概述

这是一个结合双重反转信号的趋势跟踪策略。它整合了123反转策略和性能指数策略,追踪价格反转点,实现更可靠的趋势判断。

策略原理

该策略由两个子策略组成:

123反转策略

使用14日K线判断反转信号。具体规则是:

- 多头信号:前两日收盘价下跌,当前K线收盘价高于前一日收盘价,9日Stochastic Slow低于50

- 空头信号:前两日收盘价上涨,当前K线收盘价低于前一日收盘价,9日Stochastic Fast高于50

性能指数策略

计算过去14日的涨跌幅作为指标。规则如下:

- 性能指数>(0),产生多头信号

- 性能指数<(0),产生空头信号

最终信号是两种信号的综合。即需要同向的多空信号才会产生实际的买卖操作。

这样可以过滤掉部分噪音,使得信号更加可靠。

策略优势

这种双重反转系统有以下优势:

- 结合双重因素判断,信号更加可靠

- 能够有效过滤市场噪音,避免假信号

- 123形态经典且实用,容易判断和复现

- 性能指数能够判断未来趋势走向

- 参数组合灵活,可进一步优化

策略风险

该策略也存在一些风险:

- 可能错过突发性反转,无法全面捕捉趋势

- 双重条件组合导致信号变少,可能影响盈利能力

- 需要同向判断,容易受到个股特殊波动的影响

- 参数设置问题可能导致信号偏差

可以考虑以下几个方面的优化:

- 调整参数,如K线长度、Stochastic周期等

- 优化双重信号的判断逻辑

- 结合更多因子,如成交量等

- 增加止损机制

总结

该策略整合双重反转判断,能有效发现价格转折点。虽然信号发生概率降低,但可靠性较高,适合捕捉中长线趋势。可以通过参数调整和多因子优化进一步增强策略效果。

策略源码

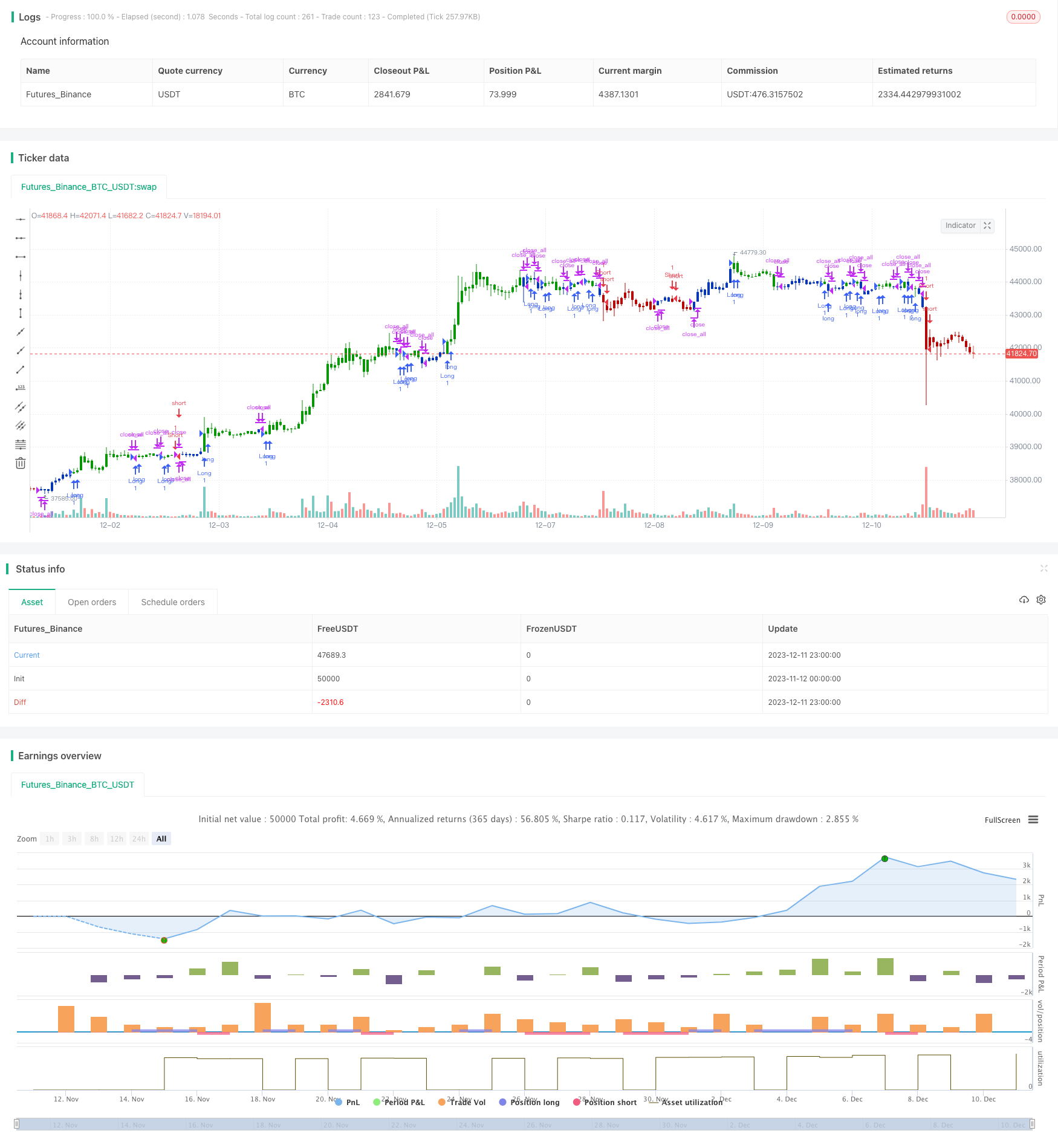

/*backtest

start: 2023-11-12 00:00:00

end: 2023-12-12 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 15/04/2021

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// The Performance indicator or a more familiar term, KPI (key performance indicator),

// is an industry term that measures the performance. Generally used by organizations,

// they determine whether the company is successful or not, and the degree of success.

// It is used on a business’ different levels, to quantify the progress or regress of a

// department, of an employee or even of a certain program or activity. For a manager

// it’s extremely important to determine which KPIs are relevant for his activity, and

// what is important almost always depends on which department he wants to measure the

// performance for. So the indicators set for the financial team will be different than

// the ones for the marketing department and so on.

//

// Similar to the KPIs companies use to measure their performance on a monthly, quarterly

// and yearly basis, the stock market makes use of a performance indicator as well, although

// on the market, the performance index is calculated on a daily basis. The stock market

// performance indicates the direction of the stock market as a whole, or of a specific stock

// and gives traders an overall impression over the future security prices, helping them decide

// the best move. A change in the indicator gives information about future trends a stock could

// adopt, information about a sector or even on the whole economy. The financial sector is the

// most relevant department of the economy and the indicators provide information on its overall

// health, so when a stock price moves upwards, the indicators are a signal of good news. On the

// other hand, if the price of a particular stock decreases, that is because bad news about its

// performance are out and they generate negative signals to the market, causing the price to go

// downwards. One could state that the movement of the security prices and consequently, the movement

// of the indicators are an overall evaluation of a country’s economic trend.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

PI(Period) =>

pos = 0.0

xKPI = (close - close[Period]) * 100 / close[Period]

pos := iff(xKPI > 0, 1,

iff(xKPI < 0, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Perfomance index", shorttitle="Combo", overlay = true)

line1 = input(true, "---- 123 Reversal ----")

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

line2 = input(true, "---- Perfomance index ----")

Period = input(14, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posPI = PI(Period)

pos = iff(posReversal123 == 1 and posPI == 1 , 1,

iff(posReversal123 == -1 and posPI == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1 )

strategy.entry("Long", strategy.long)

if (possig == -1 )

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )