概述

本策略采用威廉指标的突破原理,结合特定形态的K线,设计出一个高效的多空开仓与平仓的模式,这样能够在行情反转的关键点位准确做多做空,捕捉中短线趋势,获得超额收益。

策略原理

本策略使用威廉指标中的分形点来判断反转信号。当出现上方或下方分形时,如果与K线实体方向一致,则产生交易信号。

具体来说,策略中定义了一个自定义指标WMX Williams Fractals。该指标中使用因子函数来判断上分型(upFractal)和下分型(dnFractal)。

上分型判断逻辑是:当前K线的最高价高于之前n根K线(n是可调参数)的最高价,这样就形成一个突破上方的分型。

下分型判断逻辑是:当前K线的最低价低于之前n根K线的最低价,这样就形成一个突破下方的分型。

得到上分型和下分型后,判断它们是否发生变化,即从无到有或者从有到无。这时分型才刚形成,表示反转的可能性较大。

之后结合K线实体的方向来判断具体的交易信号。当上分型形成,Close高于Open时,做多;当下分型形成,Close低于Open时,做空。

策略优势

使用威廉指标的分型点判断反转时点,这是一种成熟可靠的技术指标

结合K线实体方向来确认交易信号,避免在非趋势区域乱 chops 的情况

参数少,只需要调节分型周期 n ,容易测试和优化

可灵活设置开仓规则,如仓位大小、平仓条件等,易于实盘应用

策略风险

分型形成后,行情可能不是完全反转,需要结合趋势判断

止损位置设置需要谨慎,防止被噪音巨幅行情止损

参数n需要根据不同品种调整,如果周期过大或过小都会影响效果

解决方法:

可以加入移动平均线等指标来判断大趋势,避免逆势开仓

动态跟踪止损或设置合理的回撤限制止损

利用Walk Forward Analysis方法进行参数优化,找到最佳参数

策略优化方向

基于分型的反转策略容易形成多次盈利后再次反转导致亏损的情况。可以考虑加入趋势过滤,进一步限制交易范围,减少不必要的反转交易。

目前的止损方式比较简单,无法有效跟踪行情。可以尝试加入诸如移动止损、时间止损、动态止损等止损方式。

目前只判断 K 线的实体方向。若考虑到影线、收盘位置等更多 K 线信息,可以设计出更精确的交易信号。

总结

本策略属于基于技术指标的反转策略。它利用威廉指标的分型来捕捉标的股在关键时点上的变化趋势,与K线实体结合形成交易信号,以期实现超额收益。

相比于其他反转策略,本策略通过参数化设计,逻辑清晰、易于理解,参数调整方便、容易测试,可直接投入实盘运行。下一步通过趋势判断、止损方式等进一步优化,可望获得更好的策略效果。

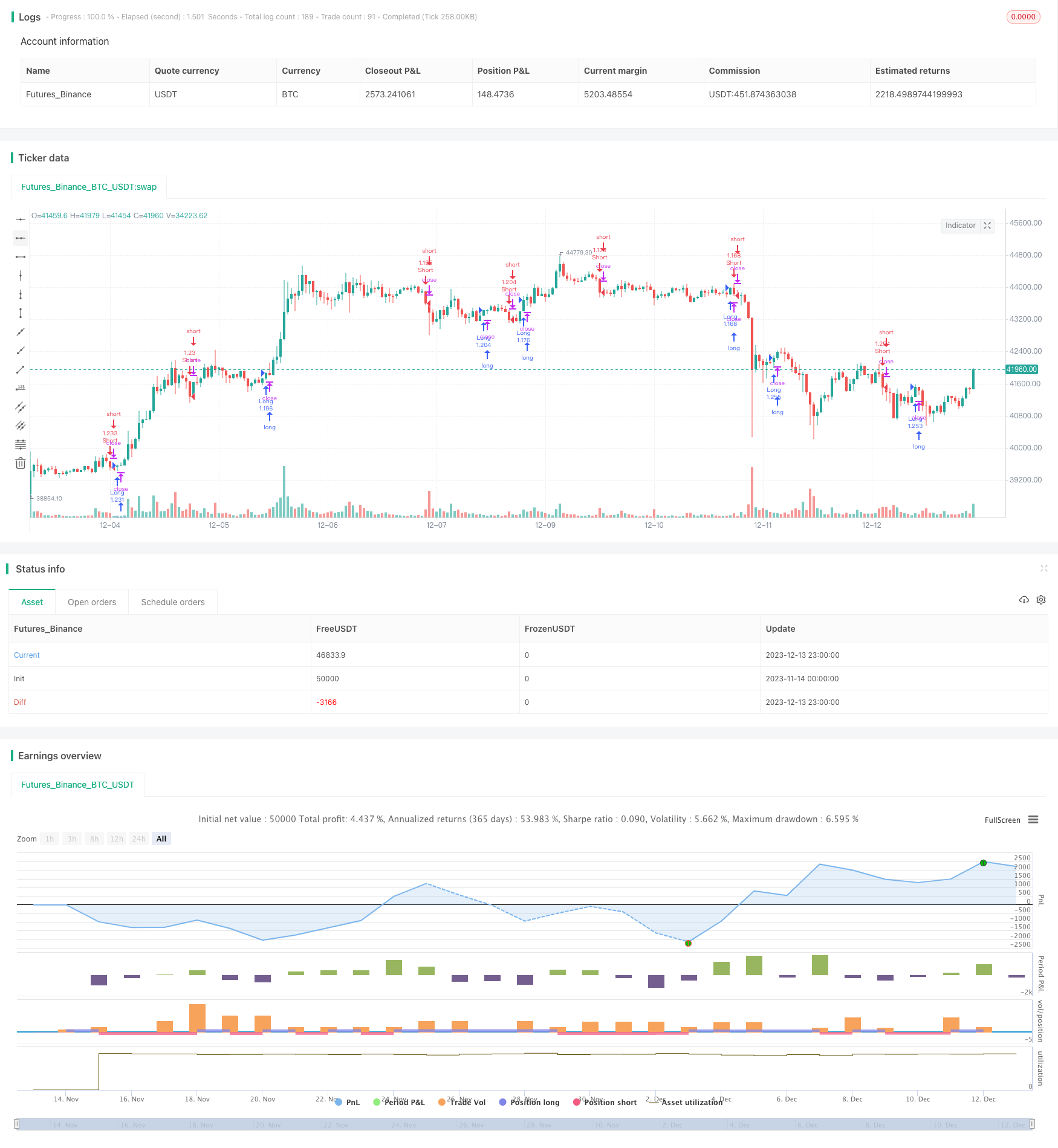

/*backtest

start: 2023-11-14 00:00:00

end: 2023-12-14 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © WMX_Q_System_Trading

//@version=4

SystemName="WMX Williams Fractals strategy V4"

InitCapital = 1000000

InitPosition = 100

InitCommission = 0.075

InitPyramidMax = 10

strategy(title=SystemName, shorttitle=SystemName, overlay=true, initial_capital=InitCapital, default_qty_type=strategy.percent_of_equity, default_qty_value=InitPosition, commission_type=strategy.commission.percent, commission_value=InitCommission)

//study("WMX Williams Fractals", shorttitle="WMX Fractals", format=format.price, precision=0, overlay=true)

// Define "n" as the number of periods and keep a minimum value of 2 for error handling.

n = input(title="Periods", defval=2, minval=2, type=input.integer)

h=close

l=close

factorh(High)=>

upFractal = ( (High[n+2] < High[n]) and (High[n+1] < High[n]) and (High[n-1] < High[n]) and (High[n-2] < High[n]))

or ( (High[n+3] < High[n]) and (High[n+2] < High[n]) and (High[n+1] == High[n]) and (High[n-1] < High[n]) and (High[n-2] < High[n]))

or ( (High[n+4] < High[n]) and (High[n+3] < High[n]) and (High[n+2] == High[n]) and (High[n+1] <= High[n]) and (High[n-1] < High[n]) and (High[n-2] < High[n]))

or ( (High[n+5] < High[n]) and (High[n+4] < High[n]) and (High[n+3] == High[n]) and (High[n+2] == High[n]) and (High[n+1] <= High[n]) and (High[n-1] < High[n]) and (High[n-2] < High[n]))

or ((High[n+6] < High[n]) and (High[n+5] < High[n]) and (High[n+4] == High[n]) and (High[n+3] <= High[n]) and (High[n+2] == High[n]) and (High[n+1] <= High[n]) and (High[n-1] < High[n]) and (High[n-2] < High[n]))

upFractal

upFractal=factorh(h)

factorl(Low)=>

dnFractal = ( (Low[n+2] > Low[n]) and (Low[n+1] > Low[n]) and (Low[n-1] > Low[n]) and (Low[n-2] > Low[n]))

or ( (Low[n+3] > Low[n]) and (Low[n+2] > Low[n]) and (Low[n+1] == Low[n]) and (Low[n-1] > Low[n]) and (Low[n-2] > Low[n]))

or ( (Low[n+4] > Low[n]) and (Low[n+3] > Low[n]) and (Low[n+2] == Low[n]) and (Low[n+1] >= Low[n]) and (Low[n-1] > Low[n]) and (Low[n-2] > Low[n]))

or ( (Low[n+5] > Low[n]) and (Low[n+4] > Low[n]) and (Low[n+3] == Low[n]) and (Low[n+2] == Low[n]) and (Low[n+1] >= Low[n]) and (Low[n-1] > Low[n]) and (Low[n-2] > Low[n]))

or ((Low[n+6] > Low[n]) and (Low[n+5] > Low[n]) and (Low[n+4] == Low[n]) and (Low[n+3] >= Low[n]) and (Low[n+2] == Low[n]) and (Low[n+1] >= Low[n]) and (Low[n-1] > Low[n]) and (Low[n-2] > Low[n]))

dnFractal=factorl(l)

U=valuewhen(upFractal[0]!= upFractal[1],l[0],3)

L=valuewhen(dnFractal[0]!=dnFractal[1],h[0],3)

longcon=crossover(close ,L) and close>open

shortcon=crossunder(close ,U) and close<open

if longcon

strategy.entry("Long", strategy.long, when = strategy.position_size <= 0 )

if shortcon

strategy.entry("Short", strategy.short, when = strategy.position_size >= 0 )