概述

该策略是一个仅买入的交易系统,基于移动平均线交叉和周期商品通道指数(CCI)或周期平均方向指数(ADX)生成买入信号。当快速移动平均线上穿慢速移动平均线并且周期CCI和/或周期ADX满足特定条件时,产生买入信号。

该策略还允许动态再入场,这意味着如果价格再次上穿三条移动平均线,可以打开新的多头头寸。然而,如果价格收盘价跌破第三条移动平均线,该策略将平掉多头头寸。

策略原理

脚本定义了生成买入信号的条件。它检查两个条件来判断一个有效的买入信号:

- 快速移动平均线上穿慢速移动平均线

- 用户可以选择使用滤波器:周期CCI或周期ADX

动态再入场: 如果没有未平仓的多头头寸且价格高于三条移动平均线,则打开新的多头头寸。

退出条件: 如果收盘价跌破第三条移动平均线,该策略将平掉多头头寸。

优势分析

该策略具有以下优势:

- 采用多种技术指标过滤信号,可以减少错误信号

- 动态再入场机制可以最大限度捕捉趋势

- 只做多,避免做空的风险

风险分析

该策略也存在以下风险:

- 会有一定的空转风险

- 多头持仓时间可能过长,需要设定止损

- 参数设置不当可能导致过于频繁交易

对应解决方法:

- 采用更佳的参数组合和技术指标组合滤波

- 设置合理的止损位

- 调整参数,确保参数稳定

优化方向

该策略可以从以下几个方面进行优化:

- 测试更多技术指标的组合,寻找更好的买入时机

- 对参数进行优化,找到最佳参数组合

- 增加止损机制,控制单笔损失

- 增加仓位数管理,根据市场情况加大或减小仓位

总结

该动态再入场买入策略整合多种技术指标判断买入时机,并采用动态再入场设计,可实时跟踪趋势;同时仅做多避免做空带来的额外风险。通过参数优化、止损设定以及仓位管理,可以将该策略运用于实盘交易中,控制风险的同时获取超额收益。

策略源码

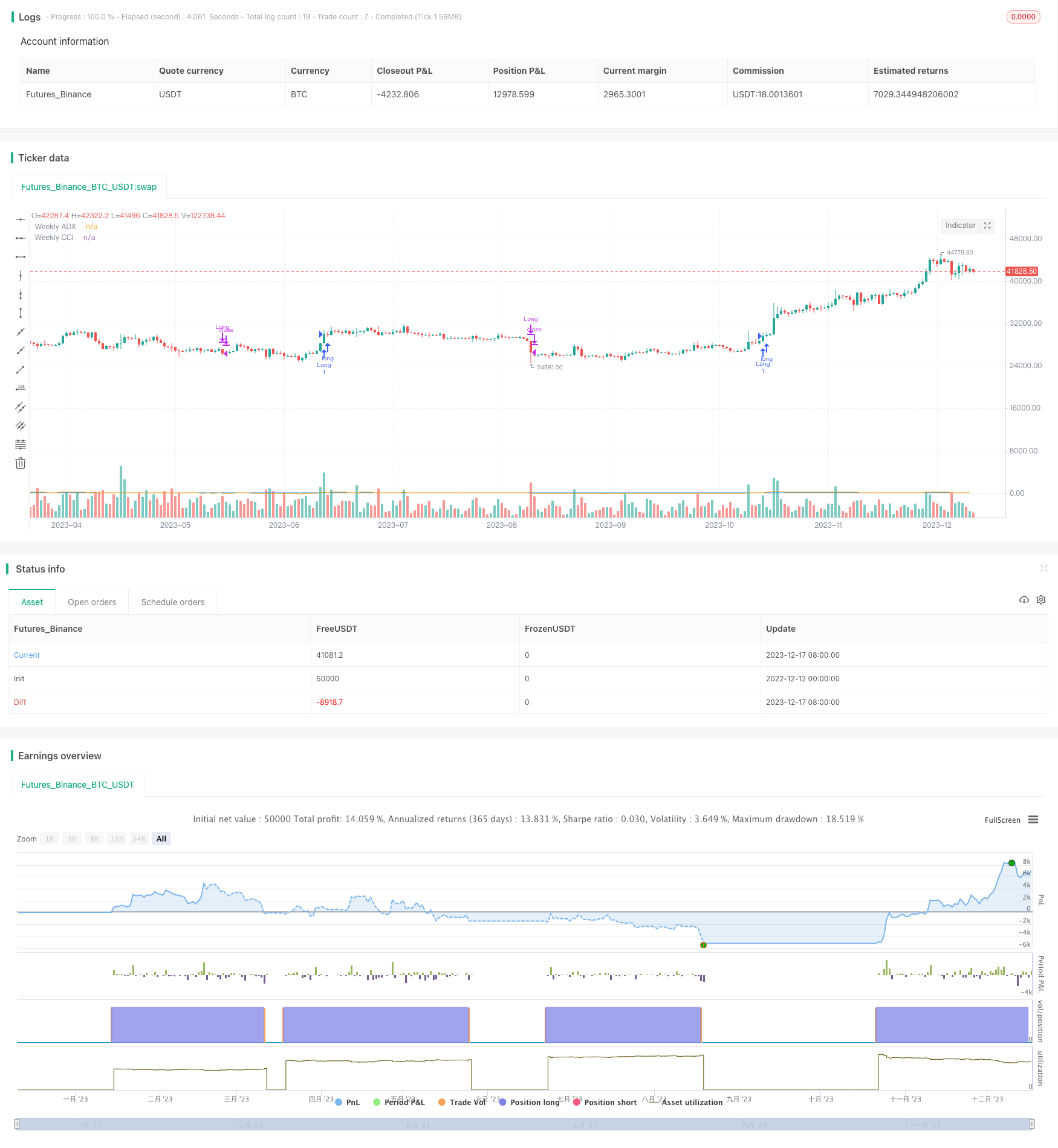

/*backtest

start: 2022-12-12 00:00:00

end: 2023-12-18 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Buy Only Strategy with Dynamic Re-Entry and Exit", overlay=true)

// Input Parameters

fast_length = input(20, title="Fast Moving Average Length")

slow_length = input(30, title="Slow Moving Average Length")

third_ma_length = input(100, title="Third Moving Average Length")

cci_period = input(14, title="CCI Period for Weekly CCI")

use_cci = input(true, title="Use CCI for Entry")

use_adx = input(true, title="Use ADX for Entry")

adx_length = input(14, title="ADX Length")

adx_threshold = input(25, title="ADX Threshold")

// Calculate Moving Averages

fast_ma = ta.sma(close, fast_length)

slow_ma = ta.sma(close, slow_length)

third_ma = ta.sma(close, third_ma_length)

// Weekly Commodity Channel Index (CCI) with user-defined period

weekly_cci = request.security(syminfo.tickerid, "W", ta.cci(close, cci_period))

// Weekly Average Directional Index (ADX)

dirmov = hlc3

plus = ta.change(dirmov) > 0 ? ta.change(dirmov) : 0

minus = ta.change(dirmov) < 0 ? -ta.change(dirmov) : 0

trur = ta.rma(ta.tr, adx_length)

plusDI = ta.rma(plus, adx_length) / trur * 100

minusDI = ta.rma(minus, adx_length) / trur * 100

sum = plusDI + minusDI

DX = sum == 0 ? 0 : math.abs(plusDI - minusDI) / sum * 100

ADX = ta.rma(DX, adx_length)

// Entry Conditions (Buy Only and Weekly CCI > 100 and/or Weekly ADX > 25)

cci_condition = use_cci ? (weekly_cci > 100) : false

adx_condition = use_adx ? (ADX > adx_threshold) : false

long_condition = ta.crossover(fast_ma, slow_ma) and (cci_condition or adx_condition)

// Exit Condition and Dynamic Re-Entry

exit_condition = close < third_ma

re_entry_condition = close > fast_ma and close > slow_ma and close > third_ma and weekly_cci > 100

// Entry and Exit Signals

strategy.entry("Long", strategy.long, when=long_condition)

strategy.close("Long", when=exit_condition)

// Dynamic Re-Entry and Exit

if strategy.position_size == 0 and re_entry_condition

strategy.entry("Long", strategy.long)

if strategy.position_size > 0 and close < third_ma

strategy.close("Long")

// Plot Weekly CCI and ADX for reference

plot(weekly_cci, title="Weekly CCI", color=color.orange)

plot(ADX, title="Weekly ADX", color=color.blue)