概述

本策略基于Keltner通道指标设计了一个回抽交易策略。该策略通过比较价格与Keltner通道上下轨的关系,判断价格可能反转的时机,采取适当的做多做空操作。

策略原理

本策略使用Keltner通道指标判断价格趋势。Keltner通道由均线和平均真实波幅(ATR)构成。通道上轨等于均线加上ATR的N倍;下轨等于均线减去ATR的N倍。当价格从下向上突破通道下轨时,认为多头力量增强,可以做多;当价格从上向下突破通道上轨时,认为空头力量增强,可以做空。

另外,本策略判断回抽机会的依据是价格重新触碰或突破通道边界。比如,价格上涨突破下轨后,在没有触碰上轨的情况下再次下跌触碰下轨,这就是一个做多回抽的机会。策略会在这个时候开仓做多。

优势分析

这是一个利用价格回抽特性进行交易的策略。它的优势在于:

- 使用Keltner通道判断价格趋势方向,可以有效过滤噪音。

- adopt回抽策略,可以在反转前进入场内,捕捉较大行情。

风险分析

该策略的主要风险在于:

- 市场长期单边行情时,回抽机会可能不多,无法获利。

- 回抽信号判断不准确时,可能导致亏损。

对策: 1. 优化参数,调整通道宽度,适应市场环境。 2. 加大仓位管理,降低单笔损失。

优化方向

该策略可以从以下几个方面进行优化:

- 基于交易量的突破过滤,避免虚假突破。

- 根据波动率调整仓位大小。

- 更新止损方式,移动止损以锁定更多利润。

总结

本策略整合了趋势判断和回抽交易的方法,在捕捉反转行情方面具有独特优势。通过参数调整和功能扩展,可以进一步增强策略的稳定性和盈利能力。

策略源码

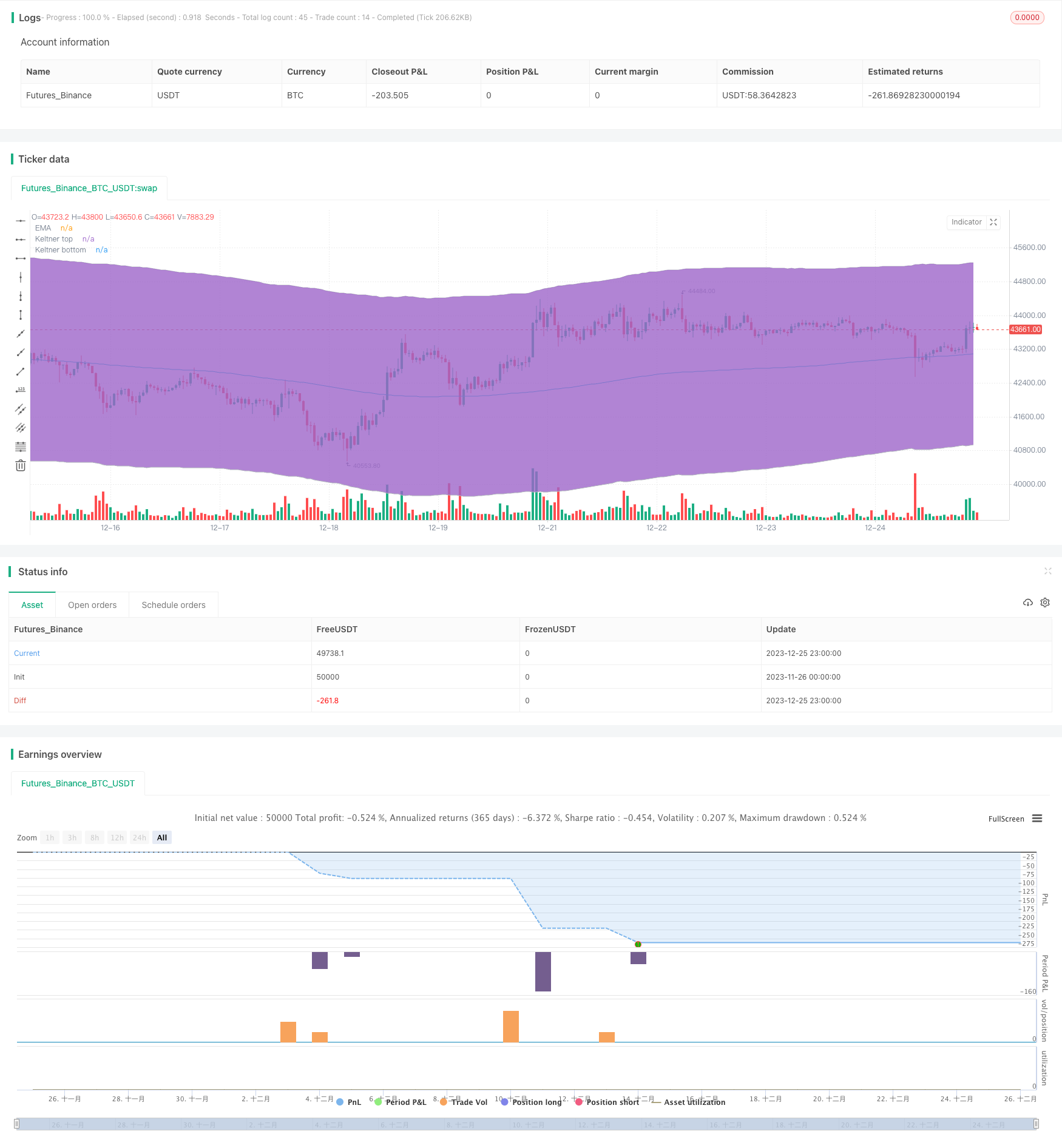

/*backtest

start: 2023-11-26 00:00:00

end: 2023-12-26 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("Keltner bounce from border. No repaint. (by Zelibobla)", shorttitle="Keltner border bounce", overlay=true)

price = close

// build Keltner

keltnerLength = input(defval=200, minval=1, title="Keltner EMA Period Length")

keltnerATRLength = input(defval=200, minval=1, title="Keltner ATR Period Length (the same as EMA length in classic Keltner Channels)")

keltnerDeviation = input(defval=8, minval=1, maxval=15, title="Keltner band width (in ATRs)")

closeOnEMATouch = input(type=bool, defval=false, title="Close trade on EMA touch? (less drawdown, but less profit and higher commissions impact)")

enterOnBorderTouchFromInside = input(type=bool, defval=false, title="Enter on border touch from inside? (by default from outside, which is less risky but less profitable)")

SL = input(defval=50, minval=0, maxval=10000, title="Stop loss in ticks (leave zero to skip)")

EMA = sma(price, keltnerLength)

ATR = atr(keltnerATRLength)

top = EMA + ATR * keltnerDeviation

bottom = EMA - ATR * keltnerDeviation

buyEntry = crossover(price, bottom)

sellEntry = crossunder(price, top)

plot(EMA, color=aqua,title="EMA")

p1 = plot(top, color=silver,title="Keltner top")

p2 = plot(bottom, color=silver,title="Keltner bottom")

fill(p1, p2)

tradeSize = input(defval=1, minval=1, title="Trade size")

if ( enterOnBorderTouchFromInside and crossunder(price, bottom) )

strategy.entry("BUY", strategy.long, qty=tradeSize, comment="BUY")

else

if( crossover(price, bottom) )

strategy.entry("BUY", strategy.long, qty=tradeSize, comment="BUY")

if( crossover(price,EMA) and closeOnEMATouch )

strategy.close("BUY")

if( 0 != SL )

strategy.exit("EXIT BUY", "BUY", qty=tradeSize, loss=SL)

strategy.exit("EXIT SELL", "SELL", qty=tradeSize, loss=SL)

if( enterOnBorderTouchFromInside and crossover(price, bottom) )

strategy.entry("SELL", strategy.long, qty=tradeSize, comment="SELL")

else

if ( crossunder(price, top) )

strategy.entry("SELL", strategy.short, qty=tradeSize, comment="SELL")

if( crossunder(price, EMA) and closeOnEMATouch )

strategy.close("SELL")