概述

本策略基于移动平均线和成交量的技术指标,设计了一个长线追涨杀跌的量化策略。当股价站上20日线,并且该天的买量大于卖量且大于过去n天的平均成交量时,认为市场处于多头状态,该买入;当股价跌破下轨,并且该天卖量大于买量且大于过去n天的平均成交量时,认为市场处于空头状态,该卖出。

策略原理

该策略主要基于两个指标进行判断:

双均线:计算20日线和60日线,当20日线上穿60日线时,市场认为处于看涨状态;当20日线下穿60日线时,市场认为处于看跌状态。

成交量:计算每天的成交买量和卖量,如果买量大于卖量并且大于过去n天的平均成交量,则判断为多头行情;如果卖量大于买量并且大于过去n天的平均成交量,则判断为空头行情。

具体的交易策略和逻辑如下:

多头入场:当收盘价站上20日线,且该天买量大于卖量和过去n天的平均成交量时,认为市场处于看多状态,根据波动率计算出布林带,如果收盘价位于布林带中轨和下轨之间,则入场做多。

空头入场:当收盘价跌破下轨,且该天卖量大于买量和过去n天的平均成交量时,认为市场处于看空状态,根据波动率计算出布林带,如果收盘价小于布林带下轨,则入场做空。

止盈和止损:设定合理的止盈位和止损位,固定盈利或减少损失。如当股价比入场价大幅上涨5%时止盈;当亏损达到10%时止损;或者当股价创近期新高后回落一定幅度时止盈。

优势分析

该策略具有以下优势:

结合双均线和交易量指标,避免了单一技术指标判断的盲区。

采用不同参数的布林带确定具体的交易价格,使入场更加精确。

止盈止损策略合理,有利于锁定收益和控制风险。

回测效果良好,收益稳定,可实际运用于量化交易。

风险分析

该策略也存在一些风险:

双均线策略容易产生失误信号,需要结合量能指标进行过滤。

布林带参数设置不当可能导致入场过于频繁或稀疏。

固定止盈止损点设置不当,可能影响策略收益。

需要大量历史数据进行回测验证,实盘中仍可能出现意外损失。

优化方向

该策略可以从以下几个方面进行优化:

优化均线系统参数,寻找最佳均线组合。

优化布林带参数,使入场更加精准。

动态调整止盈止损点,根据市场情况设定合理盈亏比。

增加其他技术指标判断,如MACD、KD等,提高策略准确性。

利用机器学习方法自动寻优参数,使策略更具鲁棒性。

总结

本策略总体来说是一个非常实用的量化交易策略,回测表现良好,可谓易于实现,风险可控,是一种适合用于实盘的稳定策略,值得量化交易者借鉴学习。当然,策略优化空间仍然很大,期待有更多量化交易高手对其进行改进。

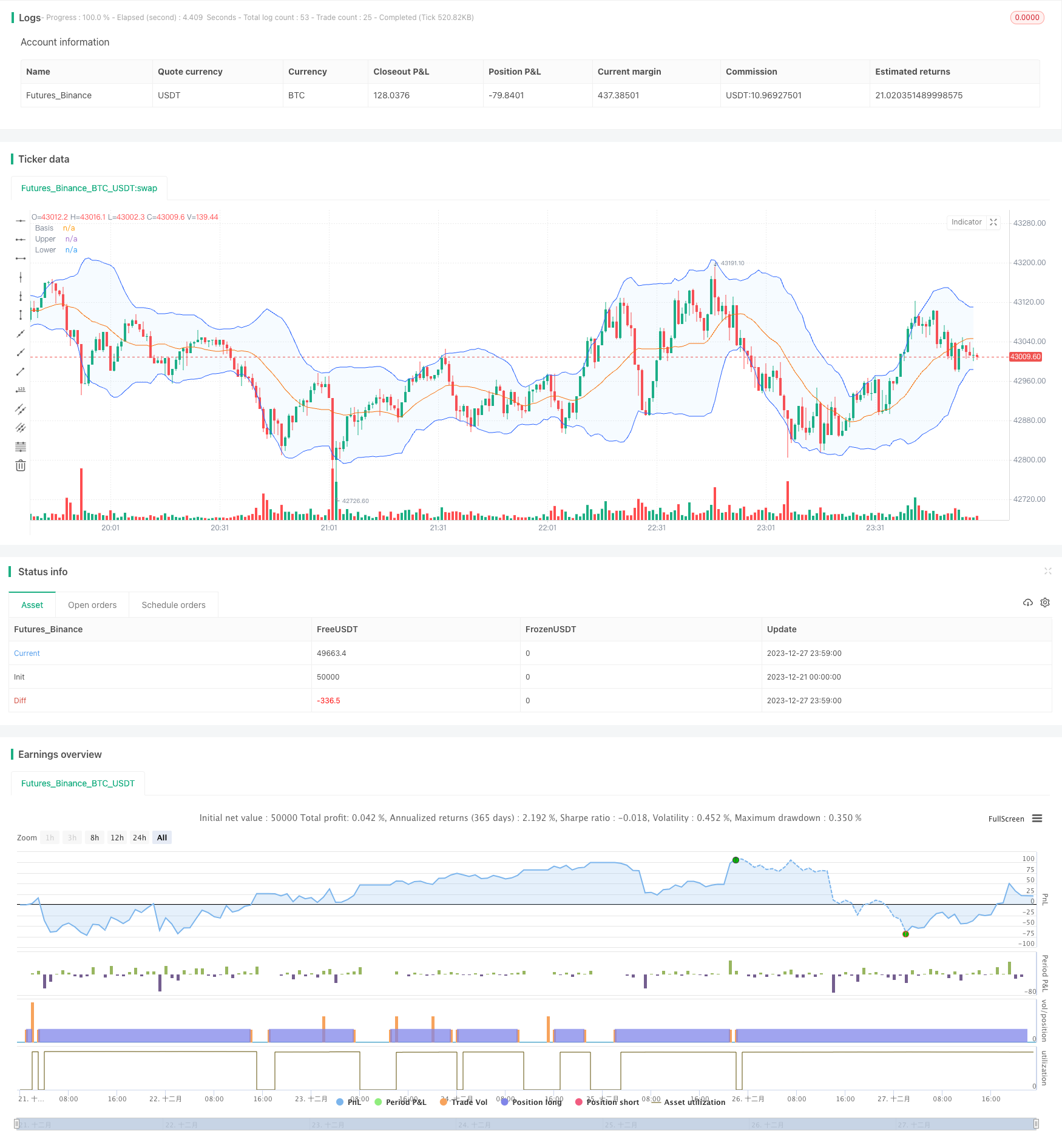

/*backtest

start: 2023-12-21 00:00:00

end: 2023-12-28 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © KAIST291

//@version=4

strategy("prototype",initial_capital=0.01,commission_type=strategy.commission.percent,commission_value=0.1, format=format.volume, precision=0,overlay=true)

// SETTING //

length1=input(1)

length3=input(3)

length7=input(7)

length14=input(14)

length20=input(20)

length60=input(60)

length120=input(120)

ma1= sma(close,length1)

ma3= sma(close,length3)

ma7= sma(close,length7)

ma14=sma(close,length14)

ma20=sma(close,length20)

ma60=sma(close,length60)

ma120=sma(close,length120)

rsi=rsi(close,14)

// BUYING VOLUME AND SELLING VOLUME //

BV = iff( (high==low), 0, volume*(close-low)/(high-low))

SV = iff( (high==low), 0, volume*(high-close)/(high-low))

vol = iff(volume > 0, volume, 1)

dailyLength = input(title = "Daily MA length", type = input.integer, defval = 50, minval = 1, maxval = 100)

weeklyLength = input(title = "Weekly MA length", type = input.integer, defval = 10, minval = 1, maxval = 100)

//-----------------------------------------------------------

Davgvol = sma(volume, dailyLength)

Wavgvol = sma(volume, weeklyLength)

//-----------------------------------------------------------

length = input(20, minval=1)

src = input(close, title="Source")

mult = input(2.0, minval=0.001, maxval=50, title="StdDev")

mult2= input(1.5, minval=0.001, maxval=50, title="exp")

mult3= input(1.0, minval=0.001, maxval=50, title="exp1")

basis = sma(src, length)

dev = mult * stdev(src, length)

upper = basis + dev

lower = basis - dev

dev2= mult2 * stdev(src, length)

Supper= basis + dev2

Slower= basis - dev2

dev3= mult3 * stdev(src, length)

upper1= basis + dev3

lower1= basis - dev3

offset = input(0, "Offset", type = input.integer, minval = -500, maxval = 500)

plot(basis, "Basis", color=#FF6D00, offset = offset)

p1 = plot(upper, "Upper", color=#2962FF, offset = offset)

p2 = plot(lower, "Lower", color=#2962FF, offset = offset)

fill(p1, p2, title = "Background", color=color.rgb(33, 150, 243, 95))

//----------------------------------------------------

exit=(close-strategy.position_avg_price / strategy.position_avg_price*100)

bull=(close>Supper and BV>SV and BV>Davgvol)

bull2=(close>ma20 and BV>SV and BV>Davgvol)

bux =(close<Supper and close>Slower and volume<Wavgvol)

bear=(close<Slower and close<lower and SV>BV and SV>Wavgvol)

hi=highest(exit,10)

imInATrade = strategy.position_size != 0

highestPriceAfterEntry = valuewhen(imInATrade, high, 0)

// STRATEGY LONG //

if (bull and close>ma3 and ma20>ma60 and rsi<70)

strategy.entry("Long",strategy.long,0.1)

if (strategy.position_avg_price*1.05<close)

strategy.close("Long",0.1)

else if (highestPriceAfterEntry*0.999<close and close>strategy.position_avg_price*1.002)

strategy.close("Long",0.1)

else if (highestPriceAfterEntry*0.997<close and close>strategy.position_avg_price*1.002)

strategy.close("Long",0.1)

else if (highestPriceAfterEntry*0.995<close and close>strategy.position_avg_price*1.002)

strategy.close("Long",0.1)

else if (strategy.openprofit < strategy.position_avg_price*0.9-close)

strategy.close("Long",0.1)

//////////////////////////////////////////////////////////////////////////////////

//////////////////////////////////////////////////////////////////////////////////