概述

该策略基于RSI指标实现了一个只做多不做空的趋势追踪策略。当RSI指标达到超买水平时会进入做多方向,采用固定比例的止盈止损。策略简单直接,适用于多头行情。

策略原理

该策略使用RSI指标判断入场时机。当RSI指标低于超卖水平25时,会进入做多方向。此后会根据入场价格设置固定比例的止盈和止损水平。具体来说,止盈水平为入场价格的7%以上,止损水平为入场价格的3.5%以下。

该策略只做多不做空,属于趋势追踪策略。它试图捕捉价格从超卖走出的上涨趋势。当RSI超卖时,代表价格可能处于短期的超跌状态,这时做多可以捕捉反弹。

优势分析

该策略具有以下优势:

思路清晰,逻辑简单,容易理解和实现。

多空逻辑分明,只做多不做空,避免Regularity FD003风险。

做多信号来自RSI指标,可以有效判断超卖反弹机会。

采用固定止盈止损比例,可以控制单笔损失。

风险分析

该策略也存在一些风险:

多头行情适用性较好,空头行情无法盈利。

没有考虑突破新高点入场的机会,可能错过部分行情。

固定比例止损无法根据市场波动度进行调整。

RSI参数设置不当可能导致交易频繁或信号不足。

优化方向

该策略可以从以下几个方面进行优化:

增加空头策略,可以在空头行情中盈利。

考虑加入新的入场条件,如突破新高或形态信号,提高准确率。

RSI参数可以训练获得最优参数,降低误差率。

止损机制可以更加智能化,结合ATR指标根据市场波动度调整。

总结

本策略整体思路清晰,使用RSI指标判断超卖机会,并追踪多头趋势。优点是简单可靠,思路直接,缺点是只适用于多头行情,优化空间较大。该策略可以作为多头追踪策略的雏形,后续可以引入更多条件和技术指标进行优化,使之成为一个可靠的正向波动跟踪系统。

策略源码

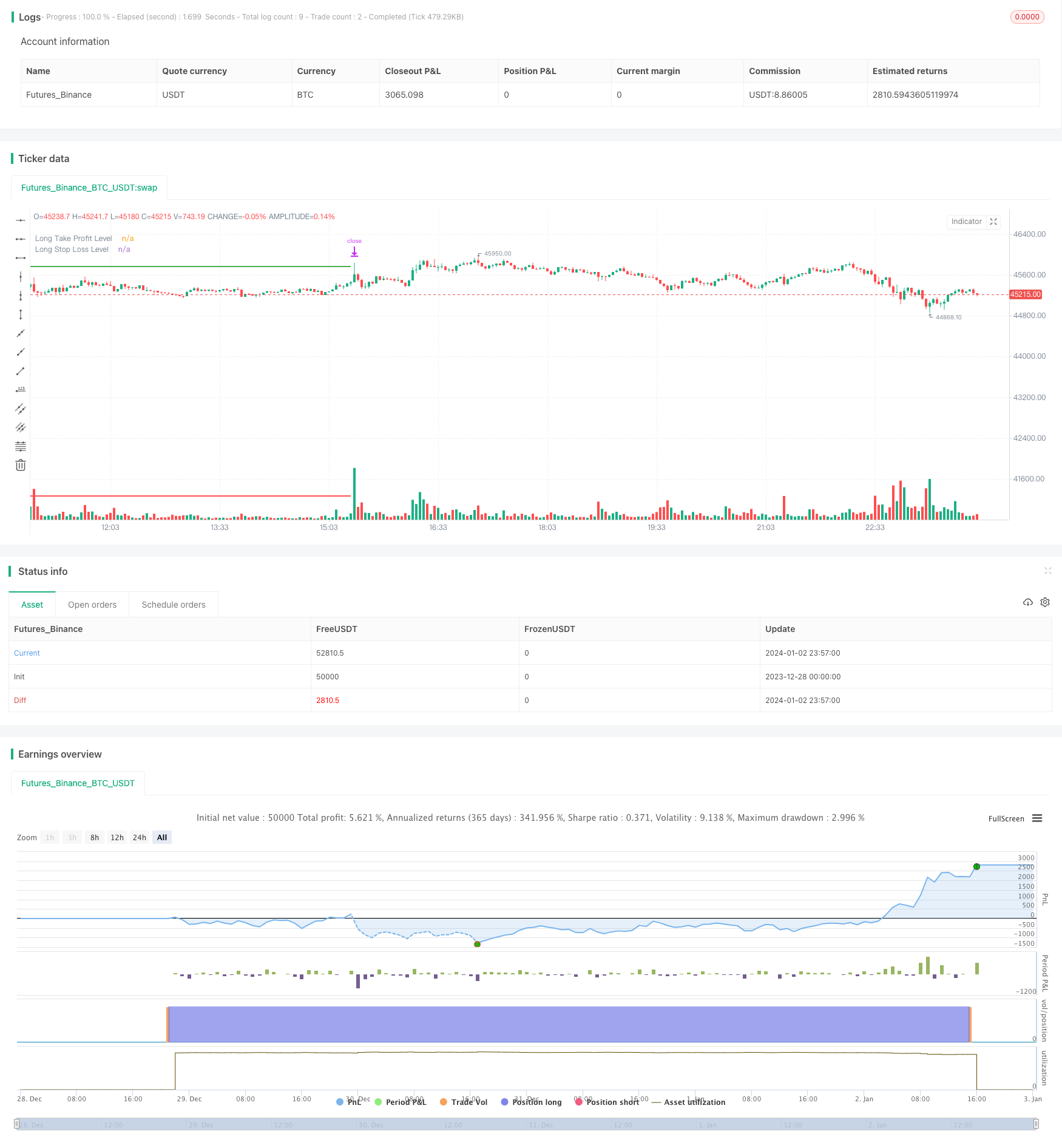

/*backtest

start: 2023-12-28 00:00:00

end: 2024-01-03 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("RSI BENI strategy (Long Only)", overlay=true, shorttitle="RSI BENI Long")

length = input(14, title="RSI Length")

overSold = input(25, title="Overbought Level")

price = close

vrsi = ta.rsi(price, length)

// Plot Einstiege und Levels im Chart für überverkaufte Zonen

plotshape(series=strategy.position_avg_price > 0 and vrsi[1] <= overSold and vrsi > overSold,

title="Long Entry",

color=color.green,

style=shape.triangleup,

size=size.small,

location=location.belowbar)

long_tp_inp = input(0.07, title='Long Take Profit %')

long_sl_inp = input(0.035, title='Long Stop Loss %')

long_take_level = strategy.position_avg_price * (1 + long_tp_inp)

long_stop_level = strategy.position_avg_price * (1 - long_sl_inp)

plot(long_take_level, color=color.green, title="Long Take Profit Level", linewidth=2)

plot(long_stop_level, color=color.red, title="Long Stop Loss Level", linewidth=2)

if (not na(vrsi))

if vrsi < overSold

// Long Entry

strategy.entry("Long", strategy.long, comment="enter long")

strategy.exit("Take Profit/Stop Loss", "Long", limit=long_take_level, stop=long_stop_level)