概述

本策略基于简单移动平均线(SMA)的金叉死叉原理设计。策略使用两个SMA,即快速SMA和慢速SMA,当快速SMA从下方向上突破慢速SMA时,产生买入信号;当快速SMA从上方向下跌破慢速SMA时,产生卖出信号。

策略原理

该策略主要依赖两个SMA指标线。其中,快速SMA期间设置较短,能更快捕捉价格变动;慢速SMA期间设置较长,能过滤掉部分噪音。当快速SMA从下方向上交叉慢速SMA时,表示短期价格上涨速度较快,产生买入信号。当快速SMA从上方向下交叉慢速SMA时,表示短期价格下跌速度较快,产生卖出信号。

通过设置不同的SMA周期参数,可以在一定程度上调整策略的参数,适应不同的市场环境。同时,该策略还允许设置回测的时间范围,方便在历史数据上测试策略 parameter。

优势分析

- 使用广为人知的SMA指标,原理简单易懂

- 可自定义SMA周期参数,适应性强

- 可设置回测时间范围,方便参数优化

- 采用交叉方式产生信号,对突破信号有一定的过滤作用,可减少错误交易

风险分析

- SMA本身存在滞后性,可能错过短线机会

- 无法判断趋势力度,产生信号的效果可能不稳定

- SMA周期参数设置不当,会增加错误信号

针对上述风险,可以采用以下措施: - 适当缩短SMA周期,提高敏感性 - 结合其他指标判断趋势力度 - 借助参数优化工具寻找最佳参数组合

优化方向

- 增加止损策略,控制单笔损失

- 增加仓位管理机制

- 结合其他技术指标进行组合

- 增加机器学习算法,实现动态参数优化

总结

本策略属于典型的趋势跟踪策略。运用简单的双均线交叉原理,在参数设置合适的前提下,可以获取较好的跟踪效果。但SMA本身存在一定的滞后性,无法判断趋势的力度。因此,实际应用中,需要引入其他辅助工具,形成指标组合,同时辅以自动化的参数优化和风险控制手段,才能使策略稳定盈利。

策略源码

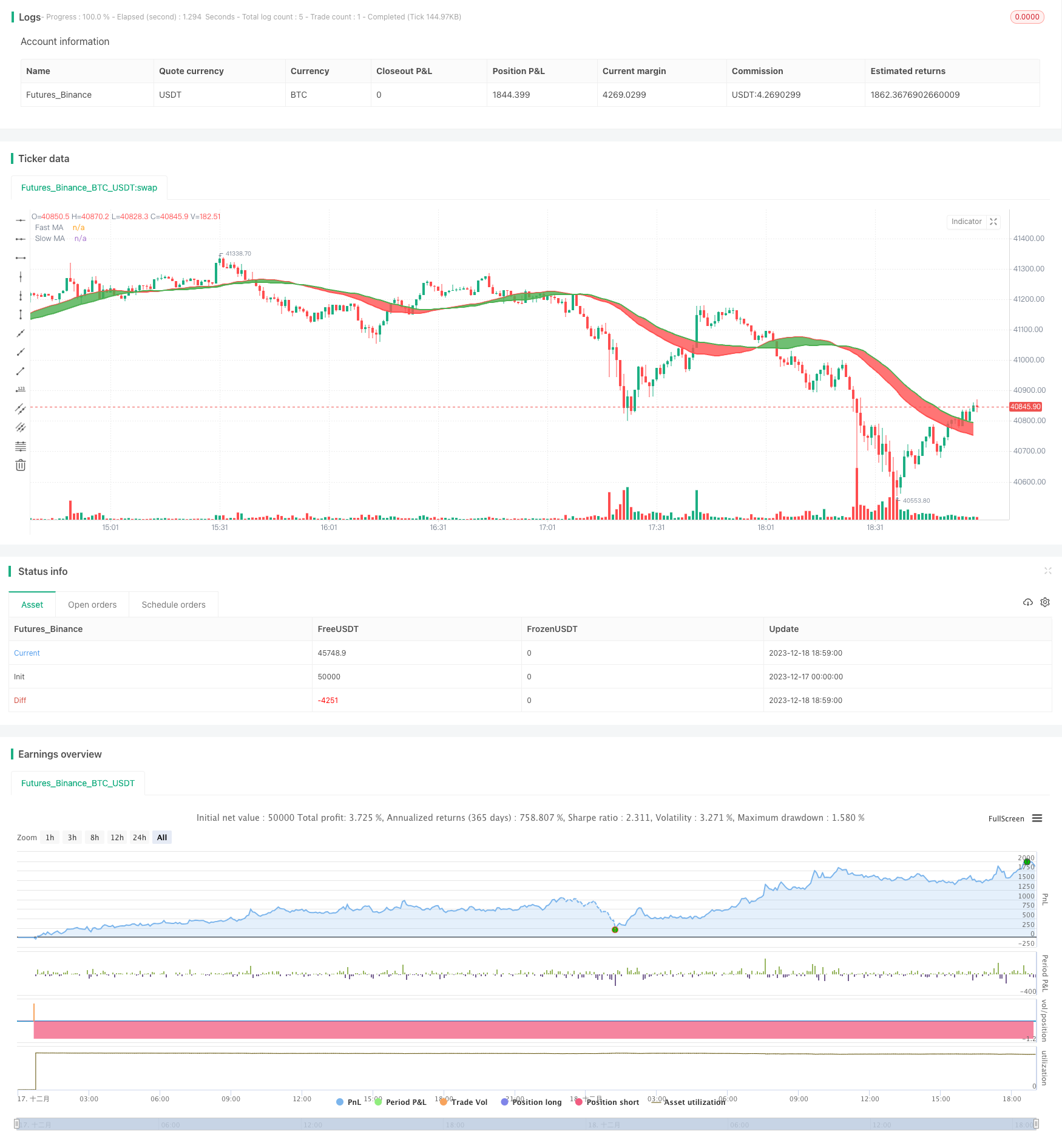

/*backtest

start: 2023-12-17 00:00:00

end: 2023-12-18 19:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//strategy(title="MA Cross Entry & Exit w/Date Range", overlay=true, initial_capital=10000, currency='USD')

strategy(title="SMA Cross Entry & Exit Strategy", overlay=true)

// Credit goes to this developer for the "Date Range Code"

// https://www.tradingview.com/script/62hUcP6O-How-To-Set-Backtest-Date-Range/

// === GENERAL INPUTS ===

// short ma

maFastSource = input(defval = open, title = "Fast MA Source")

maFastLength = input(defval = 36, title = "Fast MA Period", minval = 1)

// long ma

maSlowSource = input(defval = open , title = "Slow MA Source")

maSlowLength = input(defval = 46, title = "Slow MA Period", minval = 1)

// === SERIES SETUP ===

// a couple of ma's..

maFast = sma(maFastSource, maFastLength)

maSlow = sma(maSlowSource, maSlowLength)

// === PLOTTING ===

fast = plot(maFast, title = "Fast MA", color = red, linewidth = 2, style = line, transp = 30)

slow = plot(maSlow, title = "Slow MA", color = green, linewidth = 2, style = line, transp = 30)

// === INPUT BACKTEST RANGE ===

FromMonth = input(defval = 9, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2018, title = "From Year", minval = 2017)

ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 9999, title = "To Year", minval = 2017)

// === FUNCTION EXAMPLE ===

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => time >= start and time <= finish ? true : false // create function "within window of time"

// === LOGIC ===

//enterLong = crossover(maFast, maSlow)

//exitLong = crossover(maSlow, maFast)

enterLong = crossover(maSlow, maFast)

exitLong = crossover(maFast, maSlow)

// Entry //

strategy.entry(id="Long Entry", long=true, when=window() and enterLong)

strategy.entry(id="Short Entry", long=false, when=window() and exitLong)

// === FILL ====

fill(fast, slow, color = maFast > maSlow ? green : red)