概述

本策略通过构建多个不同周期的EMA指标,并计算其差值,形成格林美指标,用于判断价格趋势和发出交易信号。该策略适用于短期趋势跟踪,可以有效捕捉价格变化趋势。

策略原理

该策略首先构建6个短周期EMA指标和6个长周期EMA指标。短周期EMA包括3日线、5日线、8日线、10日线、12日线和15日线。长周期EMA包括30日线、35日线、40日线、45日线、50日线和60日线。

然后计算短周期EMA之和(g)和长周期EMA之和(mae)。通过长短周期EMA之差(gmae = mae - g)形成格林美差值指标。该差值指标可以判断价格趋势。

当差值上穿0轴时,表示短期均线上升速度快于长期均线,属于多头信号,做多;当差值下穿0轴时,表示短期均线下降速度快于长期均线,属于空头信号,做空。

策略优势

- 使用双EMA均线策略,可以有效跟踪短期趋势

- 构建多组EMA,避免假突破,提高信号准确率

- 差值指标直观判断长短期趋势关系

- 简单参数设置,容易实盘操作

策略风险

- 短周期操作,存在一定止损风险

- 多组EMA参数设置需要测试优化

- 只适合短线操作,不适合持续长线

策略优化

- 测试优化EMA参数,提高交易效率

- 增加止损策略,控制单笔损失

- 结合其他指标过滤入场信号

- 优化资金管理,调整仓位管理

总结

本策略通过构建格林美差值指标,捕捉短期价格趋势变化,属于短线跟踪策略。优点是反应灵敏,适合高频交易。缺点是对市场变量敏感,止损风险较大。整体而言,该策略表现出色,值得在实盘中测试和应用。

策略源码

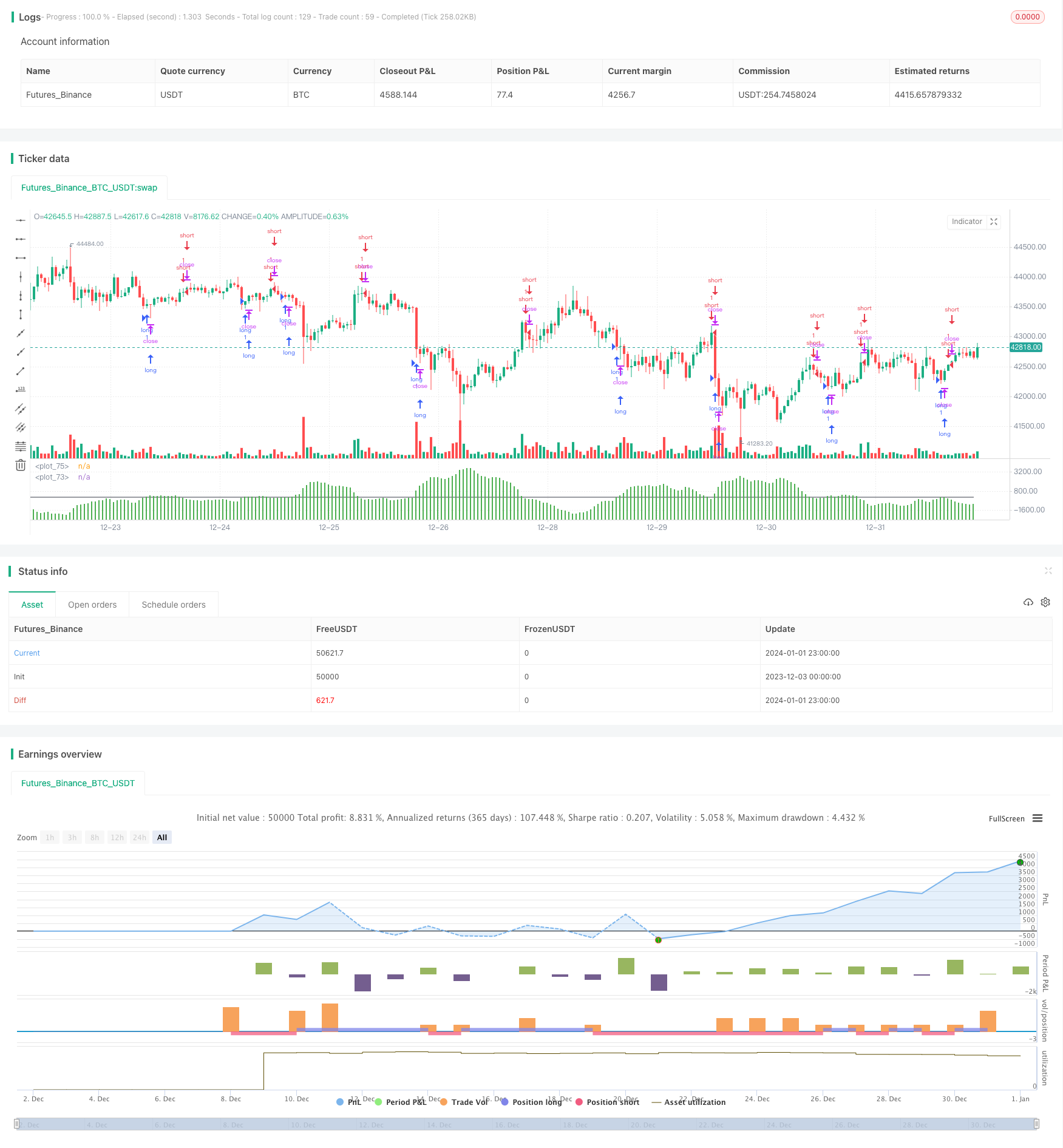

/*backtest

start: 2023-12-03 00:00:00

end: 2024-01-02 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy(title="GMAE Original (By Kevin Manrrique)", overlay=false)

/// This indicator was built and scripted by Kevin Manrrique. Please leave this copyright to the script at all times, if rebuilt please add your name onto the script.

/// If you have any questions, please message me directly. Thank you.

/// Sincerely,

///

/// Kevin Manrrique

///ONE///

len = input(3, minval=1, title="Length")

src = input(close, title="Source")

out = ema(src, len)

//plot(out, title="EMA", color=blue)

len2 = input(5, minval=1, title="Length")

src2 = input(close, title="Source")

out2 = ema(src2, len2)

//plot(out2, title="EMA", color=blue)

len3 = input(8, minval=1, title="Length")

src3 = input(close, title="Source")

out3 = ema(src3, len3)

//plot(out3, title="EMA", color=blue)

len4 = input(10, minval=1, title="Length")

src4 = input(close, title="Source")

out4 = ema(src4, len4)

//plot(out4, title="EMA", color=blue)

len5 = input(12, minval=1, title="Length")

src5 = input(close, title="Source")

out5 = ema(src5, len5)

//plot(out5, title="EMA", color=blue)

len6 = input(15, minval=1, title="Length")

src6 = input(close, title="Source")

out6 = ema(src6, len6)

//plot(out6, title="EMA", color=blue)

///TWO///

len7 = input(30, minval=1, title="Length")

src7 = input(close, title="Source")

out7 = ema(src7, len7)

//plot(out7, title="EMA", color=red)

len8 = input(35, minval=1, title="Length")

src8 = input(close, title="Source")

out8 = ema(src8, len8)

//plot(out8, title="EMA", color=red)

len9 = input(40, minval=1, title="Length")

src9 = input(close, title="Source")

out9 = ema(src9, len9)

//plot(out9, title="EMA", color=red)

len10 = input(45, minval=1, title="Length")

src10 = input(close, title="Source")

out10 = ema(src10, len10)

//plot(out10, title="EMA", color=red)

len11 = input(50, minval=1, title="Length")

src11 = input(close, title="Source")

out11 = ema(src11, len11)

//plot(out11, title="EMA", color=red)

len12 = input(60, minval=1, title="Length")

src12 = input(close, title="Source")

out12 = ema(src12, len12)

//plot(out12, title="EMA", color=red)

g=out+out2+out3+out4+out5+out6

mae=out7+out8+out9+out10+out11+out12

gmae=mae-g

plot(gmae, style=columns, color=green)

baseline=0

plot(baseline, style=line, color=black)

longCondition = crossover(gmae, baseline)

if (longCondition)

strategy.entry("long", strategy.long)

shortCondition = crossunder(gmae, baseline)

if (shortCondition)

strategy.entry("short", strategy.short)