概述

移动均线交叉交易策略是一种简单有效的量化交易策略。该策略运用指数移动均线(EMA)以及均线交叉信号来识别价格走势,确定买入和卖出的时机。相比其他更为复杂的策略,它更加简单易用,容易理解和实施。

策略原理

该策略的关键在于使用两条不同参数的EMA。EMA1设置为25天,EMA2设置为100天。当短期EMA从下方上穿较长期EMA时,是买入信号;当短期EMA从上方下穿较长期EMA时,是卖出信号。这样,短期EMA反映了价格的短期趋势和动量,较长期EMA反映了价格的长期趋势。两条EMA形成“黄金交叉”和“死亡交叉”就是买卖信号。

为过滤误差信号,策略还设置了一些附加条件。如要求柱体阳线为阴,要求交叉发生在RSI大于50时等。这可以避免因短期噪音造成错误交易。

优势分析

该策略最大的优点是简单明了,容易理解和使用。相比许多参数繁多、逻辑复杂的策略,它对交易者更为友好。

其次,该策略捕捉了价格在短期和长期上的趋势变化,利用均线的“金叉”和“死叉”这一经典技术指标识别价格反转,从而判断买入卖出的时机。这种方法行之有效,可以顺势而为,避免在没有明确信号的时候盲目交易。

最后,该策略还设置了适当的过滤条件。这可以减少误交易的概率,避免被市场噪音欺骗。这使得策略可以在复杂多变的市场中实现稳定的表现。

风险分析

该策略最大的风险在于,短期与长期趋势之间可能存在背离。价格短期内出现剧烈波动,触发了均线交叉信号,但长期趋势并未反转。这会导致错误交易亏损。此外,在长期横盘行情中,容易产生频繁的错误信号。

EMA参数设置也会影响策略表现。如果EMA周期设置不当,短期与长期EMA将失去代表性,无法有效识别趋势和趋势反转。这同样会增加错误信号和交易风险。

最后,附加过滤条件可能过于严格,错过了有效的交易机会。这会导致策略盈利能力下降。

优化建议

该策略可以考虑结合其他指标进行优化,如KDJ、MACD等,利用更多因素判断买卖时机,以减少错误信号。

此外,可以测试不同的参数,寻找最佳的EMA周期组合。也可以调整过滤条件参数,以兼顾交易频率和稳定性。

动态调整仓位也是一个改进策略的重要方向。例如,当两条EMA距离越远时,增加头寸;当两条EMA距离越近时,减少头寸。这样可以根据市场态势灵活调整风险。

总结

移动均线交叉策略是一个简单实用的量化交易策略。它利用EMA交叉买卖信号,顺应价格短期与长期趋势变化,以判断交易时机。该策略容易理解和实施,最大限度降低了复杂度,是初学者入门量化交易的好选择。但我们也不能忽视它可能存在的风险,需要对参数和过滤条件进行优化,使其可以适应更加复杂的市场环境。

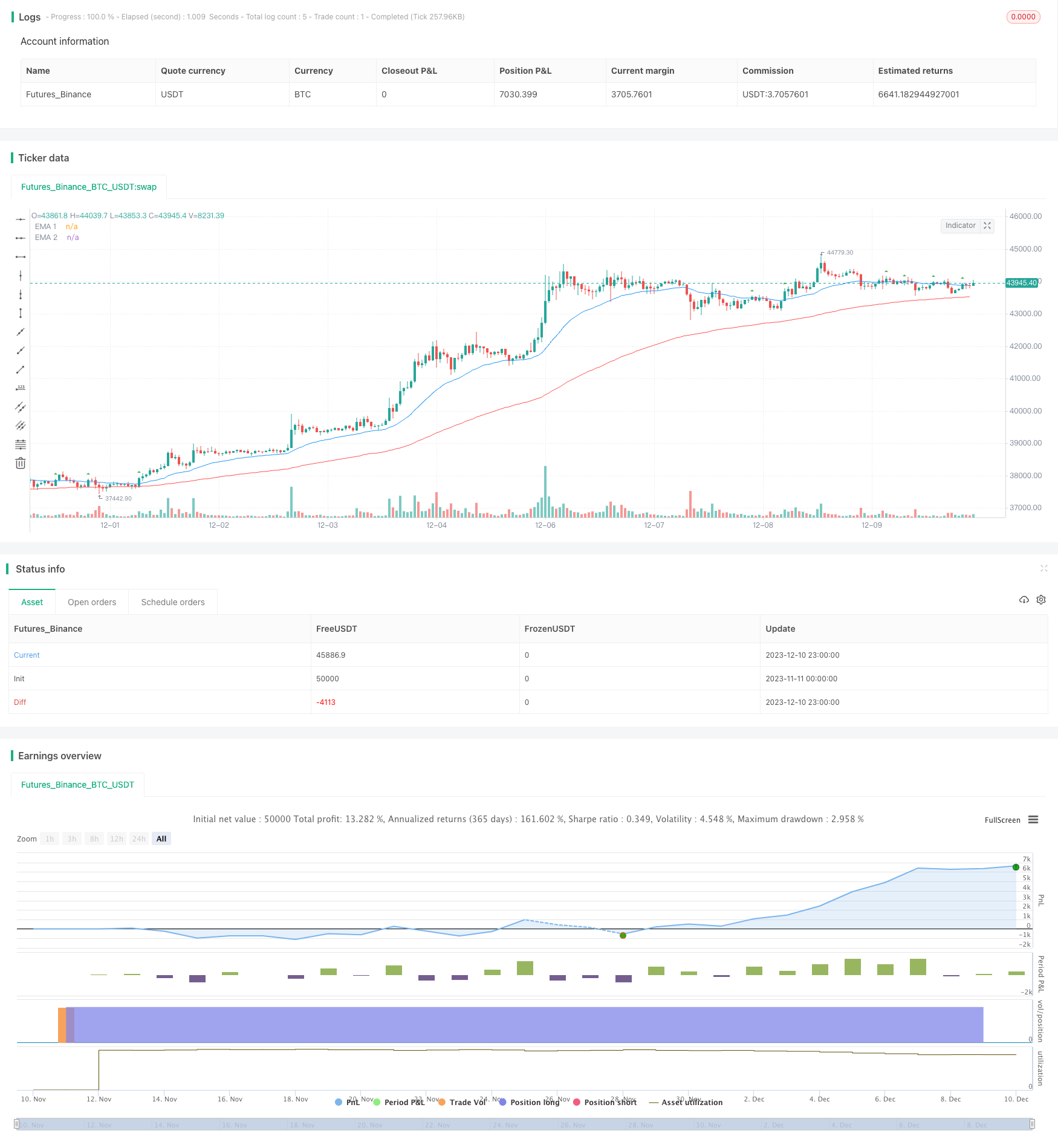

/*backtest

start: 2023-11-11 00:00:00

end: 2023-12-11 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy('EMA Crossover Signal', shorttitle='EMA Crossover Signal', overlay=true)

// Define input for position size as a percentage of equity

position_size_pct = input(1, title='Position Size (%)') / 100

//Input EMA

len1 = input.int(25, minval=1, title='EMA 1')

src1 = input(close, title='Source')

ema1 = ta.ema(src1, len1)

len2 = input.int(100, minval=1, title='EMA 2')

src2 = input(close, title='Source')

ema2 = ta.ema(src2, len2)

//End of format

//Format RSI

lenrsi = input(14, title='RSI length')

outrsi = ta.rsi(close,lenrsi)

bodybar1 = math.abs(close - open)

bodybar2 = math.abs(close[1] - open[1])

// Plot the EMAs

plot(ema1, color=color.new(color.blue, 0), title='EMA 1')

plot(ema2, color=color.new(color.red, 0), title='EMA 2')

// EMA Crossover conditions

emaCrossoverUp = ta.crossover(ema1, ema2)

emaCrossoverDown = ta.crossunder(ema1, ema2)

var entrybar = close // Initialize entrybar with the current close

// Calculate crossovers outside of the if statements

emaCrossoverUpOccured = ta.crossover(close, ema1) and ema1 > ema2 and bodybar1 > bodybar2 and close > entrybar

emaCrossoverDownOccured = ta.crossunder(close, ema1) and ema1 < ema2 and bodybar1 > bodybar2 and close < entrybar

plotshape(series=emaCrossoverUpOccured, location=location.abovebar, color=color.new(color.green, 0), style=shape.triangleup, title='New Buy Order', size=size.tiny)

plotshape(series=emaCrossoverDownOccured, location=location.belowbar, color=color.new(color.red, 0), style=shape.triangledown, title='New Sell Order', size=size.tiny)

if emaCrossoverUpOccured

strategy.entry("Enter Long", strategy.long)

else if emaCrossoverDownOccured

strategy.entry("Enter Short", strategy.short)