概述

该策略利用布林带指标判断价格是否进入超买超卖区域,结合RSI指标判断是否存在回调机会,在超买区形成死叉时做空,在价格上涨超过布林带上轨时止损。

策略原理

该策略主要基于以下原理:

- 当收盘价格上穿布林带上轨时,表示资产进入超买区域,存在回调机会

- RSI指标可以有效判断超买超卖区域,RSI>70为超买区

- 当收盘价格从上轨下穿时,做空头仓

- 当RSI从超买区回落或止损点触发时,平仓止损

优势分析

该策略具有以下优势:

- 利用布林带判断超买超卖区域,提高 trades的成功率

- 结合RSI指标过滤假突破的机会,避免不必要的 loss

- 损益比高,最大程度控制风险

风险分析

该策略存在以下风险:

- 突破上轨后继续上涨导致 loss 进一步扩大

- RSI未能及时回落,loss 进一步扩大

- 单边持仓,无法交易盘整市

可以通过以下方法降低风险:

- 适当调整止损点,及时止损

- 组合其他指标判断RSI回落信号

- 结合均线指标,判断是否进入盘整

优化方向

该策略可以从以下方面进行优化:

- 优化布林带参数,适应更多交易品种

- 优化 RSI 参数,提高指标效果

- 增加其他指标组合,判断趋势反转点

- 增加多头交易逻辑

- 结合止损策略,动态调整止损点

总结

该策略整体来说是一种典型的超买区快速短线交易策略。利用布林带判断买卖点,RSI过滤信号。通过合理止损来控制风险水平。可以通过参数优化,组合指标,增加开仓逻辑等方式进行效果提升。

策略源码

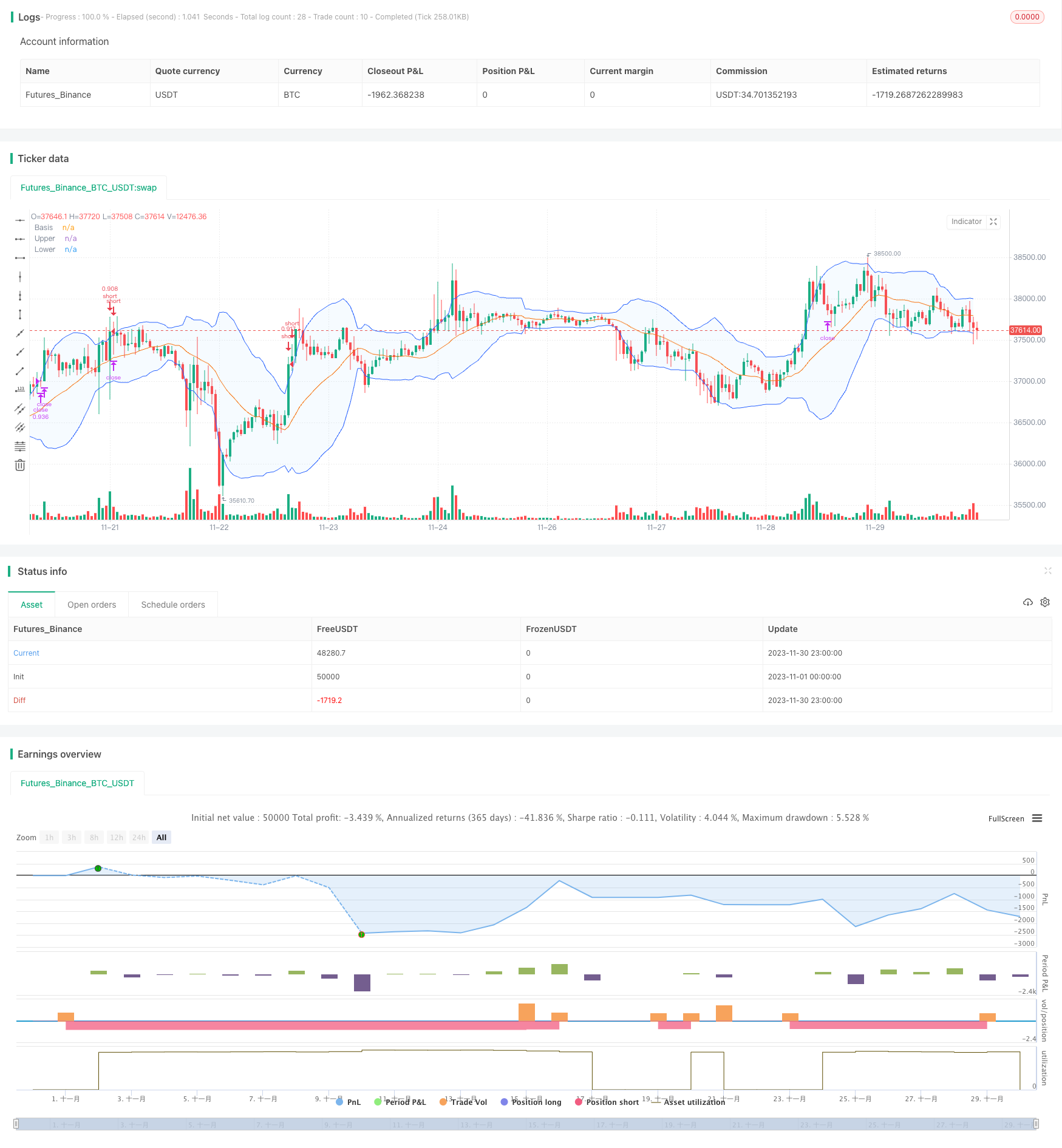

/*backtest

start: 2023-11-01 00:00:00

end: 2023-11-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Coinrule

strategy("Bollinger Band Below Price with RSI",

overlay=true,

initial_capital=1000,

process_orders_on_close=true,

default_qty_type=strategy.percent_of_equity,

default_qty_value=70,

commission_type=strategy.commission.percent,

commission_value=0.1)

showDate = input(defval=true, title='Show Date Range')

timePeriod = time >= timestamp(syminfo.timezone, 2022, 1, 1, 0, 0)

notInTrade = strategy.position_size <= 0

//Bollinger Bands Indicator

length = input.int(20, minval=1)

src = input(close, title="Source")

mult = input.float(2.0, minval=0.001, maxval=50, title="StdDev")

basis = ta.sma(src, length)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

offset = input.int(0, "Offset", minval = -500, maxval = 500)

plot(basis, "Basis", color=#FF6D00, offset = offset)

p1 = plot(upper, "Upper", color=#2962FF, offset = offset)

p2 = plot(lower, "Lower", color=#2962FF, offset = offset)

fill(p1, p2, title = "Background", color=color.rgb(33, 150, 243, 95))

// RSI inputs and calculations

lengthRSI = 14

RSI = ta.rsi(close, lengthRSI)

// Configure trail stop level with input options

longTrailPerc = input.float(title='Trail Long Loss (%)', minval=0.0, step=0.1, defval=3) * 0.01

shortTrailPerc = input.float(title='Trail Short Loss (%)', minval=0.0, step=0.1, defval=3) * 0.01

// Determine trail stop loss prices

//longStopPrice = 0.0

shortStopPrice = 0.0

//longStopPrice := if strategy.position_size > 0

//stopValue = close * (1 - longTrailPerc)

//math.max(stopValue, longStopPrice[1])

//else

//0

shortStopPrice := if strategy.position_size < 0

stopValue = close * (1 + shortTrailPerc)

math.min(stopValue, shortStopPrice[1])

else

999999

//Entry and Exit

strategy.entry(id="short", direction=strategy.short, when=ta.crossover(close, upper) and RSI < 70 and timePeriod and notInTrade)

if (ta.crossover(upper, close) and RSI > 70 and timePeriod)

strategy.exit(id='close', limit = shortStopPrice)