概述

本策略基于K线的形态和互动模式来判断买入和卖出信号。主要利用突破支撑和阻力进行交易,同时结合一定的K线形态来辅助决策。

策略原理

本策略主要判断以下几种K线形态:

- 小阳线:收盘价高于开盘价,实体部分较短

- 倒锤头:开盘价接近最高价,收盘价接近最低价

- 十字星:前一根K线与当前K线形成十字交叉

在判断K线形态的同时,本策略还设置了支撑位和阻力位。具体逻辑是:

- 当出现小阳线,且收盘价高于阻力位时,产生买入信号

- 当出现倒锤头,且收盘价低于支撑位时,产生卖出信号

通过这样的组合判断,可以过滤掉一些错误信号,使交易决策更加可靠。

优势分析

本策略具有以下几个优势:

- 结合图形形态和数值指标,使交易信号更加可靠

- 支撑阻力位的设置避免了无谓的反复交易

- K线形态判断相对简单,容易理解实现

- 可自定义参数,适应不同市场环境

总的来说,本策略较为简单实用,适合用来检验交易想法,也可以用来辅助人工交易。

风险分析

本策略也存在一些风险:

- K线形态判断并不完全可靠,可能出现误判

- 支撑阻力位设置不当也会影响策略效果

- 无法处理异常行情,如重大恶性事件造成的大幅波动

- 回测数据不足,可能高估了策略效果

对策主要是严格检验参数设定,调整支撑阻力位,并配合止损来控制风险。同时,必须在大量历史数据上进行回测,才能评估策略的实际效果。

优化方向

本策略主要可以从以下几个方面进行优化:

- 增加其他类型K线形态判断,丰富交易信号

- 优化支撑阻力位的计算方法,使其更加顺应市场走势

- 加入离均线距离、交易量变化等指数指标来辅助决策

- 增加机器学习算法,利用大数据自主判断图形特征

通过这些优化,可以使策略参数更加自动化、交易决策更加智能化,适应更加复杂的市场环境。

总结

本策略整体来说较为简单实用,特别适合个人交易者检验想法以及辅助决策。结合K线形态和支撑阻力判断产生交易信号,可以有效过滤误判。通过一定优化,本策略可以成为一个相对可靠的量化交易系统。

策略源码

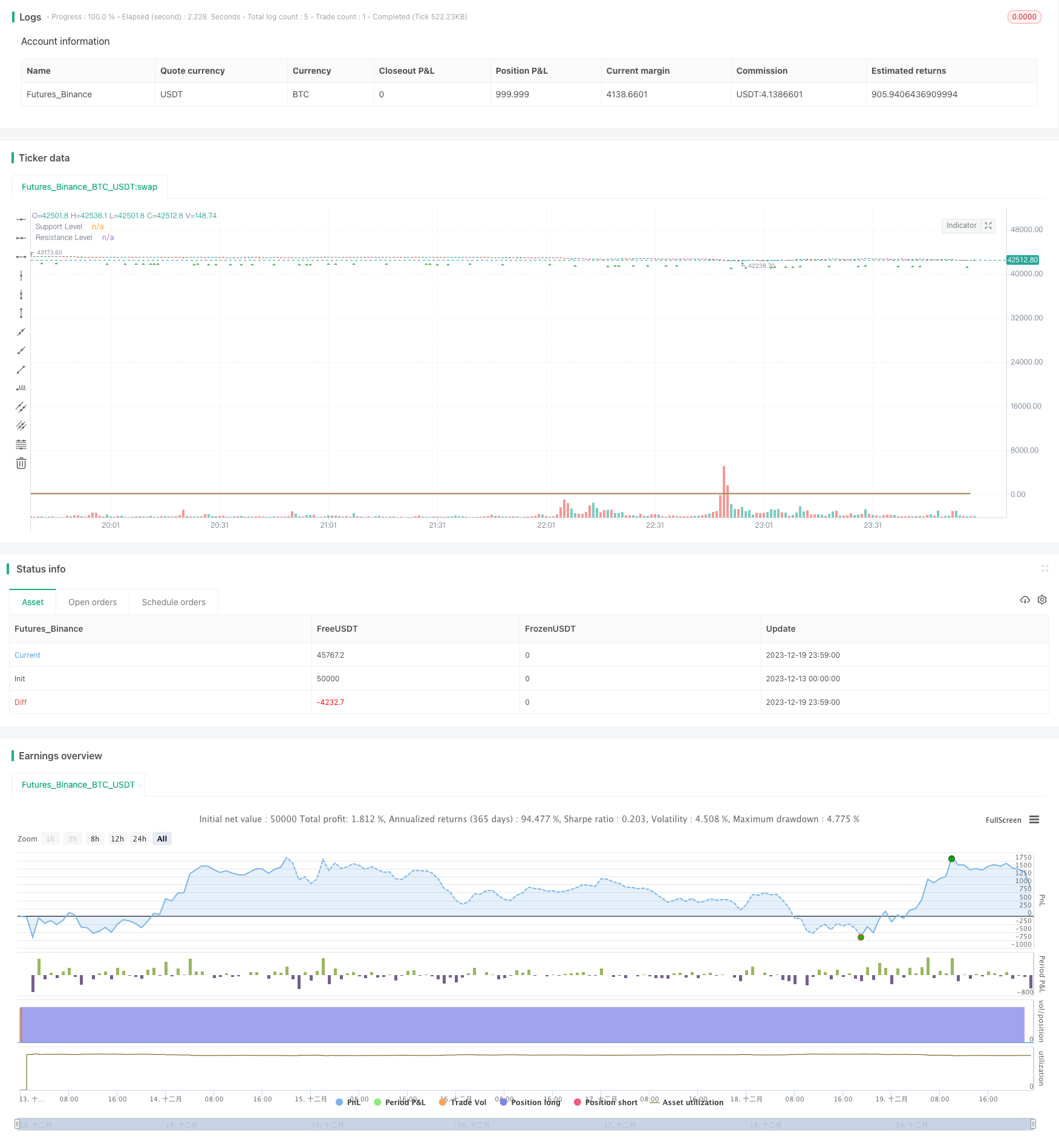

/*backtest

start: 2023-12-13 00:00:00

end: 2023-12-20 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Candlestick Pattern Strategy", overlay=true)

// Input for support and resistance levels

supportLevel = input(100, title="Support Level")

resistanceLevel = input(200, title="Resistance Level")

// Detecting Candlestick Patterns

isDoji = close == open

isPressure = close < open and open - close > close - open

isInvertedHammer = close > open and low == (close < open ? close : open) and close - open < 0.1 * (high - low)

isHammer = close > open and close - open > 0.6 * (high - low)

// Buy and Sell Conditions

buyCondition = isHammer and close > resistanceLevel

sellCondition = isInvertedHammer and close < supportLevel

// Strategy Logic

strategy.entry("Buy", strategy.long, when = buyCondition)

strategy.close("Buy", when = sellCondition)

// Plot Buy and Sell signals on the chart

plotshape(series=buyCondition, title="Buy Signal", color=color.green, style=shape.triangleup, location=location.belowbar)

plotshape(series=sellCondition, title="Sell Signal", color=color.red, style=shape.triangledown, location=location.abovebar)

// Plot Support and Resistance levels

plot(supportLevel, color=color.green, title="Support Level")

plot(resistanceLevel, color=color.red, title="Resistance Level")