概述

本策略通过组合使用移动平均线、Laguerre RSI 指标和 ADX 指标来实现突破交易。当快速移动平均线上穿慢速移动平均线,Laguerre RSI 大于 80,ADX 大于 20 时做多;当快速移动平均线下穿慢速移动平均线,Laguerre RSI 小于 20,ADX 大于 20 时做空。该策略捕捉市场的动量特征,在趋势开始发展阶段进入市场。

原理

该策略主要通过以下指标判断趋势和入市时机:

移动平均线组合:16 日 EMA,48 日 EMA,200 日 SMA。当短期平均线上穿长期平均线时判断为多头市场,下穿时判断为空头市场。

Laguerre RSI 指标判断超买超卖区域。RSI 大于 80 为多头信号,小于 20 为空头信号。

ADX 指标判断趋势状态。ADX 大于 20 表示趋势状态,适合突破交易。

入场信号是移动平均线组合判断趋势方向,Laguerre RSI 判断入场时机,ADX 过滤非趋势市场。出场信号是移动平均线发生回转。整个策略判断框架比较合理,各个指标互相配合判断多空和入退场。

优势

本策略具有以下优势:

捕捉趋势动量:该策略只在趋势开始发展的时候入场,可以捕捉到后市的指数级利润。

损失有限:止损位设置得当,可以将单笔损失控制在一定范围。即使遇到套牢也有盈利机会。

指标组合判断准确:移动平均线、Laguerre RSI 和 ADX 指标能够相对准确判断市场多空和入场时机。

实现简单:该策略只用到了3个指标,实现起来简单,容易掌握。

风险

本策略也存在一定的风险:

趋势反转风险:策略属于趋势跟踪策略,如果没有及时判断到趋势反转就会产生较大亏损。

回撤风险:在震荡行情中,止损可能被突破,给账户带来回撤。

参数优化风险:指标参数需要根据不同市场调整,否则会出现失效。

对策:

严格止损,控制单笔亏损。

优化指标参数,调整突破口数。

采用期货套期保值等方法管理回撤。

优化方向

本策略可以从以下几个方面进行优化:

最佳参数优化:对移动平均线周期、Laguerre RSI 参数、ADX 参数进行测试,寻找最优参数组合。

突破口优化:测试不同的移动平均线突破口,找到交易次数和获利率之间的平衡。

入场条件优化:测试其他指标与Laguerre RSI 指标结合,寻找更准确判断入场时机的条件。

出场条件优化:研究其他指标结合移动平均线作为更精确的出场信号判断。

盈利目标和止损优化:测试不同的止盈止损策略,优化账户收益。

总结

本策略通过运用移动平均线、Laguerre RSI 和 ADX 三种指标判断,实现了对趋势行情的有效捕捉。在趋势开始发展的时候及时入场,紧跟趋势运行捕捉指数级利润。同时设置止损策略来控制单笔亏损。本策略适合对行情有判断的积极投资者,也适合参数优化后通过程序化交易自动执行。总体来说,本策略具有较强的实用性。

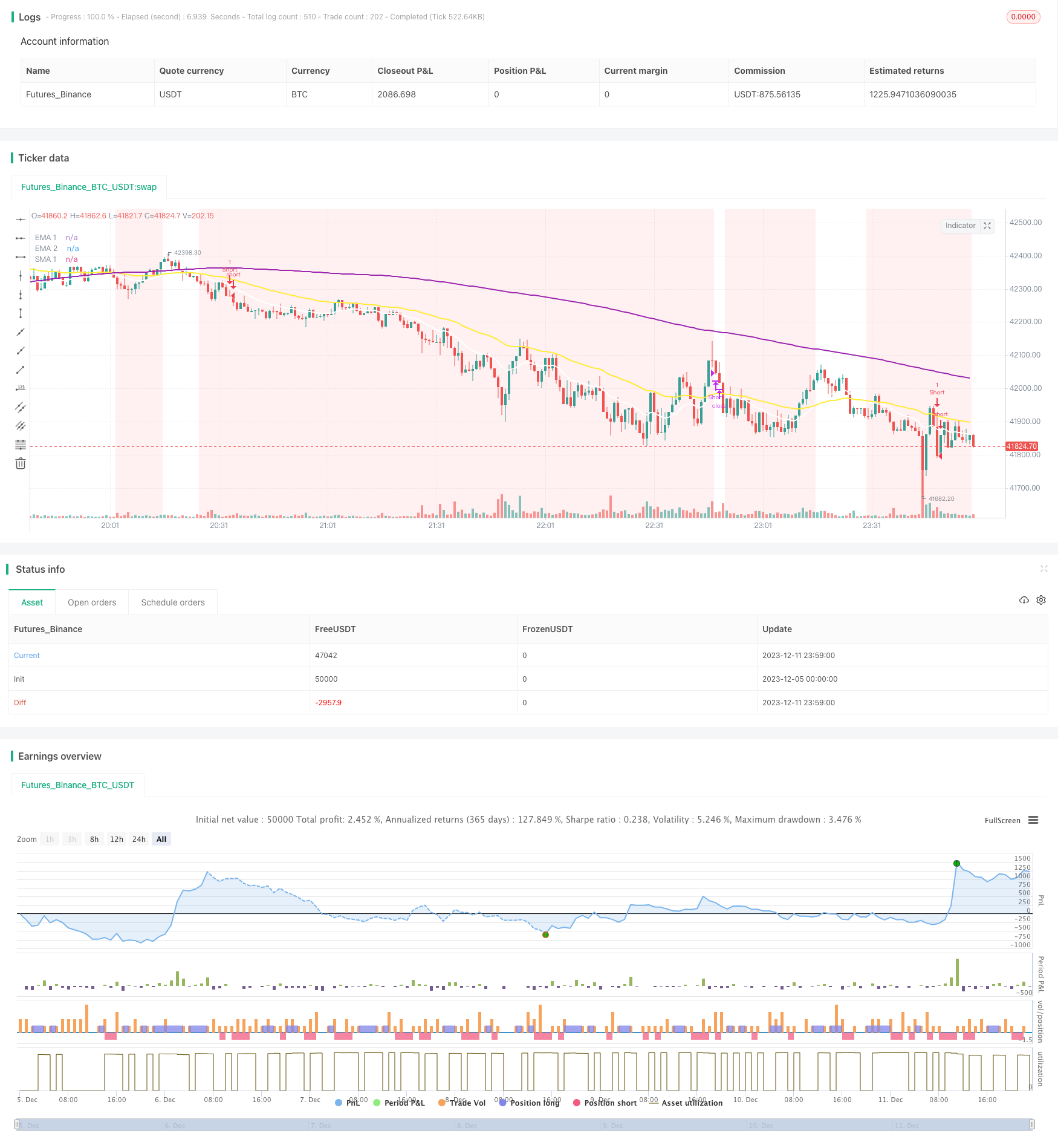

/*backtest

start: 2023-12-05 00:00:00

end: 2023-12-12 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © PtGambler

//@version=5

strategy("3MA + Laguerre RSI + ADX [Pt]", shorttitle = "3MA+LaRSI+ADX[Pt]", overlay=true, initial_capital = 10000, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, calc_on_order_fills = false, max_bars_back = 500)

// ********************************** Trade Period / Strategy Setting **************************************

startY = input(title='Start Year', defval=2011, group = "Backtesting window")

startM = input.int(title='Start Month', defval=1, minval=1, maxval=12, group = "Backtesting window")

startD = input.int(title='Start Day', defval=1, minval=1, maxval=31, group = "Backtesting window")

finishY = input(title='Finish Year', defval=2050, group = "Backtesting window")

finishM = input.int(title='Finish Month', defval=12, minval=1, maxval=12, group = "Backtesting window")

finishD = input.int(title='Finish Day', defval=31, minval=1, maxval=31, group = "Backtesting window")

timestart = timestamp(startY, startM, startD, 00, 00)

timefinish = timestamp(finishY, finishM, finishD, 23, 59)

use_entry_sess = input.bool(false, 'Use Entry Session Window', group = "Trading Session")

t1_session = input("0930-1555:23456", "Entry Session", group="Trading Session", tooltip = "Entry Signal only generated within this period.")

t1 = time(timeframe.period, t1_session)

window = true

margin_req = input.float(1, title="Margin Requirement / Leverage", step=0.1, group = "Trading Options")

qty_per_trade = input.float(100, title = "% of initial capital per trade", group = "Trading Options")

reinvest = input.bool(defval=false,title="Reinvest profit", group = "Trading Options")

reinvest_percent = input.float(defval=100, title = "Reinvest percentage", group="Trading Options")

close_eod = input.bool(false, "All trades will close at the close of trading window", group = "Trading Options")

close_b4_open = input.bool(false, "Position must hit either SL/PT before entering new trade", group = "Trading Options")

profit = strategy.netprofit

strategy.initial_capital = 50000

float trade_amount = math.floor(strategy.initial_capital*margin_req / close)

if strategy.netprofit > 0 and reinvest

trade_amount := math.floor((strategy.initial_capital* (qty_per_trade/100)+(profit*reinvest_percent*0.01))*margin_req/ close)

else

trade_amount := math.floor(strategy.initial_capital* (qty_per_trade/100)*margin_req / close)

// ******************************************************************************************

group_ma = "Moving Average Ribbon"

group_larsi = "Laguerre RSI"

group_adx = "ADX"

group_SL = "Stop Loss / Profit Target"

// ----------------------------------------- MA Ribbon -------------------------------------

ema1_len = input.int(16, "Fast EMA Length", group = group_ma)

ema2_len = input.int(48, "Slow EMA Length ", group = group_ma)

sma1_len = input.int(200, "Slow SMA Length", group = group_ma)

ema1 = ta.ema(close, ema1_len)

ema2 = ta.ema(close, ema2_len)

sma1 = ta.sma(close, sma1_len)

plot(ema1, "EMA 1", color.white, linewidth = 2)

plot(ema2, "EMA 2", color.yellow, linewidth = 2)

plot(sma1, "SMA 1", color.purple, linewidth = 2)

ma_bull = ema1 > ema2 and ema2 > sma1

ma_bear = ema1 < ema2 and ema2 < sma1

// ------------------------------------------ Laguerre RSI ---------------------------------------

alpha = input.float(0.2, title='Alpha', minval=0, maxval=1, step=0.1, group = group_larsi)

gamma = 1 - alpha

L0 = 0.0

L0 := (1 - gamma) * close + gamma * nz(L0[1])

L1 = 0.0

L1 := -gamma * L0 + nz(L0[1]) + gamma * nz(L1[1])

L2 = 0.0

L2 := -gamma * L1 + nz(L1[1]) + gamma * nz(L2[1])

L3 = 0.0

L3 := -gamma * L2 + nz(L2[1]) + gamma * nz(L3[1])

cu = (L0 > L1 ? L0 - L1 : 0) + (L1 > L2 ? L1 - L2 : 0) + (L2 > L3 ? L2 - L3 : 0)

cd = (L0 < L1 ? L1 - L0 : 0) + (L1 < L2 ? L2 - L1 : 0) + (L2 < L3 ? L3 - L2 : 0)

temp = cu + cd == 0 ? -1 : cu + cd

LaRSI = temp == -1 ? 0 : cu / temp

LaRSI := LaRSI * 100

bull_LaRSI = LaRSI > 80

bear_LaRSI = LaRSI < 20

// --------------------------------------- ADX ------------------------

adxlen = input(14, title="ADX Smoothing", group = group_adx)

dilen = input(14, title="DI Length", group = group_adx)

dirmov(len) =>

up = ta.change(high)

down = -ta.change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

truerange = ta.rma(ta.tr, len)

plus = fixnan(100 * ta.rma(plusDM, len) / truerange)

minus = fixnan(100 * ta.rma(minusDM, len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adx = 100 * ta.rma(math.abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

sig = adx(dilen, adxlen)

active_adx = sig > 20 //and sig > sig[1]

// ******************************* Profit Target / Stop Loss *********************************************

use_SLPT = input.bool(false, 'Use Fixed SL / PT', group = group_SL)

SL = input.float(50, 'Stop loss in ticks', step = 1, group = group_SL) * syminfo.mintick

PT = input.float(100, "Profit target in ticks", step = 1, group = group_SL) * syminfo.mintick

var L_PT = 0.0

var S_PT = 0.0

var L_SL = 0.0

var S_SL = 0.0

if strategy.position_size > 0

L_SL := L_SL[1]

L_PT := L_PT[1]

else if strategy.position_size < 0

S_SL := S_SL[1]

S_PT := S_PT[1]

else

L_SL := close - SL

L_PT := close + PT

S_SL := close + SL

S_PT := close - PT

entry_line = plot(use_SLPT and strategy.position_size != 0 ? strategy.opentrades.entry_price(0) : na, "Entry Price", color.white, linewidth = 1, style = plot.style_linebr)

L_PT_line = plot(use_SLPT and strategy.position_size > 0 ? L_PT : na, "L PT", color.green, linewidth = 2, style = plot.style_linebr)

S_PT_line = plot(use_SLPT and strategy.position_size < 0 ? S_PT : na, "S PT", color.green, linewidth = 2, style = plot.style_linebr)

L_SL_line = plot(use_SLPT and strategy.position_size > 0 ? L_SL : na, "L SL", color.red, linewidth = 2, style = plot.style_linebr)

S_SL_line = plot(use_SLPT and strategy.position_size < 0 ? S_SL : na, "S SL", color.red, linewidth = 2, style = plot.style_linebr)

fill(L_PT_line, entry_line, color = color.new(color.green,90))

fill(S_PT_line, entry_line, color = color.new(color.green,90))

fill(L_SL_line, entry_line, color = color.new(color.red,90))

fill(S_SL_line, entry_line, color = color.new(color.red,90))

// ---------------------------------- Strategy setup ------------------------------------------------------

L_entry1 = ma_bull and bull_LaRSI and active_adx

S_entry1 = ma_bear and bear_LaRSI and active_adx

L_exit1 = ta.crossunder(ema1, ema2)

S_exit1 = ta.crossover(ema1, ema2)

// Trigger zones

bgcolor(ma_bull ? color.new(color.green ,90) : na)

bgcolor(ma_bear ? color.new(color.red,90) : na)

if L_entry1 and (use_entry_sess ? window : true) and (close_b4_open ? strategy.position_size == 0 : true)

strategy.entry("Long", strategy.long, trade_amount)

if S_entry1 and (use_entry_sess ? window : true) and (close_b4_open ? strategy.position_size == 0 : true)

strategy.entry("Short", strategy.short, trade_amount)

if use_SLPT

strategy.exit("Exit Long", "Long", limit = L_PT, stop = L_SL, comment_profit = "Exit Long, PT hit", comment_loss = "Exit Long, SL hit")

strategy.exit("Exit Short", "Short", limit = S_PT, stop = S_SL, comment_profit = "Exit Short, PT hit", comment_loss = "Exit Short, SL hit")

else

if L_exit1

strategy.close("Long", comment = "Exit Long")

if S_exit1

strategy.close("Short", comment = "Exit Short")

if use_entry_sess and not window and close_eod

strategy.close_all(comment = "EOD close")