概述

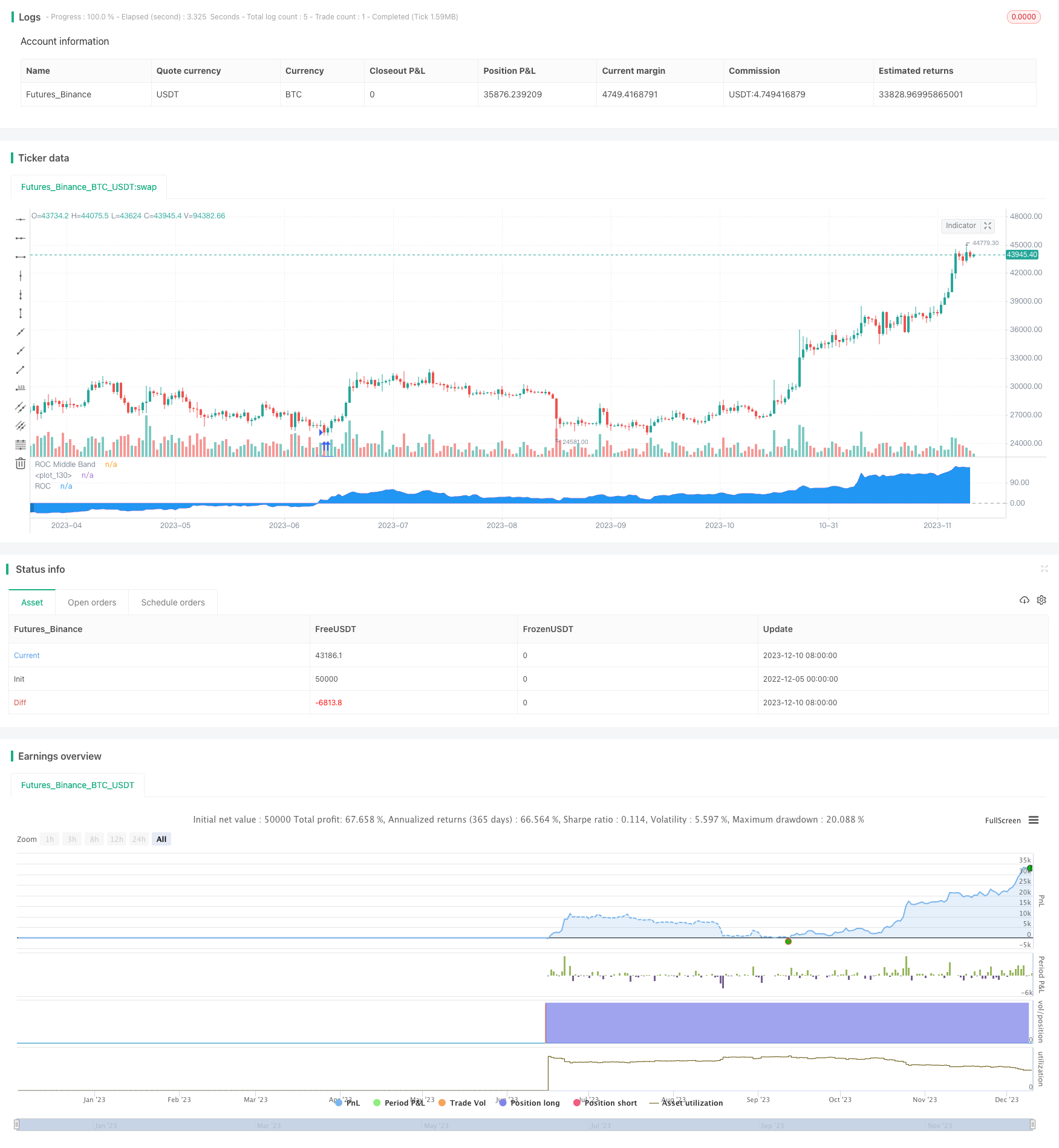

这个策略基于变化率(ROC)指标来判断市场走势和产生交易信号。策略的核心思路是追随长期趋势,通过承担较大的风险来获得超越市场的收益。

策略原理

入场规则

- 如果ROC>0,做多;如果ROC,做空。利用ROC指标的正负来判断行情方向。

- 为了过滤震荡,只有当ROC保持在同一边连续两天时,才会发出交易信号。

止损规则

设置了6%的止损。当止损触发后,改变仓位方向。这表示我们可能正处在行情的错误一边,需要及时止损反向操作。

防泡沫机制

如果ROC超过200,则判定为泡沫。当ROC落回泡沫下方时,产生做空信号。同时,要求泡沫至少持续1周。

资金管理

使用固定仓位+递增法。每上涨或下跌400美元,增加或减少200美元的仓位。这样可以利用盈利进行加仓从而获得更大收益,但也增加了回撤。

优势分析

这是一个追踪长期趋势的策略。它的优势有:

- 遵循趋势交易的哲学,容易获取长期正收益。

- 利用止损来控制风险,可以减轻短期行情波动的影响。

- 防泡沫机制可以避免在市场顶部追高。

- 固定仓位+递增的资金管理方式使其在上涨行情中获得指数型增长。

风险分析

该策略也存在一些风险:

- ROC指标容易受到震荡的影响,产生错误信号。可以考虑加入其他指标进行组合过滤。

- 没有考虑交易费用,实际运用时收益会比回测低。

- 防泡沫参数设置不当也容易错过行情。

- 固定仓位+递增法增大了损失时的回撤。

优化方向

该策略可以从以下几个方面进行优化:

- 增加其他指标判断,组成交易系统,以过滤错误信号。例如加入均线、波动率等指标。

- 优化防泡沫参数,设置更精确的泡沫识别机制。

- 调整固定仓位和递增参数,获得更好的风险收益平衡。

- 添加自动止损机制。当发生大幅亏损时自动停损。

- 考虑交易费用的影响,设置更实际的入场标准。

总结

总的来说,这是一个以ROC指标为核心的长线追踪策略。它通过承担较大的风险获得超越大盘的超额收益,是一个积极进取的策略。我们需要对其进行适当优化,使之能够在实际中运用。关键是要找到适合自己的风险偏好。

策略源码

/*backtest

start: 2022-12-05 00:00:00

end: 2023-12-11 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © gsanson66

//This strategy use the Rate of Change (ROC) of the closing price to send enter signal.

//@version=5

strategy("RATE OF CHANGE BACKTESTING", shorttitle="ROC BACKTESTING", overlay=false, precision=3, initial_capital=1000, default_qty_type=strategy.cash, default_qty_value=950, commission_type=strategy.commission.percent, commission_value=0.18)

//--------------------------------FUNCTIONS-----------------------------------//

//@function Displays text passed to `txt` when called.

debugLabel(txt, color, loc) =>

label.new(bar_index, loc, text = txt, color=color, style = label.style_label_lower_right, textcolor = color.black, size = size.small)

//@function which looks if the close date of the current bar falls inside the date range

inBacktestPeriod(start, end) => (time >= start) and (time <= end)

//----------------------------------USER INPUTS----------------------------------//

//Technical parameters

rocLength = input.int(defval=365, minval=0, title='ROC Length', group="Technical parameters")

bubbleValue = input.int(defval=200, minval=0, title="ROC Bubble signal", group="Technical parameters")

//Risk management

stopLossInput = input.float(defval=10, minval=0, title="Stop Loss (in %)", group="Risk Management")

//Money management

fixedRatio = input.int(defval=400, minval=1, title="Fixed Ratio Value ($)", group="Money Management")

increasingOrderAmount = input.int(defval=200, minval=1, title="Increasing Order Amount ($)", group="Money Management")

//Backtesting period

startDate = input(title="Start Date", defval=timestamp("1 Jan 2017 00:00:00"), group="Backtesting Period")

endDate = input(title="End Date", defval=timestamp("1 July 2024 00:00:00"), group="Backtesting Period")

//-------------------------------------VARIABLES INITIALISATION-----------------------------//

roc = (close/close[rocLength] - 1)*100

midlineConst = 0

var bool inBubble = na

bool shortBubbleCondition = na

equity = strategy.equity - strategy.openprofit

strategy.initial_capital = 50000

var float capital_ref = strategy.initial_capital

var float cashOrder = strategy.initial_capital * 0.95

bool inRange = na

//------------------------------CHECKING SOME CONDITIONS ON EACH SCRIPT EXECUTION-------------------------------//

//Checking if the date belong to the range

inRange := true

//Checking if we are in a bubble

if roc > bubbleValue and not inBubble

inBubble := true

//Checking if the bubble is over

if roc < 0 and inBubble

inBubble := false

//Checking the condition to short the bubble : The ROC must be above the bubblevalue for at least 1 week

if roc[1]>bubbleValue and roc[2]>bubbleValue and roc[3]>bubbleValue and roc[4]>bubbleValue and roc[5]>bubbleValue and roc[6]>bubbleValue and roc[7]>bubbleValue

shortBubbleCondition := true

//Checking performances of the strategy

if equity > capital_ref + fixedRatio

spread = (equity - capital_ref)/fixedRatio

nb_level = int(spread)

increasingOrder = nb_level * increasingOrderAmount

cashOrder := cashOrder + increasingOrder

capital_ref := capital_ref + nb_level*fixedRatio

if equity < capital_ref - fixedRatio

spread = (capital_ref - equity)/fixedRatio

nb_level = int(spread)

decreasingOrder = nb_level * increasingOrderAmount

cashOrder := cashOrder - decreasingOrder

capital_ref := capital_ref - nb_level*fixedRatio

//Checking if we close all trades in case where we exit the backtesting period

if strategy.position_size!=0 and not inRange

debugLabel("END OF BACKTESTING PERIOD : we close the trade", color=color.rgb(116, 116, 116), loc=roc)

strategy.close_all()

//-------------------------------LONG/SHORT CONDITION-------------------------------//

//Long condition

//We reduce noise by taking signal only if the last roc value is in the same side as the current one

if (strategy.position_size<=0 and ta.crossover(roc, midlineConst)[1] and roc>0 and inRange)

//If we were in a short position, we pass to a long position

qty = cashOrder/close

strategy.entry("Long", strategy.long, qty)

stopLoss = close * (1-stopLossInput/100)

strategy.exit("Long Risk Managment", "Long", stop=stopLoss)

//Short condition

//We take a short position if we are in a bubble and roc is decreasing

if (strategy.position_size>=0 and ta.crossunder(roc, midlineConst)[1] and roc<0 and inRange) or

(strategy.position_size>=0 and inBubble and ta.crossunder(roc, bubbleValue) and shortBubbleCondition and inRange)

//If we were in a long position, we pass to a short position

qty = cashOrder/close

strategy.entry("Short", strategy.short, qty)

stopLoss = close * (1+stopLossInput/100)

strategy.exit("Short Risk Managment", "Short", stop=stopLoss)

//--------------------------------RISK MANAGEMENT--------------------------------------//

//We manage our risk and change the sense of position after SL is hitten

if strategy.position_size == 0 and inRange

//We find the direction of the last trade

id = strategy.closedtrades.entry_id(strategy.closedtrades-1)

if id == "Short"

qty = cashOrder/close

strategy.entry("Long", strategy.long, qty)

stopLoss = close * (1-stopLossInput/100)

strategy.exit("Long Risk Managment", "Long", stop=stopLoss)

else if id =="Long"

qty = cashOrder/close

strategy.entry("Short", strategy.short, qty)

stopLoss = close * (1+stopLossInput/100)

strategy.exit("Short Risk Managment", "Short", stop=stopLoss)

//---------------------------------PLOTTING ELEMENTS---------------------------------------//

//Plotting of ROC

rocPlot = plot(roc, "ROC", color=#7E57C2)

midline = hline(0, "ROC Middle Band", color=color.new(#787B86, 25))

midLinePlot = plot(0, color = na, editable = false, display = display.none)

fill(rocPlot, midLinePlot, 40, 0, top_color = strategy.position_size>0 ? color.new(color.green, 0) : strategy.position_size<0 ? color.new(color.red, 0) : na, bottom_color = strategy.position_size>0 ? color.new(color.green, 100) : strategy.position_size<0 ? color.new(color.red, 100) : na, title = "Positive area")

fill(rocPlot, midLinePlot, 0, -40, top_color = strategy.position_size<0 ? color.new(color.red, 100) : strategy.position_size>0 ? color.new(color.green, 100) : na, bottom_color = strategy.position_size<0 ? color.new(color.red, 0) : strategy.position_size>0 ? color.new(color.green, 0) : na, title = "Negative area")