概述

该策略是基于市场最低点进行反转操作的策略。它利用200日EMA的最低点,结合卡马列拉支撑阻力位判断市场最低点,当价格反弹时进行做多操作。

策略原理

- 计算200日EMA的最低价EMA200Lows,当价格关闭低于该EMA时,认为处于市场最低点附近。

- 计算卡马列拉支撑3(S3)的9日EMA即ema_s3_9,作为重要的支撑位。

- 再计算卡马列拉中枢的9日EMA即ema_center_9,作为判断反转的信号。

- 当ema_center_9上穿ema200Lows时,并且前3根K线都低于ema200Lows时,进行做多操作。

- 止损方式为ATR止损,并追踪最低价移动。

- 目标利润为ema_h4_9(卡马列拉阻力4)和ema_s3_9(卡马列拉支撑3)。

优势分析

- 使用200日EMA最低点判断市场最低区域,避免在中途出现更低点。

- 卡马列拉支撑位与中枢结合,可以更准确判断反转点。

- ATR止损方式让止损更合理,追踪更低点有利锁定更大利润。

风险分析

- 长期持仓风险大。本策略更适合短线操作。

- 大行情下,止损可能较大。可根据ATR参数调整。

- 卡马列拉反转判断不一定百分百可靠,可能出现误判。

优化方向

- 可以考虑结合其他指标,如RSI等判断反转信号。

- 可以研究不同品种参数调整,寻找更优参数。

- 可以尝试机器学习方法动态调整ATR 止损。

总结

该策略利用EMA最低点与卡马列拉指标判断市场最低区域与反转点。通过ATR止损获取利润。整体来说,策略较完整,有一定的实战价值。后期通过进一步优化,可以使策略更加稳定可靠。

策略源码

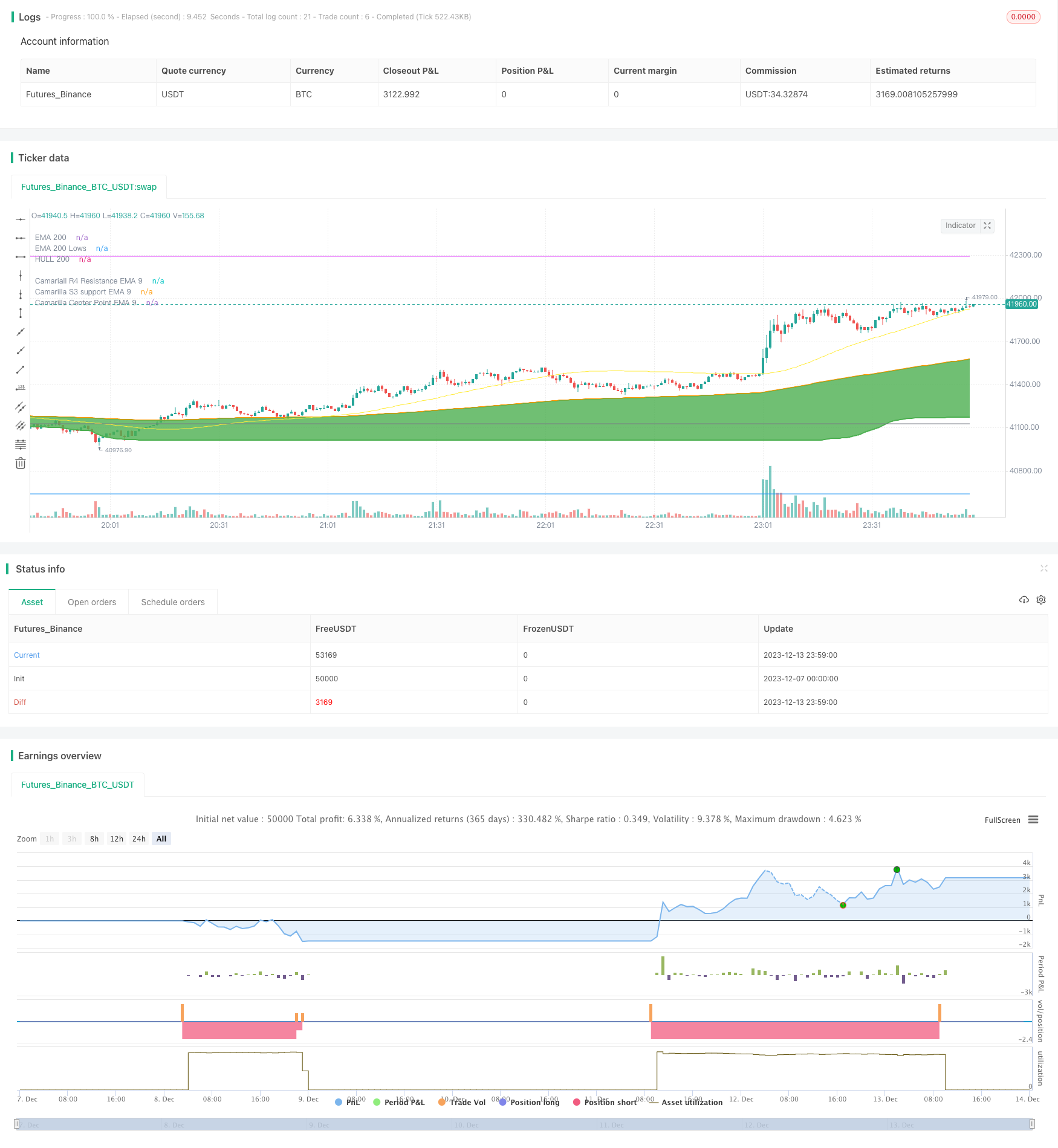

/*backtest

start: 2023-12-07 00:00:00

end: 2023-12-14 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © mohanee

//Using the lowest of low of ema200, you can find the bottom

//wait for price to close below ema200Lows line

//when pivot

//@version=4

strategy(title="PickingupFromBottom Strategy", overlay=true ) //default_qty_value=10, default_qty_type=strategy.fixed,

//HMA

HMA(src1, length1) => wma(2 * wma(src1, length1/2) - wma(src1, length1), round(sqrt(length1)))

//variables BEGIN

length1=input(200,title="EMA 1 Length")

length2=input(50,title="EMA 2 Length")

length3=input(20,title="EMA 3 Length")

sourceForHighs= input(hlc3, title="Source for Highs", type=input.source)

sourceForLows = input(hlc3, title="Source for Lows" , type=input.source)

hiLoLength=input(7, title="HiLo Band Length")

atrLength=input(14, title="ATR Length")

atrMultiplier=input(3.5, title="ATR Multiplier")

//takePartialProfits = input(true, title="Take Partial Profits (if this selected, RSI 13 higher reading over 80 is considered for partial closing ) ")

ema200=ema(close,length1)

hma200=HMA(close,length1)

////Camarilla pivot points

//study(title="Camarilla Pivots", shorttitle="Camarilla", overlay=true)

t = input(title = "Pivot Resolution", defval="D", options=["D","W","M"])

//Get previous day/week bar and avoiding realtime calculation by taking the previous to current bar

sopen = security(syminfo.tickerid, t, open[1], barmerge.gaps_off, barmerge.lookahead_on)

shigh = security(syminfo.tickerid, t, high[1], barmerge.gaps_off, barmerge.lookahead_on)

slow = security(syminfo.tickerid, t, low[1], barmerge.gaps_off, barmerge.lookahead_on)

sclose = security(syminfo.tickerid, t, close[1], barmerge.gaps_off, barmerge.lookahead_on)

r = shigh-slow

//Calculate pivots

//center=(sclose)

//center=(close[1] + high[1] + low[1])/3

center=sclose - r*(0.618)

h1=sclose + r*(1.1/12)

h2=sclose + r*(1.1/6)

h3=sclose + r*(1.1/4)

h4=sclose + r*(1.1/2)

h5=(shigh/slow)*sclose

l1=sclose - r*(1.1/12)

l2=sclose - r*(1.1/6)

l3=sclose - r*(1.1/4)

l4=sclose - r*(1.1/2)

l5=sclose - (h5-sclose)

//Colors (<ternary conditional operator> expression prevents continuous lines on history)

c5=sopen != sopen[1] ? na : color.red

c4=sopen != sopen[1] ? na : color.purple

c3=sopen != sopen[1] ? na : color.fuchsia

c2=sopen != sopen[1] ? na : color.blue

c1=sopen != sopen[1] ? na : color.gray

cc=sopen != sopen[1] ? na : color.blue

//Plotting

//plot(center, title="Central",color=color.blue, linewidth=2)

//plot(h5, title="H5",color=c5, linewidth=1)

//plot(h4, title="H4",color=c4, linewidth=2)

//plot(h3, title="H3",color=c3, linewidth=1)

//plot(h2, title="H2",color=c2, linewidth=1)

//plot(h1, title="H1",color=c1, linewidth=1)

//plot(l1, title="L1",color=c1, linewidth=1)

//plot(l2, title="L2",color=c2, linewidth=1)

//plot(l3, title="L3",color=c3, linewidth=1)

//plot(l4, title="L4",color=c4, linewidth=2)

//plot(l5, title="L5",color=c5, linewidth=1)////Camarilla pivot points

ema_s3_9=ema(l3, 9)

ema_s3_50=ema(l3, 50)

ema_h4_9=ema(h4, 9)

ema_center_9=ema(center, 9)

plot(ema_h4_9, title="Camariall R4 Resistance EMA 9", color=color.fuchsia)

plot(ema_s3_9, title="Camarilla S3 support EMA 9", color=color.gray, linewidth=1)

//plot(ema_s3_50, title="Camarilla S3 support EMA 50", color=color.green, linewidth=2)

plot(ema_center_9, title="Camarilla Center Point EMA 9", color=color.blue)

plot(hma200, title="HULL 200", color=color.yellow, transp=25)

plotEma200=plot(ema200, title="EMA 200", style=plot.style_linebr, linewidth=2 , color=color.orange)

ema200High = ema(highest(sourceForHighs,length1), hiLoLength)

ema200Low= ema(lowest(sourceForLows,length1), hiLoLength)

ema50High = ema(highest(sourceForHighs,length2), hiLoLength)

ema50Low= ema(lowest(sourceForLows,length2), hiLoLength)

ema20High = ema(highest(sourceForHighs,length3), hiLoLength)

ema20Low= ema(lowest(sourceForLows,length3), hiLoLength)

//plot(ema200High, title="EMA 200 Highs", linewidth=2, color=color.orange, transp=30)

plotEma200Low=plot(ema200Low, title="EMA 200 Lows", linewidth=2, color=color.green, transp=30, style=plot.style_linebr)

//plot(ema50High, title="EMA 50 Highs", linewidth=2, color=color.blue, transp=30)

//plotEma50Low=plot(ema50Low, title="EMA 50 Lows", linewidth=2, color=color.blue, transp=30)

fill(plotEma200, plotEma200Low, color=color.green )

// Drawings /////////////////////////////////////////

//Highlight when centerpont crossing up ema200Low a

ema200LowBuyColor=color.new(color.green, transp=50)

bgcolor(crossover(ema_center_9,ema200Low) and (close[1]<ema200Low or close[2]<ema200Low or close[3]<ema200Low)? ema200LowBuyColor : na)

//ema200LowBuyCondition= (close[1]<ema200Low or close[2]<ema200Low or close[3]<ema200Low)

strategy.entry(id="ema200Low Buy", comment="LE2", qty=2, long=true, when= crossover(ema_center_9,ema200Low) and (close[1]<ema200Low or close[2]<ema200Low or close[3]<ema200Low) ) //or (close>open and low<ema20Low and close>ema20Low) ) ) // // aroonOsc<0

//Trailing StopLoss

////// Calculate trailing SL

/////////////////////////////////////////////////////

sl_val = atrMultiplier * atr(atrLength)

trailing_sl = 0.0

//trailing_sl := max(low[1] - sl_val, nz(trailing_sl[1]))

trailing_sl := strategy.position_size>=1 ? max(low - sl_val, nz(trailing_sl[1])) : na

//draw initil stop loss

//plot(strategy.position_size>=1 ? trailing_sl : na, color = color.blue , style=plot.style_linebr, linewidth = 2, title = "stop loss")

plot(trailing_sl, title="ATR Trailing Stop Loss", style=plot.style_linebr, linewidth=1, color=color.red, transp=30)

//Trailing StopLoss

////// Calculate trailing SL

/////////////////////////////////////////////////////

strategy.close(id="ema200Low Buy", comment="TP1="+tostring(close - strategy.position_avg_price, "####.##"), qty=1, when=abs(strategy.position_size)>=1 and crossunder(close, ema_h4_9) ) //close<ema55 and rsi5Val<20 //ema34<ema55 //close<ema89

strategy.close(id="ema200Low Buy", comment="TP2="+tostring(close - strategy.position_avg_price, "####.##"), qty=1, when=abs(strategy.position_size)>=1 and crossunder(close, ema_s3_9) ) //close<ema55 and rsi5Val<20 //ema34<ema55 //close<ema89