概述

本策略的核心思想是结合随机Fisher变换和临时停止反转STOCH指标来做出买卖决策。该策略适用于中短期操作,能在平稳行情中获得不错的收益。

策略原理

本策略首先计算标准的STOCH指标,然后对其进行Fisher变换得到INVLine。当INVLine上穿过下行阈值线dl时,产生买入信号;当INVLine下穿过上行阈值线ul时,产生卖出信号。同时,该策略还设置了追踪止损机制,以锁定利润和减少损失。

具体来说,该策略的核心逻辑是:

- 计算STOCH指标:采用标准公式,计算stock的快速STOCH值

- Fisher变换:对STOCH值进行Fisher变换,得到INVLine

- 产生交易信号:INVLine上穿dl线时买入,下穿ul线时卖出

- 追踪止损:启用临时停止追踪机制,以便及时止损

优势分析

本策略主要具有以下优势:

- Fisher变换有效提高了STOCH指标的灵敏度,能更早发现趋势反转机会

- 临时停止追踪机制能够有效控制风险,锁定利润

- 适合中短期操作,特别是最近比较流行的快速量化交易

- 在平稳行情中表现较好,收益稳定

风险分析

本策略也存在一些风险:

- STOCH指标容易产生假信号,可能导致不必要的交易

- Fisher变换也会放大STOCH指标的噪音,带来更多假信号

- 在震荡行情中容易止损退出,无法持续盈利

- 需要较短的持仓期才能获得Alpha,不适合持仓太久

为降低这些风险,可以考虑优化以下几个方面:

- 调整STOCH参数,平滑曲线,减少噪音

- 优化阈值线的位置,降低误交易概率

- 增加过滤条件,避免在震荡行情中交易

- 调整持仓的时间长度,与操作周期相匹配

优化方向

本策略主要可以从以下几个方向进行优化:

- 优化Fisher变换的参数,平滑INVLine曲线

- 优化STOCH指标的长度period,寻找最佳参数组合

- 优化阈值线的参数,降低误交易概率

- 增加量价确认,避免不必要的追踪止损

- 增加日内突破过滤,减少震荡市假信号

- 结合趋势指标,避免逆势交易

总结

本策略综合运用随机Fisher变换和STOCH指标,实现了一个简单实用的短线量化策略。其优势在于操作频率高,适合最近比较流行的高频量化交易。同时,该策略也存在一些普遍的技术指标策略风险,需要对参数和过滤条件进行优化,降低风险,提高稳定性。总的来说,本策略为简单的量化交易提供了一个不错的思路,值得进一步深入研究。

策略源码

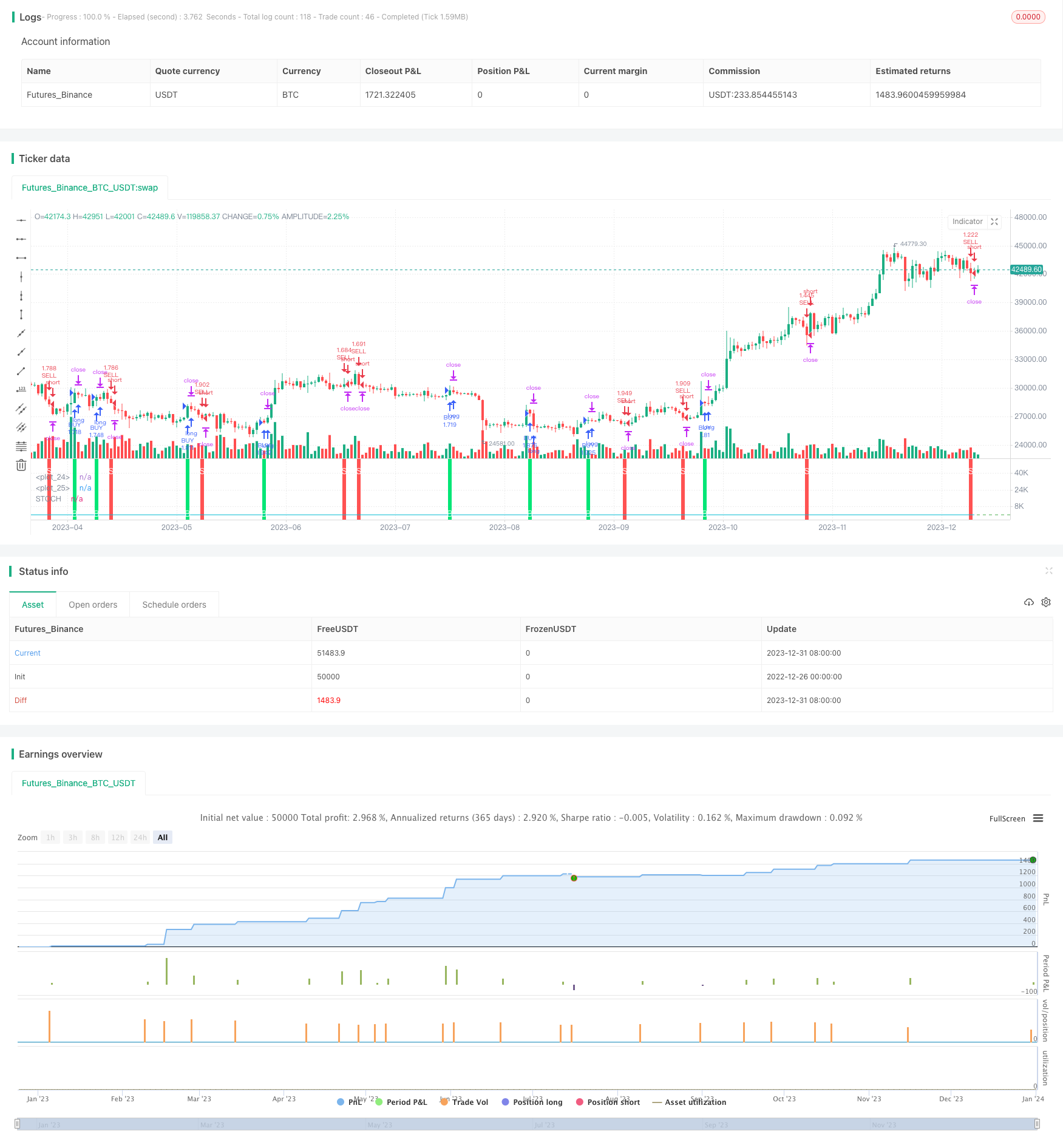

/*backtest

start: 2022-12-26 00:00:00

end: 2024-01-01 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("IFT Stochastic + Trailing Stop", overlay=false, pyramiding = 0, calc_on_order_fills = false, commission_type = strategy.commission.percent, commission_value = 0.0454, default_qty_type = strategy.percent_of_equity, default_qty_value = 100)

//INPUTS

stochlength=input(19, "STOCH Length")

wmalength=input(4, title="Smooth")

ul = input(0.64,step=0.01, title="UP line")

dl = input(-0.62,step=0.01, title="DOWN line")

uts = input(true, title="Use trailing stop")

tsi = input(title="trailing stop actiation pips",defval=245)

tso = input(title="trailing stop offset pips",defval=20)

//CALCULATIONS

v1=0.1*(stoch(close, high, low, stochlength)-50)

v2=wma(v1, wmalength)

INVLine=(exp(2*v2)-1)/(exp(2*v2)+1)

//CONDITIONS

sell = crossunder(INVLine,ul)? 1 : 0

buy = crossover(INVLine,dl)? 1 : 0

//PLOTS

plot(INVLine, color=aqua, linewidth=1, title="STOCH")

hline(ul, color=red)

hline(dl, color=green)

bgcolor(sell==1? red : na, transp=30, title = "sell signal")

bgcolor(buy==1? lime : na, transp=30, title = "buy signal")

plotchar(buy==1, title="Buy Signal", char='B', location=location.bottom, color=white, transp=0, offset=0)

plotchar(sell==1, title="Sell Signal", char='S', location=location.top, color=white, transp=0, offset=0)

//STRATEGY

strategy.entry("BUY", strategy.long, when = buy==1)

strategy.entry("SELL", strategy.short, when = sell==1)

if (uts)

strategy.entry("BUY", strategy.long, when = buy)

strategy.entry("SELL", strategy.short, when = sell)

strategy.exit("Close BUY with TS","BUY", trail_points = tsi, trail_offset = tso)

strategy.exit("Close SELL with TS","SELL", trail_points = tsi, trail_offset = tso)