概述

MACD趋势追踪短线策略是一个结合移动平均线、MACD指标和威廉指标的短线交易策略。该策略运用三种指标的不同组合,形成多空仓位的进入和退出条件,以捕捉短线价格的趋势性特征。

策略原理

该策略的主要交易逻辑基于以下几点:

当价格上穿Exponential Moving Average(EMA)均线时看多,当价格下穿时看空;

当MACD的快线高于慢线时看多,当快线低于慢线时看空;

威廉指标的快速移动平均线高于慢速移动平均线时看多,反之看空;

结合这三种情况的组合条件判断入场;

在反向情况下判断出场。

通过EMA判断大趋势方向和MACD判断短期价格动能的组合,该策略可在不错的入场点捕捉价格的趋势特征,从而获利。而威廉指标则可用来进一步验证品种的超买超卖情况,避免假突破。

策略优势

这种多指标组合结构是一个典型的短线趋势追踪策略,主要具有以下几点优势:

三种指标互相验证,可减少假信号的概率;

EMA判断主趋势方向,MACD判断短线动能强弱;

威廉指标避免在剧烈波动中追高杀跌;

反向指标组合判断退出,跟风险控制紧密结合。

策略风险

该策略也存在以下主要风险:

多指标组合结构复杂,参数调优难度较大;

短线操作频繁,交易成本可能较高;

无法正确判断真正趋势反转点,存在亏损风险。

对策主要在参数调优和止损方面,寻找最佳参数组合,并设定合适的止损水平,控制单笔交易最大损失。

策略优化方向

该策略主要可从以下几个方面进行优化:

测试更多指标参数组合,寻找最优参数;

加入更多数据源,如成交量等辅助判断;

设定动态止损或跟踪止损加强风险控制;

结合机器学习模型判断真正趋势反转点。

总结

MACD趋势追踪短线策略综合运用多种指标的优势,在判断短线趋势的同时控制风险。通过参数优化、止损水平设定以及更多数据源的引入,能进一步提高策略胜率与盈利水平。该策略思路值得进一步拓展与深入研究。

策略源码

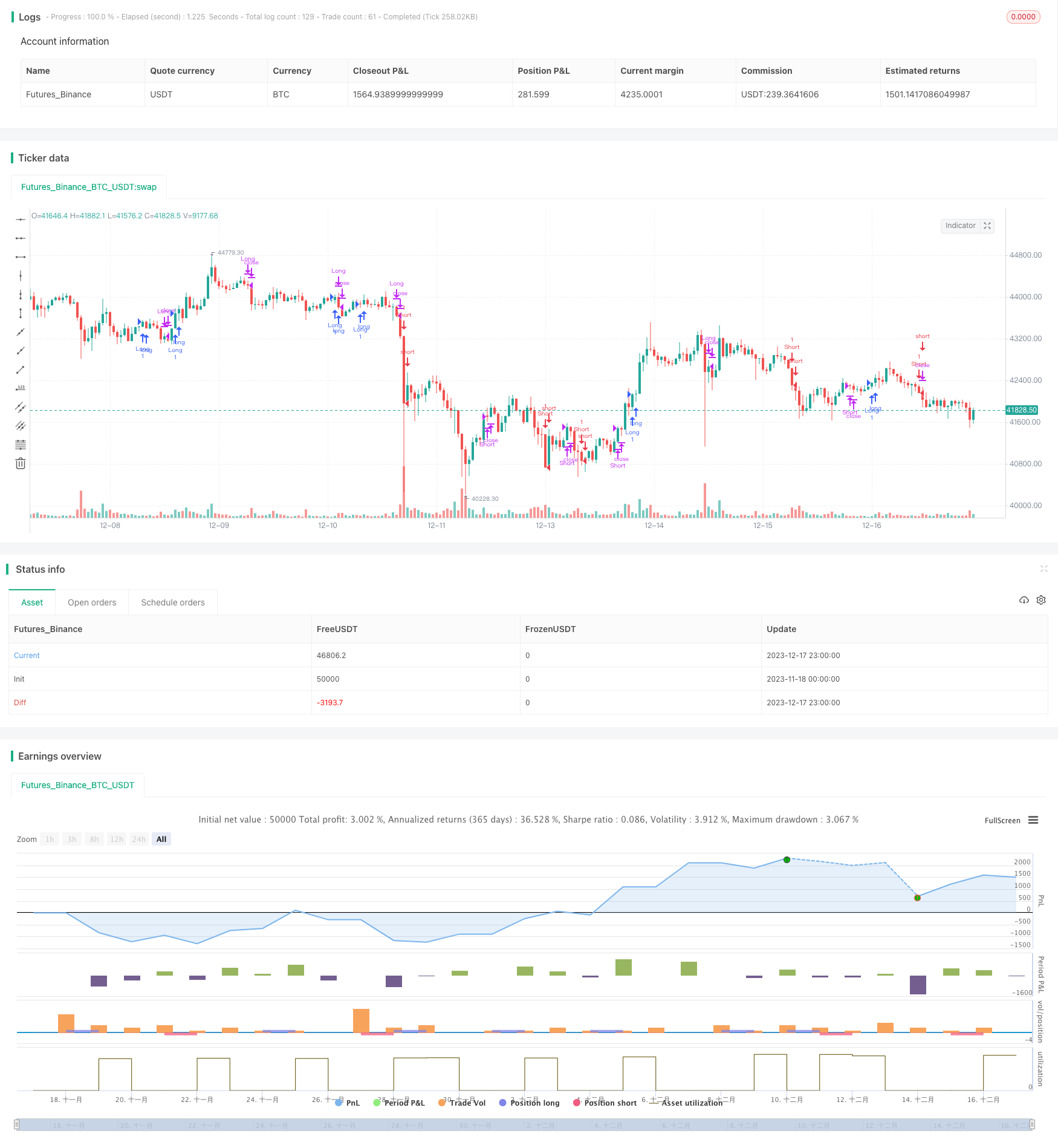

/*backtest

start: 2023-11-18 00:00:00

end: 2023-12-18 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © platsn

//@version=5

strategy("MACD Willy Strategy", overlay=true, pyramiding=1, initial_capital=10000)

// ******************** Trade Period **************************************

startY = input(title='Start Year', defval=2011, group = "Trading window")

startM = input.int(title='Start Month', defval=1, minval=1, maxval=12, group = "Trading window")

startD = input.int(title='Start Day', defval=1, minval=1, maxval=31, group = "Trading window")

finishY = input(title='Finish Year', defval=2050, group = "Trading window")

finishM = input.int(title='Finish Month', defval=12, minval=1, maxval=12, group = "Trading window")

finishD = input.int(title='Finish Day', defval=31, minval=1, maxval=31, group = "Trading window")

timestart = timestamp(startY, startM, startD, 00, 00)

timefinish = timestamp(finishY, finishM, finishD, 23, 59)

// t1 = time(timeframe.period, "0945-1545:23456")

// window = time >= timestart and time <= timefinish and t1 ? true : false

// t2 = time(timeframe.period, "0930-1555:23456")

// window2 = time >= timestart and time <= timefinish and t2 ? true : false

leverage = input.float(1, title="Leverage (if applicable)", step=0.1, group = "Trading Options")

reinvest = input.bool(defval=false,title="Reinvest profit", group = "Trading Options")

reinvest_percent = input.float(defval=20, title = "Reinvest percentage", group="Trading Options")

// entry_lookback = input.int(defval=10, title="Lookback period for entry condition", group = "Trading Options")

// -------------------------------------------- Data Source --------------------------------------------

src = input(title="Source", defval=close)

// ***************************************************************************************************** Daily ATR *****************************************************

atrlen = input.int(14, minval=1, title="ATR period", group = "Daily ATR")

iPercent = input.float(5, minval=1, maxval=100, step=0.1, title="% ATR to use for SL / PT", group = "Daily ATR")

percentage = iPercent * 0.01

datr = request.security(syminfo.tickerid, "1D", ta.rma(ta.tr, atrlen))

datrp = datr * percentage

// plot(datr,"Daily ATR")

// plot(datrp, "Daily % ATR")

//*********************************************************** VIX volatility index ****************************************

VIX = request.security("BTC_USDT:swap", timeframe.period, close)

vix_thres = input.float(20.0, "VIX Threshold for entry", step=0.5, group="VIX Volatility Index")

// ************************************************ Volume ******************************************************

vol_len = input(50, 'Volume MA Period')

avg_vol = ta.sma(volume, vol_len)

//-------------------------------------------------------- Moving Average ------------------------------------

emalen1 = input.int(200, minval=1, title='EMA', group= "Moving Averages")

ema1 = ta.ema(src, emalen1)

// ------------------------------------------ MACD ------------------------------------------

// Getting inputs

fast_length = input(title="Fast Length", defval=12)

slow_length = input(title="Slow Length", defval=26)

signal_length = input.int(title="Signal Smoothing", minval = 1, maxval = 50, defval = 9)

sma_source = input.string(title="Oscillator MA Type", defval="EMA", options=["SMA", "EMA"])

sma_signal = input.string(title="Signal Line MA Type", defval="EMA", options=["SMA", "EMA"])

// Plot colors

col_macd = input(#2962FF, "MACD Line ", group="Color Settings", inline="MACD")

col_signal = input(#FF6D00, "Signal Line ", group="Color Settings", inline="Signal")

col_grow_above = input(#26A69A, "Above Grow", group="Histogram", inline="Above")

col_fall_above = input(#B2DFDB, "Fall", group="Histogram", inline="Above")

col_grow_below = input(#FFCDD2, "Below Grow", group="Histogram", inline="Below")

col_fall_below = input(#FF5252, "Fall", group="Histogram", inline="Below")

// Calculating

fast_ma = sma_source == "SMA" ? ta.sma(src, fast_length) : ta.ema(src, fast_length)

slow_ma = sma_source == "SMA" ? ta.sma(src, slow_length) : ta.ema(src, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal == "SMA" ? ta.sma(macd, signal_length) : ta.ema(macd, signal_length)

hist = macd - signal

// ---------------------------------------- William %R --------------------------------------

w_length = input.int(defval=34, minval=1)

w_upper = ta.highest(w_length)

w_lower = ta.lowest(w_length)

w_output = 100 * (close - w_upper) / (w_upper - w_lower)

fast_period = input(defval=5, title='Smoothed %R Length')

slow_period = input(defval=13, title='Slow EMA Length')

w_fast_ma = ta.wma(w_output,fast_period)

w_slow_ma = ta.ema(w_output,slow_period)

// ------------------------------------------------ Entry Conditions ----------------------------------------

L_entry1 = close > ema1 and hist > 0 and w_fast_ma > w_slow_ma

S_entry1 = close < ema1 and hist < 0 and w_fast_ma < w_slow_ma

// -------------------------------------------------- Entry -----------------------------------------------

strategy.initial_capital = 50000

profit = strategy.netprofit

trade_amount = math.floor(strategy.initial_capital*leverage / close)

if strategy.netprofit > 0 and reinvest

trade_amount := math.floor((strategy.initial_capital+(profit*reinvest_percent*0.01))*leverage / close)

else

trade_amount := math.floor(strategy.initial_capital*leverage/ close)

if L_entry1 //and window

strategy.entry("Long", strategy.long, trade_amount)

if S_entry1 //and window

strategy.entry("Short", strategy.short, trade_amount)

// --------------------------------------------------- Exit Conditions -------------------------------------

L_exit1 = hist < 0 and w_fast_ma < w_slow_ma and w_fast_ma < -20

S_exit1 = hist > 0 and w_fast_ma > w_slow_ma and w_fast_ma > -80

// ----------------------------------------------------- Exit ---------------------------------------------

if L_exit1 //and window2

strategy.close("Long")

if S_exit1 //and window2

strategy.close("Short")

// if time(timeframe.period, "1530-1600:23456")

// strategy.close_all()