概述

该策略通过MACD指标的金叉死叉来判断趋势方向,配合ATR指标进行止损止盈,实现趋势跟踪交易。策略名称中的“金叉死叉”二字突出使用MACD指标的金叉死叉信号。

策略原理

当MACD线从下向上穿过Signal线而变为正值时产生买入信号,这就是金叉信号,表示股价上涨趋势形成。当MACD线从上向下穿过Signal线而变为负值时产生卖出信号,这就是死叉信号,表示股价下跌趋势形成。

该策略就是利用这一原理,在金叉时做多,在死叉时做空,实现趋势跟踪。同时,策略还引入ATR指标计算止损止盈位,完成交易系统的构建。

具体来说,策略首先计算快速移动平均线、慢速移动平均线、MACD差值、Signal线等标准MACD指标。然后根据选择的五种信号(延续信号、反转信号、柱状图信号、MACD零轴交叉、Signal零轴交叉)判断金叉死叉。最后结合ATR指标设置止损止盈,完成入场和出场逻辑。

优势分析

该策略具有以下优势:

使用MACD指标判断趋势方向准确可靠,多年来MACD指标在判断趋势中表现突出。

结合ATR指标的止损止盈设置可以有效控制单笔交易的风险回报比,降低亏损的概率。

提供五种可选信号,可以针对不同市场采用更为合适的信号,提高策略的适应性。

可输入参数较多,可以通过参数优化获得更好的交易结果。

风险及解决方法

该策略也存在一些风险:

MACD指标容易产生误信号,可能造成不必要的亏损。可以结合其他指标过滤信号。

ATR指标仅对最近一段时间的波动进行建模,无法对极端行情做出准确止损。可以引入动态止损来解决。

选定信号的效果可能不稳定,需要进行大量回测确定最佳参数。

信号参数和风险管理参数需要同时优化,否则难以取得最优结果。建议采用步进优化的方法。

优化建议

该策略还可以从以下方面进行优化:

尝试其他移动平均线,如TMA、hullMA等,过滤MACD信号。

尝试动态止损机制,能更好地处理极端行情的波动。

对MACD指标传统参数组合进行穷举优化,找到更佳参数。

利用机器学习方法寻找最优的ATR乘数,实现更优的风险管理。

对五种信号类型分别进行回测,确定最优信号。

训练神经网络判断信号类型的效果,寻找新的基于MACD的信号。

总结

该MACD金叉死叉趋势跟踪策略,利用MACD指标判断趋势方向,配合ATR指标进行止损止盈,能够有效获取趋势交易机会。策略具有指标参数可优化、止损机制完备、信号类型可选等多项优势。下一步工作将在提高信号质量、完善止损机制以及参数选择优化等方面入手,以获得更优异的回测和实盘结果。

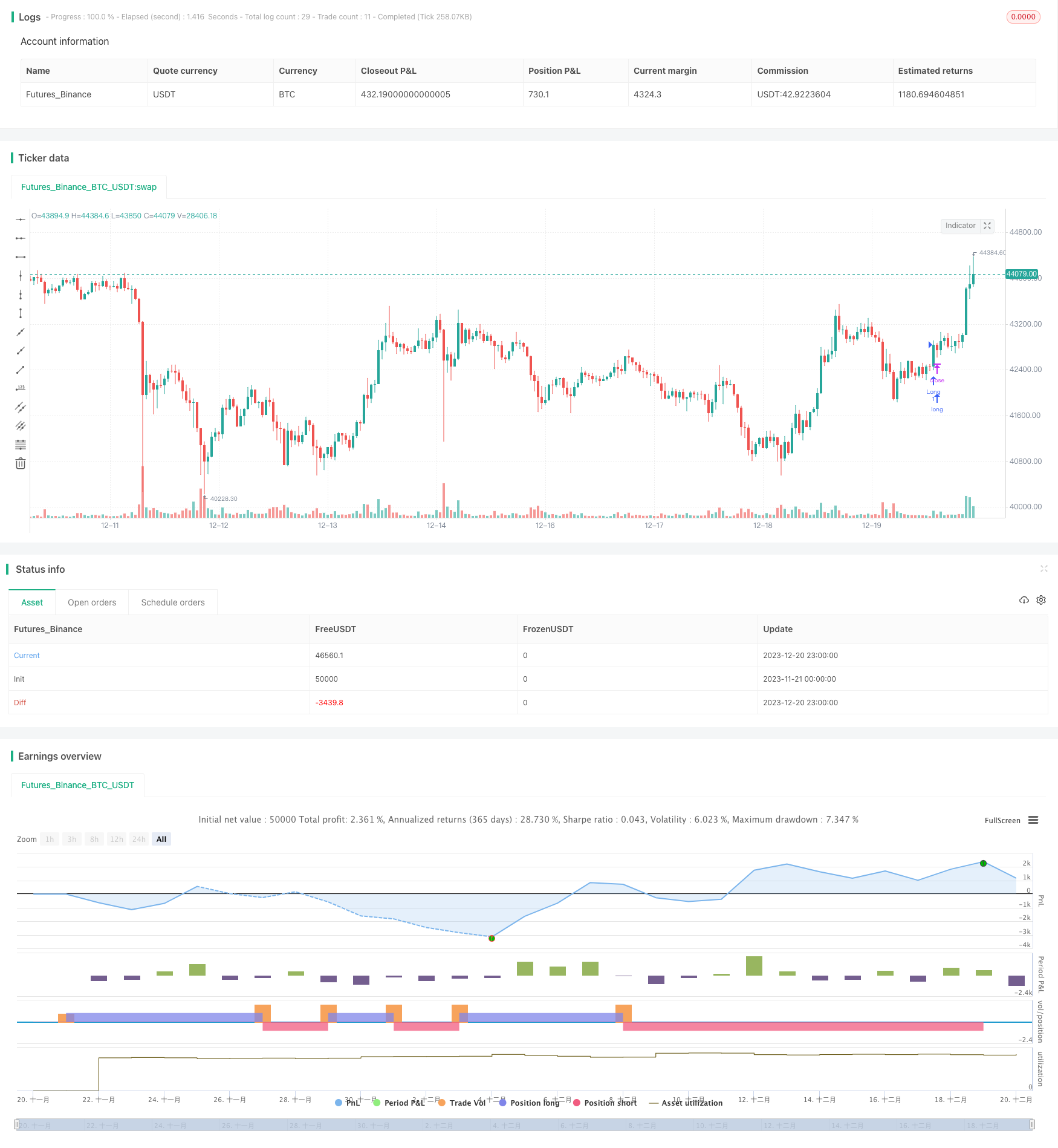

/*backtest

start: 2023-11-21 00:00:00

end: 2023-12-21 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © vuagnouxb

//@version=4

strategy("BV's MACD SIGNAL TESTER", overlay=true)

//------------------------------------------------------------------------

//---------- Confirmation Calculation ------------ INPUT

//------------------------------------------------------------------------

// Getting inputs

fast_length = input(title="Fast Length", type=input.integer, defval=12)

slow_length = input(title="Slow Length", type=input.integer, defval=26)

src = input(title="Source", type=input.source, defval=close)

signal_length = input(title="Signal Smoothing", type=input.integer, minval = 1, maxval = 50, defval = 9)

sma_source = input(title="Simple MA(Oscillator)", type=input.bool, defval=false)

sma_signal = input(title="Simple MA(Signal Line)", type=input.bool, defval=false)

// Plot colors

col_grow_above = #26A69A

col_grow_below = #FFCDD2

col_fall_above = #B2DFDB

col_fall_below = #EF5350

col_macd = #0094ff

col_signal = #ff6a00

// Calculating

fast_ma = sma_source ? sma(src, fast_length) : ema(src, fast_length)

slow_ma = sma_source ? sma(src, slow_length) : ema(src, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal ? sma(macd, signal_length) : ema(macd, signal_length)

hist = macd - signal

// plot(hist, title="Histogram", style=plot.style_columns, color=(hist>=0 ? (hist[1] < hist ? col_grow_above : col_fall_above) : (hist[1] < hist ? col_grow_below : col_fall_below) ), transp=0 )

// plot(macd, title="MACD", color=col_macd, transp=0)

// plot(signal, title="Signal", color=col_signal, transp=0)

// -- Trade entry signals

signalChoice = input(title = "Choose your signal", defval = "Continuation", options = ["Continuation", "Reversal", "Histogram", "MACD Line ZC", "Signal Line ZC"])

continuationSignalLong = signalChoice == "Continuation" ? crossover(macd, signal) and macd > 0 :

signalChoice == "Reversal" ? crossover(macd, signal) and macd < 0 :

signalChoice == "Histogram" ? crossover(hist, 0) :

signalChoice == "MACD Line ZC" ? crossover(macd, 0) :

signalChoice == "Signal Line ZC" ? crossover(signal, 0) :

false

continuationSignalShort = signalChoice == "Continuation" ? crossunder(macd, signal) and macd < 0 :

signalChoice == "Reversal" ? crossover(signal, macd) and macd > 0 :

signalChoice == "Histogram" ? crossunder(hist, 0) :

signalChoice == "MACD Line ZC" ? crossunder(macd, 0) :

signalChoice == "Signal Line ZC" ? crossunder(signal, 0) :

false

longCondition = continuationSignalLong

shortCondition = continuationSignalShort

//------------------------------------------------------------------------

//---------- ATR MONEY MANAGEMENT ------------

//------------------------------------------------------------------------

SLmultiplier = 1.5

TPmultiplier = 1

JPYPair = input(type = input.bool, title = "JPY Pair ?", defval = false)

pipAdjuster = JPYPair ? 1000 : 100000

ATR = atr(14) * pipAdjuster // 1000 for jpy pairs : 100000

SL = ATR * SLmultiplier

TP = ATR * TPmultiplier

//------------------------------------------------------------------------

//---------- TIME FILTER ------------

//------------------------------------------------------------------------

YearOfTesting = input(title = "How many years of testing ?" , type = input.integer, defval = 3)

_time = 2020 - YearOfTesting

timeFilter = (year > _time)

//------------------------------------------------------------------------

//--------- ENTRY FUNCTIONS ----------- INPUT

//------------------------------------------------------------------------

if (longCondition and timeFilter)

strategy.entry("Long", strategy.long)

if (shortCondition and timeFilter)

strategy.entry("Short", strategy.short)

//------------------------------------------------------------------------

//--------- EXIT FUNCTIONS -----------

//------------------------------------------------------------------------

strategy.exit("ATR", from_entry = "Long", profit = TP, loss = SL)

strategy.exit("ATR", from_entry = "Short", profit = TP, loss = SL)