概述

该策略是基于动量指标的反向交易策略。它使用易行指标(EOM)来判断市场的走势,当指标超过设定的阈值时做多做空。同时提供反向交易功能,可以根据实际需要选择正向交易或反向交易。

策略原理

易行指标(EOM)是衡量价格和成交量变动幅度的指标。它同时返回正负值。正值表示价格上涨,负值表示价格下跌。数值越大表示价格变动越大和/或成交量越小。

该策略的原理是:

- 计算当前K线的易行指标值

- 判断指标值是否超过设定的做多阈值或做空阈值

- 如果超过做多阈值(默认4000),做多

- 如果低于做空阈值(默认-4000),做空

- 提供反向交易功能

- 正常情况下做多时为看涨,做空时为看跌

- 开启反向交易后,做多为看跌,做空为看涨

优势分析

该策略主要优势有:

- 使用易行指标判断市场实际走势,指标反映价格和成交量变化

- 阈值可自定义设置

- 提供反向交易功能,可以根据需要选择正向交易或反向交易

- 直观通过K线颜色判断做多做空

风险分析

该策略主要风险有:

- 易行指标存在错触风险,可能出现假突破

- 阈值设定不当可能导致交易频繁或次数过少

- 反向交易时,需要确保自己有足够的风险承受能力

解决方法:

- 结合其他指标判断,避免错触

- 调整阈值参数,优化交易次数

- 正确评估自己的实际风险承受能力

优化方向

该策略可以从以下几个方向进行优化:

- 结合移动平均线等指标,避免假突破

- 添加止损机制

- 优化参数,调整做多做空的阈值

- 增加开仓条件,避免频繁交易

- 反向交易时可设置风险管理策略

通过以上几点优化,可以使策略更稳定,降低风险,提高实盘效果。

总结

总的来说,该策略利用易行指标判断市场实际走势,通过做多和做空获得超额收益。它简单易用,同时考虑了价格变动和交易量变动两个因素。如果用于实盘,建议结合其他技术指标,并适当优化参数,可以获得更好的效果。

策略源码

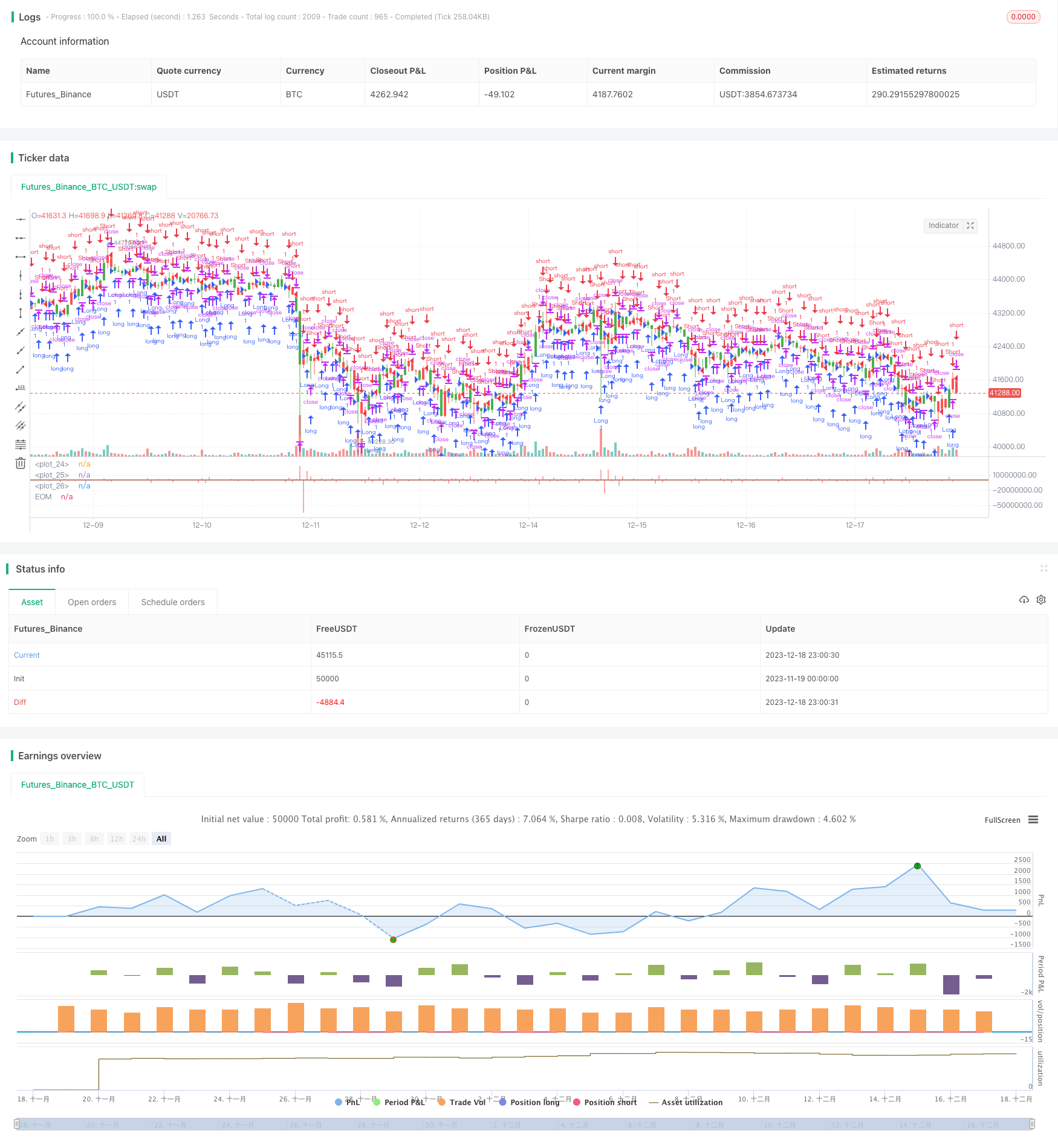

/*backtest

start: 2023-11-19 00:00:00

end: 2023-12-19 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 19/06/2018

// This indicator gauges the magnitude of price and volume movement.

// The indicator returns both positive and negative values where a

// positive value means the market has moved up from yesterday's value

// and a negative value means the market has moved down. A large positive

// or large negative value indicates a large move in price and/or lighter

// volume. A small positive or small negative value indicates a small move

// in price and/or heavier volume.

// A positive or negative numeric value. A positive value means the market

// has moved up from yesterday's value, whereas, a negative value means the

// market has moved down.

//

// You can change long to short in the Input Settings

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

strategy(title="Ease of Movement (EOM) Backtest", shorttitle="EOM")

BuyZone = input(4000, minval=1)

SellZone = input(-4000, minval=1)

reverse = input(false, title="Trade reverse")

hline(0, color=blue, linestyle=line)

hline(BuyZone, color=green, linestyle=line)

hline(SellZone, color=red, linestyle=line)

xHigh = high

xLow = low

xVolume = volume

xHalfRange = (xHigh - xLow) * 0.5

xMidpointMove = mom(xHalfRange, 1)

xBoxRatio = iff((xHigh - xLow) != 0, xVolume / (xHigh - xLow), 0)

nRes = iff(xBoxRatio != 0, 1000000 * ((xMidpointMove - xMidpointMove[1]) / xBoxRatio), 0)

pos = iff(nRes > BuyZone, 1,

iff(nRes < SellZone, -1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

plot(nRes, color=red, title="EOM", style=histogram, linewidth=2)