概述

该策略基于单均线和布林带指标,当价格突破布林带上轨或下轨时,进行买入或卖出操作。同时结合均线的方向判断趋势,只有在均线上升时才进行买入,在均线下降时才进行卖出。

策略原理

该策略主要根据以下几个指标进行判断:

- 均线(SMA):计算CLOSE收盘价的简单移动平均线,代表价格趋势。

- 布林带上轨:代表仰角阻力线,突破该线表示强势突破。

- 布林带下轨:代表支撑线,跌破该线表示趋势反转的可能。

具体交易信号如下:

- 买入信号:当收盘价突破布林带上轨,且均线处于上升状态,进行买入。

- 卖出信号:当收盘价跌破布林带下轨,且均线处于下降状态,进行卖出。

这样,结合趋势和突破,使交易信号更加可靠,避免假突破。

策略优势

- 规则简单清晰,容易理解执行。

- 利用均线判断大趋势方向,避免做空牛市,做多熊市。

- 布林带上下轨判断局部突破点位,精确捕获突破信号。

- 回撤相对较小,符合多数人的风险偏好。

策略风险

- 单一指标容易发出错误信号,可通过优化参数降低错误率。

- 无法应对大的行情震荡,可适当调整止损点位。

- 无法在趋势巨大的情况下获利更多,可考虑加大仓位。

策略优化

- 优化均线周期参数,适应更多品种。

- 增加其它指标过滤,如MACD等,减少错误信号。

- 动态调整止损点位,限制最大回撤。

- 结合资金管理思想,使盈亏更加平稳。

总结

该策略整体来说较为简单实用,适合多数人. 通过一些优化调整,可以使策略更加鲁棒,适应更多市场情况,是一个值得推荐的策略。

策略源码

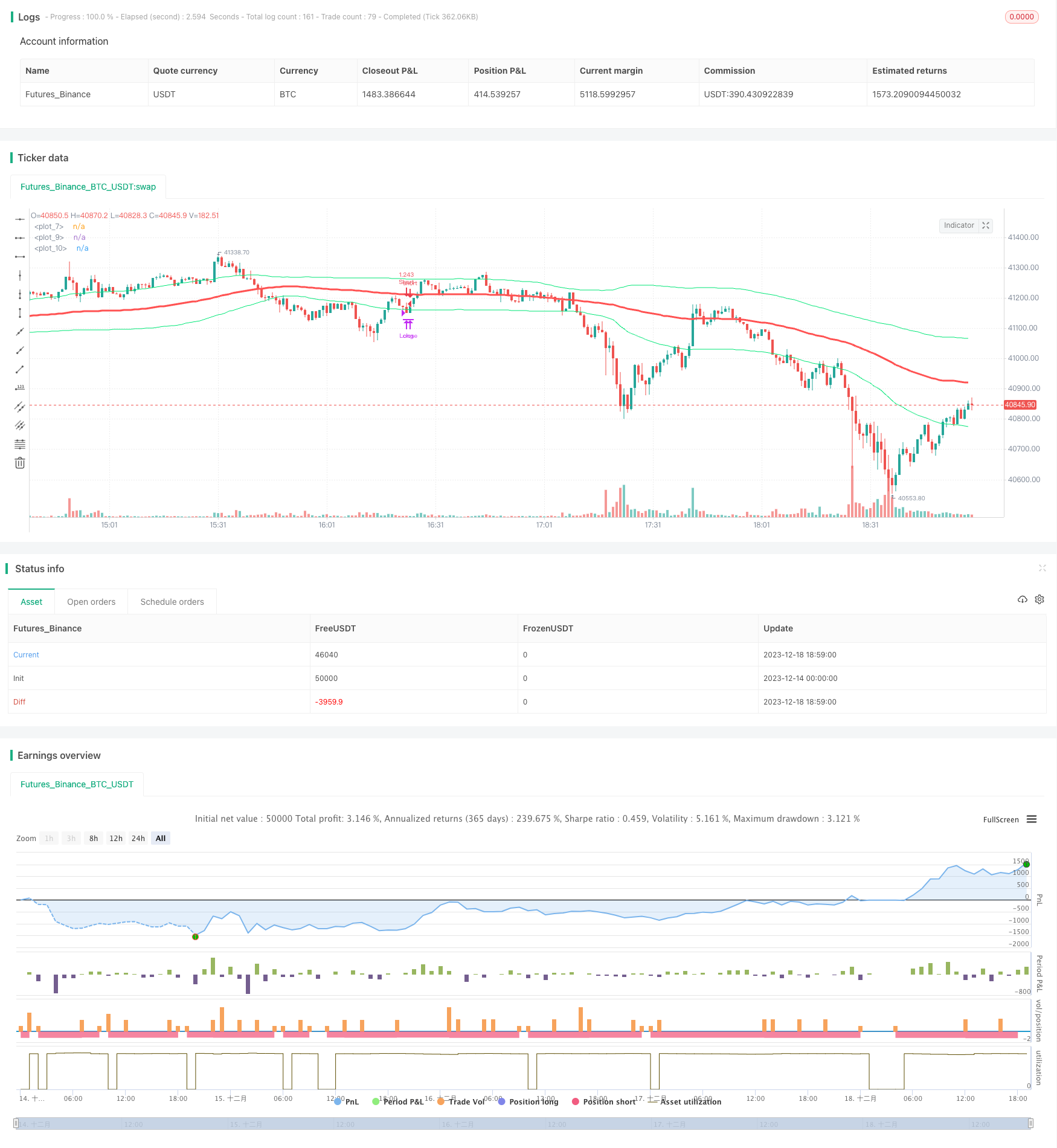

/*backtest

start: 2023-12-14 00:00:00

end: 2023-12-18 19:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy(title="single sma cross", shorttitle="single sma cross",default_qty_type = strategy.percent_of_equity, default_qty_value = 100,overlay=true,currency="USD")

s=input(title="s",defval=90)

p=input(title="p",type=float,defval=.9,step=.1)

sa=sma(close,s)

plot(sa,color=red,linewidth=3)

band=stdev(close,s)*p

plot(band+sa,color=lime,title="")

plot(-band+sa,color=lime,title="")

// ===Strategy Orders============================================= ========

inpTakeProfit = input(defval = 0, title = "Take Profit", minval = 0)

inpStopLoss = input(defval = 0, title = "Stop Loss", minval = 0)

inpTrailStop = input(defval = 0, title = "Trailing Stop Loss", minval = 0)

inpTrailOffset = input(defval = 0, title = "Trailing Stop Loss Offset", minval = 0)

useTakeProfit = inpTakeProfit >= 1 ? inpTakeProfit : na

useStopLoss = inpStopLoss >= 1 ? inpStopLoss : na

useTrailStop = inpTrailStop >= 1 ? inpTrailStop : na

useTrailOffset = inpTrailOffset >= 1 ? inpTrailOffset : na

longCondition = crossover(close,sa+band) and rising(sa,5)

shortCondition = crossunder(close,sa-band) and falling(sa,5)

crossmid = cross(close,sa)

strategy.entry(id = "Long", long=true, when = longCondition)

strategy.close(id = "Long", when = shortCondition)

strategy.entry(id = "Short", long=false, when = shortCondition)

strategy.close(id = "Short", when = longCondition)

strategy.exit("Exit Long", from_entry = "Long", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset, when=crossmid)

strategy.exit("Exit Short", from_entry = "Short", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset, when=crossmid)