概述

该策略是一个双轨道反向MACD量化交易策略。它借鉴了William Blau在他的著作《Momentum, Direction and Divergence》中描述的技术指标,并在此基础上进行了扩展。该策略同时具有回测功能,可以加上警报、过滤器、跟踪止损等附加功能。

策略原理

该策略的核心指标是MACD。它计算快速移动平均线EMA®和慢速移动平均线EMA(slowMALen),然后计算它们的差值xmacd。另外计算xmacd的EMA(signalLength)得到xMA_MACD。当xmacd上穿xMA_MACD时做多,下穿时做空。该策略的关键在于反向交易信号,即xmacd和xMA_MACD的关系与常规MACD指标相反,这也是“反向MACD”这个名称的由来。

此外,该策略还引入了趋势过滤器。在做多信号发出时,如果配置了看涨趋势过滤器,会检测价格是否在上涨;类似的,做空信号会检测价格下跌趋势。RSI指标和MFI指标也可用来过滤信号。配置止损机制,可以防止超过阈值的损失。

优势分析

该策略最大的优势在于回测功能强大。可以选择不同的交易品种,设置回测的时间范围,针对具体品种数据进行策略优化。相比简单的MACD策略,它增加了趋势、超买超卖的判断,可以过滤掉一些雷同信号。双轨道反向MACD与传统MACD不同,可以把握一些传统MACD可能遗漏的机会。

风险分析

该策略的风险主要源于反向交易的思路。反向信号虽然可以获取一些机会,但也意味着放弃了一些传统MACD买卖点,这需要谨慎评估。此外,MACD本身就容易产生多头虚假信号的问题。如果遇到震荡行情,该策略可能会产生过多交易,增加交易成本和滑点损失。

为降低风险,可以适当调整参数,优化移动平均线的长度;结合趋势和指标过滤器,避免在震荡市产生信号;适当调高止损距离,保证个别交易亏损控制。

优化方向

该策略可以从以下几个方面进行优化: 1. 调整快慢轨参数,优化移动平均线长度,对具体品种数据进行测试,找到最佳参数组合 2. 增加或调整趋势过滤器,根据回测结果判断是否有提高策略收益率 3. 测试不同的止损机制,是固定止损好还是跟踪止损好 4. 尝试结合其他指标,如KD、布林带等,设定更多过滤条件,确保信号质量

总结

双轨道反向MACD量化策略借鉴了经典MACD指标的思想,在此基础上进行了扩展与改进。该策略同时具备灵活的参数配置、丰富的过滤机制选择,以及强大的回测功能等优点。这使其能够针对不同交易品种进行个性化优化,是一种值得探索的有潜力的量化交易策略。

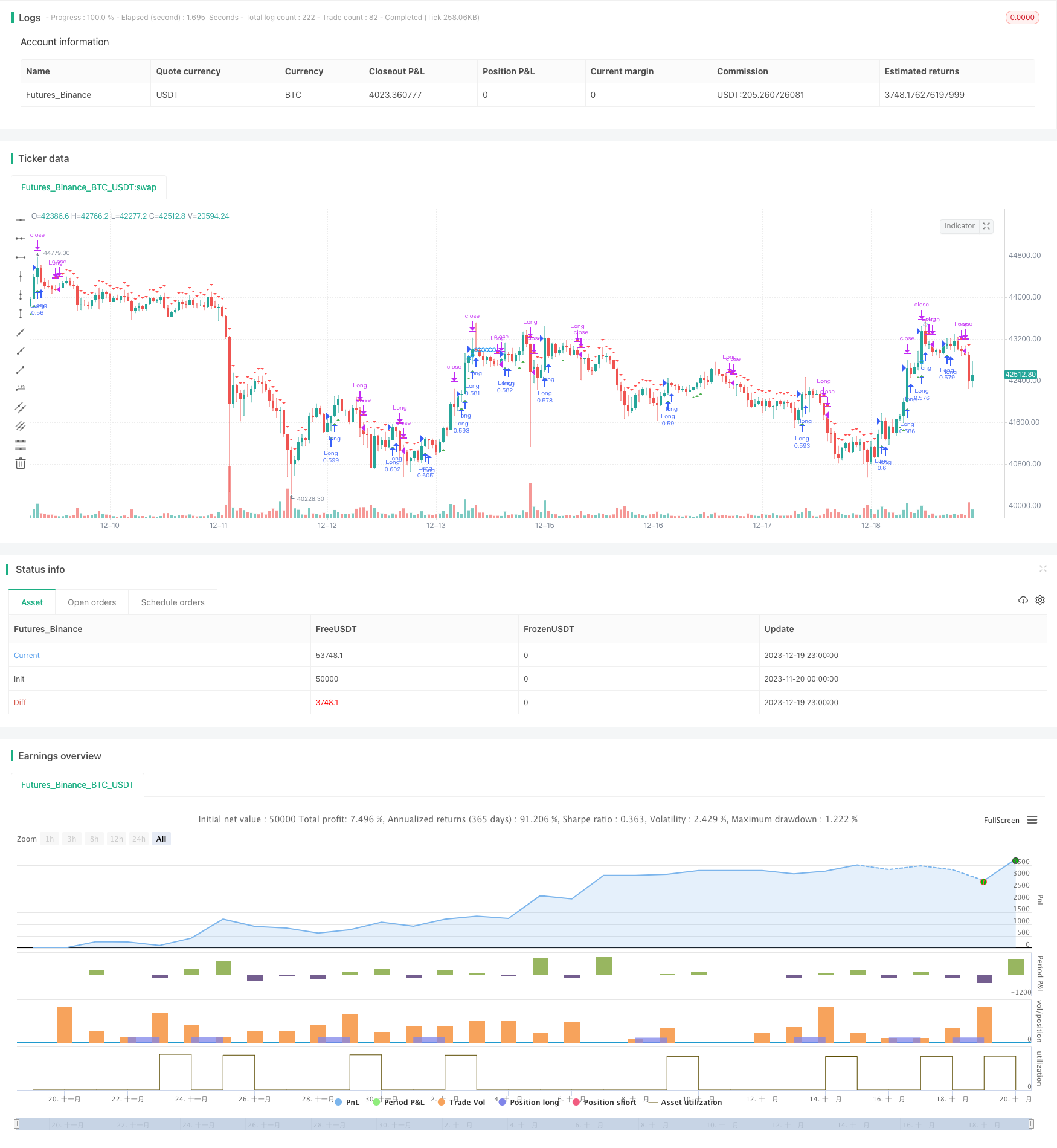

/*backtest

start: 2023-11-20 00:00:00

end: 2023-12-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version = 3

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 09/12/2016

// This is one of the techniques described by William Blau in his book

// "Momentum, Direction and Divergence" (1995). If you like to learn more,

// we advise you to read this book. His book focuses on three key aspects

// of trading: momentum, direction and divergence. Blau, who was an electrical

// engineer before becoming a trader, thoroughly examines the relationship

// between price and momentum in step-by-step examples. From this grounding,

// he then looks at the deficiencies in other oscillators and introduces some

// innovative techniques, including a fresh twist on Stochastics. On directional

// issues, he analyzes the intricacies of ADX and offers a unique approach to help

// define trending and non-trending periods.

// Blau`s indicator is like usual MACD, but it plots opposite of meaningof

// stndard MACD indicator.

//

// You can change long to short in the Input Settings

// Please, use it only for learning or paper trading. Do not for real trading.

//

//

// 2018-09 forked by Khalid Salomão

// - Backtesting

// - Added filters: RSI, MFI, Price trend

// - Trailing Stop Loss

// - Other minor adjustments

//

////////////////////////////////////////////////////////////

strategy(title="Ergotic MACD Backtester [forked from HPotter]", shorttitle="Ergotic MACD Backtester", overlay=true, pyramiding=0, default_qty_type=strategy.cash, default_qty_value=25000, initial_capital=50000, commission_type=strategy.commission.percent, commission_value=0.15, slippage=3)

// === BACKTESTING: INPUT BACKTEST RANGE ===

source = input(close)

strategyType = input(defval="Long Only", options=["Long & Short", "Long Only", "Short Only"])

FromMonth = input(defval = 7, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2018, title = "From Year", minval = 2017)

ToMonth = input(defval = 12, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 2030, title = "To Year", minval = 2017)

start = timestamp(FromYear, FromMonth, FromDay, 00, 00)

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59)

window() => true // window of time verification

// === STRATEGY ===

r = input(144, minval=1, title="R (32,55,89,100,144,200)") // default 32

slowMALen = input(6, minval=1) // default 32

signalLength = input(6, minval=1)

reverse = input(false, title="Trade reverse (long/short switch)")

//hline(0, color=blue, linestyle=line)

fastMA = ema(source, r)

slowMA = ema(source, slowMALen)

xmacd = fastMA - slowMA

xMA_MACD = ema(xmacd, signalLength)

pos = 0

pos := iff(xmacd < xMA_MACD, 1,

iff(xmacd > xMA_MACD, -1, nz(pos[1], 0)))

possig = 0

possig := iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

// === FILTER: price trend ====

trending_price_long = input(true, title="Long only if price has increased" )

trending_price_short = input(false, title="Short only if price has decreased" )

trending_price_length = input( 2, minval=1 )

trending_price_with_ema = input( false )

trending_price_ema = input( 3, minval=1 )

price_trend = trending_price_with_ema ? ema(source, trending_price_ema) : source

priceLongTrend() => (trending_price_long ? rising(price_trend, trending_price_length) : true)

priceShortTrend() => (trending_price_short ? falling(price_trend, trending_price_length) : true)

// === FILTER: RSI ===

rsi_length = input( 14, minval=1 )

rsi_overSold = input( 14, minval=0, title="RSI Sell Cutoff (Sell only if >= #)" )

rsi_overBought = input( 82, minval=0, title="RSI Buy Cutoff (Buy only if <= #)" )

vrsi = rsi(source, rsi_length)

rsiOverbought() => vrsi > rsi_overBought

rsiOversold() => vrsi < rsi_overSold

trending_rsi_long = input(false, title="Long only if RSI has increased" )

trending_rsi_length = input( 2 )

rsiLongTrend() => trending_rsi_long ? rising(vrsi, trending_rsi_length) : true

// === FILTER: MFI ===

mfi_length = input(14, minval=1)

mfi_lower = input(14, minval=0, maxval=50)

mfi_upper = input(82, minval=50, maxval=100)

upper_s = sum(volume * (change(source) <= 0 ? 0 : source), mfi_length)

lower_s = sum(volume * (change(source) >= 0 ? 0 : source), mfi_length)

mf = rsi(upper_s, lower_s)

mfiOverbought() => (mf > mfi_upper)

mfiOversold() => (mf < mfi_lower)

trending_mfi_long = input(false, title="Long only if MFI has increased" )

trending_mfi_length = input( 2 )

mfiLongTrend() => trending_mfi_long ? rising(mf, trending_mfi_length) : true

// === SIGNAL CALCULATION ===

long = window() and possig == 1 and rsiLongTrend() and mfiLongTrend() and not rsiOverbought() and not mfiOverbought() and priceLongTrend()

short = window() and possig == -1 and not rsiOversold() and not mfiOversold() and priceShortTrend()

// === trailing stop

tslSource=input(hlc3,title="TSL source")

//suseCurrentRes = input(true, title="Use current chart resolution for stop trigger?")

tslResolution = input(title="Use different timeframe for stop trigger? Uncheck box above.", defval="5")

tslTrigger = input(3.0) / 100

tslStop = input(0.6) / 100

currentPrice = request.security(syminfo.tickerid, tslResolution, tslSource, barmerge.gaps_off, barmerge.lookahead_off)

isLongOpen = false

isLongOpen := nz(isLongOpen[1], false)

entryPrice=0.0

entryPrice:= nz(entryPrice[1], 0.0)

trailPrice=0.0

trailPrice:=nz(trailPrice[1], 0.0)

// update TSL high mark

if (isLongOpen )

if (not trailPrice and currentPrice >= entryPrice * (1 + tslTrigger))

trailPrice := currentPrice

else

if (trailPrice and currentPrice > trailPrice)

trailPrice := currentPrice

if (trailPrice and currentPrice <= trailPrice * (1 - tslStop))

// FIRE TSL SIGNAL

short:=true // <===

long := false

// if short clean up

if (short)

isLongOpen := false

entryPrice := 0.0

trailPrice := 0.0

if (long)

isLongOpen := true

if (not entryPrice)

entryPrice := currentPrice

// === BACKTESTING: ENTRIES ===

if long

if (strategyType == "Short Only")

strategy.close("Short")

else

strategy.entry("Long", strategy.long, comment="Long")

if short

if (strategyType == "Long Only")

strategy.close("Long")

else

strategy.entry("Short", strategy.short, comment="Short")

//barcolor(possig == -1 ? red: possig == 1 ? green : blue )

//plot(xmacd, color=green, title="Ergotic MACD")

//plot(xMA_MACD, color=red, title="SigLin")

plotshape(trailPrice ? trailPrice : na, style=shape.circle, location=location.absolute, color=blue, size=size.tiny)

plotshape(long, style=shape.triangleup, location=location.belowbar, color=green, size=size.tiny)

plotshape(short, style=shape.triangledown, location=location.abovebar, color=red, size=size.tiny)

// === Strategy Alert ===

alertcondition(long, title='BUY - Ergotic MACD Long Entry', message='Go Long!')

alertcondition(short, title='SELL - Ergotic MACD Long Entry', message='Go Short!')

// === BACKTESTING: EXIT strategy ===

sl_inp = input(7, title='Stop Loss %', type=float)/100

tp_inp = input(1.8, title='Take Profit %', type=float)/100

stop_level = strategy.position_avg_price * (1 - sl_inp)

take_level = strategy.position_avg_price * (1 + tp_inp)

strategy.exit("Stop Loss/Profit", "Long", stop=stop_level, limit=take_level)