概述

七笔形态震荡突破策略通过检测价格形成七根K线的persistence上涨或下跌的形态,判断市场震荡趋势,并在固定时间点进行突破操作,实现盈利。

策略原理

该策略的核心逻辑基于两个指标:

- sevenReds:检测到7根持续下跌的K线,定义为市场震荡下行趋势

- sevenGreens:检测到7根持续上涨的K线,定义为市场震荡上行趋势

当检测到sevenReds时,做多;当检测到sevenGreens时,做空。

此外,策略还在每天固定时间(美国重要数据发布时间)进行平仓,锁定利润。

优势分析

七笔形态震荡突破策略具有以下优势:

- 捕捉市场震荡趋势,七根K线过滤市场噪音,提高信号质量

- 定时操作,避开重要经济数据造成的大幅跳空行情的系统风险

- 定时止盈,及时锁定收益,降低回撤概率

风险分析

七笔形态震荡突破策略也存在一定的风险:

- 形态识别错误风险。七根K线无法完全过滤市场噪音,可能会发出错误信号

- 止损措施不完善,无法限制单笔损失

- 锁定收益的时间无法动态调整,存在未及时止盈的风险

对应解决方法:

- 增加K线数量,提高persistence判断阈值

- 增加移动止损逻辑

- 动态调整止盈时间,结合波动率指标判断

优化方向

七笔形态震荡突破策略可以从以下方面进行优化:

- 增加多个证券池,进行指数或行业轮动

- 增加机器学习模型,辅助判断市场状态

- 结合均线指标进行入场时机优化

- 动态调整仓位利用率,根据回撤情况控制风险敞口

总结

七笔形态震荡突破策略通过捕捉市场中短期震荡趋势实现盈利,同时利用定时操作规避重大风险,并设置止盈逻辑锁定利润。该策略可通过多证券池轮动、机器学习等方式进行效果优化,是一种较为典型的中频量化交易策略。

策略源码

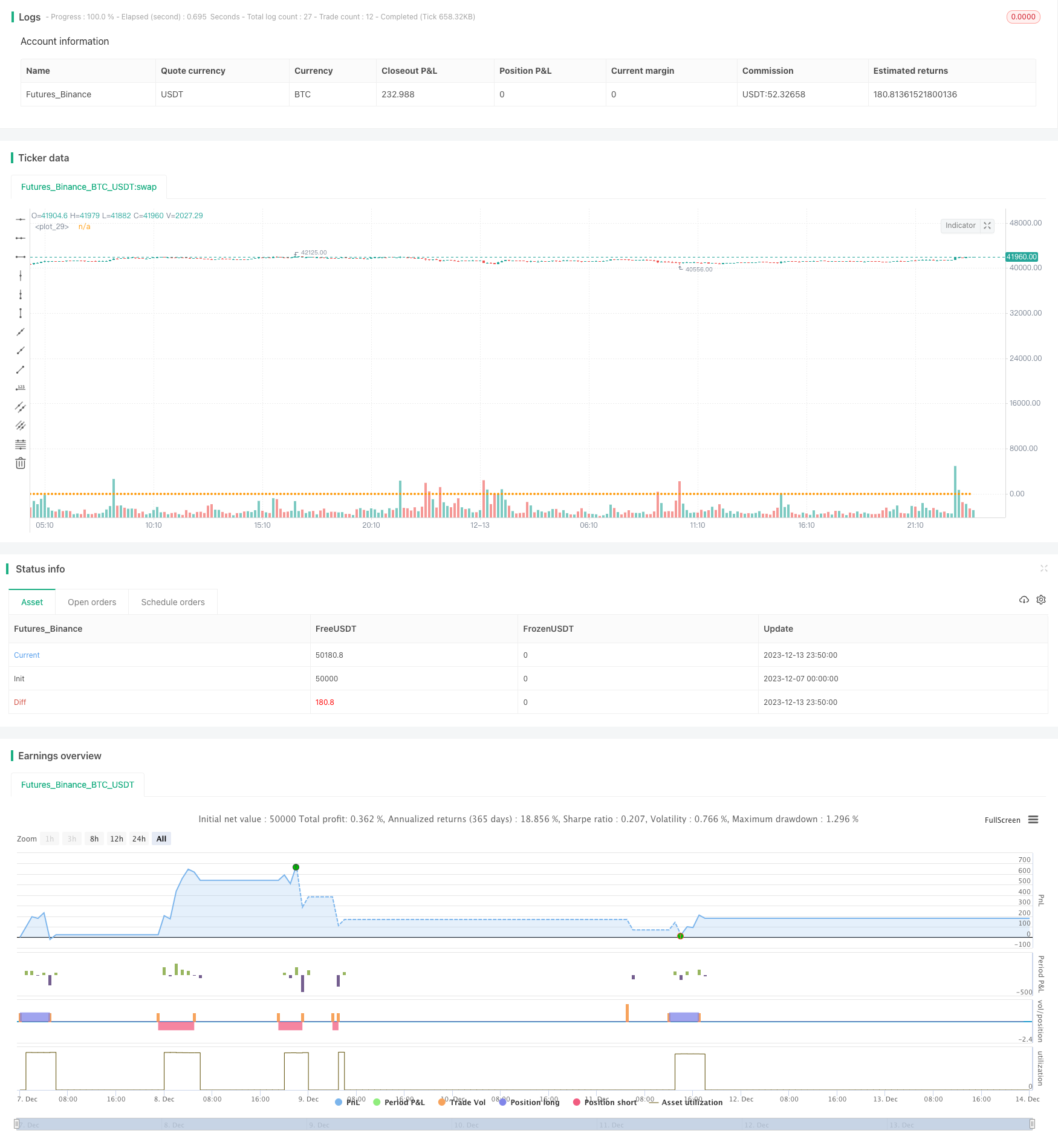

/*backtest

start: 2023-12-07 00:00:00

end: 2023-12-14 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Eliza123123

//@version=5

strategy("Breakeven Line Demo", overlay=true)

// Generic signal (not a viable strategy don't use, just some code I wrote quick for demo purposes only)

red = open > close, green = open < close

sevenReds = red and red[1] and red[2] and red[3] and red[4] and red[5] and red[6]

sevenGreens = green and green[1] and green[2] and green[3] and green[4] and green[5] and green[6]

if sevenReds

strategy.entry('Buy', direction=strategy.long)

if sevenGreens

strategy.entry('Sell', direction=strategy.short)

if (hour == 5 and minute == 0 ) or (hour == 11 and minute == 0) or (hour == 17 and minute == 0 ) or (hour == 23 and minute == 0)

strategy.close_all("Close")

// Breakeven line for visualising breakeven price on stacked orders.

var breakEvenLine = 0.0

if strategy.opentrades > 0

breakEvenLine := strategy.position_avg_price

else

breakEvenLine := 0.0

color breakEvenLineColor = na

if strategy.position_size > 0

breakEvenLineColor := #15FF00

if strategy.position_size < 0

breakEvenLineColor := #FF000D

plot(breakEvenLine, color = breakEvenLine and breakEvenLine[1] > 0 ? breakEvenLineColor : na, linewidth = 2, style = plot.style_circles)