概述

MACD长线反转策略是一个利用MACD指标识别价格长线反转,进行长线交易的策略。该策略使用MACD的快速SMA线和慢速SMA线差值构建MACD指标,并使用MACD指标的柱状线反转形态来识别价格潜在的长线反转机会。当识别到价格反转机会时,策略会进行方向性的长线入场。

策略原理

该策略使用6日EMA作为MACD快线,26日EMA作为MACD慢线,快线和慢线的差值为MACD,再计算MACD的9日SMA构成信号线。快慢线差值即柱状线为零时代表平衡,为正代表长线看涨,为负代表长线看跌。

该策略的交易逻辑是:当MACD的柱状线上涨超过前一根柱状线时(差值扩大),认为价格反转为长线看涨(买入时机);当MACD的柱状线下跌超过前一根柱状线时(差值收窄),认为价格反转为长线看跌(卖出时机)。为过滤虚假信号,该策略会等待两根柱状线的实际反转再进行入场。

优势分析

- 利用MACD指标的长期均线差值,识别价格长线反转

- 双线交叉形态过滤假突破,避免追高杀跌

- MACD参数可调,适应不同市场环境

- 可配置止损策略,控制单笔损失

风险及解决方案

- MACD divergence导致错失交易机会

- 优化为与RSI指标组合使用

- 震荡行情中出现多次虚假反转信号

- 增加移动止损,减少亏损;调整MACD参数,追求平滑

- 反转未成立或延续跌破止损价格

- 采用指数移动均线,提高止损的可靠性

- 没有止损策略,无法控制损失

- 增加移动止损或固定止损逻辑,严格控制单笔亏损额度

优化思路

- 调整MACD参数,追求MACD线更加平滑。MACD追踪长期趋势指标,过于敏感反而增加假信号。

- 增加移动止损逻辑。长期持有必然面临回撤风险,移动止损可以减少风险。

- 与RSI等其他指标组合使用。单一指标效果有限,组合其他指标可以提高效果。

- 增加仓位管理模块。不同市场状态可采用不同持仓策略。

总结

MACD长线反转策略通过判断MACD柱状线的反转来捕捉价格的长线反转机会。该策略成功控制了长短周期冲突,以及避免追高杀跌的问题。但是作为单一指标策略,MACD长线反转策略也存在一定局限性,仍有进一步优化的空间,特别是与其他指标组合使用。

策略源码

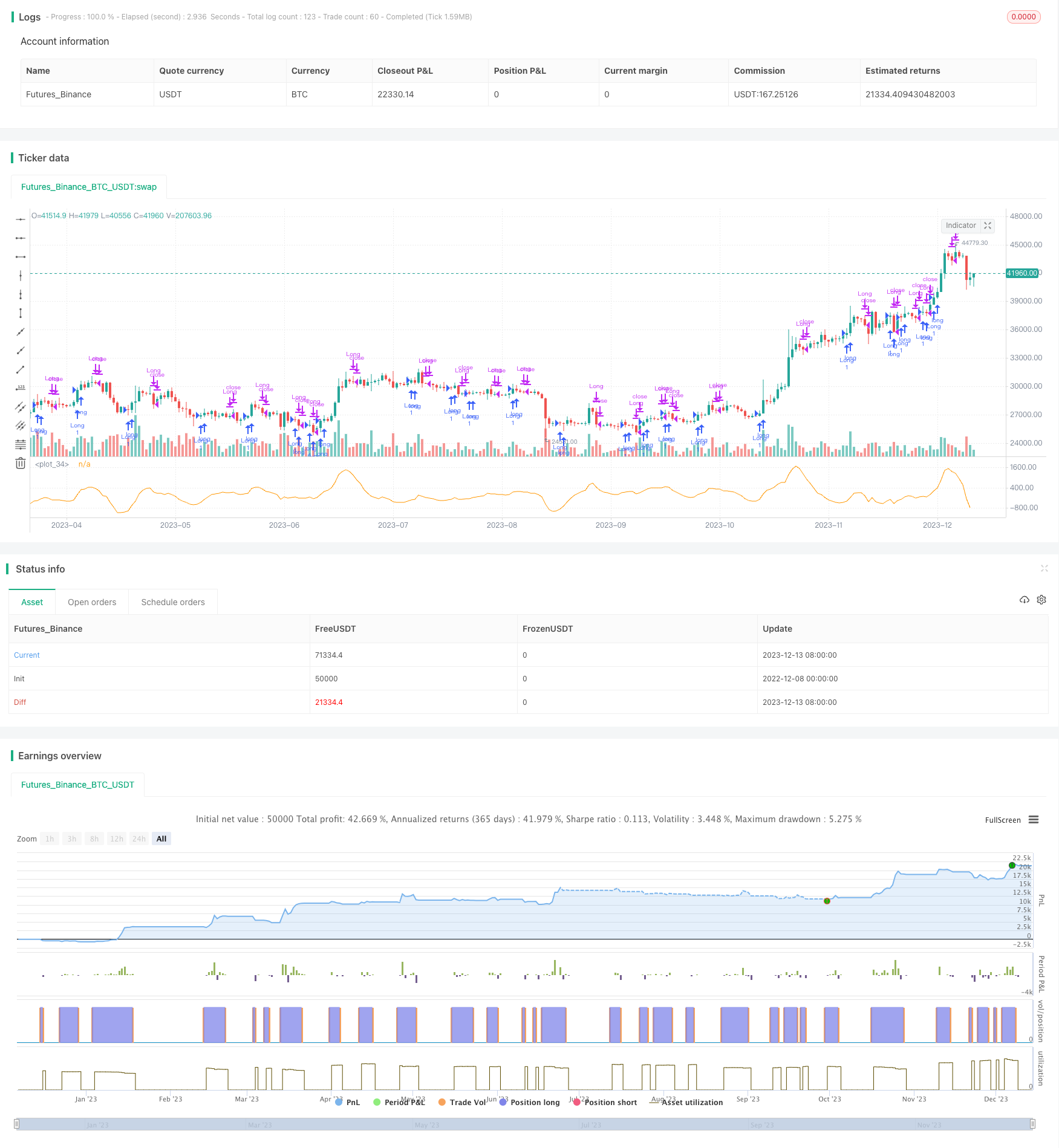

/*backtest

start: 2022-12-08 00:00:00

end: 2023-12-14 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © TheGrindToday

//@version=4

strategy("MACD Long Strat", overlay=false)

//fast = 12, slow = 26

fast = 6, slow = 26

fastMA = ema(close, fast)

slowMA = ema(close, slow)

macd = fastMA - slowMA

signal = sma(macd, 9)

histogram = macd-signal

macdpos = histogram[0] > 0

macdneg = histogram[0] < 0

histogram_reversing_negative = histogram[1] > histogram[2]

LongEntryCondition = histogram > histogram[1]

ShortEntryCondition = histogram < histogram[1]

exitConditionLong = histogram[0] < histogram[2]

if (LongEntryCondition and histogram_reversing_negative)

strategy.entry("Long", strategy.long)

if (exitConditionLong)

strategy.close("Long")

plot(histogram)