概述

移动平均百分比波段策略是一种趋势跟踪策略。它使用移动平均线作为基准,然后根据价格的百分比来计算上轨和下轨。当价格突破上轨时,做空;当价格突破下轨时,做多。这个策略最大的优势是能够自动调整波动范围,在不同的市场环境中都能够有效捕捉趋势。

策略原理

该策略的核心指标是移动平均线,中轨线就是简单的 N 日移动平均线。上轨线和下轨线则是根据价格的百分比变动来计算的。具体的计算公式是:

上轨线 = 中轨线 + 价格 * 上轨线百分比 下轨线 = 中轨线 - 价格 * 下轨线百分比

这里的上轨线百分比和下轨线百分比是可调的参数,默认值为 2,代表价格的 2%。

当价格上涨时,上轨线和下轨线会同时向上扩展;当价格下跌时,上轨线和下轨线也会同时向下收缩。这就实现了根据市场波动程度来自动调整通道宽度的效果。

在交易策略方面,当价格突破上轨线时,做空;当价格突破下轨线时,做多。此外,该策略还设定了只在特定月份交易的条件,避免在非主要趋势月份产生错误信号。

优势分析

该策略最大的优势在于波动范围是根据价格百分比变动来计算的,可以自动调整,适应不同的行情环境,既能在震荡行情中减少虚假信号,也能在趋势行情中及时捕捉转折。此外,设置了月份和日期筛选条件,可以过滤掉边际月份的噪音,避免在非主要趋势月份产生错误信号。

风险分析

该策略的主要风险在于移动平均线存在滞后性,无法对突发事件做出即时反应。此外,百分比范围的设定也会影响策略表现,如果设定太低,则会加剧移动平均线的滞后性问题;如果设定太高,则会增加虚假信号的概率。

另一个潜在风险是过于依赖日期和月份条件,如果主要走势发生在设定月份之外,该策略就会错过机会。所以这些预设条件也需要根据不同品种和市场环境来调整。

优化方向

该策略的优化空间还很大。首先,可以测试不同的参数组合,如移动平均线的时间长度、百分比参数等,找到最优的参数。其次,可以考虑加入别的指标来确认移动平均线信号,如成交量等,以提高信号的可靠性。最后,日期和月份筛选条件也可以根据不同品种和市场环境进行调整,使之更加灵活。

例如,可以基于历史数据判断哪些月份是主要的趋势月份,然后自动计算出阈值。当价格出现异常突破时,也可以暂时忽略月份条件,全面参与。引入机器学习等手段来动态优化这些参数也是可行的。

总结

移动平均百分比波段策略整体来说是一种非常实用的趋势跟踪策略。它最大的优势就是能够自动调整波动范围,适应市场的变化。同时,也存在一定的改进空间,如参数优化、信号过滤等。如果能够合理运用,它能够在多种市场环境下稳定获利。

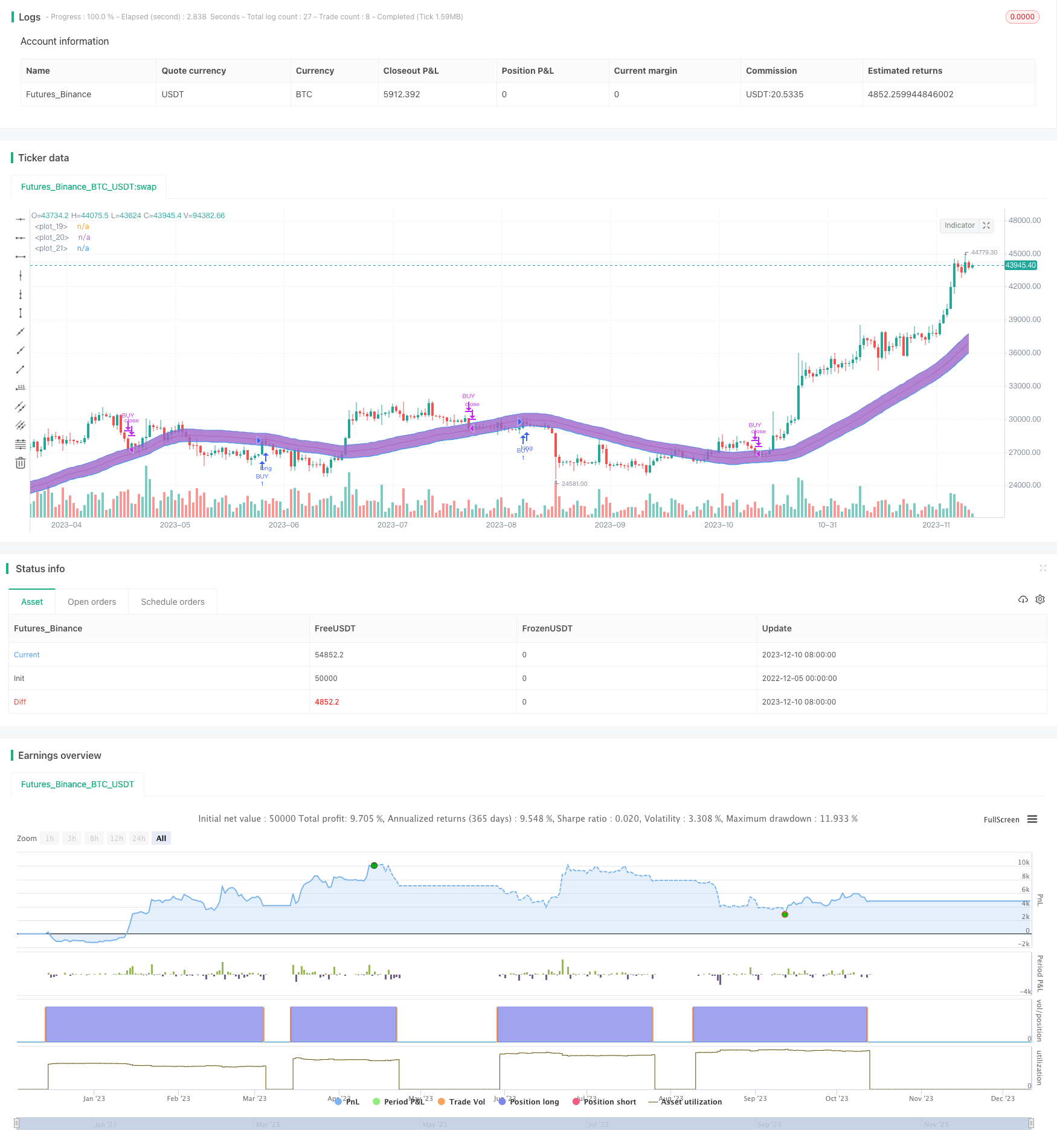

/*backtest

start: 2022-12-05 00:00:00

end: 2023-12-11 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(title = "Percentage Band", overlay = true)

//////////////// BAND ////////////////////////////

price=close

bandlength = input(50)

bbupmult =input(2,step=0.1,title="Multiplier for Percent upper Band")

bblowmult = input(2,step=0.1,title="Multiplier for Percent Lower Band")

basis = sma(close,bandlength)

devup = (bbupmult*price)/100

devlow = (bblowmult*price)/100

upper = basis + devup

lower = basis - devlow

plot(basis, color=red)

p1 = plot(upper, color=blue)

p2 = plot(lower, color=blue)

fill(p1, p2)

/////////////////////////BAND //////////////////////////

// Conditions

longCond = na

sellCond = na

longCond := crossover(price,lower)

sellCond := crossunder(price,upper)

monthfrom =input(6)

monthuntil =input(12)

dayfrom=input(1)

dayuntil=input(31)

if ( longCond )

strategy.entry("BUY", strategy.long, stop=close, oca_name="TREND",comment="BUY")

else

strategy.cancel(id="BUY")

if ( sellCond )

strategy.close("BUY")