概述

本策略名为MACD双均线追踪策略,采用MACD指标的双均线金叉死叉作为交易信号,结合昨日最低价作为止损点,追踪股价短线移动。

策略原理

- 计算快线EMA(close,5)、慢线EMA(close,8)和信号线SMA(MACD,3)

- 定义多头信号:快线上穿慢线时做多

- 定义空头信号:快线下穿慢线或当日收盘价低于昨日最低价时做空

- 持仓量为初始资金2000美元除以收盘价

- 多头止损使用空头信号平仓

优势分析

- 使用MACD指标判断市场超买超卖区域,配合双均线形成交易信号,避免假突破

- 追踪短期趋势,及时止损

- 持仓量动态调整,避免单笔损失过大

风险分析

- MACDIndicator存在滞后,可能错过短线机会

- 双均线交易信号可能产生假信号

- 止损点过于激进,存在过度频繁止损的可能

优化方向

- 优化MACD参数组合,提高指标敏感性

- 增加趋势判断,避免震荡市产生的假信号

- 结合Volatility Index评估市场波动率,调整止损点

总结

本策略采用经典的MACD双均线组合指标判断超买超卖区间,产生交易信号,同时引入动态持仓量和前日最低价的止损点设计,针对股价的短线波动特征进行捕捉,整体策略思路清晰易懂,值得进一步测试优化。

策略源码

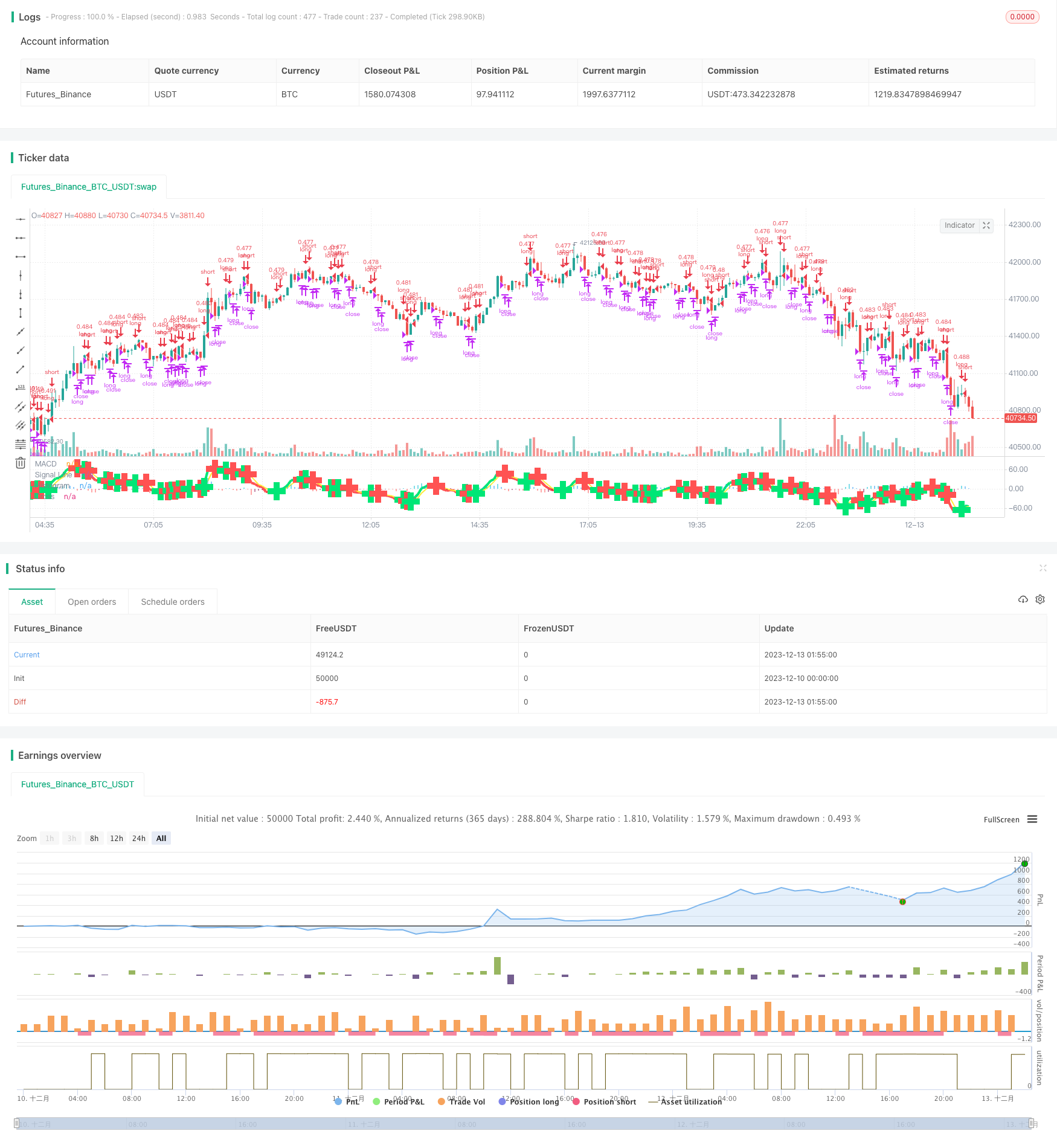

/*backtest

start: 2023-12-10 00:00:00

end: 2023-12-13 02:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

// macd/cam v1 strategizing Chris Moody Macd indicator https://www.tradingview.com/script/OQx7vju0-MacD-Custom-Indicator-Multiple-Time-Frame-All-Available-Options/

// macd/cam v2 changing to macd 5,8,3

// macd/cam v2.1

// Sell when lower than previous day low.

// Initial capital of $2k. Buy/sell quantity of initial capital / close price

// Quitar short action

// Note: custom 1-week resolution seems to put AMD at 80% profitable

strategy(title="MACD/CAM 2.1", shorttitle="MACD/CAM 2.1") //

source = close

//get inputs from options

useCurrentRes = input(true, title="Use Current Chart Resolution?")

resCustom = input(title="Use Different Timeframe? Uncheck Box Above", defval="60")

smd = input(true, title="Show MacD & Signal Line? Also Turn Off Dots Below")

sd = input(true, title="Show Dots When MacD Crosses Signal Line?")

sh = input(true, title="Show Histogram?")

macd_colorChange = input(true,title="Change MacD Line Color-Signal Line Cross?")

hist_colorChange = input(true,title="MacD Histogram 4 Colors?")

venderLowerPrev = input(true,title="Vender cuando closing price < previous day low?")

res = useCurrentRes ? timeframe.period : resCustom

fastLength = input(5, minval=1), slowLength=input(8,minval=1)

signalLength=input(3,minval=1)

// find exponential moving average of price as x and fastLength var as y

fastMA = ema(source, fastLength)

slowMA = ema(source, slowLength)

macd = fastMA - slowMA

// simple moving average

signal = sma(macd, signalLength)

hist = macd - signal

outMacD = request.security(syminfo.tickerid, res, macd)

outSignal = request.security(syminfo.tickerid, res, signal)

outHist = request.security(syminfo.tickerid, res, hist)

histA_IsUp = outHist > outHist[1] and outHist > 0

histA_IsDown = outHist < outHist[1] and outHist > 0

histB_IsDown = outHist < outHist[1] and outHist <= 0

histB_IsUp = outHist > outHist[1] and outHist <= 0

//MacD Color Definitions

macd_IsAbove = outMacD >= outSignal

macd_IsBelow = outMacD < outSignal

plot_color = hist_colorChange ? histA_IsUp ? aqua : histA_IsDown ? blue : histB_IsDown ? red : histB_IsUp ? maroon :yellow :gray

macd_color = macd_colorChange ? macd_IsAbove ? lime : red : red

signal_color = macd_colorChange ? macd_IsAbove ? yellow : yellow : lime

circleYPosition = outSignal

plot(smd and outMacD ? outMacD : na, title="MACD", color=macd_color, linewidth=4)

plot(smd and outSignal ? outSignal : na, title="Signal Line", color=signal_color, style=line ,linewidth=2)

plot(sh and outHist ? outHist : na, title="Histogram", color=plot_color, style=histogram, linewidth=4)

circleCondition = sd and cross(outMacD, outSignal)

// Determine long and short conditions

longCondition = circleCondition and macd_color == lime

redCircle = circleCondition and macd_color == red

redCirclePrevLow = redCircle or low<low[1]

shortCondition = redCircle

if (venderLowerPrev)

shortCondition = redCirclePrevLow

strategy.initial_capital = 20000

// Set quantity to initial capital / closing price

cantidad = strategy.initial_capital/close

// Submit orders

strategy.entry(id="long", long=true, qty=cantidad, when=longCondition)

strategy.close(id="long", when=shortCondition)

plot(circleCondition ? circleYPosition : na, title="Cross", style=cross, linewidth=10, color=macd_color)

// hline(0, '0 Line', linestyle=solid, linewidth=2, color=white)