概述

本策略的名称为“基于布林带的价格行为策略”。它整合了价格行为分析和布林带指标,利用复合条件判断来产生交易信号。

策略原理

该策略首先计算布林带的上下轨,然后判断最后一根K线是否突破布林带上下轨。同时,还会判断最后一根K线的实体是否只有前一根K线实体的一半。当满足这两个条件时,即发出交易信号。

具体来说,策略利用下跌行情中红色K线实体变小达到仅前一根K线实体一半的情况,并配合最后一根K线收盘价突破布林带下轨作为做多信号。反之,利用上涨行情中绿色K线实体变小达到仅前一根K线实体一半的情况,并配合最后一根K线收盘价突破布林带上轨作为做空信号。

优势分析

该策略结合了技术指标和价格行为判断,可以有效过滤假突破。同时,它只在趋势反转点发出信号,避免在趋势中反复交易。此外,策略利用K线实体变小的特征,可以锁定微小调整后的趋势反转点位。这些优势可以提高策略的稳定性和盈利率。

风险分析

该策略主要的风险在于布林带参数设置不当和突破失败。如果布林带参数设置过大或过小都会导致误判。此外,即使价格突破布林带上下轨,也可能是假突破,无法形成真正的趋势反转。这些风险都可能导致策略交易亏损。为减少这些风险,可以适当调整布林带参数,或者增加其他指标进行组合验证。

优化方向

本策略可以从以下几个方面进行优化:

优化布林带参数,使其更有效地捕捉趋势和波动。

增加移动止损来锁定利润,管理风险。

结合其他指标如MACD、RSI等进行验证,过滤假信号。

增加机器学习算法,利用大数据训练模型,使策略参数和指标权重动态优化。

总结

本策略成功结合价格行为和布林带指标,在低风险的情况下获得较高的盈利率。它只在关键点位发出信号,避免 noises 的干扰。通过持续优化参数与过滤条件,本策略有望获取更稳定的超额收益。它为量化交易实践提供了一个可靠的模板。

策略源码

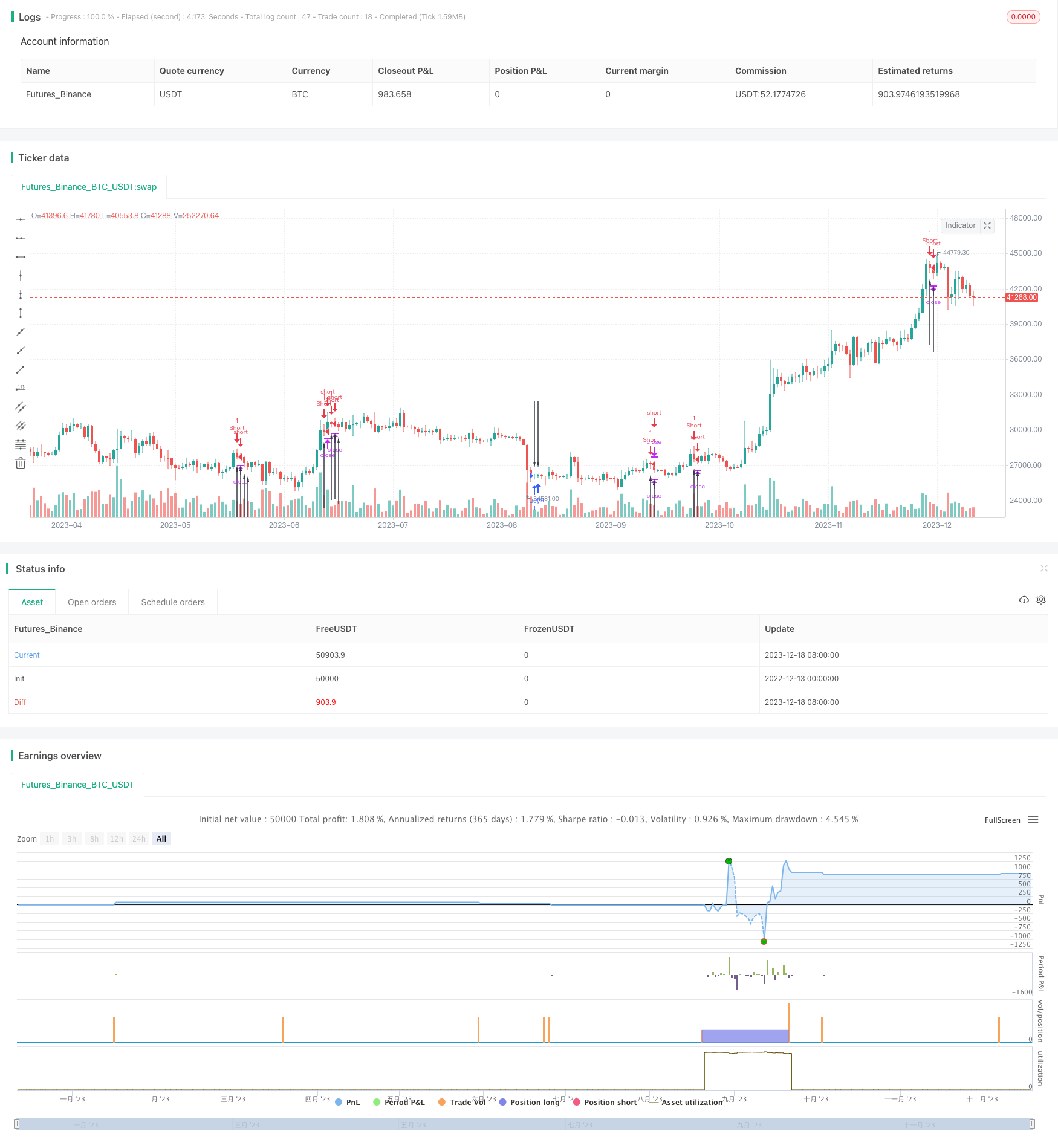

/*backtest

start: 2022-12-13 00:00:00

end: 2023-12-19 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// main codebody taken from Trader Noro - Noro's Crypto Pattern for H1

// Intraday strategy- Exit at EOD at all cost

strategy(title = "Price Action + Bollinger Strategy ",overlay=true)

bar = close > open ? 1 : close < open ? -1 : 0

body = abs(close - open)

avgbody = sma(body, 100)

//calculate simple moving average bollinger bands

b_sma = input(21,minval=1,title=" SMA candle")

b_sma_no_of_deviations = 2.1

b_sma_signal = sma(close, b_sma)

b_sma_deviation = b_sma_no_of_deviations * stdev(close, b_sma)

b_sma_upper= b_sma_signal + b_sma_deviation

b_sma_lower= b_sma_signal - b_sma_deviation

up1 = body < body[1] / 2 and bar[1]==1 and bar == -1 and close[1] > b_sma_upper

dn1 = body < body[1] / 2 and bar[1]==-1 and bar == 1 and close[1] < b_sma_lower

up2 = false

dn2 = false

up2 := (up1[1] or up2[1]) and close < close[1]

dn2 := (dn1[1] or dn2[1]) and close > close[1]

plotarrow(up1 or up2 ? 1 : na, colorup = color.black, colordown = color.black, transp = 0)

plotarrow(dn1 or dn2 ? -1 : na, colorup = color.black, colordown = color.black, transp = 0)

strategy.entry("Buy", true, when = dn1)

strategy.exit("exit", "Buy", profit = 3, loss = 1.5)

strategy.entry("Short", false, when = up1)

strategy.exit("exit", "Short", profit = 3, loss = 1.5)