概述

该策略是一个组合策略,结合了动量指标、趋势跟踪指标以及均线指标,实现了趋势跟踪与突破买入/卖出。主要通过 Stochastic 指标与 Supertrend 指标的组合判断买入/卖出时机,辅以 EMA 均线判断市场主要趋势。

策略原理

该策略主要由以下几部分指标组成:

EMA 均线:使用 EMA 25、50、100 和 200 四条均线判断主要趋势。EMA25 上穿 EMA50 且 EMA100 上穿 EMA200 时为上升趋势,否则为下降趋势。

Supertrend 趋势跟踪指标:参数为 Factor 3和 ATR 10,判断当前价格是否处于上升或下降趋势中。当 Supertrend 为绿色时为上升趋势,红色为下降趋势。

Stochastic 动量指标:%K 8 和 %D 3,判断Stochastic 是否产生金叉或死叉现象。当 %K 线从下方上穿 %D 线时为金叉信号,反之死叉信号。

买入策略为:EMA 显示上升趋势 + Supertrend 显示上升趋势 + Stochastic 金叉时机。 卖出策略为:EMA 显示下降趋势 + Supertrend 显示下降趋势 + Stochastic 死叉时机。

该策略综合了趋势、动量和突破三个指标,能比较可靠地判断市场走势与买卖点。

优势分析

该策略主要具有以下优势:

结合多种指标,判断力较强,可以有效过滤假突破。

动量指标的加入可以提早判断转折点。

可自定义参数,适用于不同市场环境。

实现了相对高效的止损与止盈设置。

可以在高周期如日线进行回测,效果较好。

风险分析

该策略也存在一些风险:

参数设置不当可能导致交易频繁或信号不稳定。需要对参数调优。

在择时上仍有可能出现误判的情况。可以考虑加入更多滤波指标。

止损点设置为 Stochastic 指标的极值点,可能会过于靠近,可以考虑适当放宽。

回测数据不足,可能对参数拟合产生影响,应扩大回测周期。

优化方向

该策略可以从以下几个方向进行优化:

1.测试更多参数组合,找到最优参数。如调整 Supertrend 的 Factor 参数等。

2.加入更多滤波指标,如能量指标、波动率指标等,减少误判概率。

3.可以测试不同的止损方式,如在极值点一定百分比设置止损线等。

4.优化止盈方式,如考虑动态止盈,以锁定更多利润。

5.扩大策略适用范围,如尝试适配更多交易品种,或尝试在更高周期使用。

总结

该策略整体思路清晰,指标选择合理,实现了趋势跟踪与突破交易,回测效果较好。但仍有优化空间存在,通过参数调整、加入更多滤波指标、改进止损止盈方式等进行多方位优化,可以使策略更加稳定可靠。

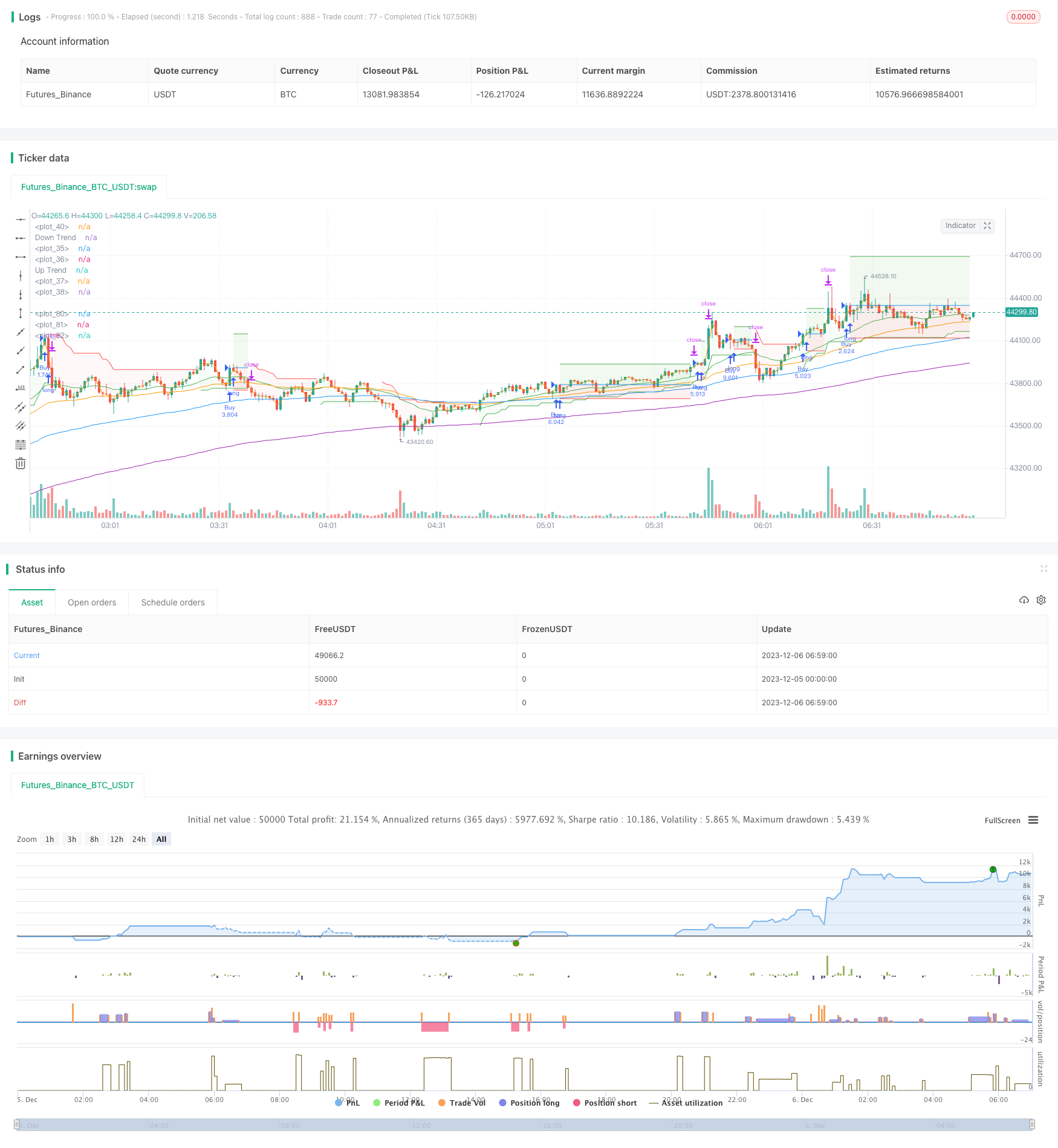

/*backtest

start: 2023-12-05 00:00:00

end: 2023-12-06 07:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="Supertrend + Stoch Strategy", overlay=true)

// ---inputs---

pl = input(1.5, title="P/L", minval=0.1)

lossPercentage = input(1, title="Loss Percentage", minval=1, maxval=100)

atrPeriod = input(10, "ATR Length")

factor = input(3, "Supertrend Factor")

periodK = input(8, title="%K Length", minval=1)

smoothK = input(3, title="%K Smoothing", minval=1)

periodD = input(3, title="%D Smoothing", minval=1)

ema1l = input(25, title="EMA 1 Length", minval=1)

ema2l = input(50, title="EMA 2 Length", minval=1)

ema3l = input(100, title="EMA 3 Length", minval=1)

ema4l = input(200, title="EMA 4 Length", minval=1)

// ---lines---

ema1 = ema(close, ema1l)

ema2 = ema(close, ema2l)

ema3 = ema(close, ema3l)

ema4 = ema(close, ema4l)

trendUpper = ema1 > ema2 and ema3 > ema4

trendLower = ema1 < ema2 and ema3 < ema4

[supertrend, direction] = supertrend(factor, atrPeriod)

supertrendUpper = direction < 0

supertrendLower = direction > 0

k = sma(stoch(close, high, low, periodK), smoothK)

d = sma(k, periodD)

stochCrossOver = crossover(k, d)

stochCrossUnder = crossunder(k, d)

// ---plot---

plot(ema1, color=color.green)

plot(ema2, color=color.orange)

plot(ema3, color=color.blue)

plot(ema4, color=color.purple)

bodyMiddle = plot((open + close) / 2, display=display.none)

upTrend = plot(direction < 0 ? supertrend : na, "Up Trend", color = color.green, style=plot.style_linebr)

downTrend = plot(direction < 0 ? na : supertrend, "Down Trend", color = color.red, style=plot.style_linebr)

fill(bodyMiddle, upTrend, color.new(color.green, 95), fillgaps=false)

fill(bodyMiddle, downTrend, color.new(color.red, 95), fillgaps=false)

// ---stop place compute---

edge = 0. // periodly high/low

edge := stochCrossOver ? high : stochCrossUnder ? low : k > d ? max(edge[1], high) : k < d ? min(edge[1], low) : edge[1]

// plot(edge)

// ---trade condition---

// longCond = trendUpper and supertrendUpper and stochCrossOver

// shortCond = trendLower and supertrendLower and stochCrossUnder

longCond = trendUpper and supertrendUpper and stochCrossOver and strategy.position_size == 0

shortCond = trendLower and supertrendLower and stochCrossUnder and strategy.position_size == 0

// ---stop & take---

stop = 0.

stop := nz(stop[1], stop)

take = 0.

take := nz(take[1], take)

if longCond

stop := edge[1]

take := close + (close - stop) * pl

if shortCond

stop := edge[1]

take := close - (stop - close) * pl

// ---trade---

qty = strategy.equity / abs(stop - close) / 100 * lossPercentage

strategy.entry("Buy", strategy.long, when=longCond, qty=qty)

strategy.exit("Close Buy","Buy", limit=take, stop=stop)

strategy.entry("Sell", strategy.short, when=shortCond, qty=qty)

strategy.exit("Close Sell","Sell", limit=take, stop=stop)

stopLine = plot(strategy.position_size != 0 ? stop : na, color=color.red, style=plot.style_linebr)

takeLine = plot(strategy.position_size != 0 ? take : na, color=color.green, style=plot.style_linebr)

entryLine = plot(strategy.position_size != 0 ? strategy.position_avg_price : na, color=color.blue, style=plot.style_linebr)

fill(entryLine, stopLine, color.new(color.red, 90), fillgaps=false)

fill(entryLine, takeLine, color.new(color.green, 90), fillgaps=false)