概述

该策略利用快速EMA均线(9周期)和慢速EMA均线(21周期)的交叉作为入场信号,并结合移动止损来锁定利润,避免回撤过大。

策略原理

当快速EMA线从下方向上突破慢速EMA线时,生成买入信号;当快速EMA线从上方向下跌破慢速EMA线时,生成卖出信号。

一旦入场,策略会实时跟踪最高价,并在当前价格低于最高价2%时触发移动止损,将利润锁定。

优势分析

- 利用EMA均线的趋势跟踪和信号生成能力,能够有效捕捉中长线趋势

- 移动止损机制可以锁定大部分利润,避免全部收益被吞噬

- EMA均线参数可调,可以适应不同市场环境

- 买卖信号规则清晰,容易实施

风险分析

- EMA均线存在滞后,可能错过短线机会

- 移动止损距离设置不当可能过早止损或止损无效

- 参数不匹配市场环境可能导致交易频繁或信号不足

风险解决方法:

- 选择合适的EMA参数组合

- 测试和评估止损距离参数

- 调整参数以适应市场波动率变化

优化方向

- 根据市场波动率和风险偏好动态调整移动止损距离

- 添加其他指标过滤,降低虚假信号

- 优化EMA均线周期参数的选择

- 结合趋势指标判断大趋势,避免反趋势交易

总结

该策略整合了趋势判断与止损管理的优点,既可以顺势而为,也可以有效控制风险。通过参数调整和优化,可以适用于不同类型的市场和交易品种,值得进一步测试实践。

策略源码

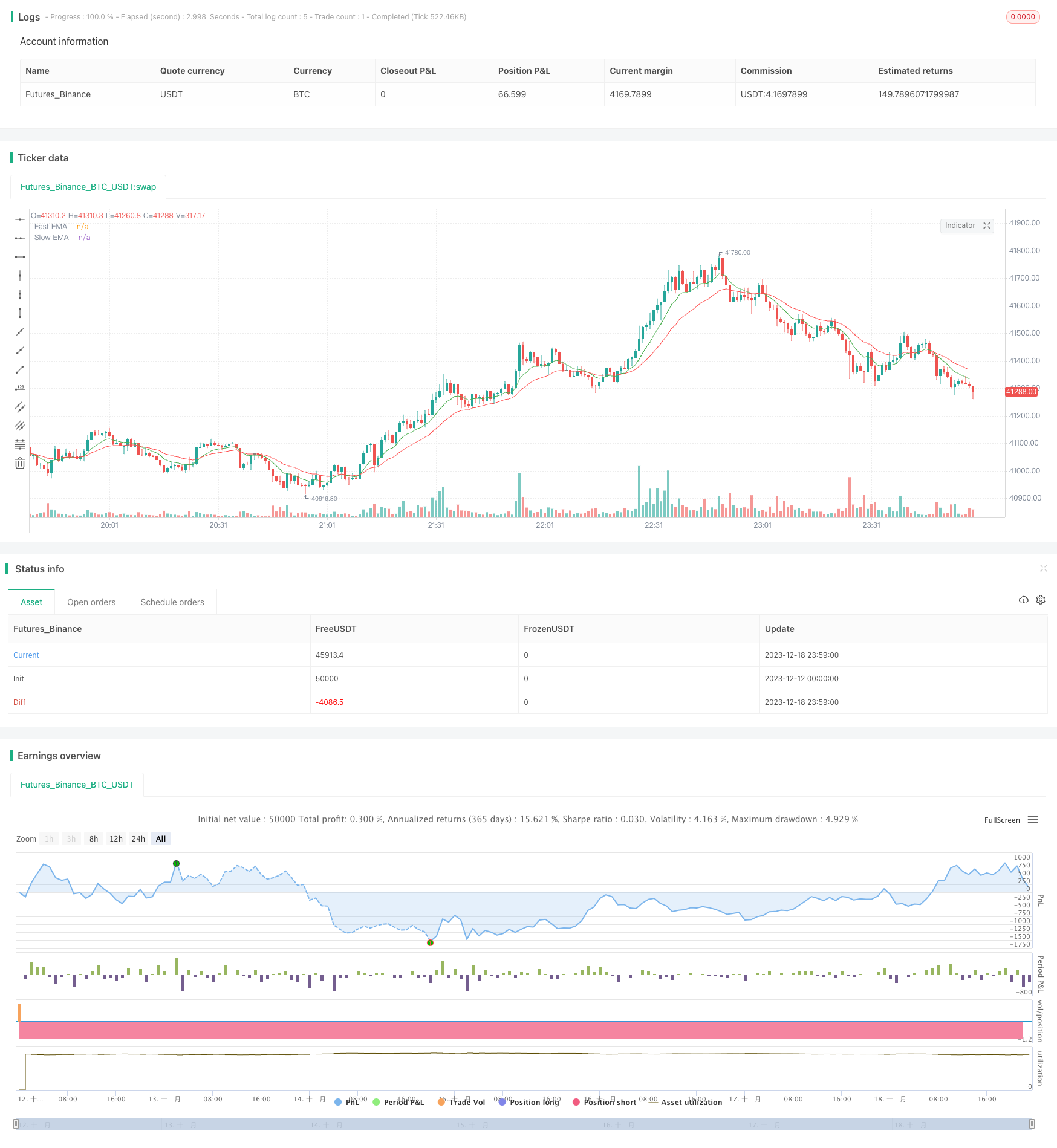

/*backtest

start: 2023-12-12 00:00:00

end: 2023-12-19 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("EMA Crossover with Trailing Stop-Loss", overlay=true)

fastEMA = ema(close, 9)

slowEMA = ema(close, 21)

// Entry conditions

longCondition = crossover(fastEMA, slowEMA)

shortCondition = crossunder(fastEMA, slowEMA)

// Trailing stop-loss calculation

var float trailingStop = na

var float highestHigh = na

if (longCondition)

highestHigh := na

trailingStop := na

if (longCondition and high > highestHigh)

highestHigh := high

if (strategy.position_size > 0)

trailingStop := highestHigh * (1 - 0.02) // Adjust the trailing percentage as needed

// Execute trades

strategy.entry("Long", strategy.long, when=longCondition)

strategy.entry("Short", strategy.short, when=shortCondition)

// Apply trailing stop-loss to long positions

strategy.exit("Long", from_entry="Long", loss=trailingStop)

// Plot EMAs and Trailing Stop-Loss

plot(fastEMA, color=color.green, title="Fast EMA")

plot(slowEMA, color=color.red, title="Slow EMA")

plot(trailingStop, color=color.orange, title="Trailing Stop-Loss", linewidth=2)