概述

本策略基于日线确定趋势方向,再利用15分钟K线形成的新的高点或低点作为止损位或追踪止损位,实现动态调整止损来锁定更多利润的策略。

策略原理

利用日K线收盘价和前一日的最高价最低价比较,判断趋势方向。如果收盘价高于前一日的最高价,定义为上涨趋势;如果收盘价低于前一日的最低价,定义为下跌趋势。

在上涨趋势中,当15分钟K线收盘价高于前一个15分钟K线的最高价时,做多;在下跌趋势中,当15分钟K线收盘价低于前一个15分钟K线的最低价时,做空。

做多后,以前一个15分钟K线的最低价作为止损位。做空后,以前一个15分钟K线的最高价作为止损位。

当15分钟K线再次创出新的高点或低点时,调整止损位。做多时调整为新的低点,做空时调整为新的高点,实现动态追踪止损。

优势分析

本策略最大的优势在于可以动态调整止损位,在保证了风险控制的同时,最大程度地锁定利润,降低止损被冲击的概率。

具体优势如下:

基于趋势运算,能够及时判断市场走势并选择正确的交易方向。

15分钟级别的交易,可以频繁进出场,捕捉较多机会。

动态调整止损策略,可以根据新高或新低来降低止损被冲击的风险。

止损位置设置合理,最大程度避免无谓损失。

风险分析

本策略的主要风险来自于趋势判断上的错误。具体风险点如下:

日线趋势判断发生错误,可能导致交易方向错误。

行情短期内发生剧烈波动,15分钟止损位被突破的概率较大。

趋势转折点识别不当,可能导致亏损。

对应解决方法如下:

增加其他时间周期指标进行综合判断,避免仅凭单一周期产生错误。

评估市场波动性,在波动较大时适当放宽止损范围。

增加趋势转折点判断机制,在转折前及时平仓。

优化方向

本策略仍有进一步优化的空间:

增加其他周期指标判断,优化趋势掌握。

测试不同止损比例设置,选取最优参数。

增加量能指标,避免量能背离产生错误交易。

增设趋势转折机制,优化 Exit 点。

评估增加 Trailing Stop 区间值,进一步减少止损被冲击概率。

总结

本策略总体运行效果良好,思路清晰易于理解,具有止损动态调整、频繁交易、顺势而为等优点,能够有效控制风险并锁定利润,值得进一步测试与优化应用。但也存在一定改进空间,建议从多角度综合判断、优化参数设置、增加趋势转折判别等方面入手,以进一步增强策略的稳定性与收益率。

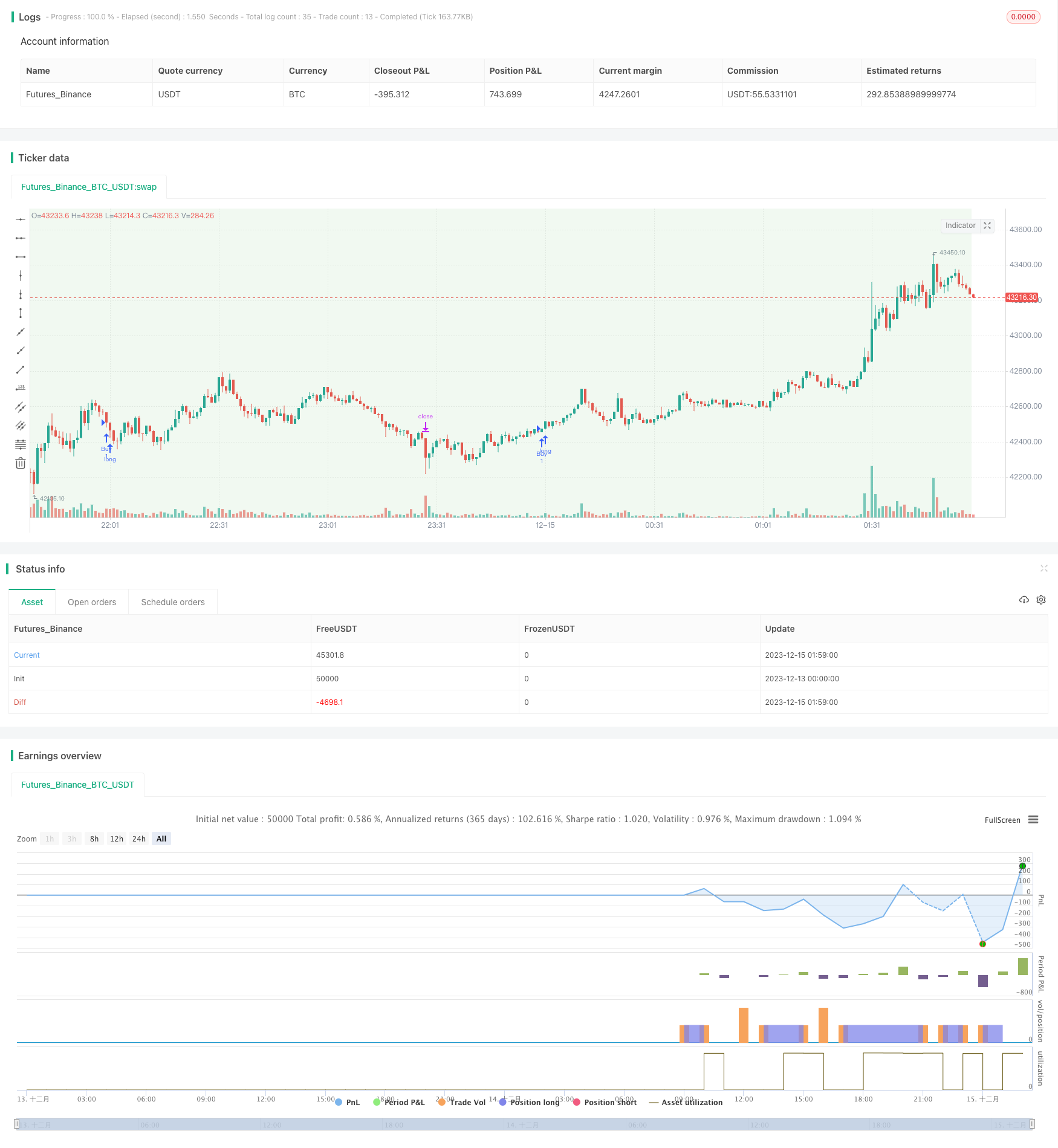

/*backtest

start: 2023-12-13 00:00:00

end: 2023-12-15 02:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Anand's Strategy", overlay=true)

// Get the high and low of the previous day's candle

prev_high = request.security(syminfo.tickerid, "D", high[2])

prev_low = request.security(syminfo.tickerid, "D", low[2])

// var float prev_high = na

// var float prev_low = na

prev_close = request.security(syminfo.tickerid, "D", close[1])

getDayIndexedHighLow(_bar) =>

_indexed_high = request.security(syminfo.tickerid, "D", high[_bar])

_indexed_low = request.security(syminfo.tickerid, "D", low[_bar])

[_indexed_high, _indexed_low]

var index = 2

while index >= 0

[indexed_high_D, indexed_low_D] = getDayIndexedHighLow(index)

if prev_close > indexed_high_D or prev_close < indexed_low_D

prev_high := indexed_high_D

prev_low := indexed_low_D

break

// Decrease the index to move to the previous 15-minute candle

index := index - 1

// Determine the trade direction based on the candle criterion

trade_direction = prev_close > prev_high ? 1 : (prev_close < prev_low ? -1 : 0)

// Get the current close from 15-minute timeframe

current_close = request.security(syminfo.tickerid, "15", close[1])

prev_high_15m = request.security(syminfo.tickerid, "15", high[2])

prev_low_15m = request.security(syminfo.tickerid, "15", low[2])

// var float prev_high_15m = na

// var float prev_low_15m = na

getIndexedHighLow(_bar) =>

_indexed_high = request.security(syminfo.tickerid, "15", high[_bar])

_indexed_low = request.security(syminfo.tickerid, "15", low[_bar])

[_indexed_high, _indexed_low]

// Loop through previous 15-minute candles until the condition is met

var i = 2

while i >= 2

[indexed_high_15m, indexed_low_15m] = getIndexedHighLow(i)

if current_close > indexed_high_15m or current_close < indexed_low_15m

prev_high_15m := indexed_high_15m

prev_low_15m := indexed_low_15m

break

// Decrease the index to move to the previous 15-minute candle

i := i - 1

buy_condition = trade_direction == 1 and current_close > prev_high_15m

stop_loss_buy = prev_low_15m

// Sell Trade Criteria in Negative Trend

sell_condition = trade_direction == -1 and current_close < prev_low_15m

stop_loss_sell = prev_high_15m

// Trailing Stop Loss for Buy Trade

// Custom Trailing Stop Function for Buy Trade

var float trail_stop_buy = na

trailing_buy_condition = buy_condition and current_close > trail_stop_buy

if trailing_buy_condition

trail_stop_buy := current_close

// Custom Trailing Stop Function for Sell Trade

var float trail_stop_sell = na

trailing_sell_condition = sell_condition and current_close < trail_stop_sell

if trailing_sell_condition

trail_stop_sell := current_close

// Take Buy Trade with Stop Loss

if (buy_condition)

strategy.entry("Buy", strategy.long)

strategy.exit("Buy Stop Loss", "Buy", stop=stop_loss_buy)

// Take Sell Trade with Stop Loss

if (sell_condition)

strategy.entry("Sell", strategy.short)

strategy.exit("Sell Stop Loss", "Sell", stop=stop_loss_sell)

// Set the background color based on the trade direction

bgcolor(trade_direction == 1 ? color.new(color.green, 90) : trade_direction == -1 ? color.new(color.red, 90) : na)