概述

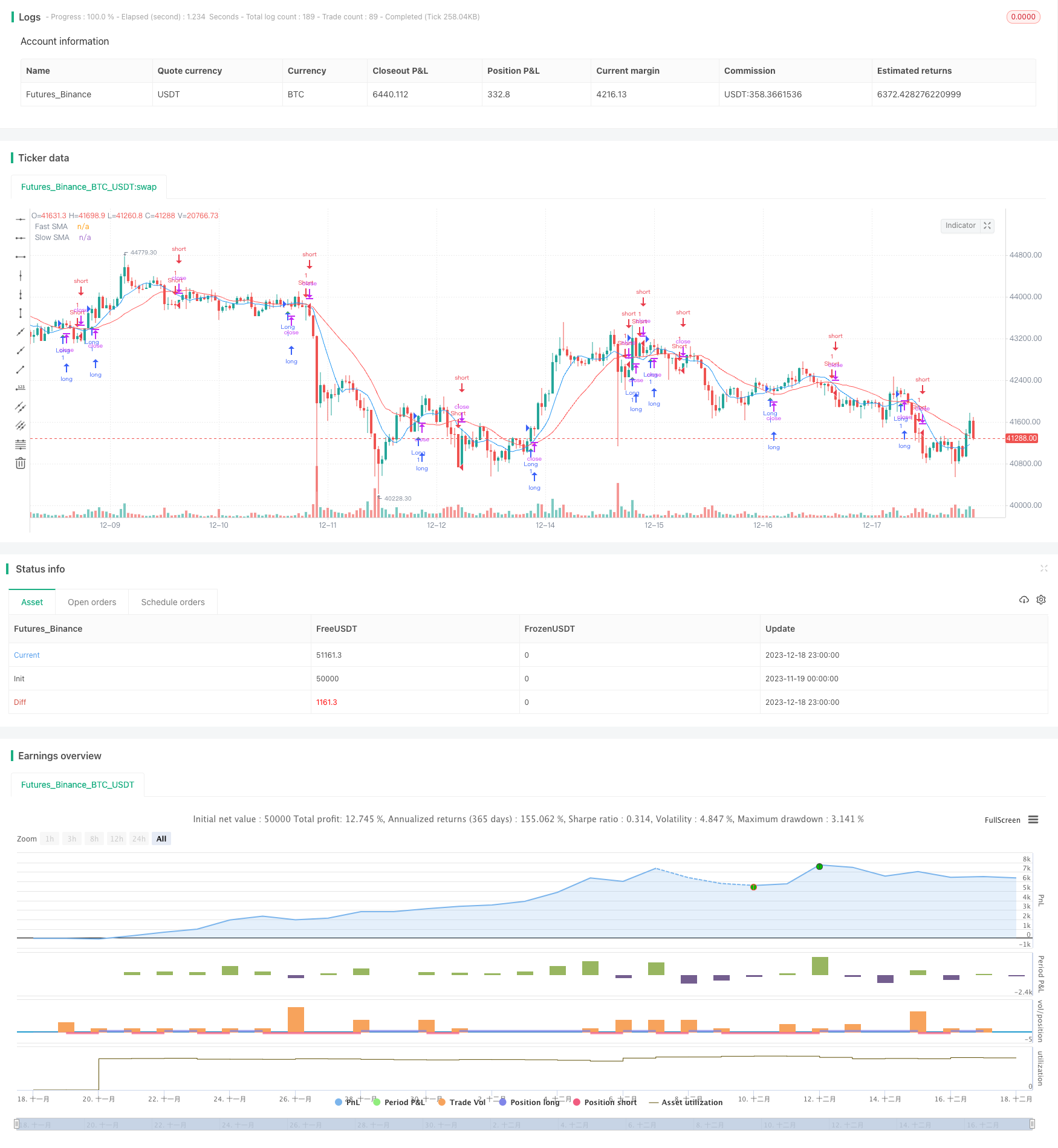

该策略是一个基于 8 周期和 20 周期简单移动平均线(SMA)的交叉策略。当快速 SMA 上穿慢速 SMA 时做多,当快速 SMA 下穿慢速 SMA 时做空。该策略主要利用不同周期均线的交叉来捕捉趋势的变化。

策略原理

- 计算 8 周期和 20 周期的 SMA。

- 当 8 周期 SMA 上穿 20 周期 SMA 时,做多。

- 当 8 周期 SMA 下穿 20 周期 SMA 时,做空。

- 平仓信号:当发生反向交叉时平掉当前头寸。

该策略利用快速均线和慢速均线的交叉来判断趋势的变化。由于快速均线对价格变化更为敏感,可以更早地捕捉到短期趋势的转折。当快速均线上穿慢速均线时,表示短线开始进入多头,这是一个做多的信号。当快速均线下穿慢速均线时,表示市场已经从多头转为空头,这是一个做空的信号。

策略优势

- 概念简单,容易理解和实现。

- 参数选择灵活,可以根据市场调整均线参数。

- 交易信号明确,操作规则清晰。

- 能够有效地捕捉短期趋势的变化。

该策略最大的优势在于简单和直观,容易理解和实现。同时,也比较灵活,通过调整均线参数可以适应不同的市场环境。这可以作为一个基础策略,并在其基础上进行扩展和优化。

策略风险

- 可能出现频繁的错诊和假信号。

- 无法判断趋势的长短,可能过早入场和离场。

- 大幅震荡市场中容易止损。

- 参数不当可能导致亏损。

由于该策略仅仅依赖均线交叉这样简单的指标,所以对复杂的市场情况判断能力较弱。无法判断具体的趋势长度和方向变化,可能过早入场和离场。同时也容易在震荡行情中被套住。此外参数选择不当也会直接影响策略表现。

可以通过和其他指标组合,判断趋势信号的确认来减少误判。同时适当放宽止损幅度也可以一定程度上避免震荡市场的亏损。

策略优化

- 结合其他指标过滤信号。比如 KDJ,MACD等。

- 增加趋势判断规则,避免不必要的反转。

- 优化参数,调整均线周期。

- 结合波动率指标,根据市场调整止损位置。

该策略可以与其他指标组合使用,利用更多因子判断趋势信号,过滤假信号。同时通过趋势判断,避免过于频繁的反转。此外参数优化和止损优化也可以大幅提高策略稳定性。

总结

该均线交叉策略概念简单,容易理解和实现。利用不同速度均线的交叉判断趋势变化,可以有效捕捉短期趋势。但也存在一些问题,识别能力较弱,容易产生误信号。通过与其他指标组合使用,适当调整参数和止损位置,可以获得更好的绩效。该策略为量化交易奠定了基础,也为进一步优化提供了方向。

策略源码

/*backtest

start: 2023-11-19 00:00:00

end: 2023-12-19 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("SMA Crossover Strategy", overlay=true)

// Define SMA lengths

fastLength = input.int(8, title="Fast SMA Length", minval=1)

slowLength = input.int(20, title="Slow SMA Length", minval=1)

// Calculate SMAs

fastSMA = ta.sma(close, fastLength)

slowSMA = ta.sma(close, slowLength)

// Plot SMAs on the chart

plot(fastSMA, color=color.blue, title="Fast SMA")

plot(slowSMA, color=color.red, title="Slow SMA")

// Trading strategy

longCondition = ta.crossover(fastSMA, slowSMA)

shortCondition = ta.crossunder(fastSMA, slowSMA)

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

if (ta.crossunder(fastSMA, slowSMA))

strategy.close("Long")

if (ta.crossover(fastSMA, slowSMA))

strategy.close("Short")

// Plot buy and sell signals on the chart

plotshape(series=longCondition, title="Buy Signal", color=color.green, style=shape.triangleup, location=location.belowbar)

plotshape(series=shortCondition, title="Sell Signal", color=color.red, style=shape.triangledown, location=location.abovebar)