概述

该策略采用EMA快慢线交叉的方式,实现对价格趋势的跟踪。当快线从下方上穿慢线时,做多;当快线从上方下穿慢线时,平仓。该策略主要适用于趋势较明显的品种,能够有效跟踪趋势,获得超额收益。

策略原理

该策略的核心指标为EMA均线。EMA均线的计算公式为:

EMA(t)=C(t)×2/(n+1)+EMA(t-1)×(n-1)/(n+1)

其中,t为当前时刻,C(t)为当前行情收盘价,n为参数N的值。 such that EMA是一种带有加权因子的移动平均线技术指标。EMA赋予了最新价格更高的权重,这样可以更快速地反应最新价格变动。

该策略构建快速EMA均线和慢速EMA均线,以快速线上穿慢速线为买入信号,快速线下穿慢速线为卖出信号。当快速线上穿时,表示价格开始新一轮的上涨;当快速线下穿时,表示价格上涨趋势结束,开始回调下跌。

优势分析

该策略具有如下优势:

- 策略思路清晰,容易理解和实现;

- 利用EMA这个简单实用的技术指标,对价格趋势进行判断,避免错过主要趋势机会;

- 策略参数较少,主要依赖快慢EMA均线,方便调整优化;

- 买入后能够跟踪上涨趋势,及时获利;

- 卖出后能够避开价格回调,减少风险;

- 回测数据充足,可靠性较高。

风险分析

该策略的主要风险有:

- EMA均线发出假信号的概率较大,可能导致亏损;

- 行情震荡时,EMA均线容易互相穿越,产生频繁交易信号;

- 突发事件导致快速断头方向改变,无法及时止损;

- PARAMETERS优化空间有限,实际表现可能弱于回测结果。

为降低上述风险,可采取如下优化措施:

- 结合其他指标进行filtered,避免假信号;

- 调整参数,减少信号频繁;

- 增加止损策略,控制单笔损失;

- 测试不同时间周期参数,寻找最优参数。

优化方向

该策略可从以下几个方面进行优化:

- 多时间周期合成指标。例如配合周线或月线判断大趋势方向;

- 增加filter条件避免假突破。例如成交量,布林带等;

- 动态调整参数。使参数可根据行情实时变化;

- 结合其他指标构建模型。例如网格、回归等算法模型。

总结

该策略总体来说是一种较为简单实用的趋势跟踪策略。它利用EMA均线判断价格趋势,操作逻辑清晰,易于实现。优点是参数调整简单,能够有效跟踪趋势;缺点是容易发出假信号,实际表现可能弱于回测。下一步可从引入filter条件、动态调参、模型构建等方面进行优化,使策略更加稳定可靠。

策略源码

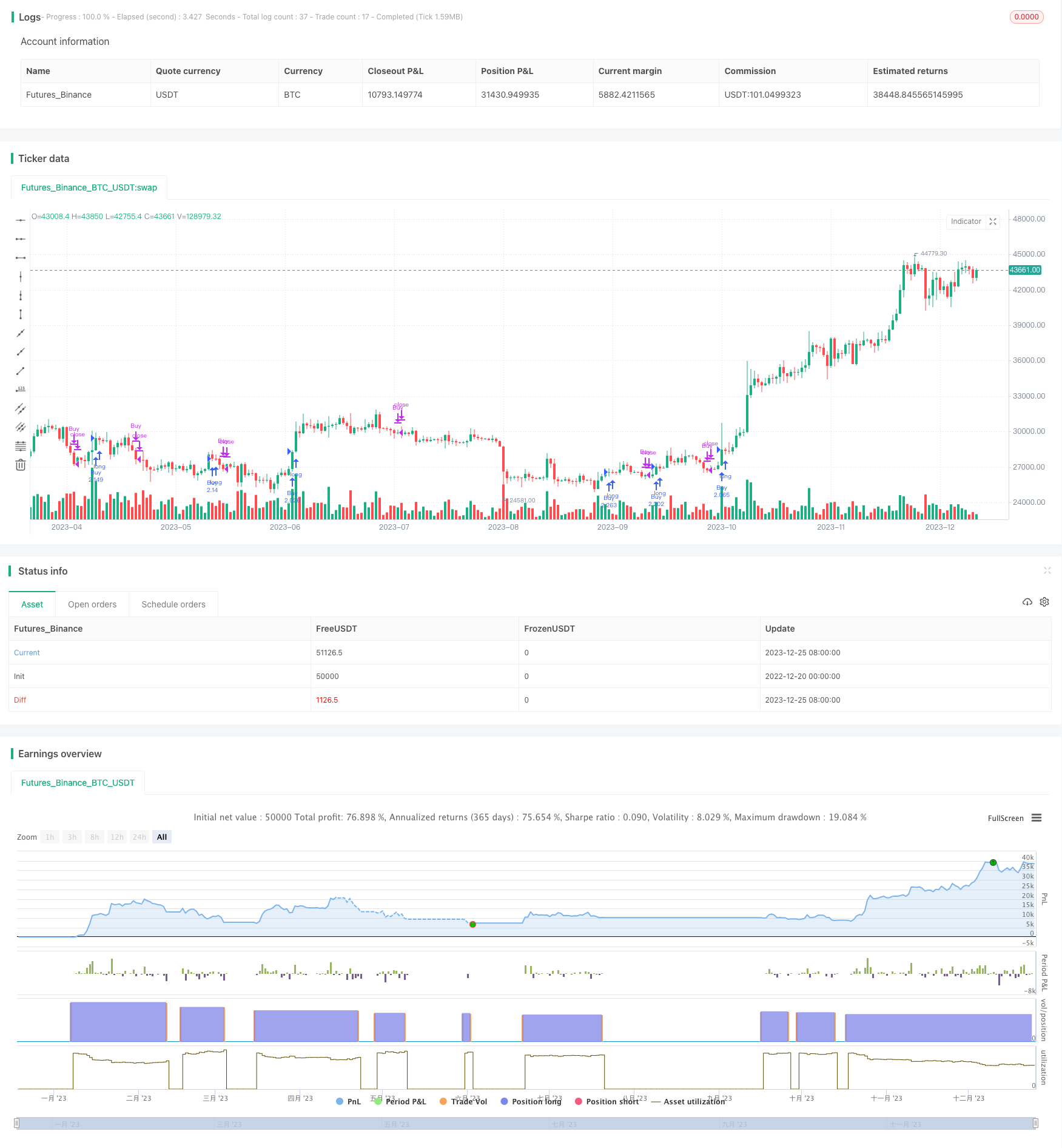

/*backtest

start: 2022-12-20 00:00:00

end: 2023-12-26 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("EMA交叉策略by GPT",

format = format.inherit,

overlay = true,

default_qty_type= strategy.percent_of_equity,

default_qty_value = 100,

currency = currency.USD,

initial_capital = 1000000)

// 定義回測交易開始和結束時間的變數

start_time = input(title="開始時間", type=input.time, defval=timestamp("01 Jan 2020 00:00 +0000"))

end_time = input(title="結束時間", type=input.time, defval=timestamp("31 Dec 2050 23:59 +0000"))

// 判斷是否在回測交易時間範圍內

in_range = true

// Define input variables

fast_length = input(title="Fast EMA Length", type=input.integer, defval=5)

slow_length = input(title="Slow EMA Length", type=input.integer, defval=20)

// Define EMAs

fast_ema = ema(close, fast_length)

slow_ema = ema(close, slow_length)

// Define buy and sell signals

buy_signal = crossover(fast_ema, slow_ema)

sell_signal = crossunder(fast_ema, slow_ema)

// Buy signal

if in_range and buy_signal

strategy.entry("Buy", strategy.long, when=in_range)

// Sell signal

if in_range and sell_signal

strategy.close("Buy", when=sell_signal)