策略名称:动量驱动的线性MACD策略

概述:这是一个利用线性回归预测股票价格,并与MACD指标结合的量化策略。它利用线性回归分析历史价格和交易量,预测未来价格趋势。在获利机会出现时,它结合MACD指标判断入场时机。

策略原理: 1. 计算价格的线性回归系数:根据历史交易量拟合一条线性回归线,用于预测未来价格。 2. 绘制预测价格:根据步骤1中的回归系数,绘制价格的预测线。 3. 生成买入信号:当预测价格处于开盘价和收盘价之间,且MACD上涨时,产生买入信号。 4. 生成卖出信号:当MACD下降,同时价格低于预测价格时,产生卖出信号。

优势分析: 这是一个结合了统计预测和技术指标判断的策略。它利用线性回归得出价格预测,避免主观臆测。同时,MACD指标可有效判断市场买卖力道,精准捕捉机会。整体来说,这是一个系统化程度高,预测准确,风险可控的策略。

风险分析: 线性回归仅依赖历史数据,对突发事件如重大利空消息反应不敏感,可能产生错误信号。此外,参数设置如回归周期长度等,也会影响策略表现。我们建议采用vwma平滑预测价格,降低曲线抖动对策略的影响。

优化方向: 我们认为该策略可从以下几个方面进行优化: 1. 加入止损机制。当价格突破止损线时平仓,有效控制个别错误信号带来的损失。 2. 引入机器学习模型。使用更高效的模型预测价格趋势,提升策略准确性。 3. 结合情绪指标。引入市场恐惧指数等情绪指标,判断市场买卖氛围,提高策略胜率。 4. 多时框结合。不同时间周期预测可能互相验证,形成组合策略,降低单一时框的局限性。

总结: 本策略通过线性回归预测价格与MACD指标判断,形成系统化的量化交易策略。它具有预测逻辑清晰,风险可控,优化空间广阔等优势。我们相信,通过持续优化与迭代,它的表现将越来越出色。它为我们提供了利用科学预测方法进行量化交易的思路,值得我们深入研究与应用。

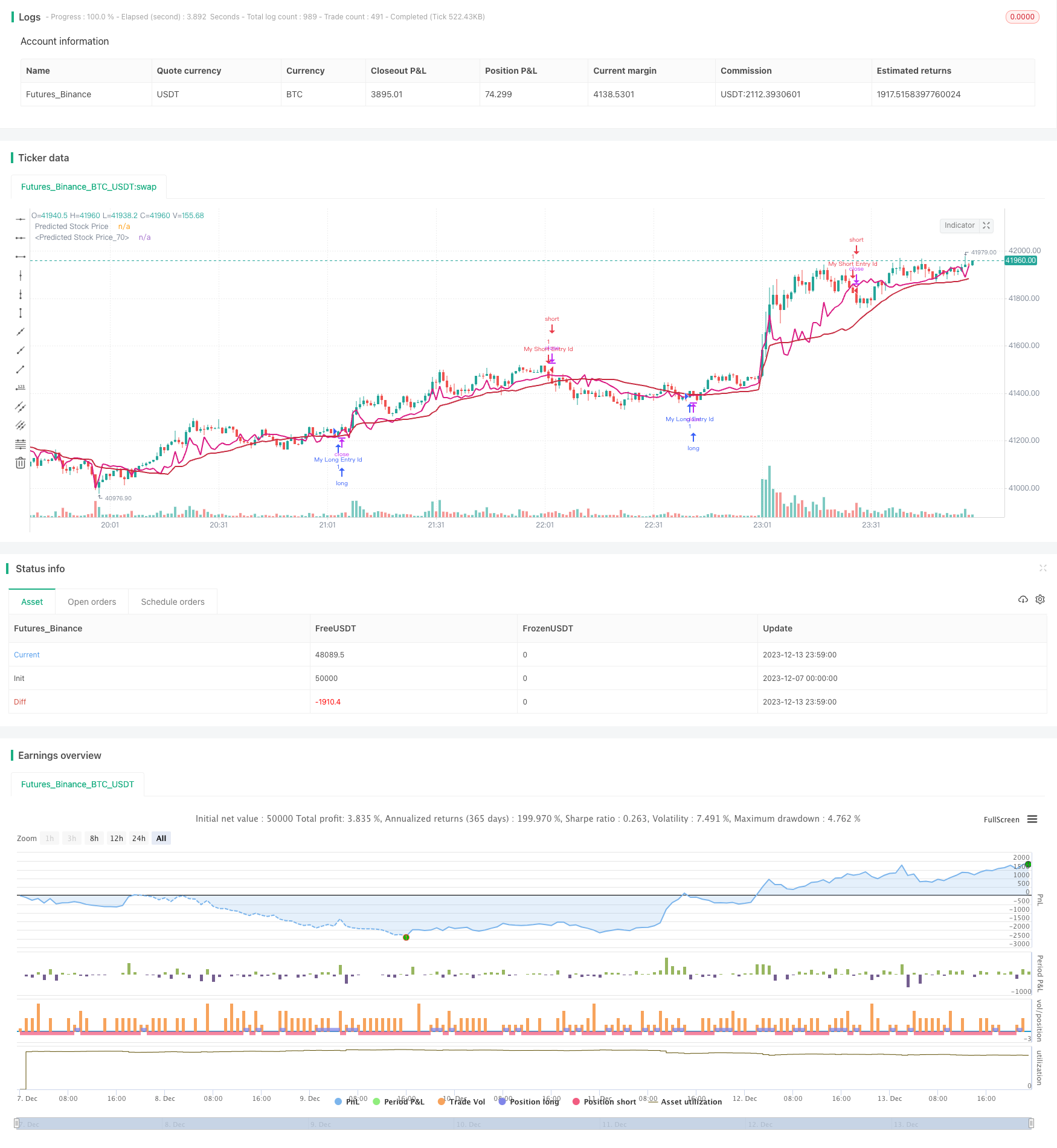

/*backtest

start: 2023-12-07 00:00:00

end: 2023-12-14 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © stocktechbot

//@version=5

strategy("Linear On MACD", overlay=true, margin_long=100, margin_short=100)

fast_length = input(title="Fast Length", defval=12)

slow_length = input(title="Slow Length", defval=26)

tolerance = input.string(title="Risk tolerance", defval = "LOW", options=["LOW", "HIGH"])

chng = 0

obv = ta.cum(math.sign(ta.change(close)) * volume)

if close < close[1] and (open < close)

chng := 1

else if close > close[1]

chng := 1

else

chng := -1

obvalt = ta.cum(math.sign(chng) * volume)

//src = input(title="Source", defval=close)

src = obvalt

signal_length = input.int(title="Signal Smoothing", minval = 1, maxval = 50, defval = 9)

sma_source = input.string(title="Oscillator MA Type", defval="EMA", options=["SMA", "EMA"])

sma_signal = input.string(title="Signal Line MA Type", defval="EMA", options=["SMA", "EMA"])

// Calculating

fast_ma = sma_source == "SMA" ? ta.sma(src, fast_length) : ta.ema(src, fast_length)

slow_ma = sma_source == "SMA" ? ta.sma(src, slow_length) : ta.ema(src, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal == "SMA" ? ta.sma(macd, signal_length) : ta.ema(macd, signal_length)

hist = macd - signal

//hline(0, "Zero Line", color=color.new(#787B86, 50))

//plot(hist, title="Histogram", style=plot.style_columns, color=(hist>=0 ? (hist[1] < hist ? col_grow_above : col_fall_above) : (hist[1] < hist ? col_grow_below : col_fall_below)))

//plot(macd, title="MACD", color=col_macd)

//plot(signal, title="Signal", color=col_signal)

[macdLine, signalLine, histLine] = ta.macd(close, 12, 26, 9)

//Linear Regression

vol = volume

// Function to calculate linear regression

linregs(y, x, len) =>

ybar = math.sum(y, len)/len

xbar = math.sum(x, len)/len

b = math.sum((x - xbar)*(y - ybar),len)/math.sum((x - xbar)*(x - xbar),len)

a = ybar - b*xbar

[a, b]

// Historical stock price data

price = close

// Length of linear regression

len = input(defval = 21, title = 'Lookback')

// Calculate linear regression for stock price based on volume

[a, b] = linregs(price, vol, len)

// Predicted stock price based on volume

predicted_price = a + b*vol

// Check if predicted price is between open and close

is_between = open < predicted_price and predicted_price < close

// Plot predicted stock price

plot(predicted_price, color=color.rgb(218, 27, 132), linewidth=2, title="Predicted Stock Price")

plot(ta.vwma(predicted_price,len), color=color.rgb(199, 43, 64), linewidth=2, title="Predicted Stock Price")

//BUY Signal

lincrossunder = close > predicted_price

macdrise = ta.rising(macd,2)

//macdvollong = ta.crossover(macd, signal)

//macdlong = ta.crossover(macdLine, signalLine)

macdvollong = macd > signal

macdlong = macdLine > signalLine

longCondition=false

if macdlong and macdvollong and is_between and ta.rising(predicted_price,1)

longCondition := true

if (longCondition)

strategy.entry("My Long Entry Id", strategy.long)

//Sell Signal

lincrossover = close < predicted_price

macdfall = ta.falling(macd,1)

macdsell = macd < signal

shortCondition = false

risklevel = predicted_price

if (tolerance == "HIGH")

risklevel := ta.vwma(predicted_price,len)

if macdfall and macdsell and (macdLine < signalLine) and (close < risklevel)

shortCondition := true

if (shortCondition)

strategy.entry("My Short Entry Id", strategy.short)