概述

这个策略是一个简单的仅做多,使用RSI指标判断超买超卖的策略。我们对其进行了增强,添加了止损止盈,同时集成了概率模块进行概率增强,只有当最近一段时间盈利交易的概率大于等于51%时才会开仓。这大大提高了策略的表现。

策略原理

该策略使用RSI指标判断市场超买超卖。具体来说,当RSI下破设定的超卖区间下限时做多;当RSI上破设定的超卖区间上限时平仓。此外,我们设定了止损止盈比例。

关键的是,我们集成了一个概率判断模块。该模块会统计最近一段时间(通过lookback参数设定)内,做多交易是盈是亏的比例。只有当近期盈利交易的概率大于等于51%时,才会开仓做多。这就大大减少了可能出现的亏损交易。

优势分析

这是一个概率增强的RSI策略,相比普通的RSI策略有以下优势:

- 增加止损止盈设置,可以限制单笔损失,锁定盈利

- 集成概率模块,避免盈利概率较低的市场 vrf

- 概率模块参数可调,可以针对不同市场环境进行优化

- 仅做多机制简单易理解,容易实施

风险分析

该策略也存在一定风险:

- 仅做多,无法利用跌市获利

- 概率模块判断不当可能错过较好机会

- 无法确定最佳参数组合,不同市场环境下表现差异大

- 止损设置过于宽松,单笔损失依然可能较大

对应解决方法: 1. 可以考虑加入做空机制 2. 优化概率模块参数,降低误判概率 3. 采用机器学习方法动态优化参数 4. 设定更保守的止损水平,缩小单笔损失空间

优化方向

该策略可以从以下几个方面进行进一步优化:

- 增加做空模块,实现双向交易

- 使用机器学习方法动态优化参数设置

- 尝试其他指标判断超买超卖

- 优化止损止盈策略,实现盈亏比优化

- 结合其他因子过滤信号,提高概率

总结

该策略是一个简单的RSI策略,集成概率判断模块进行增强。相比普通RSI策略,可以过滤掉部分亏损交易,整体回撤和盈亏比有所优化。后续可从做空、动态优化等方面进行改进,使策略更加稳健。

策略源码

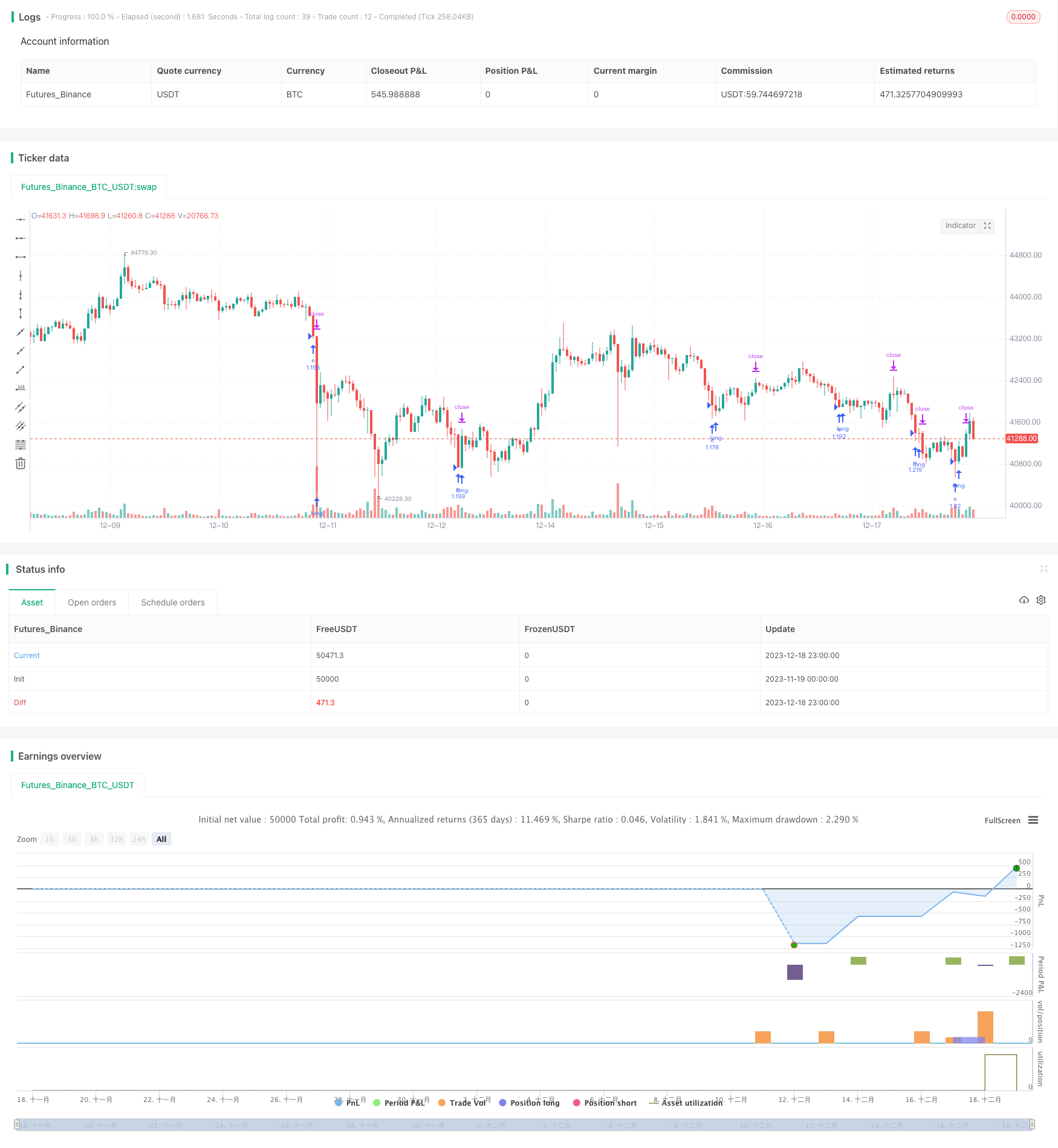

/*backtest

start: 2023-11-19 00:00:00

end: 2023-12-19 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © thequantscience

//@version=5

strategy("Reinforced RSI",

overlay = true,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 100,

pyramiding = 1,

currency = currency.EUR,

initial_capital = 1000,

commission_type = strategy.commission.percent,

commission_value = 0.07)

lenght_rsi = input.int(defval = 14, minval = 1, title = "RSI lenght: ")

rsi = ta.rsi(close, length = lenght_rsi)

rsi_value_check_entry = input.int(defval = 35, minval = 1, title = "Oversold: ")

rsi_value_check_exit = input.int(defval = 75, minval = 1, title = "Overbought: ")

trigger = ta.crossunder(rsi, rsi_value_check_entry)

exit = ta.crossover(rsi, rsi_value_check_exit)

entry_condition = trigger

TPcondition_exit = exit

look = input.int(defval = 30, minval = 0, maxval = 500, title = "Lookback period: ")

Probabilities(lookback) =>

isActiveLong = false

isActiveLong := nz(isActiveLong[1], false)

isSellLong = false

isSellLong := nz(isSellLong[1], false)

int positive_results = 0

int negative_results = 0

float positive_percentage_probabilities = 0

float negative_percentage_probabilities = 0

LONG = not isActiveLong and entry_condition == true

CLOSE_LONG_TP = not isSellLong and TPcondition_exit == true

p = ta.valuewhen(LONG, close, 0)

p2 = ta.valuewhen(CLOSE_LONG_TP, close, 0)

for i = 1 to lookback

if (LONG[i])

isActiveLong := true

isSellLong := false

if (CLOSE_LONG_TP[i])

isActiveLong := false

isSellLong := true

if p[i] > p2[i]

positive_results += 1

else

negative_results -= 1

positive_relative_probabilities = positive_results / lookback

negative_relative_probabilities = negative_results / lookback

positive_percentage_probabilities := positive_relative_probabilities * 100

negative_percentage_probabilities := negative_relative_probabilities * 100

positive_percentage_probabilities

probabilities = Probabilities(look)

lots = strategy.equity/close

var float e = 0

var float c = 0

tp = input.float(defval = 1.00, minval = 0, title = "Take profit: ")

sl = input.float(defval = 1.00, minval = 0, title = "Stop loss: ")

if trigger==true and strategy.opentrades==0 and probabilities >= 51

e := close

strategy.entry(id = "e", direction = strategy.long, qty = lots, limit = e)

takeprofit = e + ((e * tp)/100)

stoploss = e - ((e * sl)/100)

if exit==true

c := close

strategy.exit(id = "c", from_entry = "e", limit = c)

if takeprofit and stoploss

strategy.exit(id = "c", from_entry = "e", stop = stoploss, limit = takeprofit)