策略概述

这是一个基于相对强度指标(RSI)和相对交易量指标的量化交易策略。该策略通过捕捉强势行情最快阶段的交易信号来获取超额收益。

策略原理

该策略整合了两个指标:相对强度指标(RSI)和相对量指标(RVOL)。RSI用于判断市场走势的超买超卖情况。当RSI低于30时为超卖,高于70时为超买。RVOL用于判断交易量的爆发性,相对平均交易量大于设定阈值时表示买卖力道强劲。

策略逻辑是:当RSI表现超买(RSI高于阈值)和RVOL表现超大时看多入市; 当RSI表现超卖(RSI低于阈值)和RVOL表现超大时看空入市。平仓信号是RSI回归正常水平(多头平仓:RSI低于69;空头平仓:RSI高于31)。

优势分析

该策略最大的优势是利用RSI指标判断市场超买超卖的时机,再结合高相对量的信号,在行情最激进的时候捕捉超强势行情的爆发点。使用RSI和RVOL的组合信号,可以过滤掉很多假突破的机会,从而提高获利概率。

相对于单一使用RSI指标,该策略增加了交易量的参考,避免在交易量不足时介入市场。相对于单一使用突破指标,该策略避免在超买超卖区域打向主流的反弹。

风险分析

该策略最大的风险在于RSI指标发出错误信号的概率。当市场处于sideway时,RSI指标可能频繁进出超买超卖区域,产生虚假信号。此外,该策略对交易量变化较为敏感,如果遇到量能不足的个股,获利空间会打折扣。

为了降低风险,可以适当调整RSI的参数,增加RSI的平均长度,或者调高RVOL的阈值。也可以加入其它指标进行组合,增加策略的稳健性。

优化方向

该策略可以从以下几个方面进行优化:

结合流动性指标,避免流动性差的标的;

加入波动率指标,只在波动加剧时介入;

增加排除假突破的机制,如加入成交量的监测;

使止损策略更加严格,降低回撤;

进行参数优化,结合回测数据找到最优参数组合。

总结

该相对量指标策略通过相对强度指标和相对交易量的结合,成功定位了超买超卖区域内交易量爆发的时点,是一种有效的趋势捕捉策略。该策略心理场景清晰,经过参数调优以后,可以成为量化交易体系中的有效组成部分。

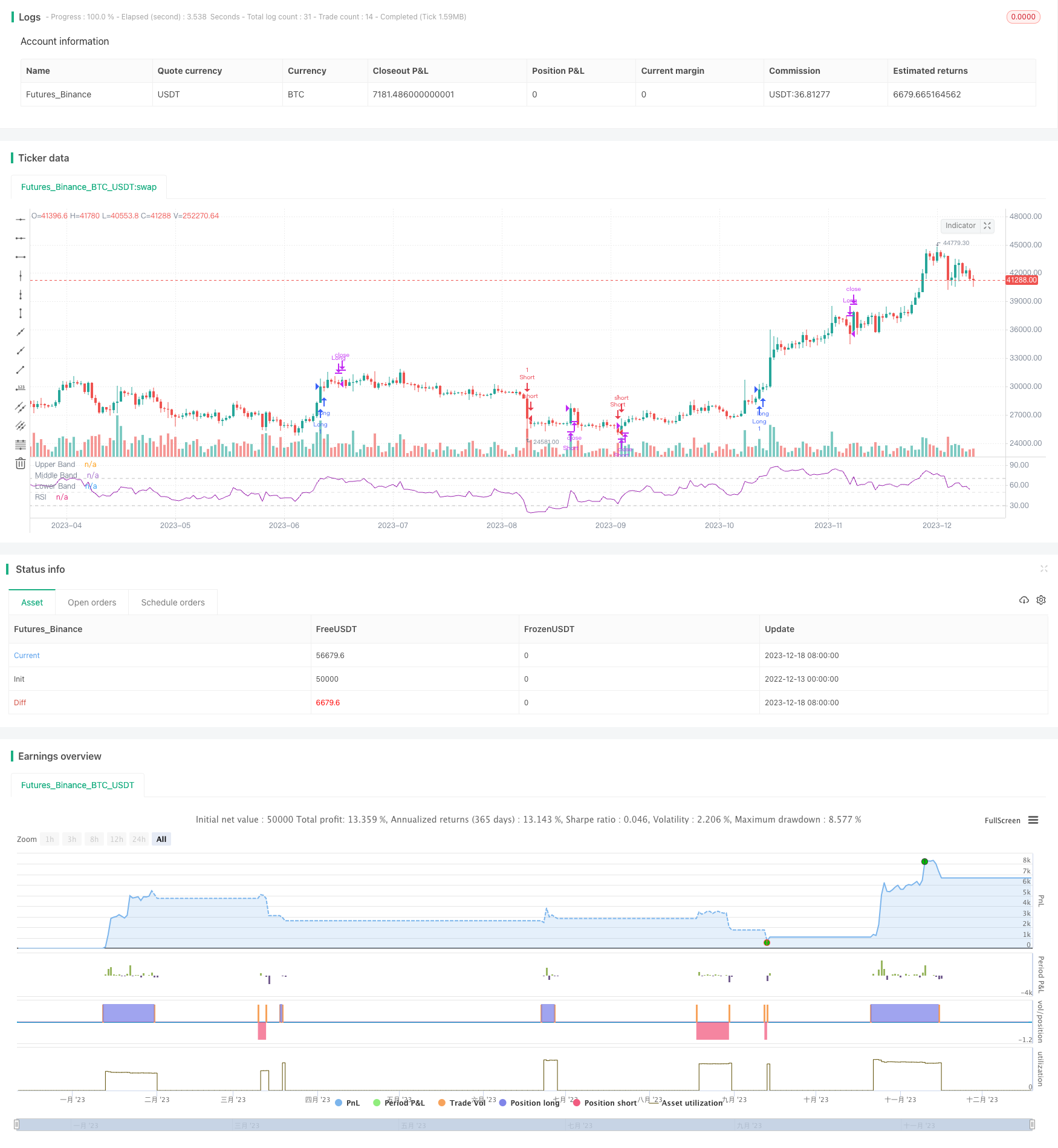

/*backtest

start: 2022-12-13 00:00:00

end: 2023-12-19 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © gary_trades

//This script is a basic concept to catch breakout moves utilising a spike in relative volume when the RSI is high (for longs) or when the RSI is low (for shorts).

//Drawdown is typically low as it exits out of the trade once the RSI returns back to "normal levels".

//@version=4

strategy(title="Relative Volume & RSI Pop", shorttitle="VOL & RSI Pop", overlay=false, precision=2, margin_long=100, margin_short=100)

//RSI

RSIlength = input(14, title="RSI Period")

RSItop = input(70, title="RSI buy", minval= 69, maxval=100)

RSIbottom = input(35, title="RSI short", minval= 0, maxval=35)

price = close

vrsi = rsi(price, RSIlength)

RSIco = crossover(vrsi, RSItop)

RSIcu = crossunder(vrsi, RSIbottom)

plot(vrsi, "RSI", color=color.purple)

band1 = hline(70, "Upper Band", color=#C0C0C0)

bandm = hline(50, "Middle Band", color=color.new(#C0C0C0, 50))

band0 = hline(30, "Lower Band", color=#C0C0C0)

fill(band1, band0, color=color.purple, transp=90, title="Background")

//RELATIVE VOLUME

RVOLlen = input(14, minval=1, title="RV Period")

av = sma(volume, RVOLlen)

RVOL = volume / av

RVOLthreshold = input(1.5,title="RV Threshold", minval=0.5, maxval=10)

//TRADE TRIGGERS

LongCondition = RSIco and RVOL > RVOLthreshold

CloseLong = vrsi < 69

ShortCondition = RSIcu and RVOL > RVOLthreshold

CloseShort = vrsi > 35

if (LongCondition)

strategy.entry("Long", strategy.long)

strategy.close("Long", when = CloseLong)

if (ShortCondition)

strategy.entry("Short", strategy.short)

strategy.close("Short", when = CloseShort)