概述

该策略结合了移动平均线,幅度指标和抛物线转向指标,实现了对趋势的判断和突破点的确认,属于典型的趋势追踪策略。当判断到处于上升趋势且价格突破最高点时会建立做多头寸,实现趋势追踪;当判断趋势反转时会平仓止损。

策略原理

该策略使用双EMA判断价格趋势,使用SMA辅助判断。当快线EMA在慢线EMA之上,并且快线SMA在慢线SMA之上时,认为处于上升趋势。

使用抛物线转向指标PSAR判断价格反转点。当PSAR下穿价格最高点时,说明价格可能反转下跌,此时平仓止损。

当判断为上升趋势且PSAR上穿价格最高点时,说明价格继续上涨,此时做多追踪趋势。

优势分析

- 使用双EMA结合SMA判断趋势,可过滤假突破。

- PSAR可有效判断反转点,实现快速止损。

- 能够有效识别趋势转折点,及时建仓追踪。

- 规则清晰易操作。

风险分析

- 趋势判断存在错误的可能。

- 策略对交易品种参数需要优化,否则 chasing risk 可能较大。

- 存在未考虑交易成本的问题。

解决方法:

- 优化EMA和SMA参数,提高判断准确率。

- 针对不同品种优化PSAR参数。

- 加入交易成本考量。

优化方向

- 加入更多指标判断趋势,如BOLL,MACD等。

- 对品种参数进行训练和优化。

- 考虑加入止损策略。

- 优化建仓和止损逻辑。

总结

该策略整体来说属于较为典型的趋势追踪策略。优点是规则较为清晰简单,能够识别趋势转折;缺点是对参数比较敏感,存在一定的 chasing risk。总体来说值得进一步优化和调整后实盘验证,主要优化方向在于参数优化、止损策略加入等。

策略源码

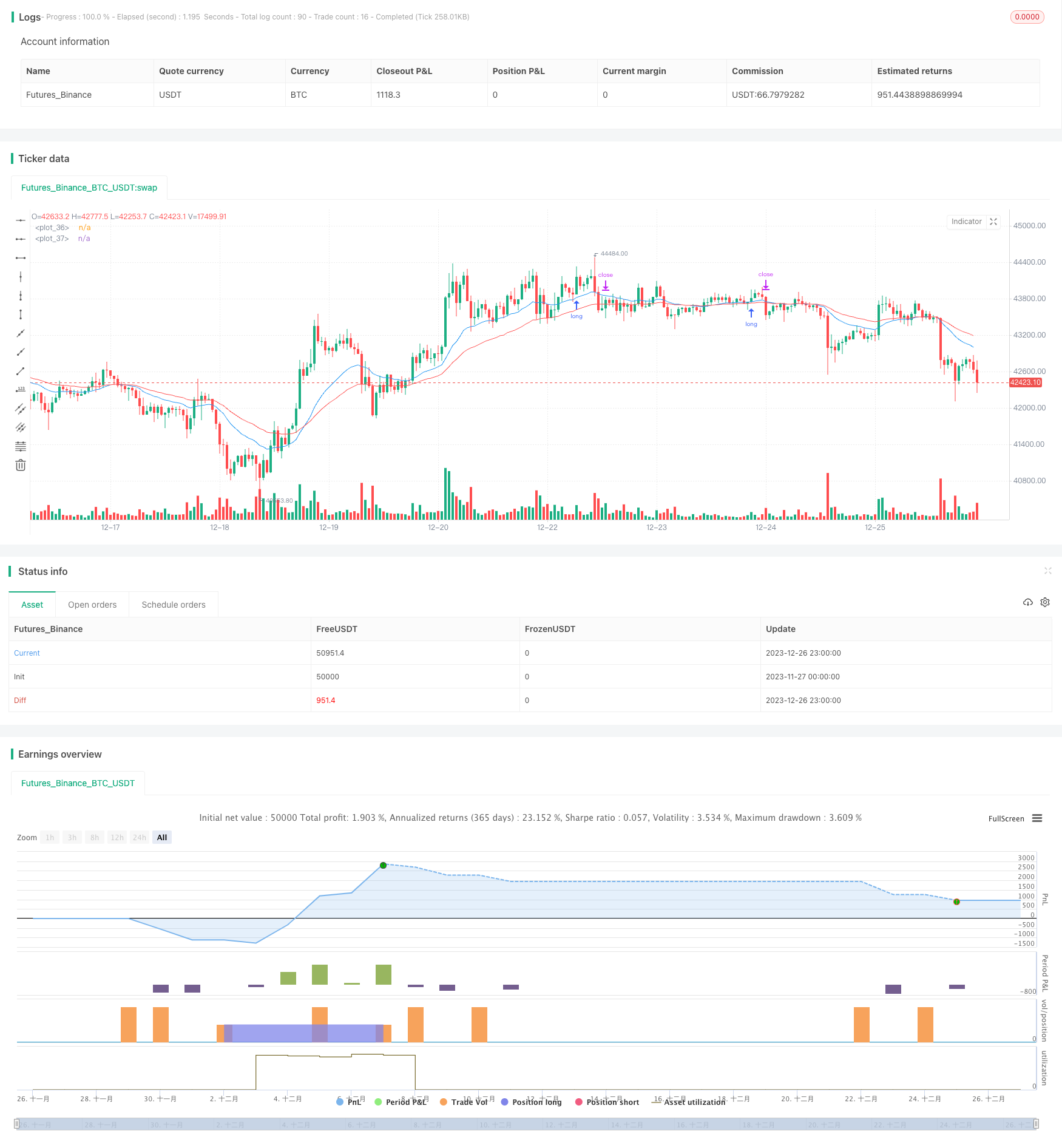

/*backtest

start: 2023-11-27 00:00:00

end: 2023-12-27 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("Buy Dip MA & PSAR", overlay=true)

PSAR_start = input(0.02)

PSAR_increment = input(0.02)

PSAR_maximum = input(0.2)

EMA_fast = input(20)

EMA_slow = input(40)

SMA_fast = input(100)

SMA_slow = input(200)

emafast = ema(close, EMA_fast)

emaslow = ema(close, EMA_slow)

smafast = sma(close, SMA_fast)

smaslow = sma(close, SMA_slow)

psar = sar(PSAR_start, PSAR_increment, PSAR_maximum)

uptrend = emafast > emaslow and smafast > smaslow

breakdown = not uptrend

if (psar >= high and uptrend)

strategy.entry("Buy", strategy.long, stop=psar, comment="Buy")

else

strategy.cancel("Buy")

if (psar <= low)

strategy.exit("Close", "Buy", stop=psar, comment="Close")

else

strategy.cancel("Close")

if (breakdown)

strategy.close("Buy")

plot(emafast, color=blue)

plot(emaslow, color=red)