshold) : (fast_ma < slow_ma and rsi > overbought_threshold))

// Calculate the trailing stop

ts_calc = close * (1/tick) * ts_rate * 0.01

// Submit the entry orders and the exit orders

// Long position

if ConditionEntryL

strategy.entry("RSI Long", strategy.long)

// Exit from a long position

strategy.exit("Exit Long", "RSI Long", trail_points=0, trail_offset=ts_calc)

// Short position

if ConditionEntryS

strategy.entry("RSI Short", strategy.short)

// Exit from a short position

strategy.exit("Exit Short", "RSI Short", trail_points=0, trail_offset=ts_calc)

// Highlights long conditions

bgcolor (ConditionEntryL ? color.navy : na, transp=60, offset=1, editable=true, title="Long position band")

// Highlights short conditions

bgcolor (ConditionEntryS ? color.olive : na, transp=60, offset=1, editable=true, title="Short position band")