概述

震荡突破策略是一个利用价格震荡形态,在价格突破关键支撑或阻力位时进行买卖操作的策略。该策略结合多种技术指标识别关键交易机会。

策略原理

该策略主要基于布林带中线、48日简单移动平均线(SMA)、MACD和ADX四个技术指标。具体逻辑是:

当收盘价上穿或下穿48日SMA时,考虑交易机会;

当收盘价突破布林带中线时,作为进场信号;

MACD要大于或小于0,作为确定趋势方向的辅助指标;

ADX要大于25,以过滤掉非趋势行情。

满足以上四个条件时,做多或做空。

策略优势

这是一个结合趋势和震荡指标的策略。其主要优势有:

48日SMA过滤掉过度频繁交易,锁定中长线趋势;

布林带中线突破把握关键支撑阻力突破点,具有很强的止损功能;

MACD判断大趋势方向,避免逆势交易;

ADX过滤非趋势市场,提高策略胜率。

综上,该策略在控制交易频率、把握关键点、判断趋势和过滤无效行情等多个方面做了优化,胜率较高。

策略风险

该策略主要存在以下风险:

震荡市场中,布林带中线频繁触发交易机会,可能过度交易;

ADX指标在判断趋势和无效行情时,也存在一定误差;

回撤风险较大,适合有一定风险承受能力的投资者。

策略优化

该策略可从以下几个方面进行进一步优化:

增加ATR指标,设定止损位,减小单笔止损;

优化布林带参数,降低中线触发频率;

增加交易量或趋势强度指标判断趋势强弱,避免弱势逆转。

总结

综上所述,该震荡突破策略整体较为成熟,有效把握震荡行情中的关键交易点。它结合趋势和震荡指标,把握风险与收益之间的平衡。通过进一步优化,可望获得更稳定的超额收益。

策略源码

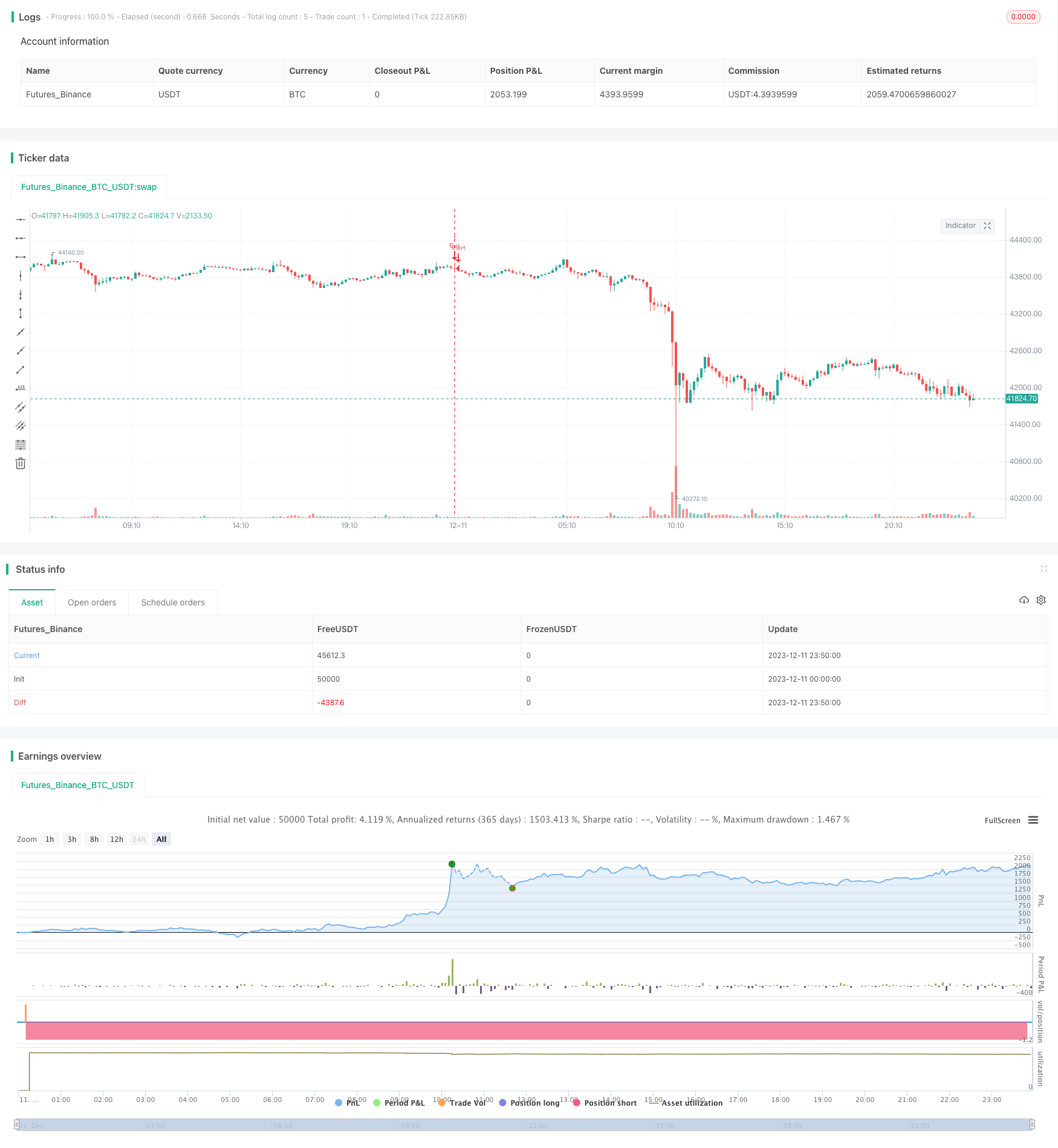

/*backtest

start: 2023-12-11 00:00:00

end: 2023-12-12 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © 03.freeman

//Volatility Traders Minds Strategy (VTM Strategy)

//I found this startegy on internet, with a video explaingin how it works.

//Conditions for entry:

//1 - Candles must to be above or bellow the 48 MA (Yellow line)

//2 - Candles must to break the middle of bollinger bands

//3 - Macd must to be above or bellow zero level;

//4 - ADX must to be above 25 level

//@version=4

strategy("Volatility Traders Minds Strategy (VTM Strategy)", shorttitle="VTM",overlay=true)

source = input(close)

//MA

ma48 = sma(source,48)

//MACD

fastLength = input(12)

slowlength = input(26)

MACDLength = input(9)

MACD = ema(source, fastLength) - ema(source, slowlength)

aMACD = ema(MACD, MACDLength)

delta = MACD - aMACD

//BB

length = input(20, minval=1)

mult = input(2.0, minval=0.001, maxval=50)

basis = sma(source, length)

dev = mult * stdev(source, length)

upper = basis + dev

lower = basis - dev

//ADX

adxThreshold = input(title="ADX Threshold", type=input.integer, defval=25, minval=1)

adxlen = input(14, title="ADX Smoothing")

dilen = input(14, title="DI Length")

dirmov(len) =>

up = change(high)

down = -change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

truerange = rma(tr, len)

plus = fixnan(100 * rma(plusDM, len) / truerange)

minus = fixnan(100 * rma(minusDM, len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adx = 100 * rma(abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

sig = adx(dilen, adxlen)

// Strategy: (Thanks to JayRogers)

// === STRATEGY RELATED INPUTS ===

//tradeInvert = input(defval = false, title = "Invert Trade Direction?")

// the risk management inputs

inpTakeProfit = input(defval = 0, title = "Take Profit Points", minval = 0)

inpStopLoss = input(defval = 0, title = "Stop Loss Points", minval = 0)

inpTrailStop = input(defval = 0, title = "Trailing Stop Loss Points", minval = 0)

inpTrailOffset = input(defval = 0, title = "Trailing Stop Loss Offset Points", minval = 0)

// === RISK MANAGEMENT VALUE PREP ===

// if an input is less than 1, assuming not wanted so we assign 'na' value to disable it.

useTakeProfit = inpTakeProfit >= 1 ? inpTakeProfit : na

useStopLoss = inpStopLoss >= 1 ? inpStopLoss : na

useTrailStop = inpTrailStop >= 1 ? inpTrailStop : na

useTrailOffset = inpTrailOffset >= 1 ? inpTrailOffset : na

// === STRATEGY - LONG POSITION EXECUTION ===

enterLong() => close>ma48 and close>basis and delta>0 and sig>adxThreshold // functions can be used to wrap up and work out complex conditions

//exitLong() => jaw>teeth or jaw>lips or teeth>lips

strategy.entry(id = "Buy", long = true, when = enterLong() ) // use function or simple condition to decide when to get in

//strategy.close(id = "Buy", when = exitLong() ) // ...and when to get out

// === STRATEGY - SHORT POSITION EXECUTION ===

enterShort() => close<ma48 and close<basis and delta<0 and sig>adxThreshold

//exitShort() => jaw<teeth or jaw<lips or teeth<lips

strategy.entry(id = "Sell", long = false, when = enterShort())

//strategy.close(id = "Sell", when = exitShort() )

// === STRATEGY RISK MANAGEMENT EXECUTION ===

// finally, make use of all the earlier values we got prepped

strategy.exit("Exit Buy", from_entry = "Buy", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

strategy.exit("Exit Sell", from_entry = "Sell", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

// === Backtesting Dates === thanks to Trost

testPeriodSwitch = input(false, "Custom Backtesting Dates")

testStartYear = input(2020, "Backtest Start Year")

testStartMonth = input(1, "Backtest Start Month")

testStartDay = input(1, "Backtest Start Day")

testStartHour = input(0, "Backtest Start Hour")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,testStartHour,0)

testStopYear = input(2020, "Backtest Stop Year")

testStopMonth = input(12, "Backtest Stop Month")

testStopDay = input(31, "Backtest Stop Day")

testStopHour = input(23, "Backtest Stop Hour")

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,testStopHour,0)

testPeriod() =>

time >= testPeriodStart and time <= testPeriodStop ? true : false

isPeriod = testPeriodSwitch == true ? testPeriod() : true

// === /END

if not isPeriod

strategy.cancel_all()

strategy.close_all()