概述

该策略通过判断K线的“意义柱线”来预测趋势,并结合突破信号发出交易信号。策略会过滤掉过小的K线,只对“意义柱线”做分析,可以避免被过于频繁的小涨跌干扰,使信号更加平稳可靠。

策略原理

判断当前K线的实体长度body,如果大于过去6根K线body平均值的3倍,就认为是“意义柱线”。

如果连续3根“意义柱线”都是阳线,则判断为多头信号;如果连续3根“意义柱线”都是阴线,则判断为空头信号。

在判断信号的同时,如果价格突破之前高点或低点,也会产生附加的交易信号。

使用SMA均线作为过滤器,只有价格突破SMA时才开仓。

持仓后,如果价格再次突破入场点或SMA均线,则平仓。

优势分析

使用“意义柱线”判断趋势,可过滤掉过多不必要的干扰,使信号更加清晰。

结合趋势信号和突破信号,可提高信号质量,减少假信号。

SMA均线过滤可避免追高杀跌。Closing以下买入,Closing以上卖出,增加信号的可靠性。

设定止盈止损条件,可以及时止损止盈,有利于资金保全。

风险分析

本策略较为激进,使用3根K线判断信号,可能会误判短期震荡为趋势反转。

测试数据不充足,不同品种和不同周期效果可能会有所差异。

未加入夜盘隔夜仓位控制,存在隔夜仓位风险。

优化方向

对“意义柱线”的参数可进一步优化,如判断的K线数量、“意义”的定义等。

可测试不同周期参数对效果的影响,寻找最佳周期。

可加入ATR止损来控制风险。

可考虑加入隔夜仓位控制逻辑。

总结

本策略利用“意义柱线”滤波和趋势判断,结合突破形成交易信号,可有效过滤掉过多不必要的小幅波动,信号更加清晰可靠。但由于判断周期较短,可能存在一定的误判风险。可通过参数优化和风控手段进一步完善。

策略源码

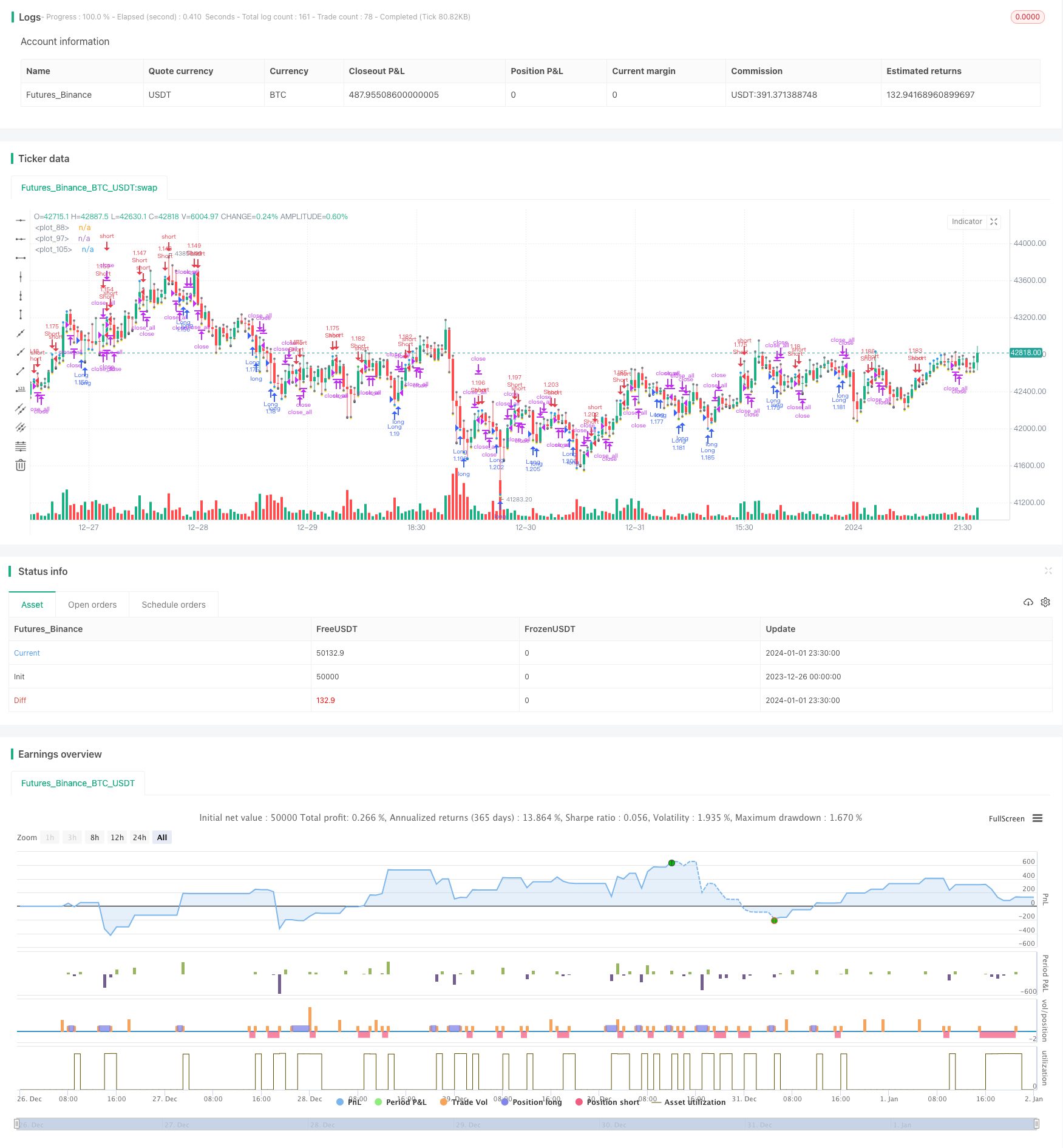

/*backtest

start: 2023-12-26 00:00:00

end: 2024-01-02 00:00:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//AlexInc

//2018

// закрытие - вычислить и в течение скольки-то баров его добиваться

// если нет, то по первому противоположному

// по стоп-лоссу в любом случае - стоп вычислить

//@version=2

strategy(title = "AlexInc's Bar v1.2", shorttitle = "AlexInc Bar 1.2", overlay = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 0)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

usemar = input(false, defval = false, title = "Use Martingale")

tryprofitbars = input(6, defval = 6, minval = 1, maxval = 100, title = "Number of candles to take profit anyway")

capital = input(100, defval = 100, minval = 1, maxval = 10000, title = "Capital, %")

useSMAfilter = input(false, defval = true, title = "Use SMA filter")

SMAlimit = input(10, defval = 10, minval = 1, maxval = 30, title = "SMA filter limit")

bodysizeMlt = input(3, defval = 3, minval = 1, maxval = 10, title = "Body Size Multiplier")

meanfulbardiv = input(3, title = "Meanful Bar size Divider")

showarr = input(false, defval = false, title = "Show Arrows")

fromyear = input(2018, defval = 2018, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

//SMA #

index = 0

index := barstate.isfirst ==true ? 0 : nz(index[1])+1

buyindex = 0

buyindex := barstate.isfirst ==true ? 0 : buyindex[1]

sellindex = 0

sellindex := barstate.isfirst ==true ? 0 : sellindex[1]

//predictprofit = barstate.isfirst ==true ? 0 : predictprofit[1]

smafilter = sma(close, SMAlimit)

//Body

body = abs(close - open)

range = abs(high - low)

abody = sma(body, 6)

max3 = 0

if body >= body[1] and body >= body[2]

max3 := body

else

if body[1] >= body and body[1] >= body[2]

max3 := body[1]

else

if body[2] >= body and body[2] >= body[1]

max3 := body[2]

prevmax3 = 0

prevmax3 := nz(max3[1])

bar = close > open ? 1 : close < open ? -1 : 0

firstbullishopen = 0

firstbullishopen := bar == 1 and bar[1] != 1 ? open : nz(firstbullishopen[1])

firstbearishopen = 0

firstbearishopen := bar == -1 and bar[1] != -1 ? open : nz(firstbearishopen[1])

meanfulbar = body > abody / meanfulbardiv

meanfulbearish = 0

meanfulbearish := nz(meanfulbearish[1])

meanfulbullish = 0

meanfulbullish := nz(meanfulbullish[1])

if meanfulbar

if bar == 1

meanfulbullish := 1 + meanfulbullish

meanfulbearish := 0

else

if bar == -1

meanfulbearish := 1 + meanfulbearish

meanfulbullish := 0

plot(min(low, high)-10, style=circles, color = meanfulbar ? yellow:black, linewidth=3)

//Signals

up1 = (meanfulbearish >= 3) and (close < firstbullishopen or 1) and (strategy.position_size == 0 or close < strategy.position_avg_price) and body > abody / 5 and (useSMAfilter == false or close < smafilter)

if up1 == true

predictprofit = sma(body, 3)

up2 = sma(bar, 1) == -1 and body > prevmax3 * bodysizeMlt and (strategy.position_size == 0 or close < strategy.position_avg_price) and body > abody / 5 and (useSMAfilter == false or close < smafilter)

if up2 == true

predictprofit = body * 0.5

plot(min(low, high), style=circles, color = up1?blue:up2?green:gray, linewidth=3)

dn1 = (meanfulbullish >= 3) and (close > firstbearishopen or 1) and (strategy.position_size == 0 or close > strategy.position_avg_price) and body > abody / 5 and (useSMAfilter==false or close > smafilter)

if dn1 ==true

predictprofit = sma(body, 3)

dn2 = sma(bar, 1) == 1 and body > prevmax3 * bodysizeMlt and (strategy.position_size == 0 or close > strategy.position_avg_price) and body > abody / 5 and (useSMAfilter==false or close > smafilter)

if dn2 ==true

predictprofit = body * 0.5

plot(max(low, high), style=circles, color = dn1?blue:dn2?green:gray, linewidth=3)

exit = (((strategy.position_size > 0 and bar == 1 ) or (strategy.position_size < 0 and bar == -1)) and body > abody / 2 )

// or index >= buyindex (or sellindex) + tryprofitbars

//Arrows

col = exit ? black : up1 or dn1 ? blue : up2 or dn2 ? red : na

needup = up1 or up2

needdn = dn1 or dn2

needexitup = exit and strategy.position_size < 0

needexitdn = exit and strategy.position_size > 0

plotarrow(showarr and needup ? 1 : na, colorup = blue, colordown = blue, transp = 0)

plotarrow(showarr and needdn ? -1 : na, colorup = blue, colordown = blue, transp = 0)

plotarrow(showarr and needexitup ? 1 : na, colorup = black, colordown = black, transp = 0)

plotarrow(showarr and needexitdn ? -1 : na, colorup = black, colordown = black, transp = 0)

//Trading

profit = exit ? ((strategy.position_size > 0 and close > strategy.position_avg_price) or (strategy.position_size < 0 and close < strategy.position_avg_price)) ? 1 : -1 : profit[1]

mult = usemar ? exit ? profit == -1 ? mult[1] * 2 : 1 : mult[1] : 1

lot = strategy.position_size == 0 ? strategy.equity / close * capital / 100 * mult : lot[1]

if up1 or up2

if strategy.position_size < 0

strategy.close_all()

buyindex = index

sellindex = index

if strategy.position_size == 0

buyindex = index

strategy.entry("Long", strategy.long, needlong == false ? 0 : lot )

if dn1 or dn2

if strategy.position_size > 0

strategy.close_all()

buyindex = index

sellindex = index

if strategy.position_size == 0

sellindex = index

strategy.entry("Short", strategy.short, needshort == false ? 0 : lot )

if exit

strategy.close_all()