概述

超级趋势 LSMA 多头策略是一种结合超级趋势指标和 LSMA 移动平均线的多头策略。它适用于股票、加密货币等长期趋势市场,在较大时间框架下效果更佳。

策略原理

该策略的交易规则如下:

多头入场信号:当超级趋势指标发出做多信号,且收盘价高于 LSMA 移动平均线时,做多入场。

多头出场信号:当超级趋势指标发出做空信号时,平仓多单。

即利用超级趋势判断大趋势方向,再利用 LSMA 判断具体入场点。

优势分析

这种策略结合了趋势跟踪和移动平均线,既可以抓住大趋势,又可以利用均线过滤错位现象,从而避免被套。相比单一使用趋势指标或均线指标,可以更好地控制风险。

另外,超级趋势本身就具有一定的滞后性,再结合 LSMA 的平滑特点,可以有效过滤市场噪音,避免被假突破误导。

风险分析

该策略最大的风险在于无法准确判断趋势反转点。当趋势发生转变时,由于超级趋势和 LSMA 的滞后性,可能导致亏损扩大。此时需要及时止损来控制风险。

另外,参数设置也会影响策略表现。如果 ATR 参数或因子参数设置不当,则超级趋势判断效果会打折扣;如果 LSMA 周期设置过短,则滤波效果差,容易被噪音影响。因此参数优化至关重要。

优化方向

该策略可以从以下几个方面进行优化:

利用机器学习算法自动优化参数,使参数更符合不同市场环境。

增加止损机制。当亏损达到事先设定的止损幅度时,强制平仓止损。

增加仓位管理模块。当大趋势形成时,适当加大仓位;当判断趋势结束时,减小仓位。

增加更多过滤指标。例如波动率指标、量能指标等,避免趋势反转的风险。

利用深度学习模型判断趋势,替代简单的超级趋势判定,使趋势判断更加智能化。

总结

超级趋势 LSMA 多头策略整合了趋势跟踪指标与均线指标的优点,既可以抓住较长时间内的大方向,又可以利用均线过滤噪声。通过参数优化、止损机制、风控模块的加强,可以使该策略的盈利能力和风险控制能力进一步提升,成为一个非常实用的量化策略。

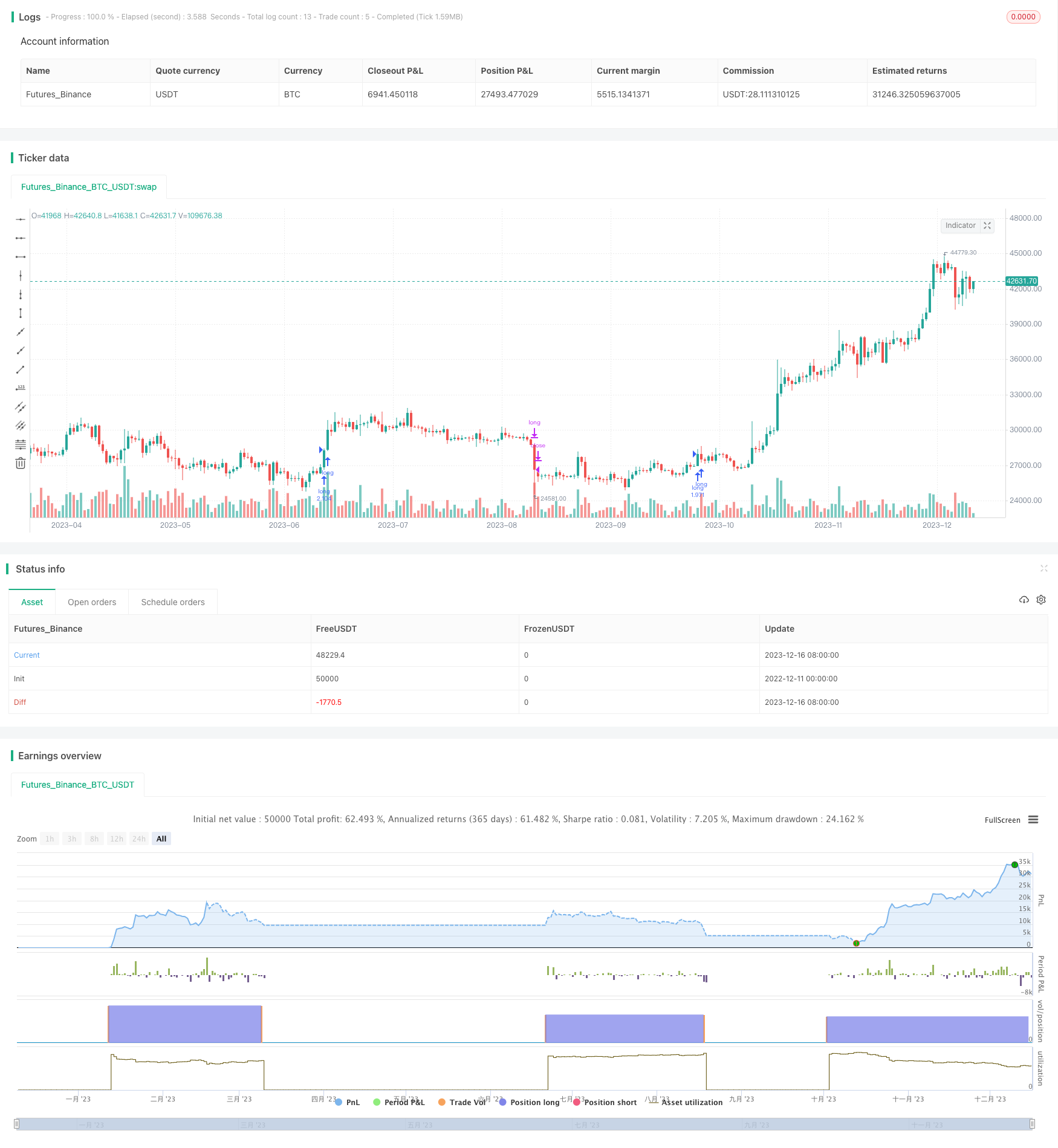

/*backtest

start: 2022-12-11 00:00:00

end: 2023-12-17 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title = "Supertrend LSMA long Strategy", overlay = true, pyramiding=1,initial_capital = 100, default_qty_type= strategy.percent_of_equity, default_qty_value = 100, calc_on_order_fills=false, slippage=0,commission_type=strategy.commission.percent,commission_value=0.1)

atrPeriod = input(14, "ATR Length")

factor = input(3, "Factor")

//Time

fromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

fromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

fromYear = input(defval = 2010, title = "From Year", minval = 1970)

//monday and session

// To Date Inputs

toDay = input(defval = 31, title = "To Day", minval = 1, maxval = 31)

toMonth = input(defval = 12, title = "To Month", minval = 1, maxval = 12)

toYear = input(defval = 2031, title = "To Year", minval = 1970)

startDate = timestamp(fromYear, fromMonth, fromDay, 00, 00)

finishDate = timestamp(toYear, toMonth, toDay, 00, 00)

time_cond = time >= startDate and time <= finishDate

//LSMA

lengthx = input(title="Length LSMA", type=input.integer, defval=101)

offset = 0//input(title="Offset", type=input.integer, defval=0)

src = input(close, title="Source")

lsma = linreg(src, lengthx, offset)

[_, direction] = supertrend(factor, atrPeriod)

if(time_cond)

if change(direction) < 0 and close > lsma

strategy.entry("long", strategy.long)

if change(direction) > 0 //and close < lsma

strategy.close("long")

//strategy.entry("short", strategy.short)

//strategy.close("long",when=close<lsma)

//strategy.close("short",when=change(direction) < 0 )

//plot(strategy.equity, title="equity", color=color.red, linewidth=2, style=plot.style_areabr)