概述

该策略是一种判断价格趋势的长线趋势跟踪策略。它通过计算历史价格的分形点,判断最后一个分形点的突破来决定建仓。同时,它通过计算最后N个分形点的平均价来判断趋势方向,当趋势转向时平仓。

策略原理

- 计算价格的分形点。分形点定义为当天的最高价高于前两天和后两天的最高价。

- 记录最后一个分形点的价格作为阻力。

- 当关闭价格突破最后一个分形点时,认为阻力被突破,建立做多仓位。

- 计算最后N个分形点的平均价格来判断趋势,当平均价格上涨时为看涨趋势,下跌时为看跌趋势。

- 如果在做多仓位时,平均分形点价格转为下跌,则平仓。

优势分析

这种基于分形点判断趋势的策略,最大的优势是能有效过滤市场噪音,判断更长线的趋势方向。相比简单的移动平均线等指标,它对突发异常波动的抵抗能力更强。

另外,该策略判断建仓和平仓标准非常明确,不会出现频繁交易的问题。这也使得它特别适合长线持有。

风险分析

这种策略最大的风险在于分形点本身判断的概率性。分形点无法百分百预判价格必然反转,也就是说判断错误的概率依然存在。当出现错判时,将面临亏损的风险。

此外,分形点判断的时间跨度较长,不能适应高频交易。如果追求短线交易,这种策略也不太适合。

优化方向

考虑到分形点判断的误差概率,我们可以通过以下几个方法优化:

结合其他指标确认,如布林线通道、移动平均线等,避免单一分形点判断错误。

调整分形点的参数,如判断的前后周期数量,来优化分形点的判断。

增加止损策略,在亏损扩大到一定程度时止损。

总结

该突破型分形策略整体来说非常适合判断长线趋势,也十分适合长线投资者使用。我们只需要在确保判断准确率的前提下,适当调整参数,增加其他过滤指标,就可以大幅优化该策略,使其成为量化Decision的重要组成部分。

策略源码

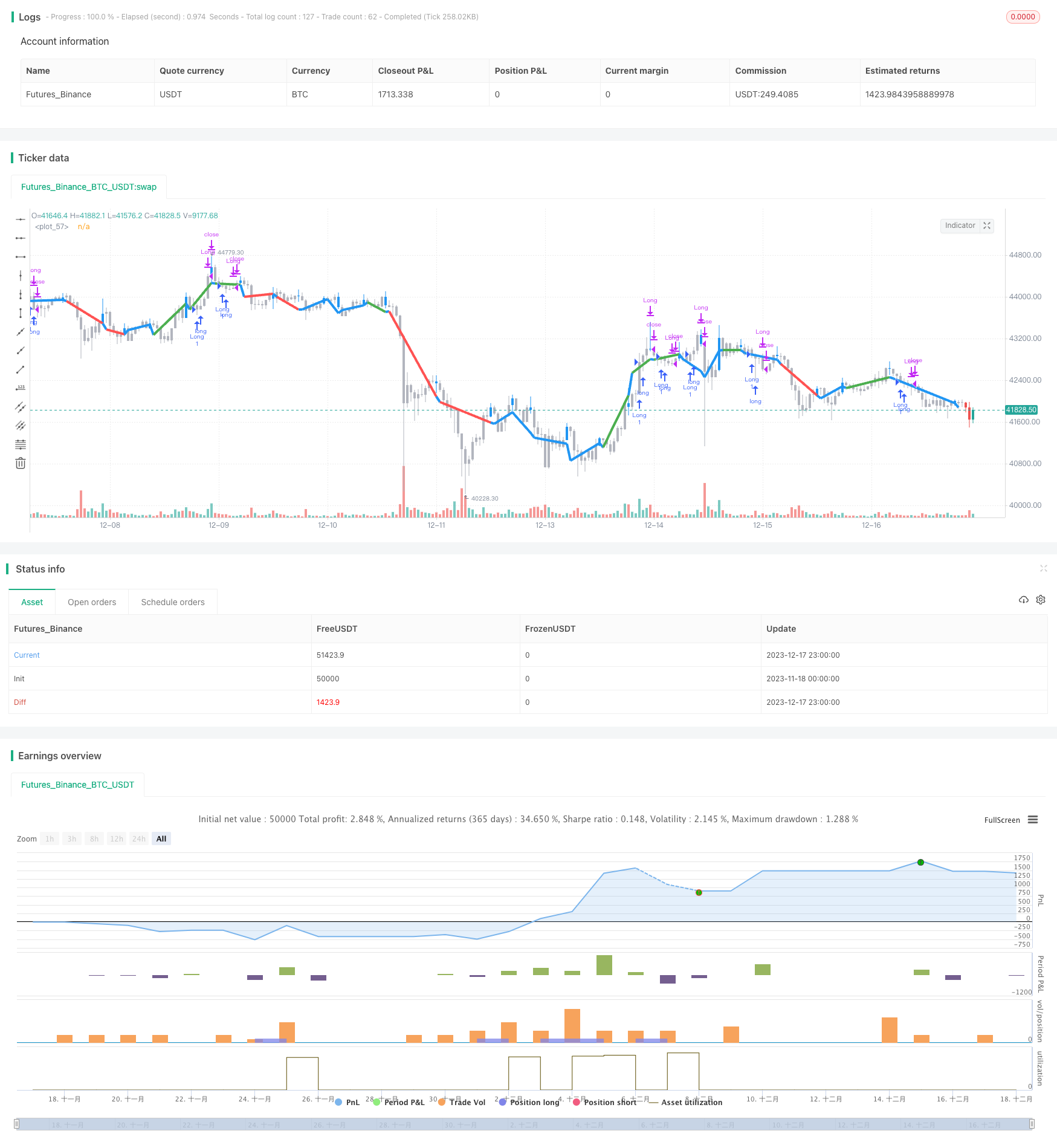

/*backtest

start: 2023-11-18 00:00:00

end: 2023-12-18 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("Fractal Breakout Strategy (by ChartArt)", shorttitle="CA_-_Fractal_Breakout_Strat", overlay=true)

// ChartArt's Fractal Breakout Strategy

//

// Version 1.0

// Idea by ChartArt on April 24, 2016.

//

// This long only strategy determines the last fractal top

// and enters a trade when the price breaks above the last

// fractal top. The strategy also calculates the average

// price of the last 2 (or 3) fractal tops to get the trend.

//

// The strategy exits the long trade when the average of the

// fractal tops is falling (when the trend is lower highs).

// And the user can manually set a delay of this exit.

//

// In addition the fractals tops can be colored in blue

// and a line can be drawn based on the fractal tops.

// This fractal top line is colored by the fractal trend.

//

// List of my work:

// https://www.tradingview.com/u/ChartArt/

//

// __ __ ___ __ ___

// / ` |__| /\ |__) | /\ |__) |

// \__, | | /~~\ | \ | /~~\ | \ |

//

//

// input

n_time = input(title='Always exit each trade after this amount of bars later (Most important strategy setting)', defval=3)

price = input(hl2,title='Price type to determine the last fractal top and the fractal breakout, the default is (high+low)/2')

// fractal calculation

fractal_top = high[2] > high[3] and high[2] > high[4] and high[2] > high[1] and high[2] > high[0]

fractal_price = valuewhen(fractal_top, price, 1)

use_longer_average = input(true,title='Use Fractal price average of the last 3 fractals instead of the last 2 fractals?')

fractal_average = use_longer_average?(fractal_price[1] + fractal_price[2] + fractal_price[3] ) / 3 : (fractal_price[1] + fractal_price[2]) / 2

fractal_trend = fractal_average[0] > fractal_average[1]

no_repainting = input(true,title='Use the price of the last bar to prevent repainting?')

fractal_breakout = no_repainting?price[1] > fractal_price[0]:price[0] > fractal_price[0]

// highlight fractal tops

show_highlight = input(true,title='Highlight fractal tops in blue and color all other bars in gray?')

highlight = fractal_top?blue:silver

barcolor(show_highlight?highlight:na,offset=-2)

show_fractal_top_line = input(true,title='Draw a colored line based on the fractal tops?')

fractal_top_line = change(fractal_top) != 0 ? price : na

fractal_top_line_color = change(fractal_price) > 0 and fractal_breakout == true ? green : change(fractal_price) < 0 and fractal_breakout == false ? red : blue

plot(show_fractal_top_line?fractal_top_line:na,offset=-2,color=fractal_top_line_color,linewidth=4)

// strategy

trade_entry = fractal_trend and fractal_breakout

trade_exit = fractal_trend[n_time] and fractal_trend == false

if (trade_entry)

strategy.entry('Long', strategy.long)

if (trade_exit)

strategy.close('Long')