概述

该策略主要通过计算价格的双重EMA动量和DEMA动量的交叉以识别趋势,并结合ATR波动率指标来过滤假突破,实现了一个双动量指标与波动率过滤的量化交易策略。

策略原理

该策略主要包含以下几个部分:

计算价格的EMA和DEMA作为双重动量指标。其中较长周期的EMA反映长期趋势,DEMA作为更敏感的短期动量指标。当DEMA上穿EMA时生成买入信号。

计算ATR波动率指标。通过ATR的大小判断市场的波动率和流动性情况。波动率过大时过滤掉动量指标的信号,避免假突破。

ATR波动率通过参数化移动平均线来判断高低。当ATR波动率低于移动平均线时,允许动量指标信号的触发。

通过参数控制ATR时间周期、ATR长度、ATR移动平均线类型和长度等。

建立多头仓位的止损、止盈和追踪止损规则。

优势分析

这种双EMA过滤的策略,可以明显减少普通EMA金叉死叉策略中的假信号和频繁交易。加入ATR波动率指标后,可以有效过滤细微波动带来的误导信号,避免被套。

相比单一动量指标,该策略采用双指标设计,可以提高判断效果。DEMA作为更加灵敏的短期动量指标,配合稳定的长线EMA,形成比较可靠的组合信号。

通过调节ATR参数,可以针对不同标的物设定合适的波动率条件,提高策略的适用性。

风险分析

该策略最大的风险在于参数设置不当可能导致交易信号过于稀少。DEMA和EMA长度设置过长,或者ATR波动率界限设置过高,都可能减弱策略的实际运作效果。这需要通过反复测试来调整至最佳参数组合。

另一个潜在风险是,在极端行情中,价格波动可能突破ATR参数的约束,从而带来亏损。这需要人为监控市场异常情况,暂停策略运行。

优化方向

测试不同的动量指标参数组合,找到最佳参数。

尝试将动量指标由双EMA调整为MACD或其他指标。

测试不同的波动率指标设定,如整体历史ATR,市场波动率指数等。

增加对交易量的过滤,避免价格不真实突破的风险。

优化止损止盈机制,使盈亏比更优。

总结

该策略整合了动量指标与波动率分析,在扎实的理论基础上设计。通过参数调整和规则优化,可以成为一个稳定可靠的量化交易策略。其交易信号清晰,风险可控,值得实盘验证与应用。

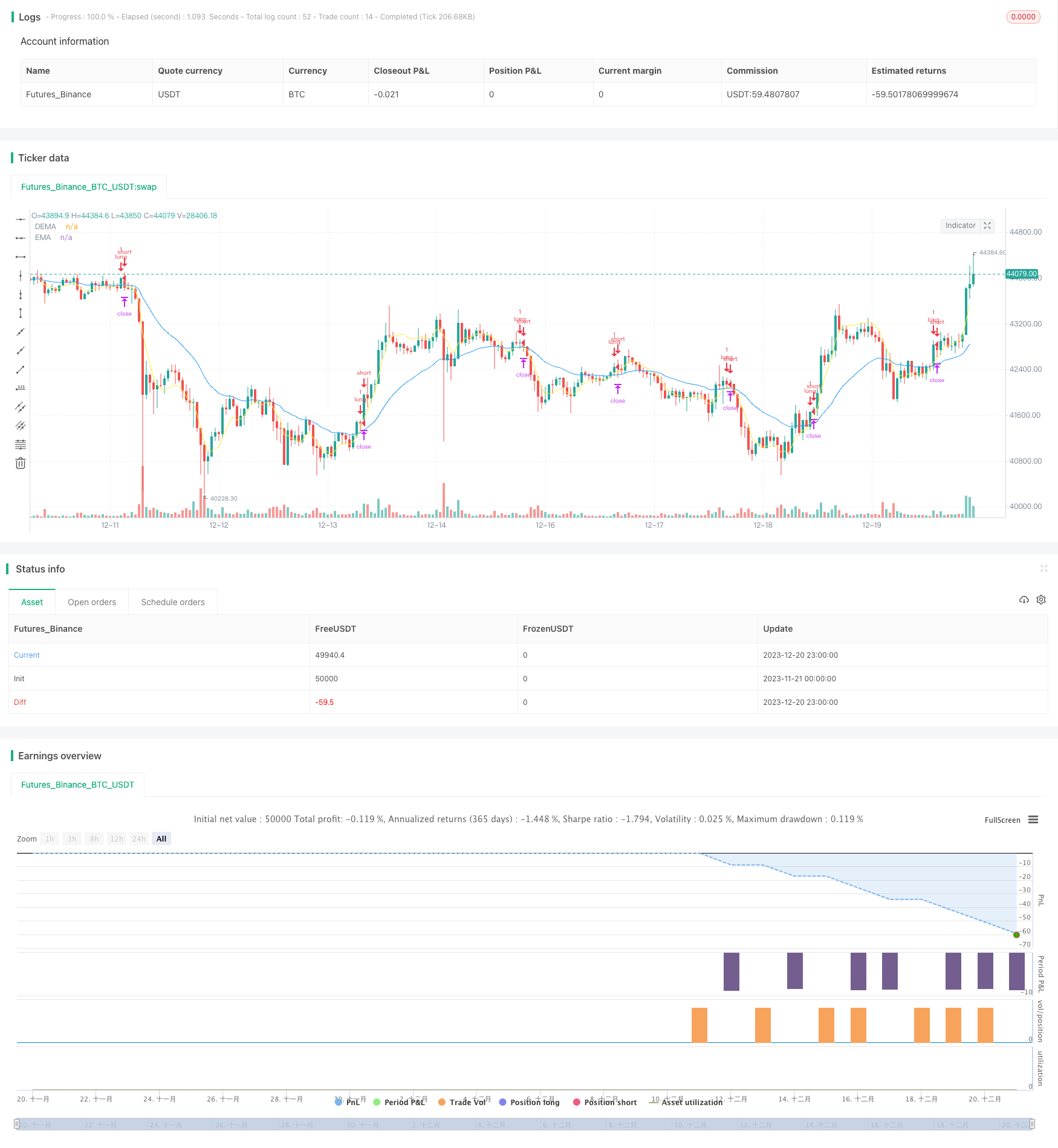

/*backtest

start: 2023-11-21 00:00:00

end: 2023-12-21 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Qorbanjf

//@version=4

strategy("ORIGIN DEMA/EMA & VOL LONG ONLY", shorttitle="ORIGIN DEMA/EMA & VOL LONG", overlay=true)

// DEMA

length = input(10, minval=1, title="DEMA LENGTH")

src = input(close, title="Source")

e1 = ema(src, length)

e2 = ema(e1, length)

dema1 = 2 * e1 - e2

plot(dema1, "DEMA", color=color.yellow)

//EMA

len = input(25, minval=1, title="EMA Length")

srb = input(close, title="Source")

offset = input(title="Offset", type=input.integer, defval=0, minval=-500, maxval=500)

ema1 = ema(srb, len)

plot(ema1, title="EMA", color=color.blue, offset=offset)

// Inputs

atrTimeFrame = input("D", title="ATR Timeframe", type=input.resolution)

atrLookback = input(defval=14,title="ATR Lookback Period",type=input.integer)

useMA = input(title = "Show Moving Average?", type = input.bool, defval = true)

maType = input(defval="EMA", options=["EMA", "SMA"], title = "Moving Average Type")

maLength = input(defval = 20, title = "Moving Average Period", minval = 1)

//longLossPerc = input(title="Long Stop Loss (%)",

// type=input.float, minval=0.0, step=0.1, defval=1) * 0.01

longTrailPerc = input(title="Trail stop loss (%)",

type=input.float, minval=0.0, step=0.1, defval=50) * 0.01

longProfitPerc = input(title="Long Take Profit (%)",

type=input.float, minval=0.0, step=0.1, defval=3000) / 100

// === INPUT BACKTEST RANGE ===

FromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2017, title = "From Year", minval = 2000)

ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 9999, title = "To Year", minval = 2017)

// ATR Logic // atrValue = atr(atrLookback) // atrp = (atrValue/close)*100 // plot(atrp, color=color.white, linewidth=2, transp = 30)

atrValue = security(syminfo.tickerid, atrTimeFrame, atr(atrLookback))

atrp = (atrValue/close)*100

// Moving Average Logic

ma(maType, src, length) =>

maType == "EMA" ? ema(src, length) : sma(src, length) //Ternary Operator (if maType equals EMA, then do ema calc, else do sma calc)

maFilter = security(syminfo.tickerid, atrTimeFrame, ma(maType, atrp, maLength))

// variables for enter position

enterLong = crossover(dema1, ema1) and atrp < maFilter

// variables for exit position

sale = crossunder(dema1, ema1)

// stop loss

//longStopPrice = strategy.position_avg_price * (1 - longLossPerc)

// trail stop

// Determine trail stop loss prices

longStopTrail = 0.0

longStopTrail := if (strategy.position_size > 0)

stopValue = close * (1 - longTrailPerc)

max(stopValue, longStopTrail[1])

else

0

//Take profit Percentage

longExitPrice = strategy.position_avg_price * (1 + longProfitPerc)

//Enter trades when conditions are met

strategy.entry(id="long",

long=strategy.long,

when=enterLong,

comment="long")

//

strategy.close("long", when = sale, comment = "Sell")

//place exit orders (only executed after trades are active)

strategy.exit(id="sell",

limit = longExitPrice,

stop = longStopTrail,

comment = "SL/TP")