概述

宽带突破策略是一种趋势跟踪策略。它利用波动率范围来确定进场和出场的时机。具体来说,它使用布林带的上轨和下轨来判断价格是否突破。当价格突破上轨时做多,当价格跌破下轨时平仓。

策略原理

该策略基于布林带指标。布林带包含三条线:

- 中线 - n日简单移动平均线

- 上轨 - 中线 + k * n日标准差

- 下轨 - 中线 - k * n日标准差

这里的k值一般取1.5或2。当价格突破上轨时,表示股票进入强势区域,做多;当价格跌破下轨时,表示股票进入弱势区域,平仓。

该策略使用20日中线和1.5倍标准差构建布林带。当价格突破上轨时做多, exited有两种选择:

- 使用下轨止损

- 使用中线止损

如果是高波动股票,使用下轨止损效果更好。

优势分析

该策略主要有以下优势:

- 能够有效跟踪价格趋势,及时捕捉突破信号

- 利用波动率范围来确定进场点位,可以有效过滤噪音

- prebuiltr两种止损方式,可以根据股票特点选择最优方案

风险分析

该策略也存在一些风险:

- 突破信号可能是假突破,无法有效跟踪趋势

- 止损点设置不当可能造成过度止损

- 无法有效处理盘整市场

可以通过优化参数、结合其它指标等方式来降低这些风险。

优化方向

该策略可以从以下几个方面进行优化:

- 优化布林带的参数,寻找最佳的参数组合

- 结合交易量等指标来验证突破信号的可靠性

- 利用其它指标构建过滤机制,避免假突破

- 动态调整止损位置,降低止损风险

总结

宽带突破策略整体来说是一种较为经典的趋势跟踪策略。它可以通过参数优化和规则优化进行改进,使其更适应不同市场环境。该策略易于理解和实现,是量化交易的一个很好的入门策略选择。

策略源码

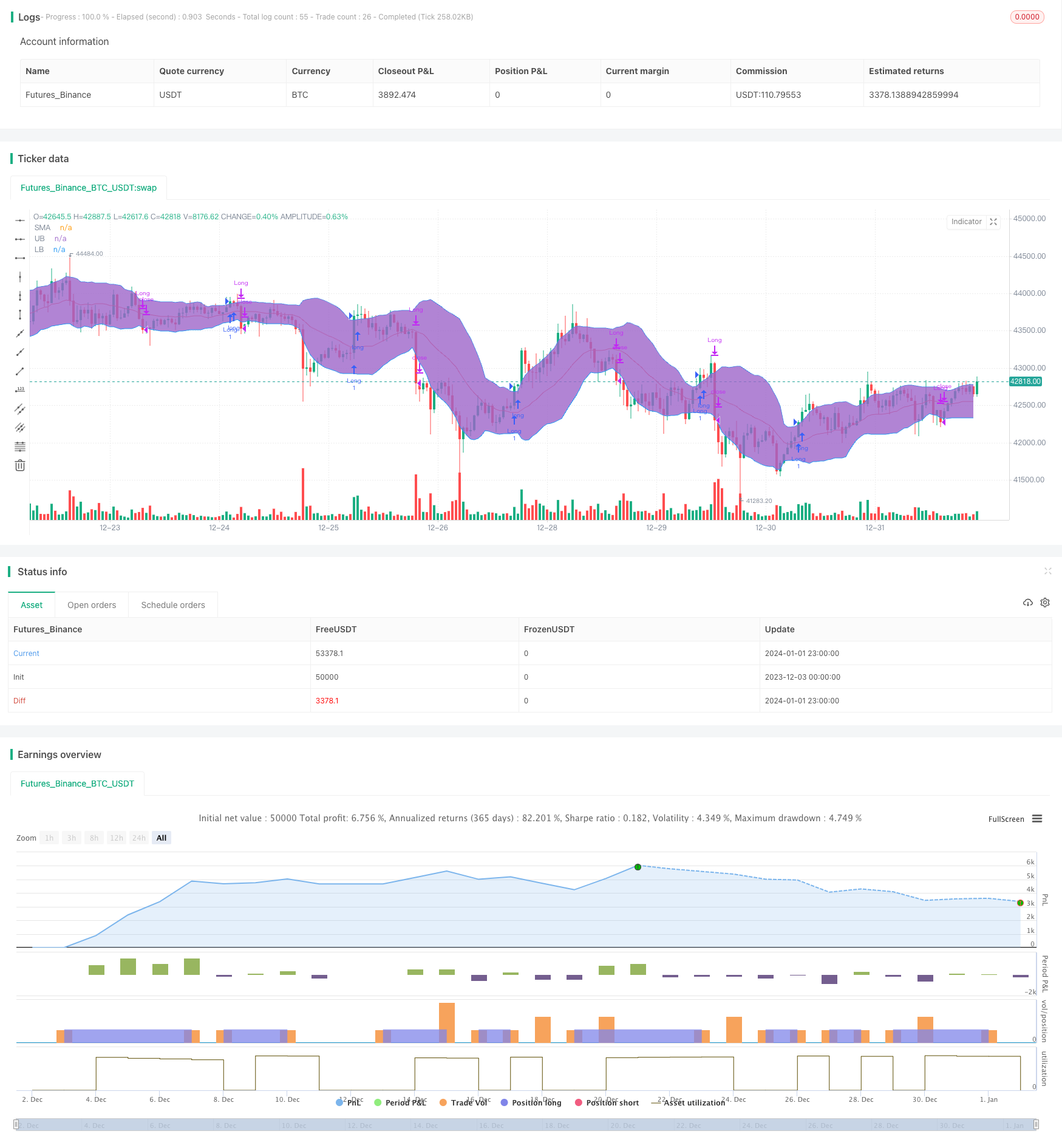

/*backtest

start: 2023-12-03 00:00:00

end: 2024-01-02 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Senthaamizh

//@version=4

strategy(title="Bollinger Band Breakout", shorttitle = "BB-BO", overlay=true)

source = close

length = input(20, minval=1, title = "Period") //Length of the Bollinger Band

mult = input(1.5, minval=0.001, maxval=50, title = "Standard Deviation") // Use 1.5 SD for 20 period MA; Use 2 SD for 10 period MA

exit = input(1, minval=1, maxval=2,title = "Exit Option") // Use Option 1 to exit using lower band; Use Option 2 to exit using moving average

basis = sma(source, length)

dev = mult * stdev(source, length)

upper = basis + dev

lower = basis - dev

if (crossover(source, upper))

strategy.entry("Long", strategy.long, qty=1)

if(exit==1)

if (crossunder(source, lower))

strategy.close("Long")

if(exit==2) //basis is good for N50 but lower is good for BN (High volatility)

if (crossunder(source, basis))

strategy.close("Long")

plot(basis, color=color.red,title= "SMA")

p1 = plot(upper, color=color.blue,title= "UB")

p2 = plot(lower, color=color.blue,title= "LB")

fill(p1, p2)