概述

本策略将一种日本指标一云图与布林带指标组合,形成交易信号,进行多空判断。策略可以有效判断市场趋势,并在布林带指标发出多空信号时进行判断,避免错误交易。

策略原理

一云图由转换线、基准线、延迟线、先行线组成。转换线为9日均线,基准线为26日均线。当转换线在基准线之上时为多头信号,反之为空头信号。

延迟线即价格的延迟移动。当延迟线在上方时表示多头趋势,下方为空头。

云带由两条先行线组成,分别为52日均线和26日均线的均值。价格在云带之上视为多头,下方为空头。

布林带由n日均线及标准差构成,为股价波动带。当价格突破上带时看多,下破下带时看空。

本策略在一云图发出多空信号时,同时判断布林带的突破,形成交易规则。如转换线向上突破基准线,延迟线在上方,价格突破云带,并突破布林带上带时,为做多信号。

策略优势

一云图判断趋势清晰,转换线和延迟线可判断短期趋势,云带判断中长期趋势方向。

布林带判断价格是否过冲,可有效过滤掉部分不必要交易。

组合指标,使交易信号更加清晰可靠,避免交易风险。

风险及优化

布林带参数设置不当可能导致交易信号不准确。应根据不同标的谨慎设置参数。

应适当调整持仓比例以控制风险。持仓过大可能导致亏损扩大。

可以考虑加入止损策略,在价格向不利方向运行超过一定幅度时止损。

可以测试更多指标与一云图进行组合,形成更可靠的交易策略。

总结

本策略有效利用一云图判断趋势方向和布林带指标过滤信号。策略信号较为清晰可靠,通过参数调整和止损优化,可以降低交易风险,获得较好收益。

策略源码

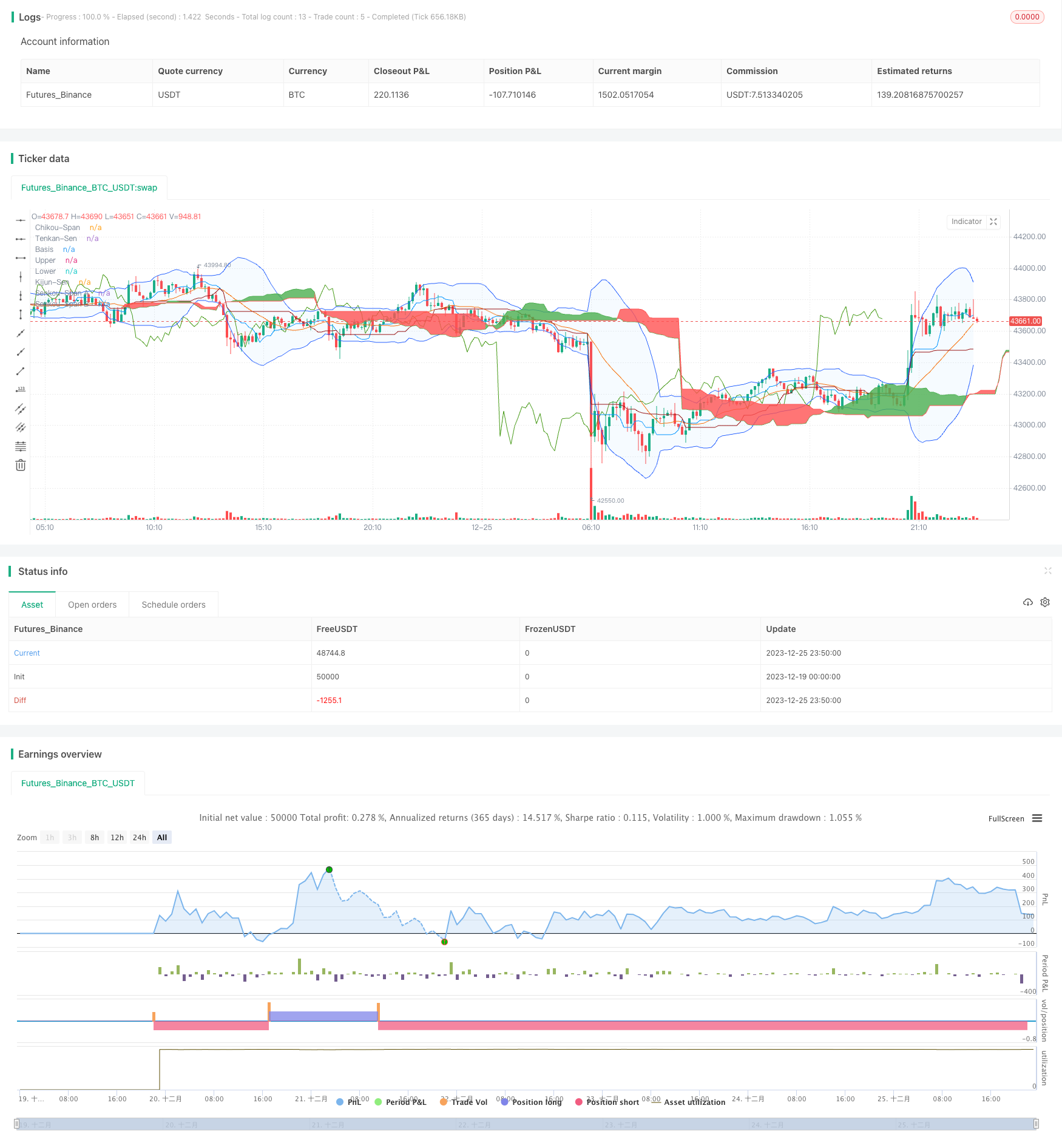

/*backtest

start: 2023-12-19 00:00:00

end: 2023-12-26 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Coinrule

//@version=5

strategy("Ichimoku Cloud and Bollinger Bands",

overlay=true,

initial_capital=1000,

process_orders_on_close=true,

default_qty_type=strategy.percent_of_equity,

default_qty_value=30,

commission_type=strategy.commission.percent,

commission_value=0.1)

showDate = input(defval=true, title='Show Date Range')

timePeriod = true

notInTrade = strategy.position_size <= 0

//Ichimoku Cloud

//Inputs

ts_bars = input.int(9, minval=1, title="Tenkan-Sen Bars")

ks_bars = input.int(26, minval=1, title="Kijun-Sen Bars")

ssb_bars = input.int(52, minval=1, title="Senkou-Span B Bars")

cs_offset = input.int(26, minval=1, title="Chikou-Span Offset")

ss_offset = input.int(26, minval=1, title="Senkou-Span Offset")

long_entry = input(true, title="Long Entry")

short_entry = input(true, title="Short Entry")

middle(len) => math.avg(ta.lowest(len), ta.highest(len))

// Components of Ichimoku Cloud

tenkan = middle(ts_bars)

kijun = middle(ks_bars)

senkouA = math.avg(tenkan, kijun)

senkouB = middle(ssb_bars)

// Plot Ichimoku Cloud

plot(tenkan, color=#0496ff, title="Tenkan-Sen")

plot(kijun, color=#991515, title="Kijun-Sen")

plot(close, offset=-cs_offset+1, color=#459915, title="Chikou-Span")

sa=plot(senkouA, offset=ss_offset-1, color=color.green, title="Senkou-Span A")

sb=plot(senkouB, offset=ss_offset-1, color=color.red, title="Senkou-Span B")

fill(sa, sb, color = senkouA > senkouB ? color.green : color.red, title="Cloud color")

ss_high = math.max(senkouA[ss_offset-1], senkouB[ss_offset-1])

ss_low = math.min(senkouA[ss_offset-1], senkouB[ss_offset-1])

// Entry/Exit Conditions

tk_cross_bull = tenkan > kijun

tk_cross_bear = tenkan < kijun

cs_cross_bull = ta.mom(close, cs_offset-1) > 0

cs_cross_bear = ta.mom(close, cs_offset-1) < 0

price_above_kumo = close > ss_high

price_below_kumo = close < ss_low

//Bollinger Bands Indicator

length = input.int(20, minval=1)

src = input(close, title="Source")

mult = input.float(2.0, minval=0.001, maxval=50, title="StdDev")

basis = ta.sma(src, length)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

offset = input.int(0, "Offset", minval = -500, maxval = 500)

plot(basis, "Basis", color=#FF6D00, offset = offset)

p1 = plot(upper, "Upper", color=#2962FF, offset = offset)

p2 = plot(lower, "Lower", color=#2962FF, offset = offset)

fill(p1, p2, title = "Background", color=color.rgb(33, 150, 243, 95))

bullish = tk_cross_bull and cs_cross_bull and price_above_kumo and ta.crossover(lower, close)

bearish = tk_cross_bear and cs_cross_bear and price_below_kumo and ta.crossover(close, lower)

strategy.entry('Long', strategy.long, when=bullish and long_entry and timePeriod)

strategy.close('Long', when=bearish and not short_entry)

strategy.entry('Short', strategy.short, when=bearish and short_entry and timePeriod)

strategy.close('Short', when=bullish and not long_entry)

//Works well on BTC 30m/1h (11.29%), ETH 2h (29.05%), MATIC 2h/30m (37.12%), AVAX 1h/2h (49.2%), SOL 45m (45.43%)